Bitcoin - Navigating The PreHalving Retrace

The Pre-Halving Retrace & Old All Time Re-Accumulation Ranges

Is the Pre-Halving Retrace underway?

Historically, it has begun 28 to 14 days before the Halving.

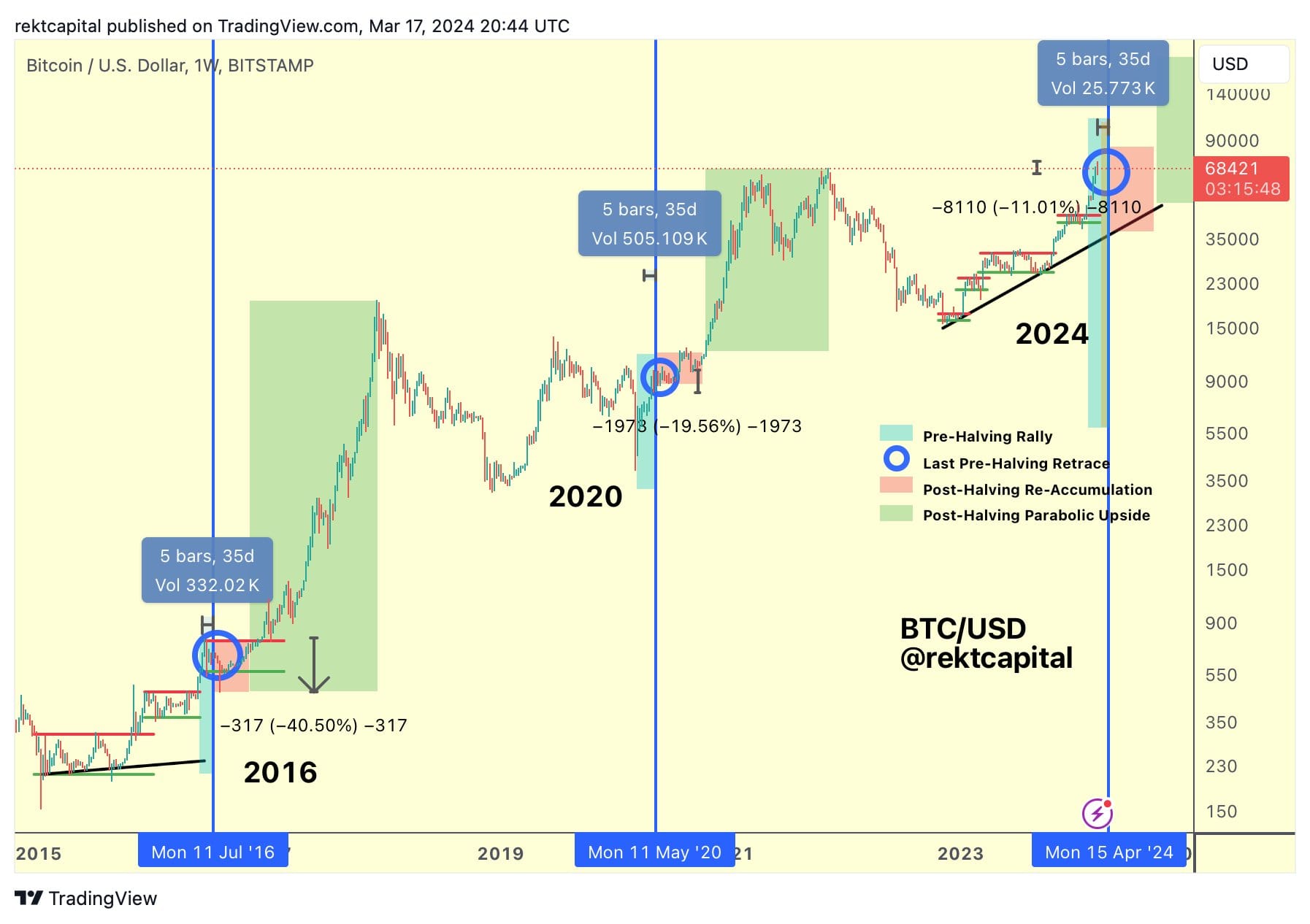

With approximately 30 days to the Halving, Bitcoin is slowly transitioning away from its "Pre-Halving Rally" phase (light blue) into its "Pre-Halving Retrace" phase (dark blue circle).

The "Danger Zone" (orange box) denotes this 28 to 14 day period where the Pre-Halving Retrace could really mature.

Thus far, BTC is down -11% already which poses an interesting question: is the Pre-Halving Retrace a little early?

It's possible, because the "Pre-Halving Rally" phase began a handful of days ahead of schedule and perhaps the "Pre-Halving Retrace" is the same in this respect.

And while the current cycle is vastly Accelerated by 260 days thus far, it is these Bitcoin Halving Phases that still appear to be beginning almost like clockwork, in line with historical tendencies.

So while this cycle is different in many ways, how these phases begin remains the same.

In this cycle, Bitcoin is writing its own history on the one hand while still repeating history on the other.

So before we dive into the main topic of today's newsletter, there are a few things to keep in mind as we prepare to navigate a possible Pre-Halving Retrace which may already be under way.

There are three additional points to take into account:

- Re-Accumulation at Old All Time Highs

- Altcoin Hype Cycles

- Altcoin Market Cap

Re-Accumulation Around Old All Time Highs

The green circle shows us where Bitcoin is in the current cycle.

It rarely is a swift ascent beyond Old All Time Highs, with BTC often experiencing some turbulence at old ATHs before breaking into Price Discovery.

But it is very interesting that this is occurring at the same time of the Pre-Halving Retrace.

Tremendous confluence.

Altcoin Hype Cycles

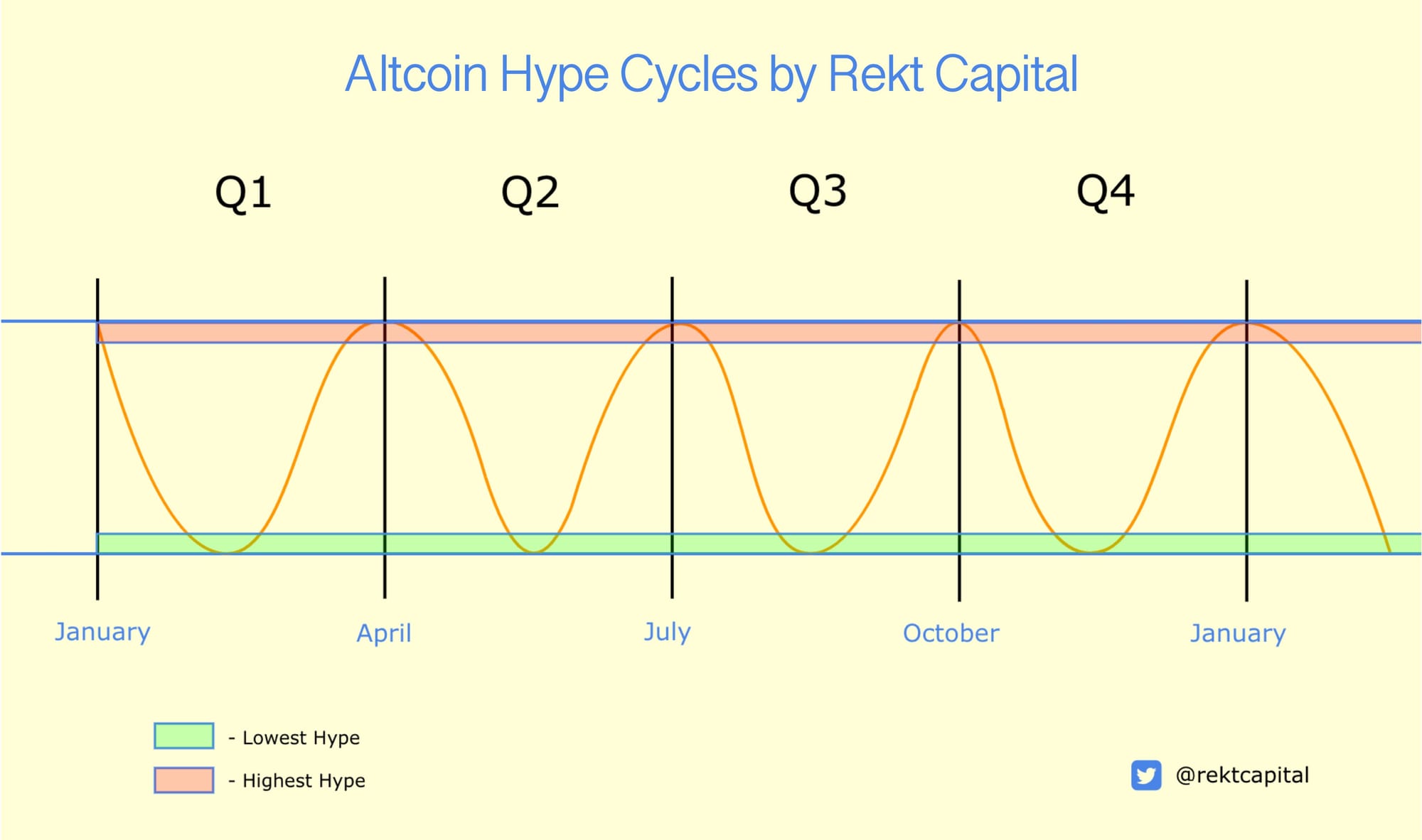

According to Altcoin Hype Cycles, Altcoins are in their "Highest Hype" phase, which is where valuations tend to peak before experiencing a downturn.

Typically, this deflation in the Altcoin market tends to occur near the end of the Quarter.

And with Quarter 1 already coming to an end, it is very interesting confluence that the Pre-Halving Retrace is occurring around the exact time that the Q1 Altcoin Hype Cycle tends to end.

Altcoin Market Cap

And lastly before we dive into the main topic of today's newsletter, Altcoin Market Cap is hovering around the red $315bn level.

Though Altcoin Market Cap is in the process of technically trying to retest this level as new support to enable further upside, this $315bn red level has always acted as a notable trouble area, acting as a home for tremendous volatility to the upside and downside.

If the confluence between the Quarter 1 Altcoin Hype Cycle and Bitcoin Pre-Halving Retrace continues to persist, then it will probably be only after the Halving that Altcoin Market Cap will be able to revisit the black $425 bn level (light blue circle) and lots of volatility around here could occur in the meantime (including a potential failed retest of $315bn as support like in early 2021 though most likely not to such a harsh extent).

Let's now dive into today's main topic where we'll talk about how to best make the most of the PreHalving Retrace while taking into account the Re-Accumulation possibilities that tend to occur around Old All Time Highs.