Bitcoin: Pre-Halving Retrace, Post-Halving Re-Accumulation

Analysis of Bitcoin's final bargain-buying opportunities

The Last Bargain-Buying Opportunity

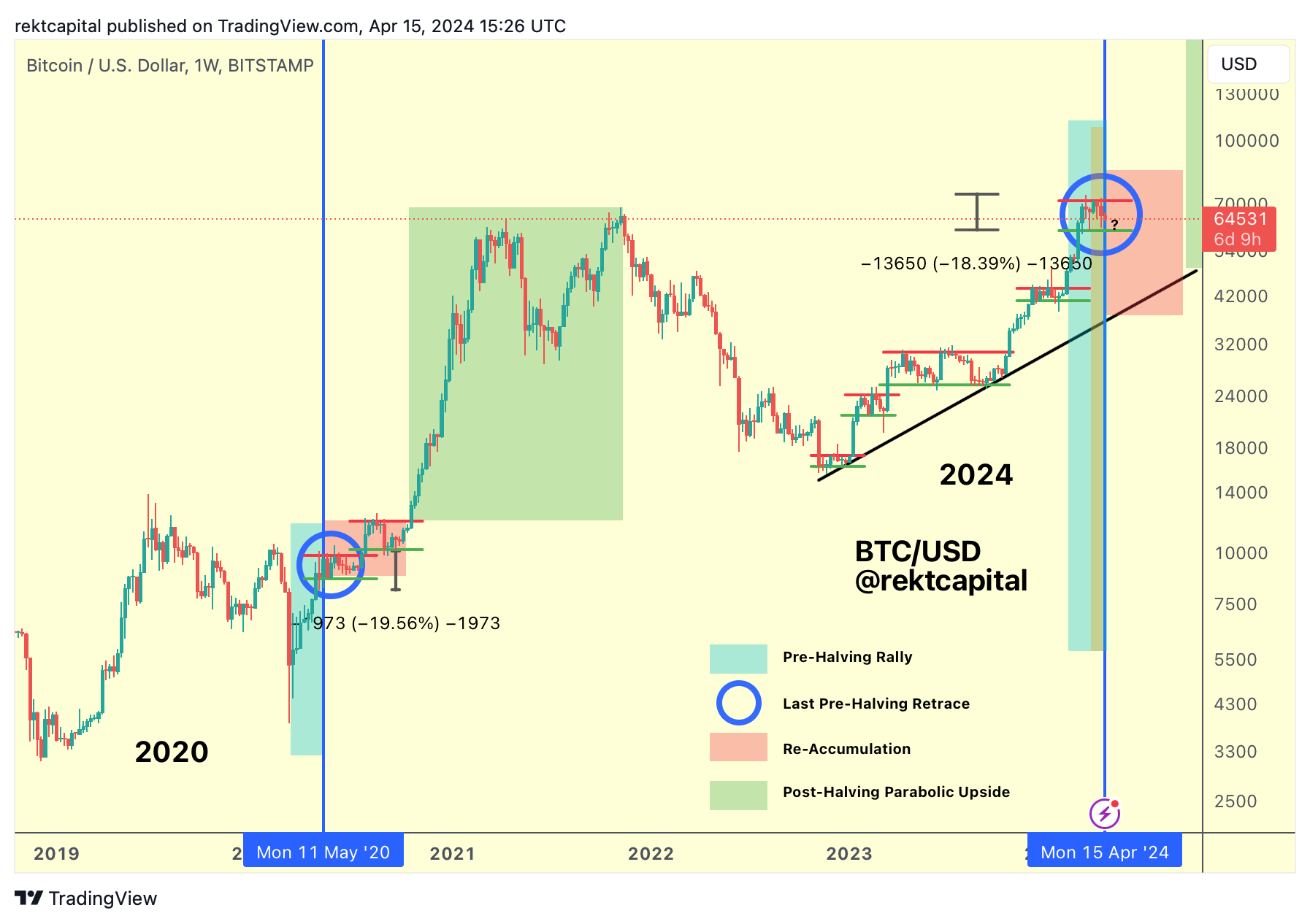

As we approach the Halving, Bitcoin followed through on its historical price tendencies.

It performed a Pre-Halving Retrace and is forming a Re-Accumulation Range as we approach the Halving.

The Pre-Halving Retrace is essential in mapping out the Re-Accumulation phase.

For example, in 2020 the Pre-Halving Retrace essentially mapped out the Range Low of the Re-Accumulation Range.

In 2016 this was also the case though with a minor caveat:

What happened in 2016 was that the Pre-Halving pullback initially mapped out the Re-Accumulation Range Low but after the Halving Bitcoin experience follow-through on its retrace, revisiting those Pre-Halving retrace lows but also producing a downside wick below the Range Low of the Re-Accumulation Range.

But the principle remains the same - the PreHalving Retrace is useful in mapping out the Re-Accumulation Range Low.

And at the moment, the Range Low is at ~$60600.

And while history suggests that Bitcoin has a good chance of holding this current Range Low at $60600, from a practical point of view it would be amiss to not be prepared for some out-of-the-blue downside volatility below the Range Low in an effort to get the best bargain-buying price for BTC in the Post-Halving period.

After all - investors are running out of bargain-buying opportunities as price prepares for the Parabolic Upside phase.

One the of bargain-buying opportunities is offered by the Pre-Halving Retrace and the second is the accumulating as close to the bottom of the Re-Accumulation Range Low in the Post-Halving period as possible.

But given how the Pre-Halving Retrace and the Re-Accumulation Range are closely linked, these two phases essentially represent one larger bargain-buying phase.

These two phases effectively represent the last bargain-buying opportunity before the Parabolic Upside phase begins (green) months after the Halving.