Altcoin Newsletter #171

Features OCEAN NEAR INJ VET UNI GRT RVN ATOM

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Ocean Protocol (OCEAN)

- Near Protocol (NEAR)

- Injective (INJ)

- VeChain (VET)

- UniSwap (UNI)

- The Graph (GRT)

- RavenCoin (RVN)

- Cosmos (ATOM)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

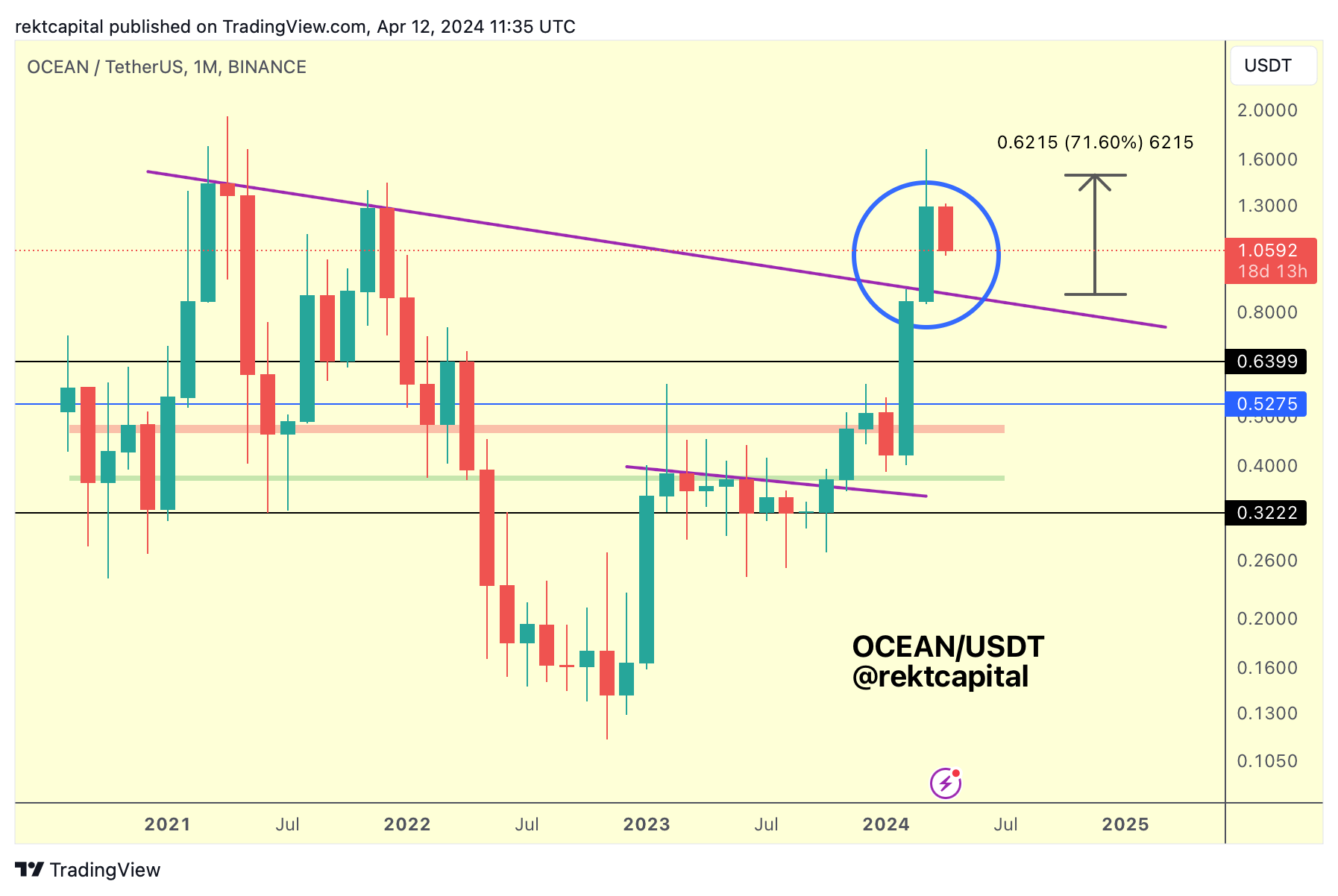

Ocean Protocol - OCEAN/USDT

OCEAN has been on a phenomenal run over the past couple of months, convincingly breaking its final Macro Downtrend (purple).

And by breaking the Macro Downtrend, OCEAN is slowly positioning itself for a new Macro Uptrend.

So how can OCEAN best position itself for success?

As with any breakout, there usually is 1) a candle close above key resistance, 2) followed by a pullback for a retest of old resistance into new support, 3) followed by trend-continuaton upon success retest.

At the moment, OCEAN has Monthly Candle Closed above the Macro Downtrend to kickstart this three-step breakout process.

The second step in the process could be a pullback and retest; the best opportunity for bargain-buyers would be at the Macro Downtrend where price would retest the old Macro Downtrend resistance into one of support.

Lastly, trend continuation upon successful retest would occur.

All said, it isn't guaranteed that OCEAN would need to retrace that much for a retest; some Altcoins don't have to pullback as low as to the Macro Downtrend.

However if that were to be the case for OCEAN, then it would be clear that textbook retest is taking place.

What would need to happen, technically, for this retest to occur?

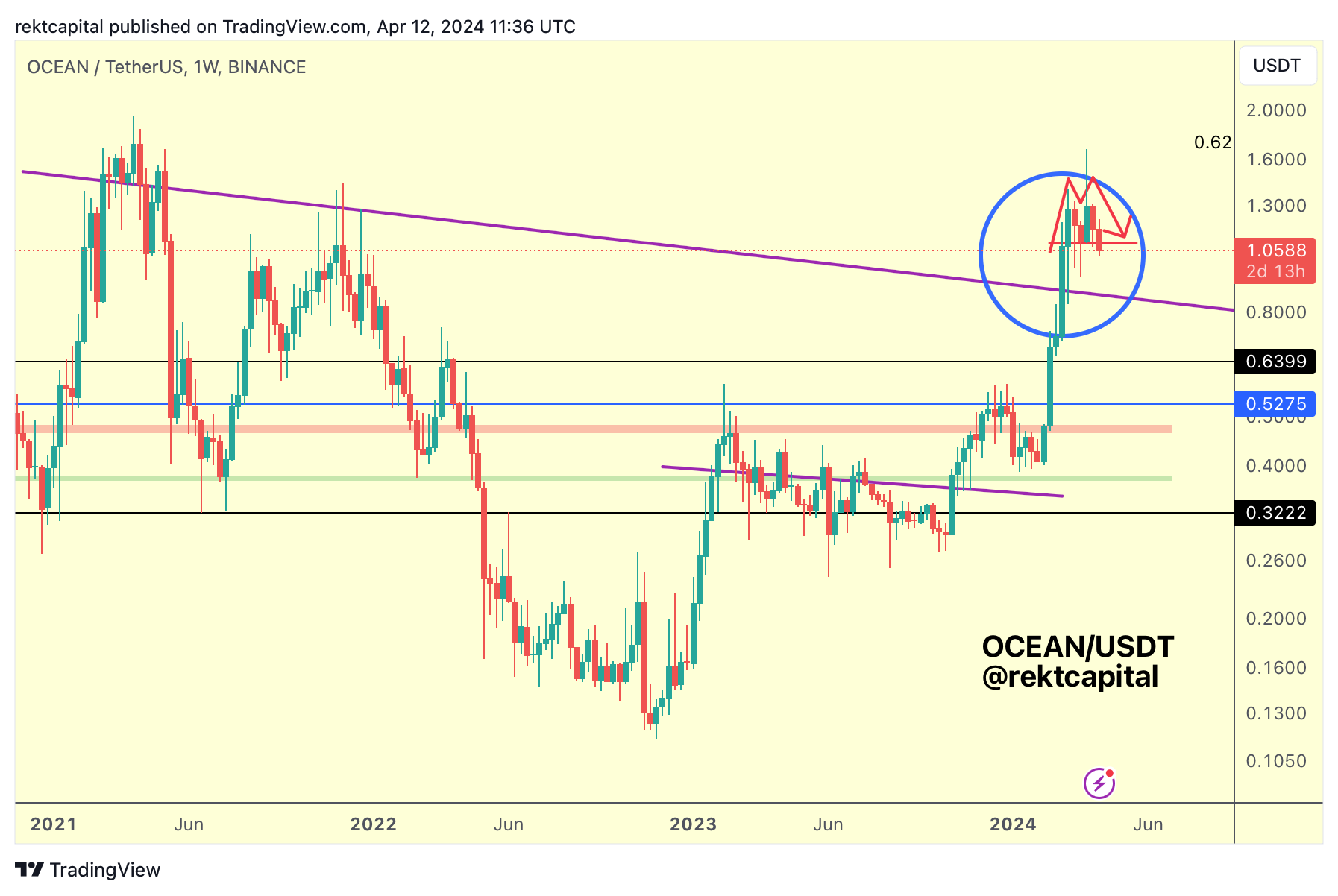

On the Weekly timeframe, OCEAN is potentially forming a Double Top at highs.

That said, in recent weeks OCEAN has been producing downside wicks below the base of the pattern. And if OCEAN forms another downside wick also this week, then OCEAN would stave off a breakdown.

But a Weekly Close below the base of the Double Top would probably kickstart the breakdown process, especially if OCEAN flips the base of that pattern into a new resistance and rejects to begin downside continuation.

This Weekly pattern holds the key to whether that Macro Downtrend retest would occur in the future.

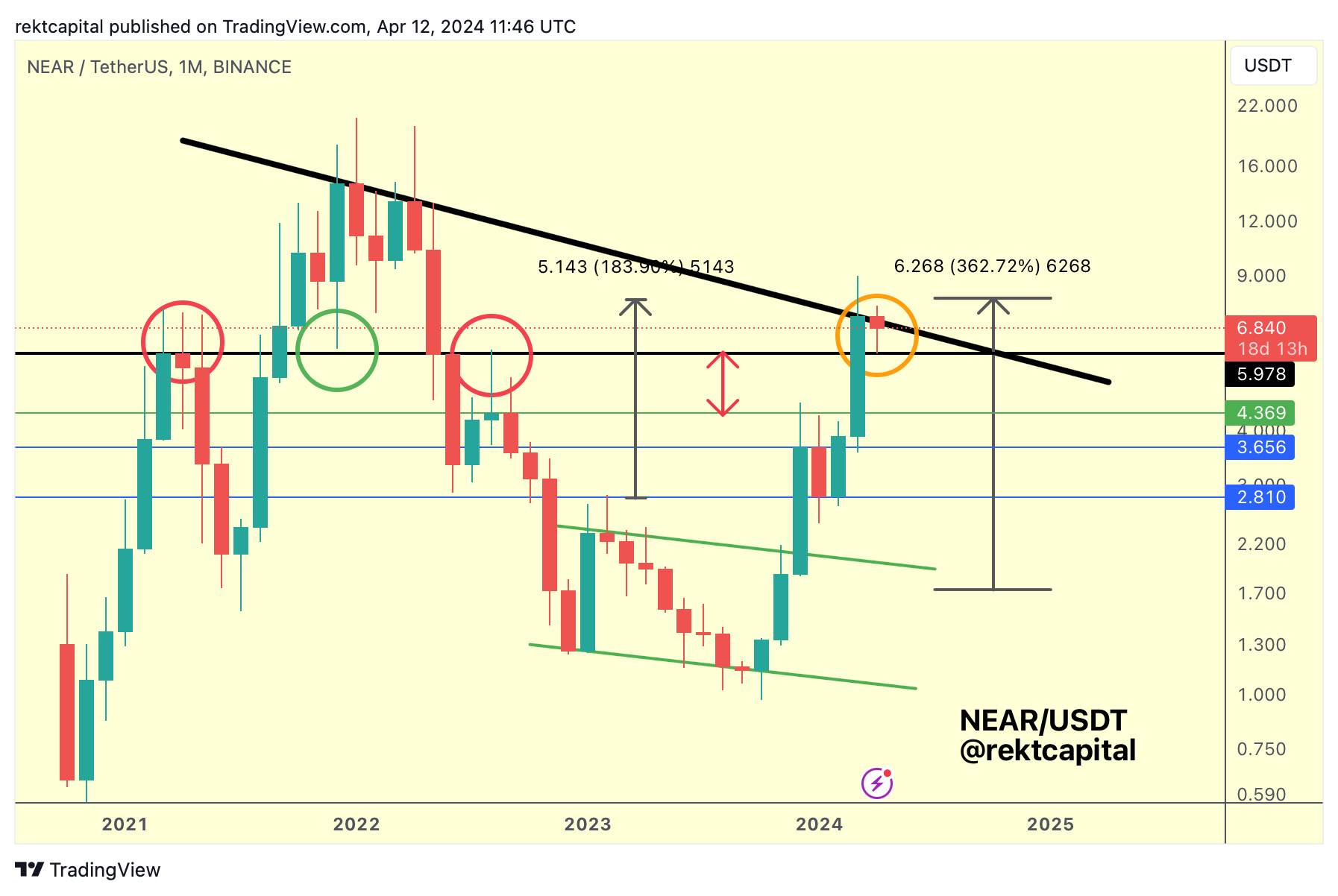

Near Protocol - NEAR/USDT

Near Protocol has revisited its Macro Downtrend (black), for the first time since early 2022.

Currently, price is rejecting from here but holding the black $5.97 level as support; this level used to act as resistance back in early 2021 & mid-2022 (red circles) whereas now it is acting as support like in late 2021 (green circle).

NEAR will be able to break this Macro Downtrend with time, the chances for that a very high.

But the question is how low could NEAR dip before doing so?

For the time being, this retest at these levels is successful and as long as this remains the case, NEAR won't have to dip much to break this Macro Downtrend.

Losing this black level would make things interesting however as that would signal that NEAR would be ready to breakdown into the red-arrowed range where price would consolidate within to find a local bottom.

NEAR hasn't shown any signs of breaking down and following through on this bearish path because the retest is successful thus far.

In fact, if this retest continues to be successful to the point that it would enable a Monthly Close above the Macro Downtrend, then the dip would be over, NEAR would possibly retest the Macro Downtrend before embarking on another uptrend.