Altcoin Newsletter #168

Features GRT HBAR ADA RUNE AVAX MATIC

In today’s Altcoin newsletter I cover the following Altcoins, specifically:

- The Graph (GRT)

- Hedera Hashgraph (HBAR)

- Cardano (ADA)

- Thorchain (RUNE)

- Avalanche (AVAX)

- Polygon (MATIC)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

The Graph - GRT/USDT

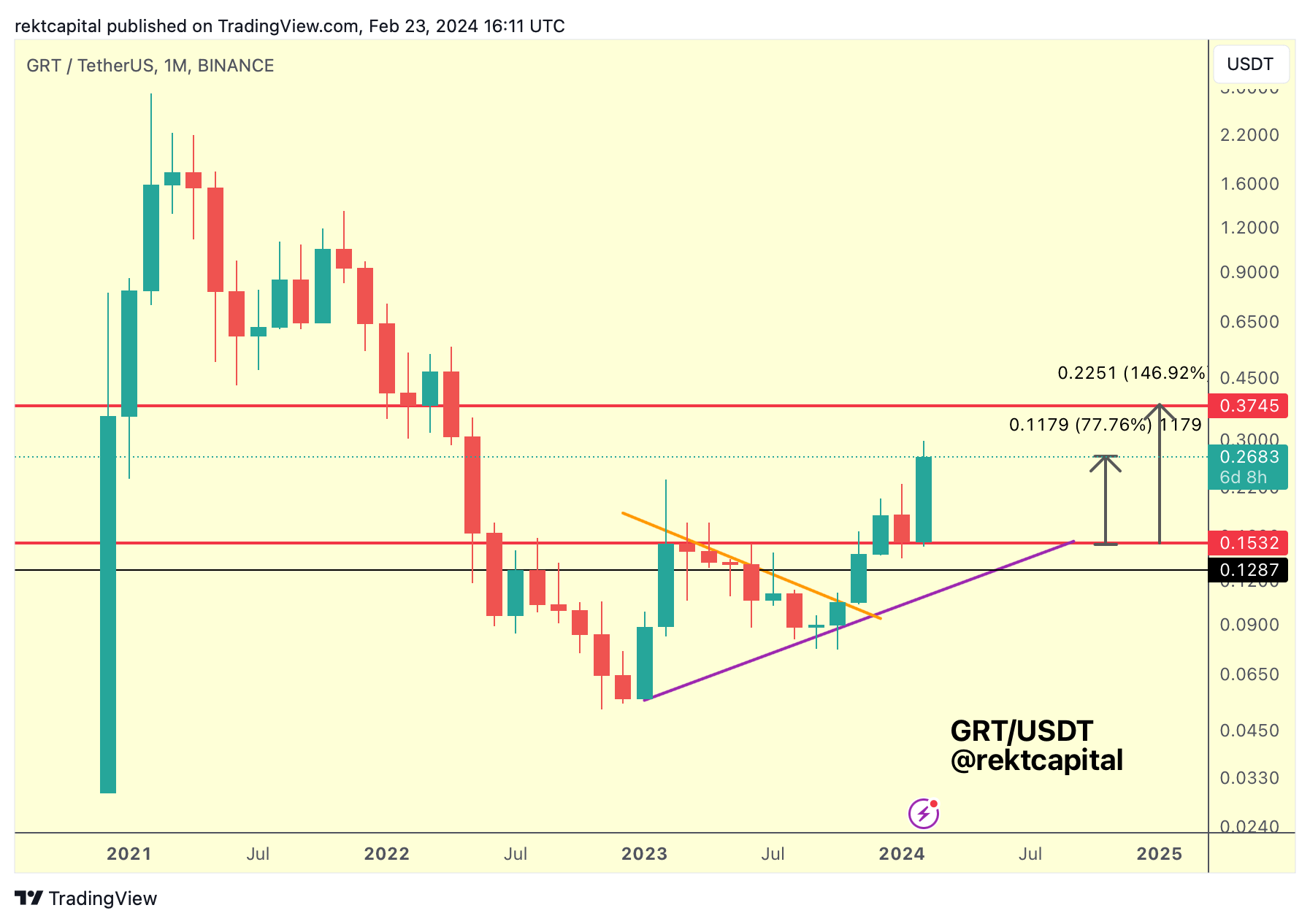

We've been covering GRT for a while now, first discussing it when it was on the cusp of a breakout from its macro Ascending Triangle back in late November 2023.

The idea was for it to traverse across the entire red-red macro range ($0.15-$0.37):

By late February, GRT had broken out from the Ascending Triangle, successfully retested its top to confirm the breakout (in the process solidifying the top of the pattern as a new Range Low) to enable trend continuation across the red-red range:

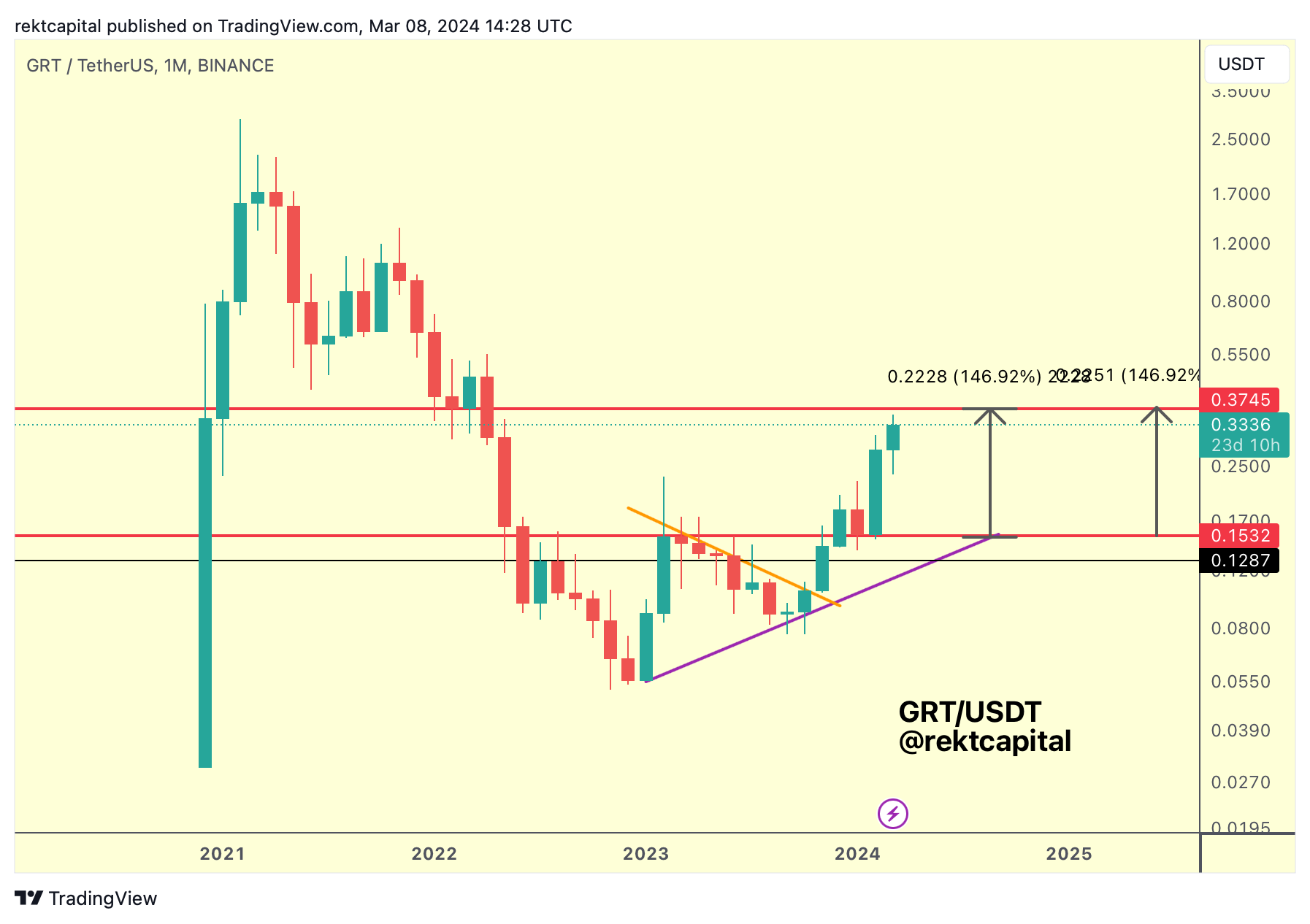

Finally, over time - GRT competed its entire move:

And in fact, now GRT is trying to breakout from this range, trying to do what it had done all these months ago and that's reclaim and old resistance to confirm further upside:

In other words, GRT is trying to reclaim the Range High of its red-red macro, in a very similar way to how it confirm the Range Low as new support two-three months ago.

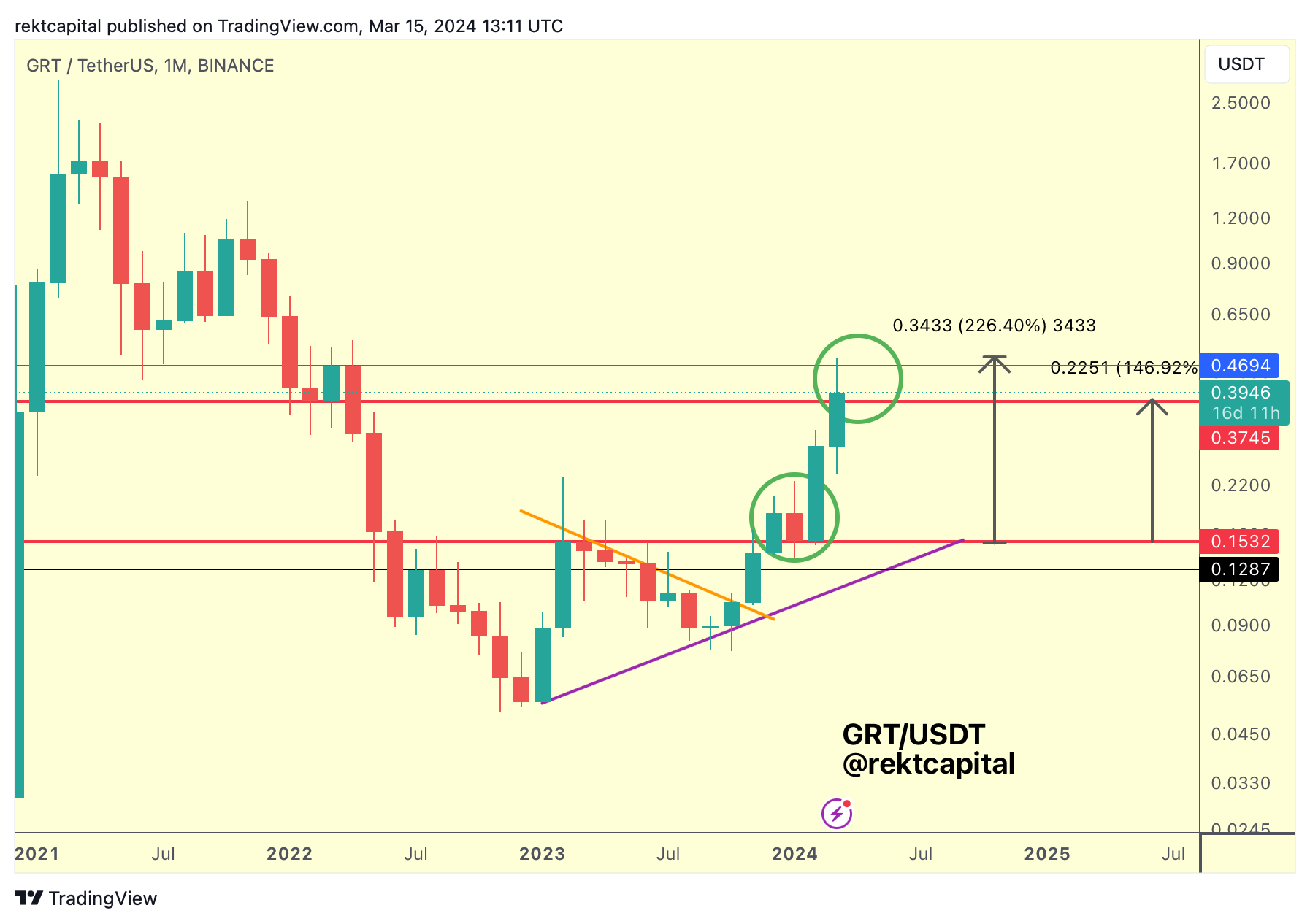

The green circle demonstrates this similarity.

Now only does it demonstrate the similarity in terms of retesting but also in potentially developing a similar re-accumulation range at highs as part of this retest.

The re-accumulation range that could form now would occur between the red $0.37 Range High and the blue $0.46 resistance.

So continued retesting of the Range High (red) would allow for GRT to consolidate here and thus re-accumulate in preparation for the next move.

Retest of the Range High is now in progress - let's see how the Range High continues to hold as this stability here is necessary if GRT is to breakout from the red-red range altogether.

Retest is thus in progress now.

Hedera Hashgraph - HBAR/USDT

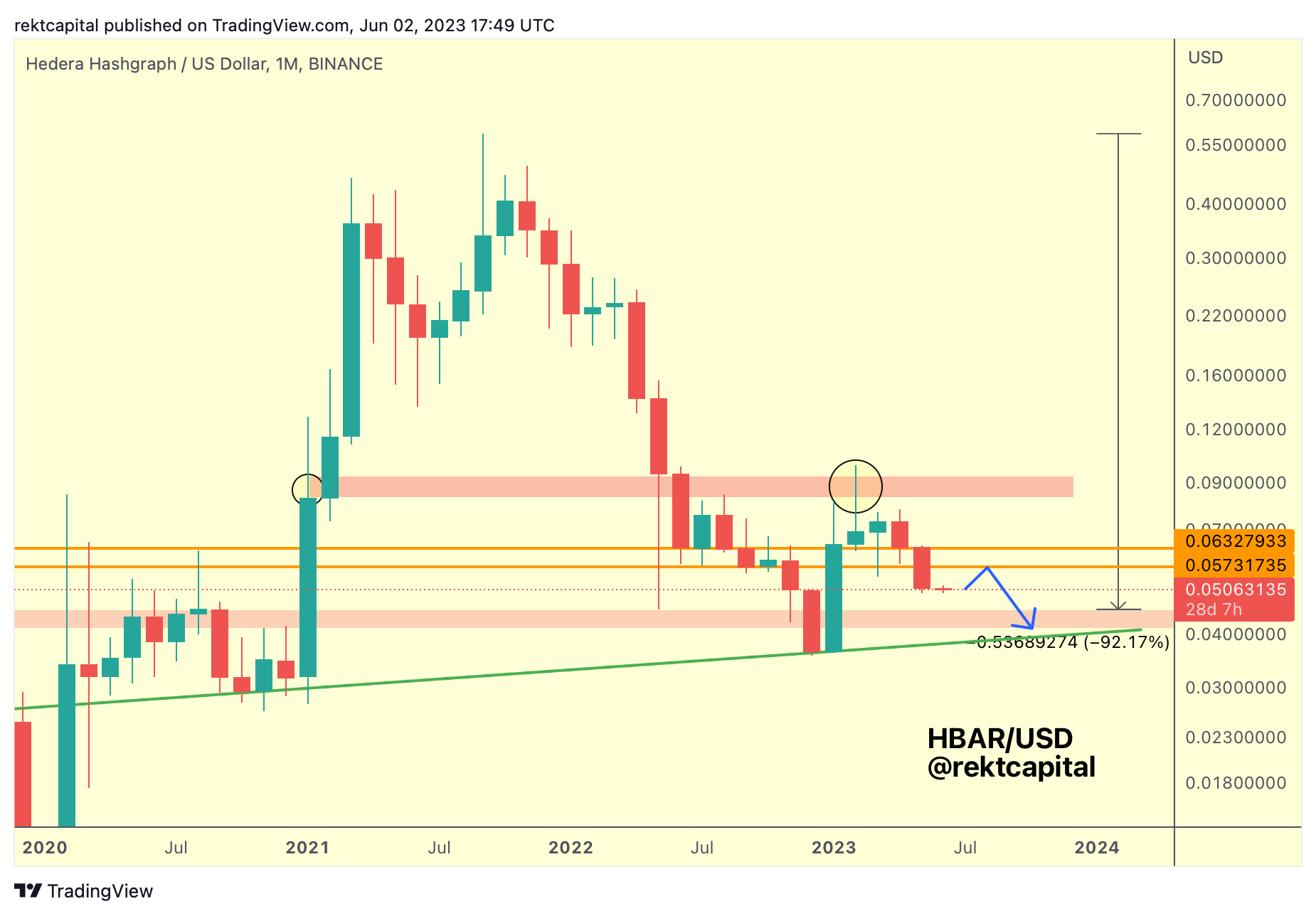

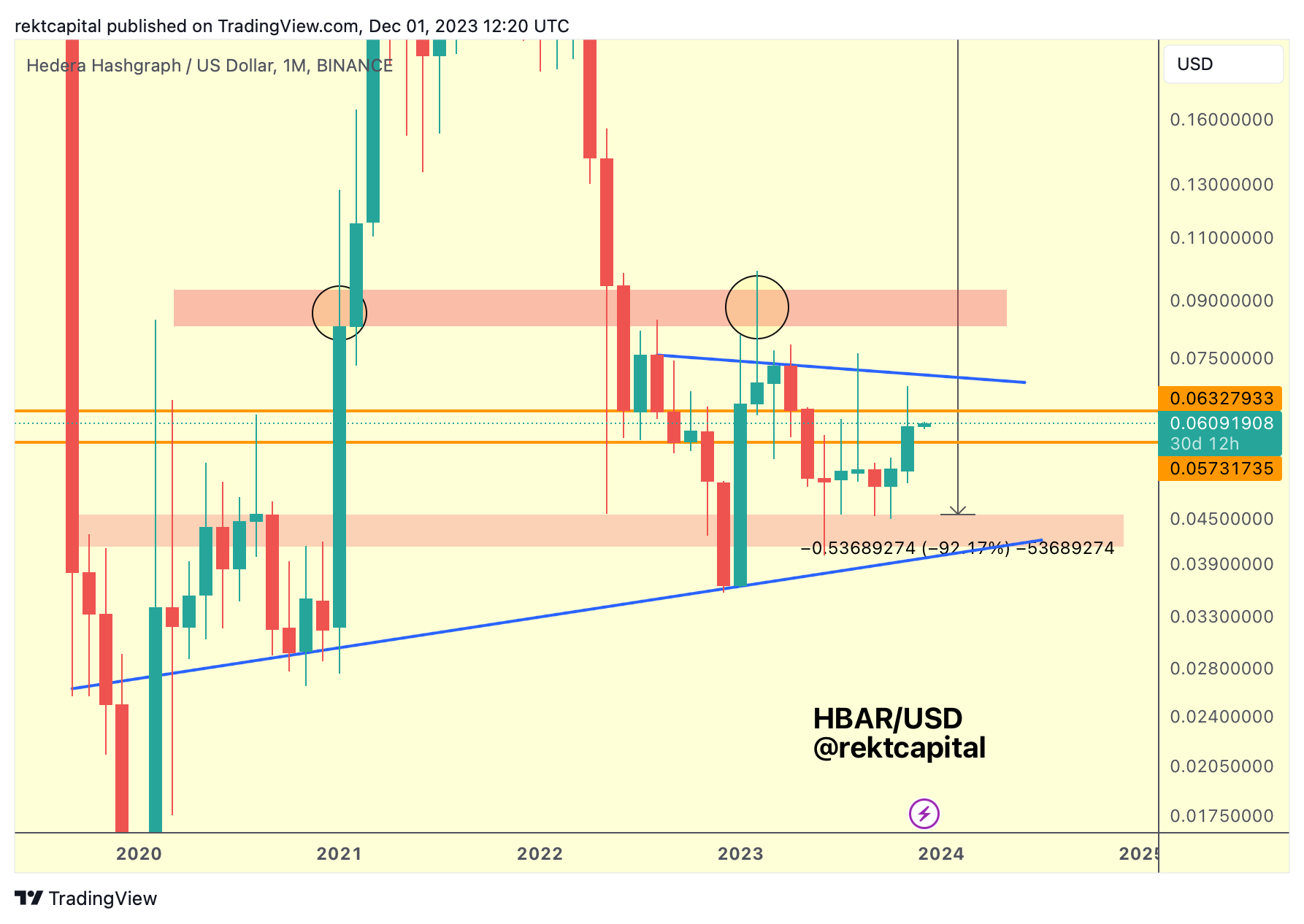

One of the first updates on HBAR came in June 2023 where we discussed HBAR's historical support area (red) which was approximately confluent with the multi-year Higher Low support trendline (green):

That turned out to be the bottom - but about that in a moment.

Because since rebounding from that red Bear Market Bottom region, HBAR formed a macro wedging structure (blue), with the base of that pattern being the multi-year Higher Low trendline support:

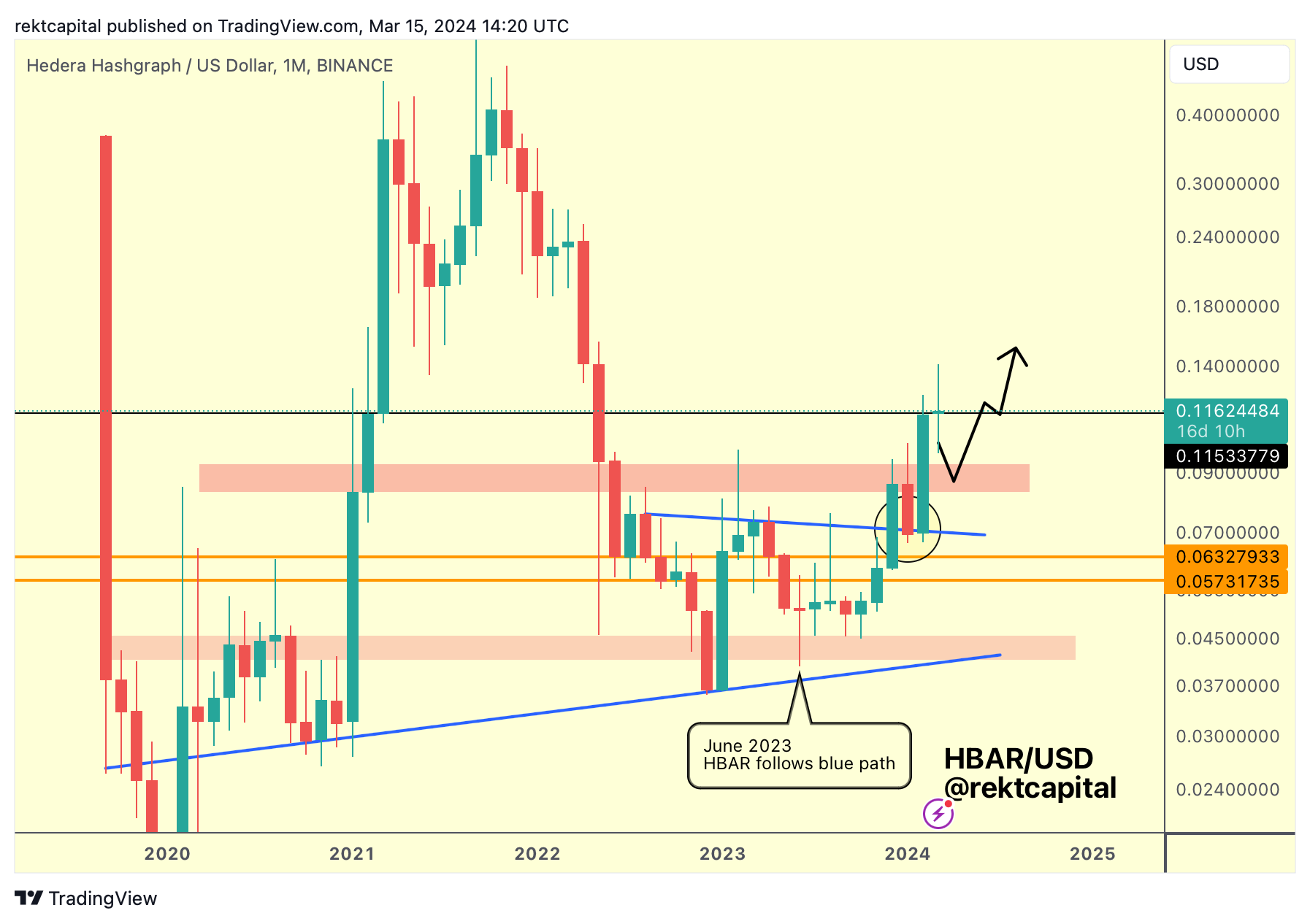

Retesting the top of the blue wedging structure was essential to confirm the breakout from the structure and over time, HBAR did that:

In any case, HBAR needs to retest this black $0.11 level as support to rally via the black pathway.

Historically, clearing this black level of $0.11 has enabled tremendous upside.

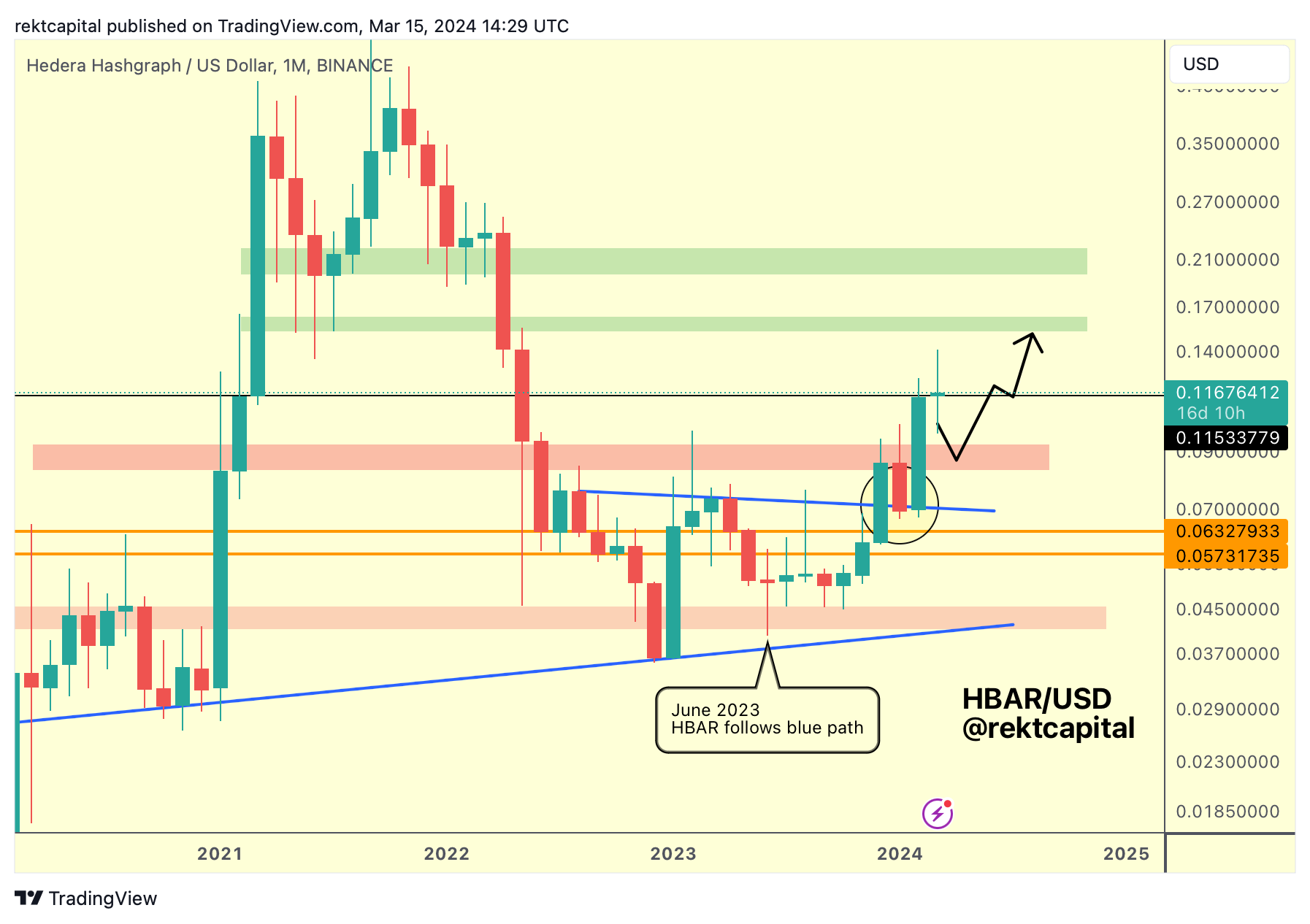

After retesting this black level as support successfully, HBAR would have two major resistance above (green):

In the mid to long-term, HBAR will revisit these two areas and possibly form a re-accumulation range between them.

In the short-term, it's a question of how low does HBAR need to go before rallying to the upside: does it retest this black level of $0.11 as support and that would be sufficient?

Or does it need to downside wick into the red region, which acted as resistance to force a retest of the top of the blue pattern (yellow circle)?

Some downside wicking towards this red region occurred this month, but those are the two possibilities as HBAR tries to gear itself up for further upside in what is now a confirmed new macro uptrend since breaking out from the blue pattern.