Rekt Capital's Altcoin Watchlist

Features analysis on 7 Altcoins: OCEAN SUSHI THETA WOO FET COTI MATIC

This Friday, I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can.

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the buttom below to leave a comment with your TA request!

Let's dive into today's Altcoin Watchlist.

In today’s edition of the Rekt Capital Newsletter, the following cryptocurrencies will be analysed & discussed:

- Ocean Protocol (OCEAN)

- SushiSwap (SUSHI)

- Theta Token (THETA)

- Woo Network (WOO)

- Fetch ai (FET)

- Coti (COTI)

- Polygon (MATIC)

Let’s dive in.

Ocean Protocol - OCEAN/USDT

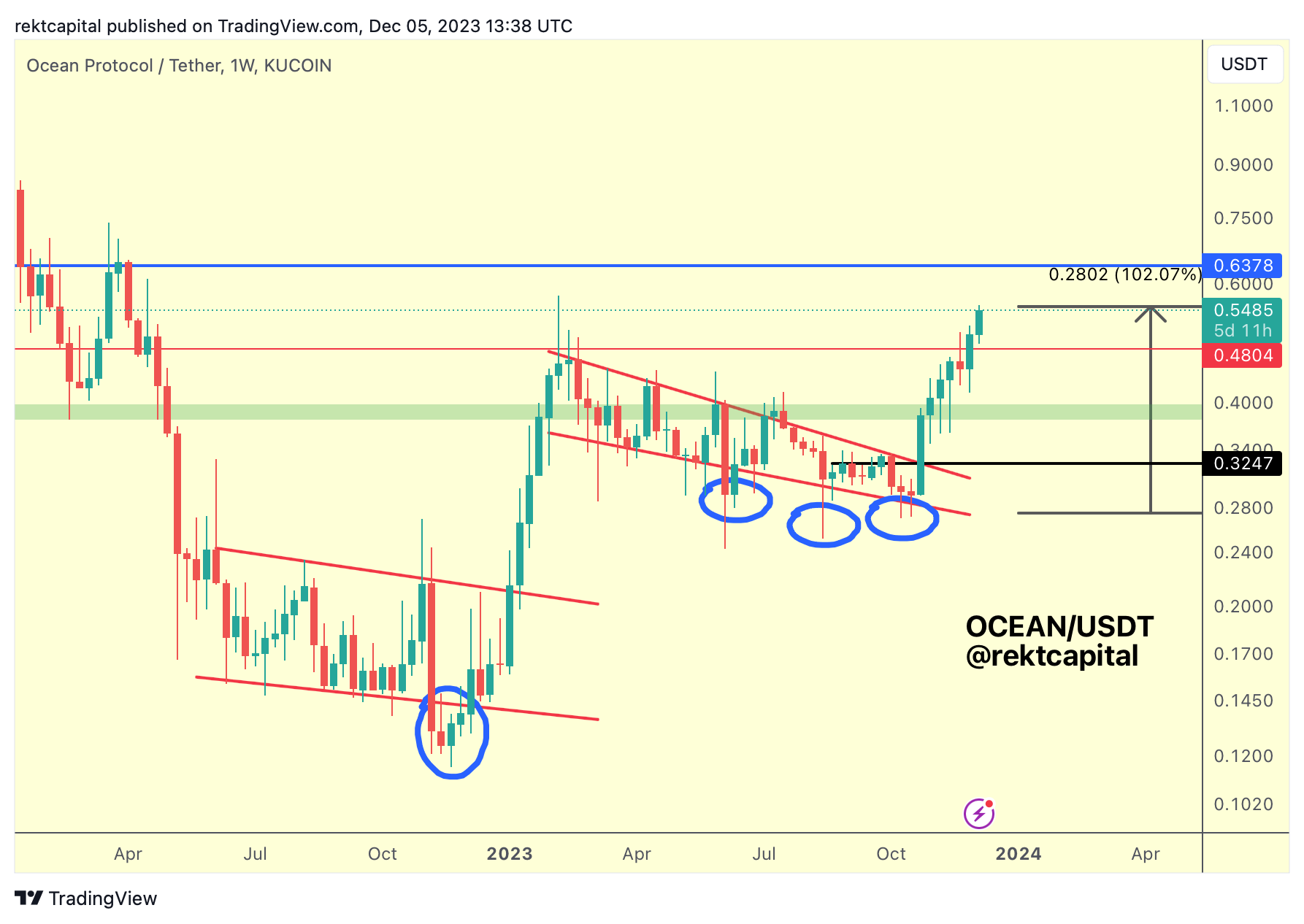

OCEAN has been an Altcoin we've been covering for weeks now.

It started with downside wicking below the Channel:

And then OCEAN rallied over 100% since then:

On this recent breakout move this week, OCEAN has broken into the red-blue range ($0.48-$0.63).

Any dips into the red Range Low will likely serve as a retest attempt to re-affirm said level as new support.

From my perspective, it's important to add to winners in strong uptrends which is why moments of re-accumulation can figure as prime opportunities for just that.

Should a dip into the red level indeed occur, that would be another re-accumulation opportunity.

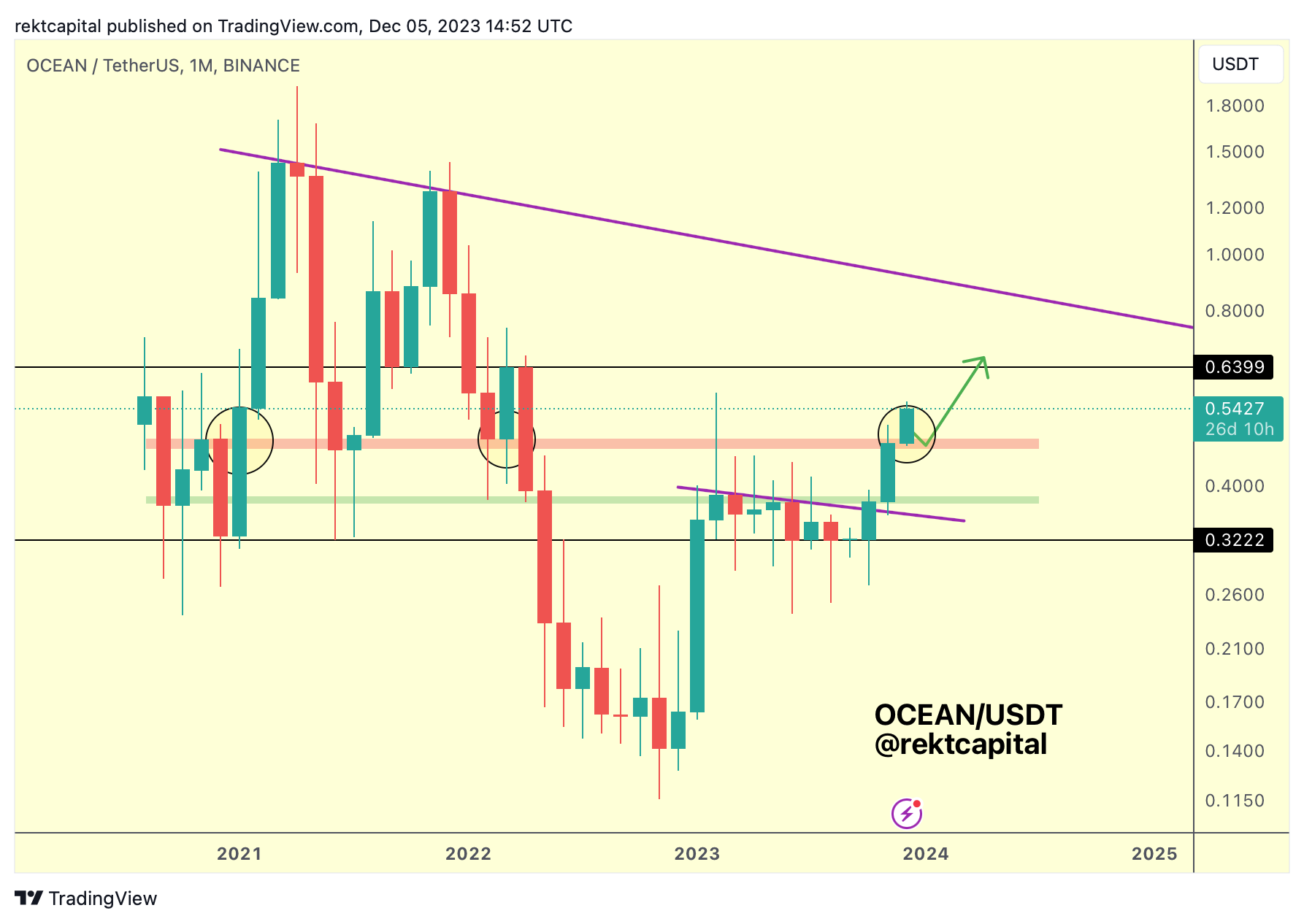

Generally, OCEAN Monthly Closed inside a key region of resistance to kickstart this December move:

Holding above the red region throughout December would be positive for price and will position OCEAN for a move to the Macro Downtrend above (purple), with time.

In the meantime, a dip into red or a reclaim of the black $0.63 Range High resistance would be figure as prime re-accumulation moments.

SushiSwap - SUSHI/USDT

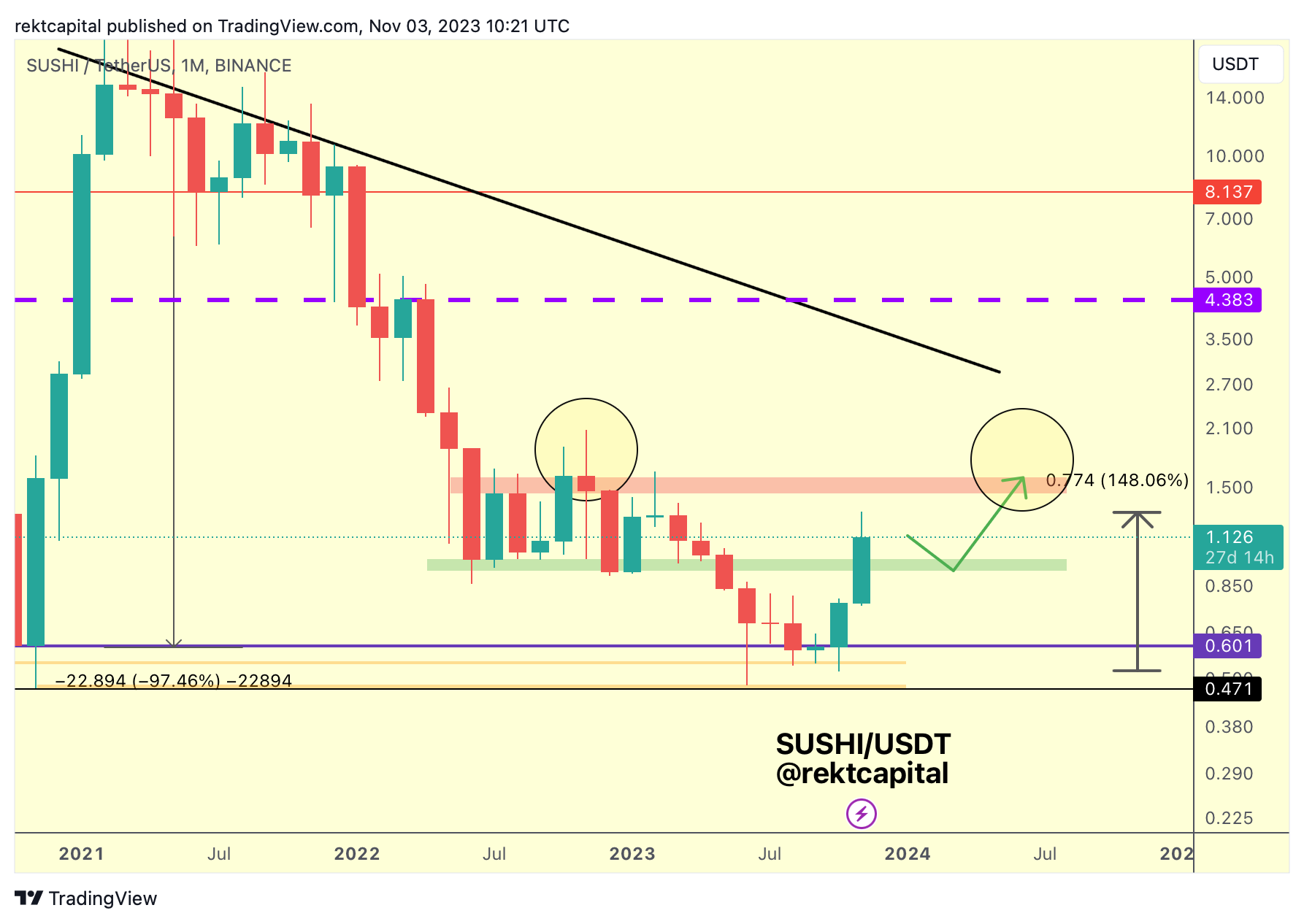

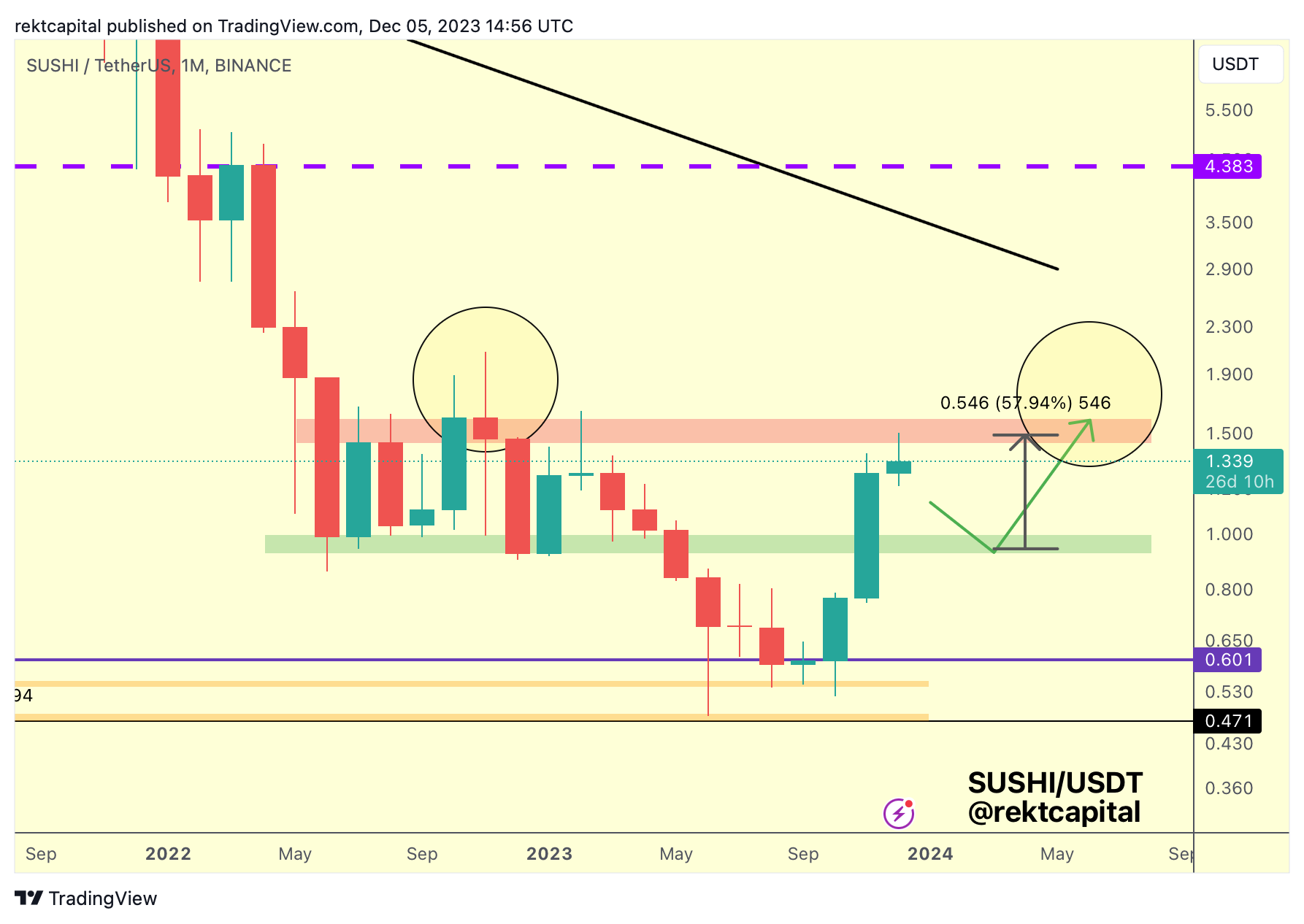

Here is the chart I shared for SUSHI earlier this month, suggesting a retrace into the Range Low area (green):

Here's a follow-up to that chart, one week afterwards:

SUSHI had indeed dipped into the Range Low for a retest.

The path suggested further upside after a successful retest there.

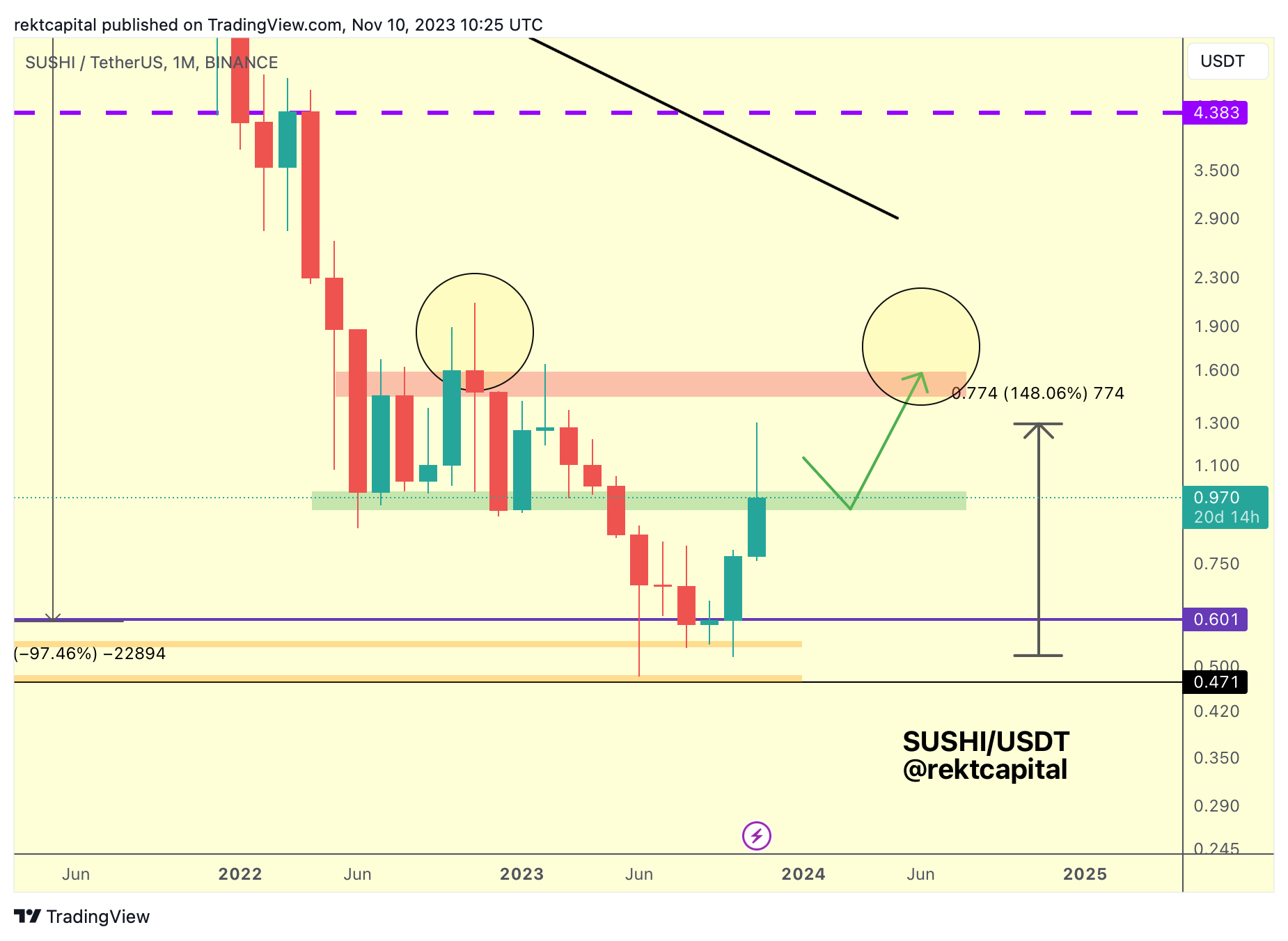

Here's today's update:

SUSHI has rallied +58% into the Range High resistance.

Fantastic move from Range Low support to Range High resistance, all inside the time span of 1-month.

With price now near the top of the range, the risk of a rejection is increasing given how a resistance like this tends to serve as the point of maximum financial risk.

However, given how we are at the early stages of a Bull Market, there is a chance SUSHI could still reclaim the red Range High as new support.

In the past, merely upside wicking beyond the Range High is a bearish sign whereas printing a higher timeframe candle close beyond that point would be bullish.

This is something SUSHI needs to demonstrate in the coming period: is it able to perform higher timeframe candle closes beyond the Range High?

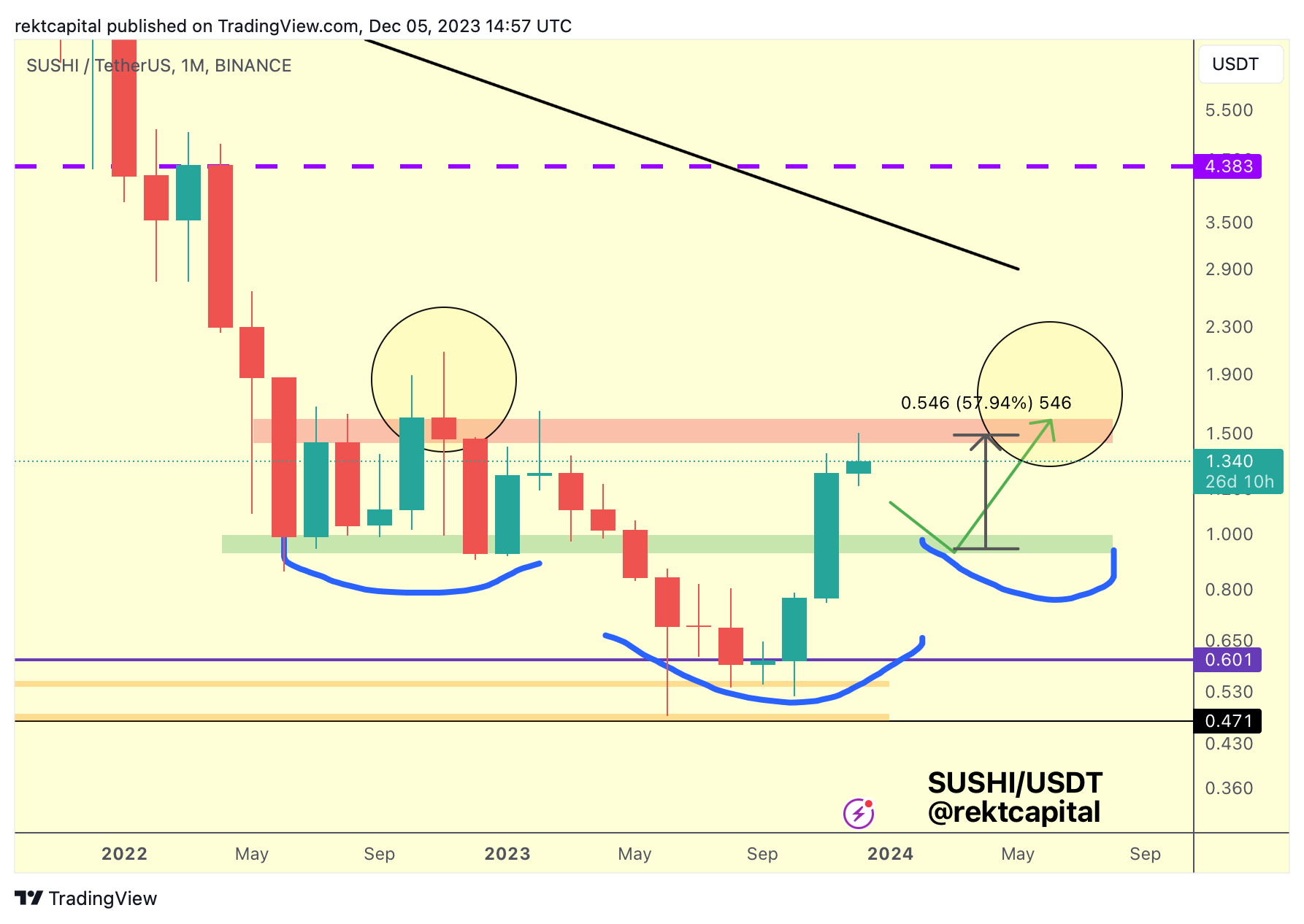

If SUSHI isn't able to break the Range High on the first time of asking, then it's worth considering a return to the Range Low support, given how price is inside the green-red range and technically just consolidating:

A return to the Range Low support would mean that SUSHI could take the shape of an inverse Head & Shoulders formation, with the Neckline of the structure being the Range High resistance.

It's a question of probabilities now.

In the past, in 2022, SUSHI rejected strongly from the Range High resistance on three major occasions.

Can SUSHI break beyond this resistance on the first time of asking in the coming weeks?

Maybe probability doesn't favour SUSHI right now but at least we know to watch for at least a weekly candle close above the Range High resistance for SUSHI to tilt the odds back in its favour for a breakout.