Bitcoin Breaks $40000 - What's Next?

How To Navigate The Rest of 2023

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

Bitcoin - Weekly Timeframe

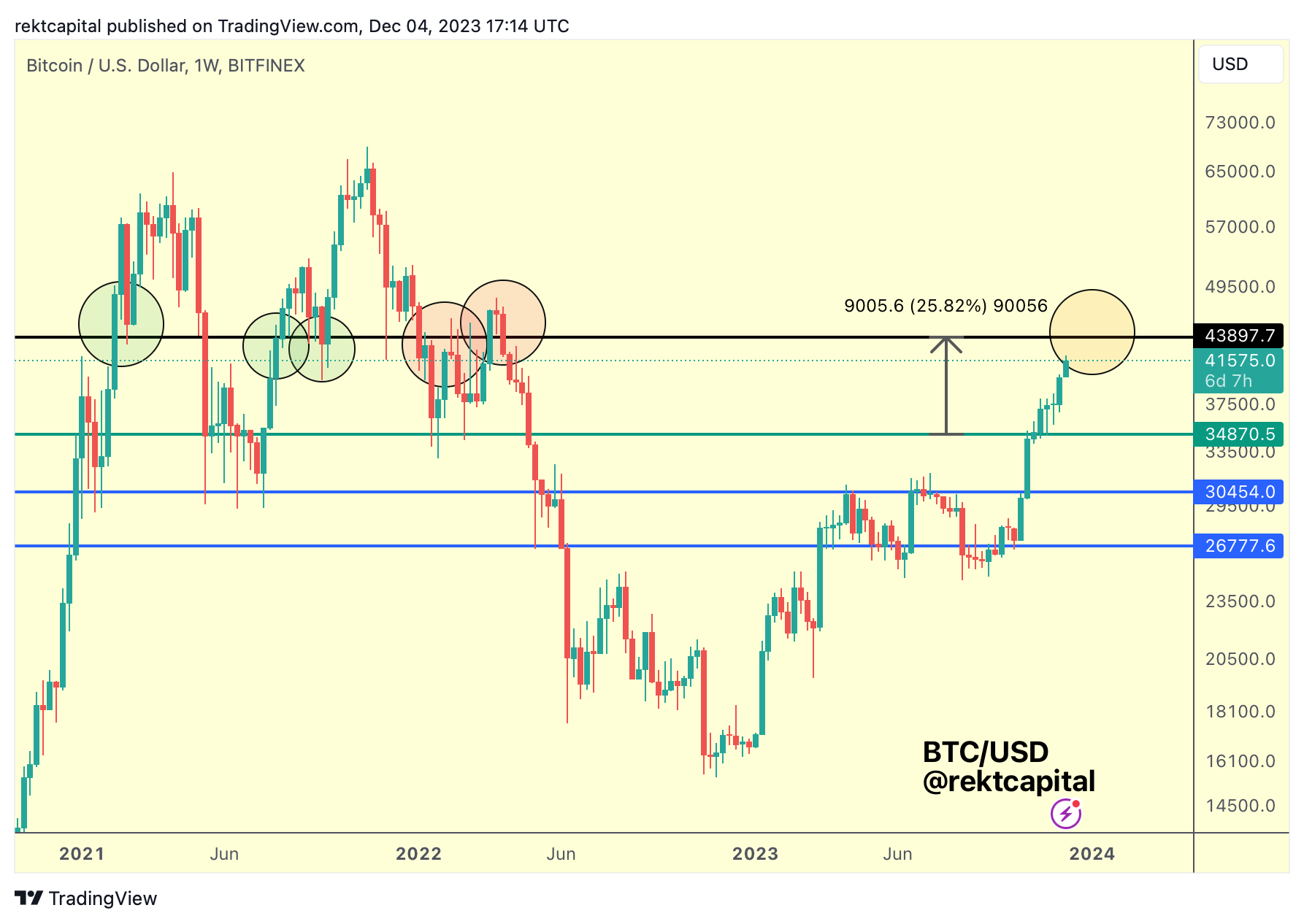

In late November, we spoke about how Bitcoin had established a range within the $36120-$43200 zone (blue-orange) and needed to hold the Range Low to ascend higher within said range:

Here's today update:

Bitcoin successfully retested the Range Low as support and has rallied considerably in recent days, with the goal of revisiting the black $43900 Range High resistance.

So we'd successfully mapped out the Range Low support and discussed the importance of it when it comes to building the current move, let's do the same for the current Range High resistance:

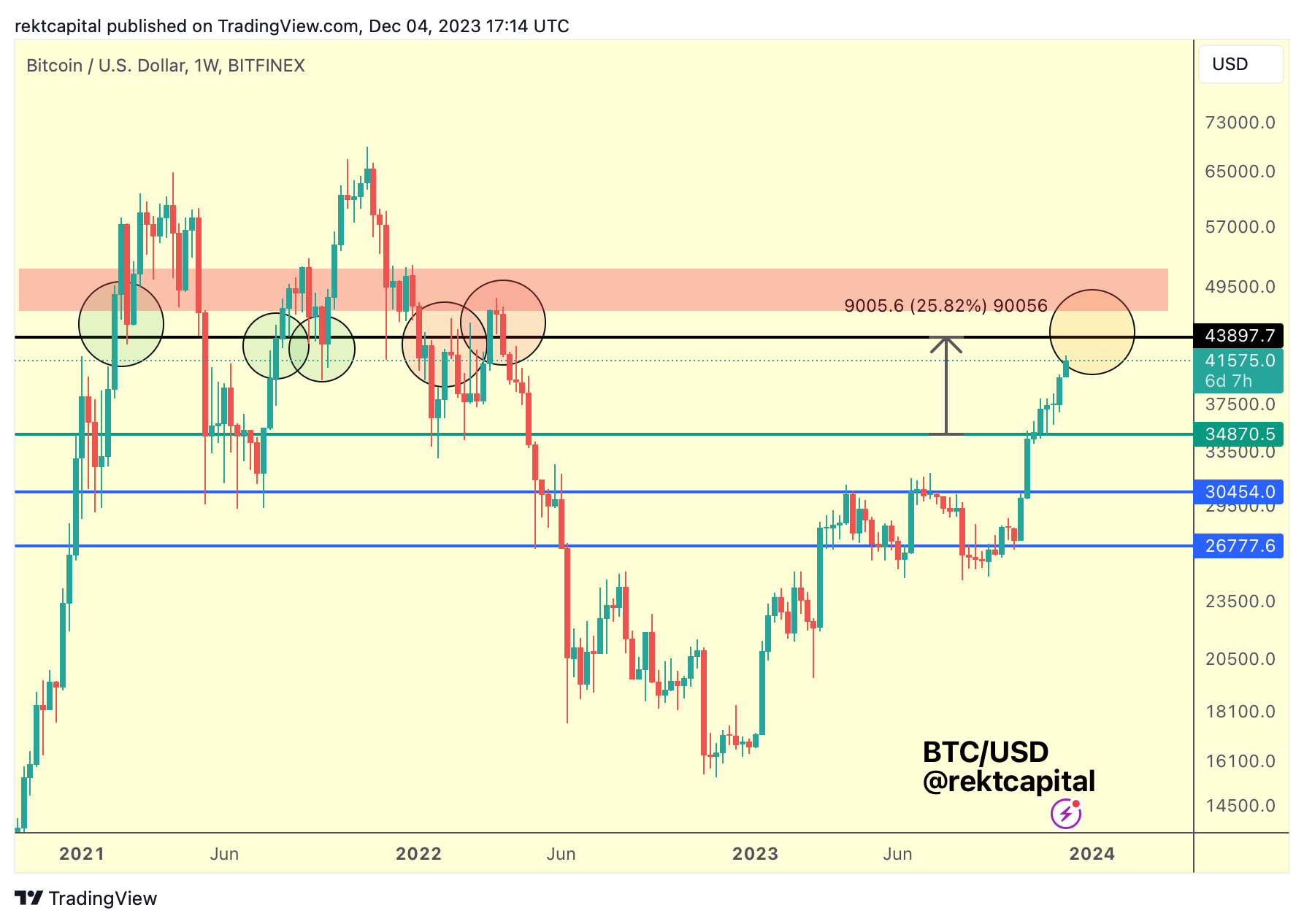

The black Range High is also an important reference point for price.

In 2021 in the parabolic phase of the Bull Market, BTC managed to break beyond this black level with relative ease.

- The first time was earlier in the year of 2021 where price just blasted beyond the level but then in the following weeks retested this level a new support to rally higher

- The second time was in mid-2021 where BTC successfully retested the black level as support in the short-term and then again in the weeks that followed.

Then after those two instances, BTC had lost this black level as support in late 2021 (first red circle from the left) and then fake-broke out beyond this level, failing to hold it as support before crashing into a multi-week downtrend.

It's clear.

Bitcoin will need to successfully retest the black $43900 level as support if it wants to move higher.

Bitcoin has a good track record of breaking beyond this level in Bull Markets but a bad one in Bear Markets, to state the obvious.

But a Weekly Close above the black level would be a very good sign towards setting up the all-important retest of this level.

It's important to note that a retest of this level could occur first in the short-term following a Weekly Close and/or in the mid-term, in the weeks that follow the first successful retest.

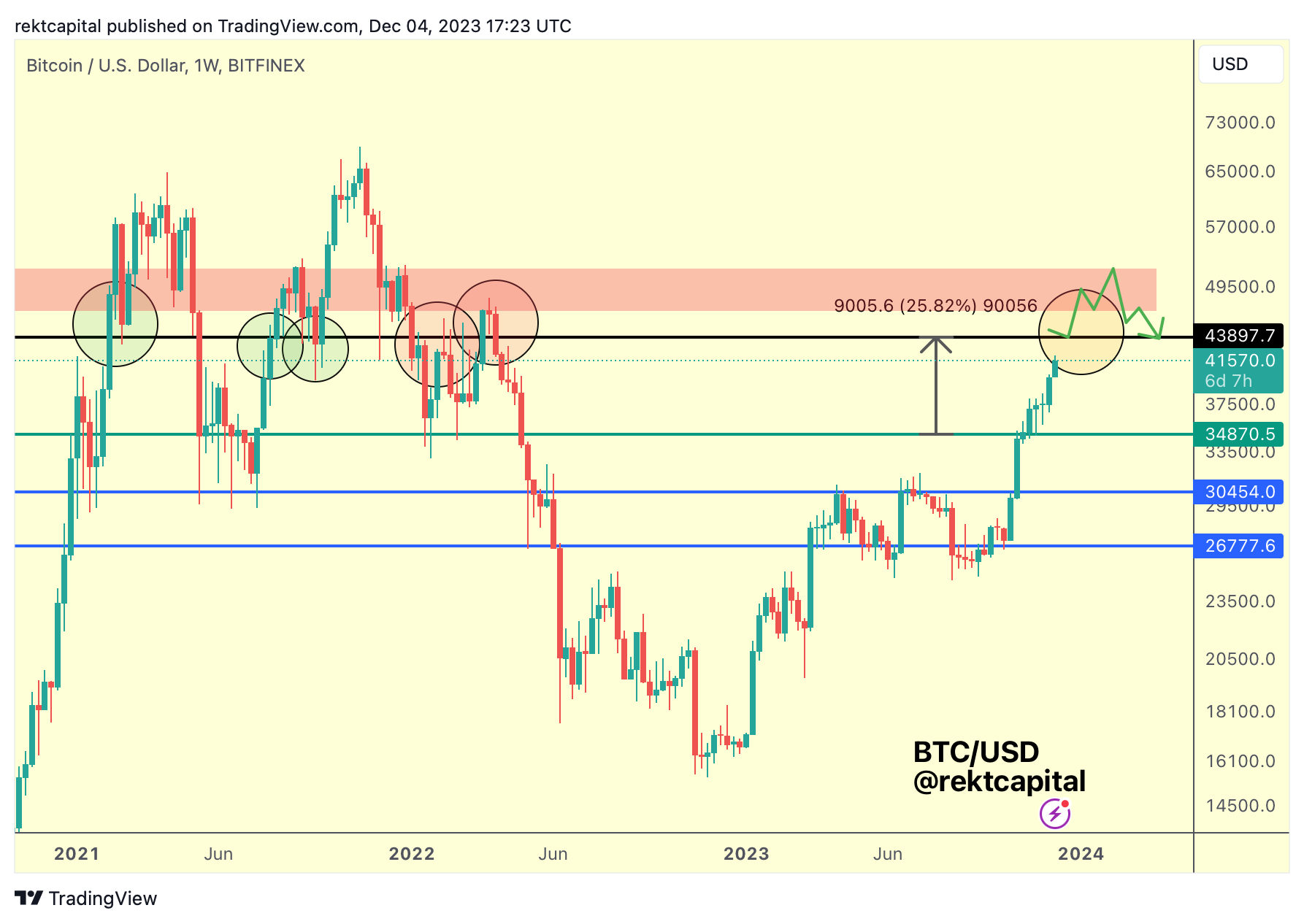

So for example:

If Bitcoin Weekly Closes above the black level of $43900 and then short-term retests it successfully, it would rally straight into the major resistance (red) before potentially rejecting there for a pullback back into the black level for a mid-term retest (green path):

For BTC to be able to rally to ~$51500 (i.e. top of the red box), it would need to retest $46700 as support (i.e. the bottom of the red box) as the green path suggests.

However, if Bitcoin is unable to break beyond the black ~$43900 resistance, then price will continue to remain in the range ($34900-$43900) in which case that could become a 2016-like Re-Accumulation range going into the Halving, barring any deeper Pre-Halving retraces.