Altcoin Newsletter #155

Features HBAR HIFI PYR SOL DUSK ADA FIL OCEAN

In today’s Altcoin newsletter I cover 8 different Altcoins, specifically:

- Hedera Hashgraph (HBAR)

- HiFi (HIFI)

- Vulcan Forged (PYR)

- Solana (SOL)

- Dusk Network (DUSK)

- Cardano (ADA)

- Filecoin (FIL)

- Ocean Protocol (OCEAN)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter

Let’s dive in...

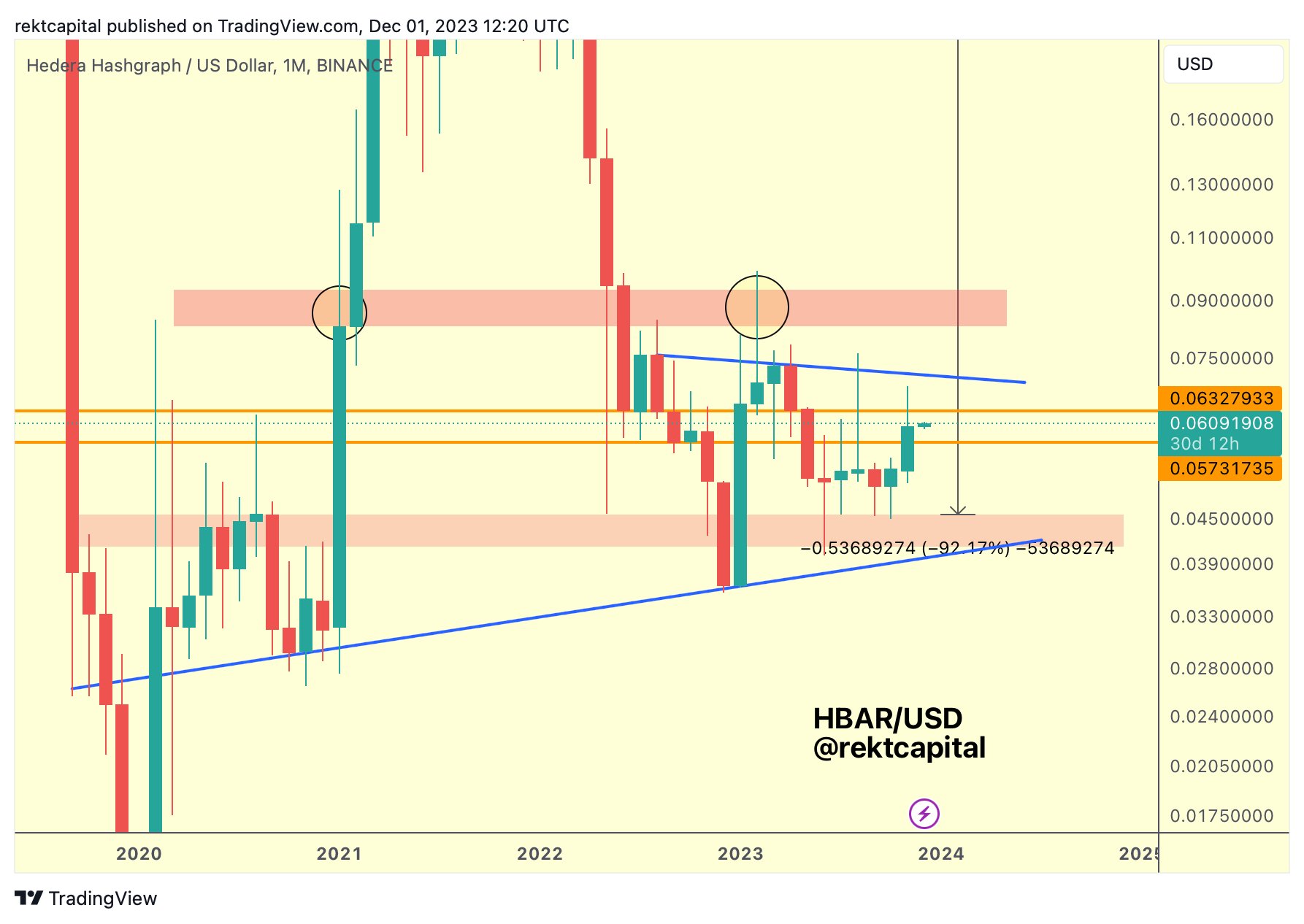

Hedera Hashgraph - HBAR/USD

Earlier this year, HBAR enjoyed a strong rebound from the blue Macro Higher Low to form out its Bear Market Bottom.

On this move however, HBAR formed a new Macro Lower High (blue).

Together, these two blue trendlines may be forming a wedging structure for HBAR.

And in the months that followed, HBAR developed a based at the red region, forming support there; a far-cry development compared to the 2020-2021 period where this same red region acted as a point of rejection.

Over time, HBAR should be able to challenge the blue Lower High above.

In the meantime however, HBAR has Monthly Closed inside the orange-orange range.

In late 2022, HBAR tried to develop a support at the orange Range Low but failed and broke down; however this time, HBAR Monthly Closed above the Range Low and may in the short-term dip to this level to retest it as support before continuing to the blue Lower High resistance.

In short, the way HBAR would revisit the blue Lower High trendline for a breakout attempt would be by virtue of retesting the orange Range Low as new support.

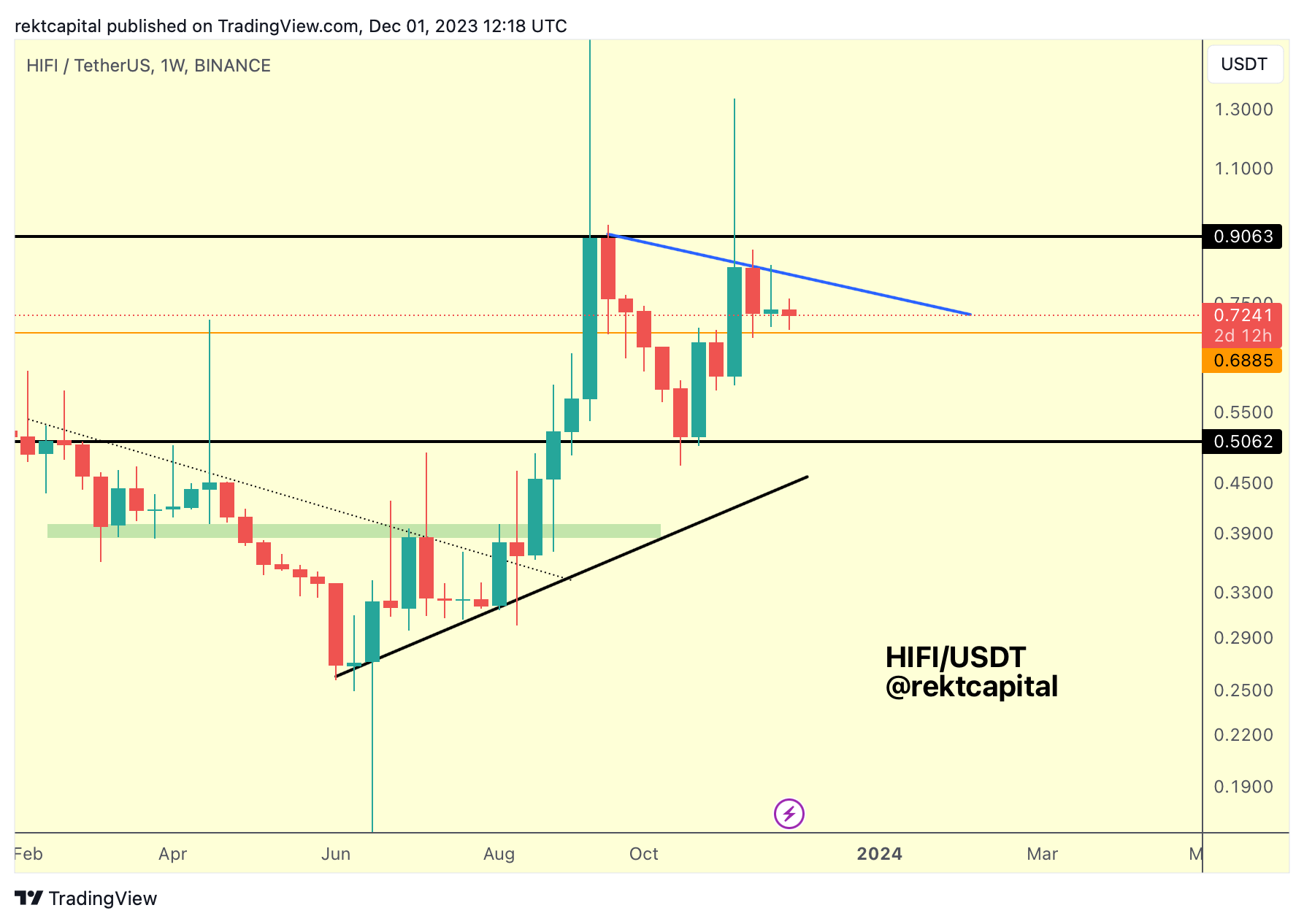

HiFi - HIFI/USDT

After the Summer 2023, HIFI developed a clear Macro Range (black-black; $0.50-$0.90).

In August, HIFI Monthly Closed above the black $0.50 level and retested it as support in the following month; this retest enabled a move to the black $0.90 Range High resistance where price rejected for the first time.

Then in October, HIFI successfully retested the black $0.50 level again, solidifying it as a Range Low and this retest enabled a revisit of the black Range High resistance at $0.90.

In revisiting the black Range High however, HIFI formed a new Macro Lower High in recent weeks (blue).

The orange level acts as a mid-range for the Macro Range.

Finding support here means that price could continue to behave within the upper half of the range whereas losing orange could mean price would need to revisit the lower half of the range.

There is a chance that this mid-range will be lost as support and HIFI would drop closer towards the Range Low but perhaps at a new Higher Low to form a new blue triangle-like structure.