New Altcoin Market Update

Features analysis on 6 Altcoins: LINK WOO ETH BCH SOL RUNE

This Friday, I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the buttom below to leave a comment with your TA request!

In today’s edition of the Rekt Capital Newsletter, the following cryptocurrencies will be analysed and discussed:

- Chainlink (LINK)

- Woo Network (WOO)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Solana (SOL)

- Thorchain (RUNE)

Let’s dive in.

Chainlink - LINK/USDT

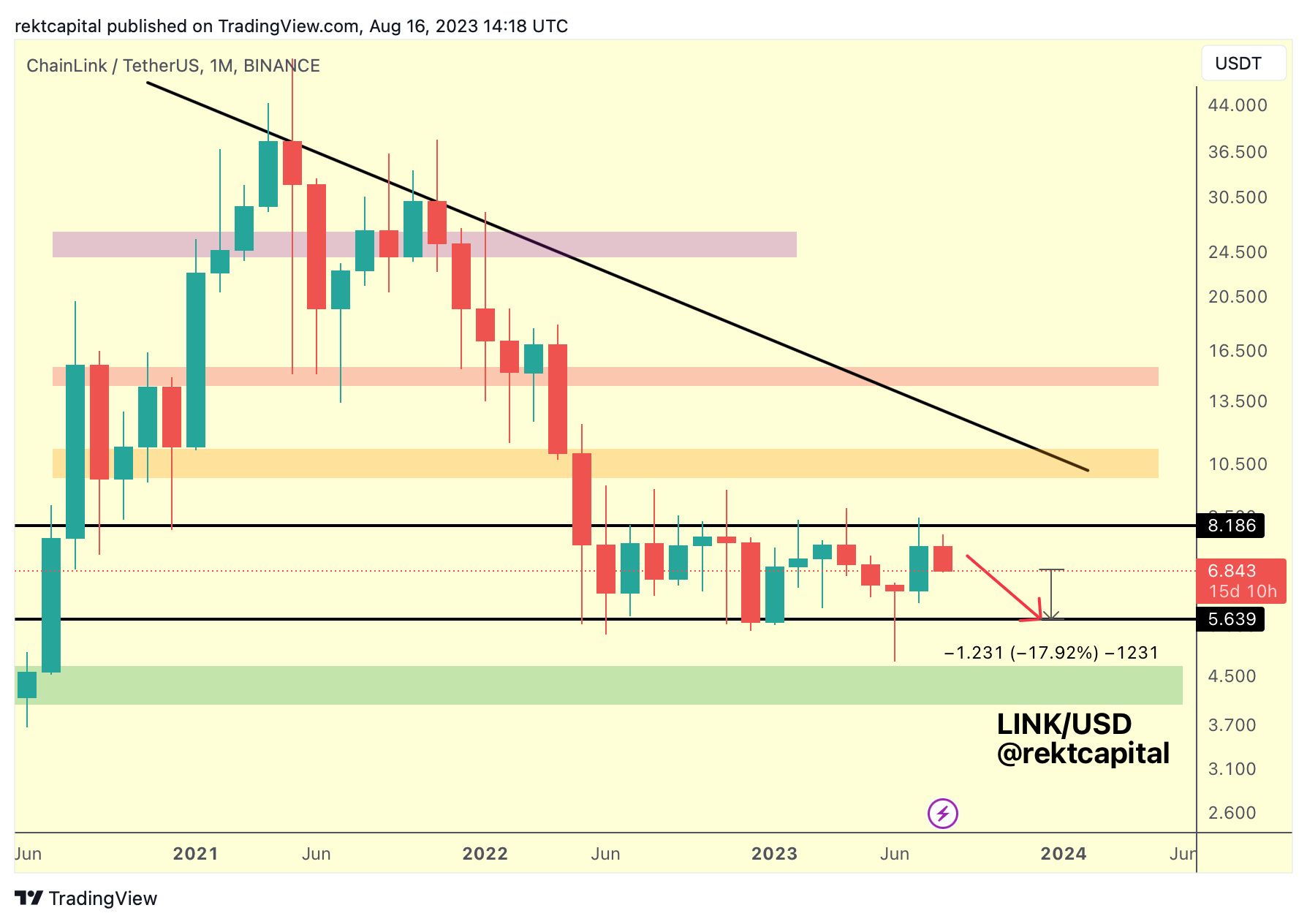

Over the past few weeks, we have periodically shared updates on LINK starting on August 16th where we assumed price would drop an additiona -17% to the downside to revisit the Range Low support:

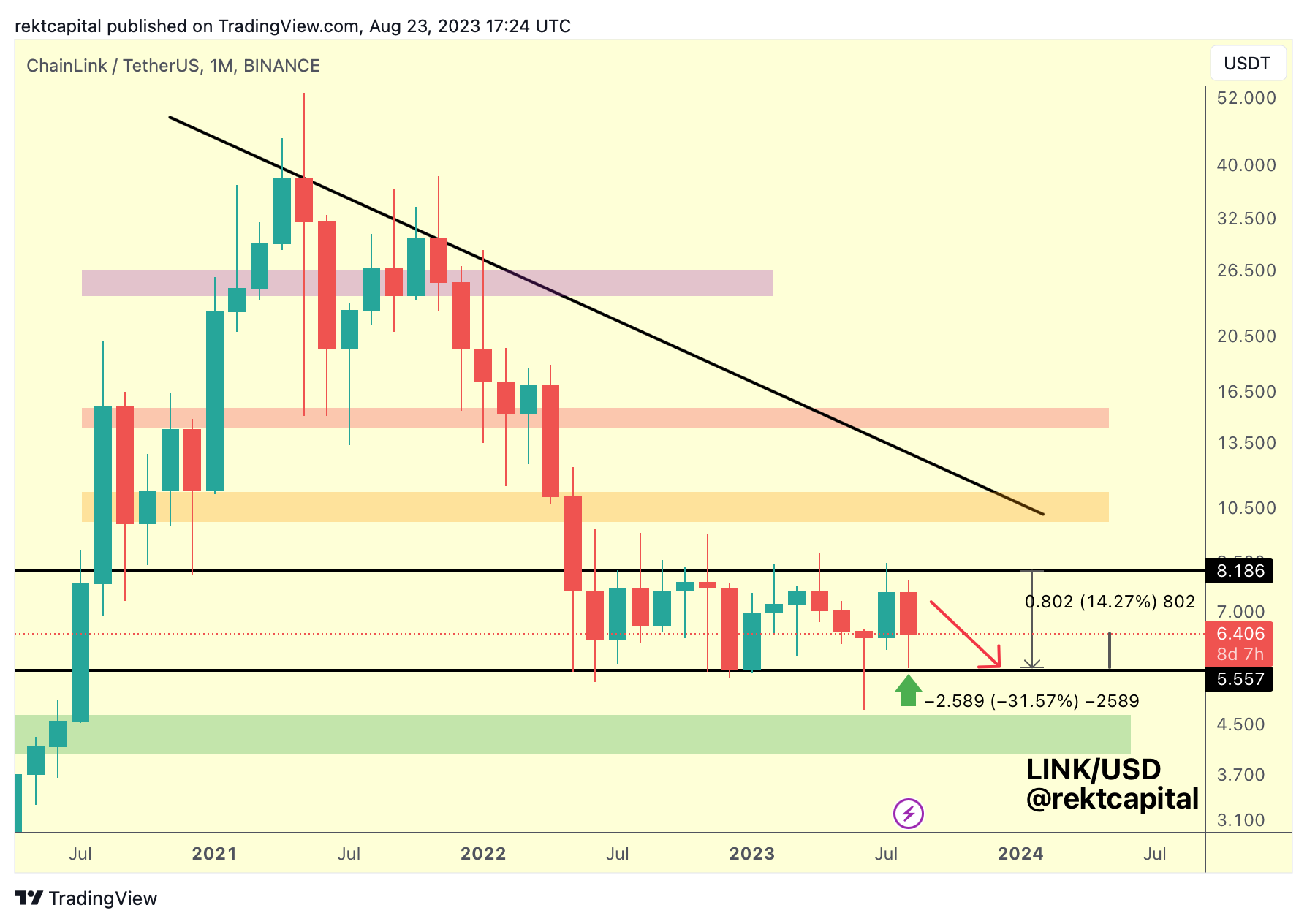

On August 23rd LINK has successfully retested the Range Low as support once again:

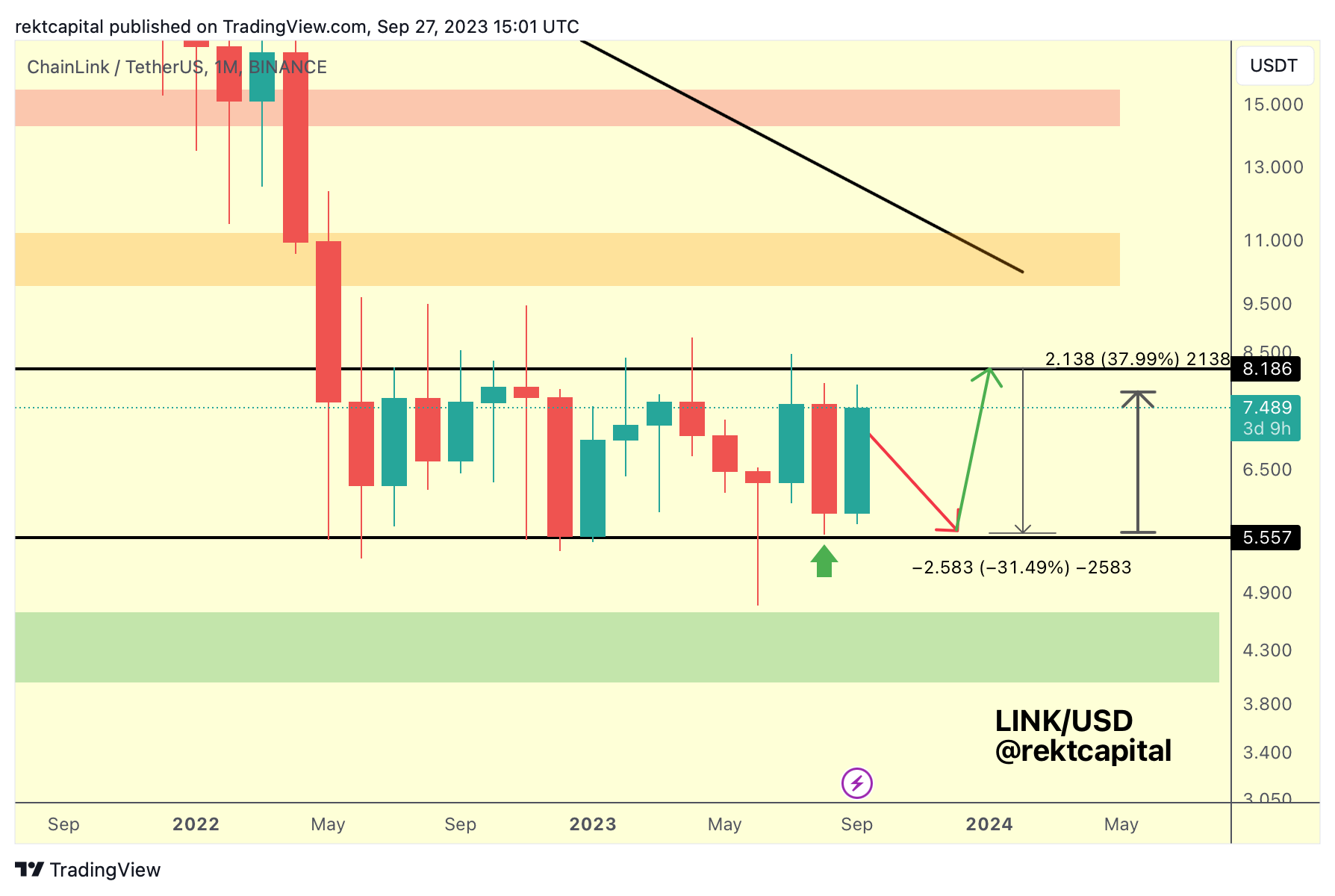

Here was last week's update:

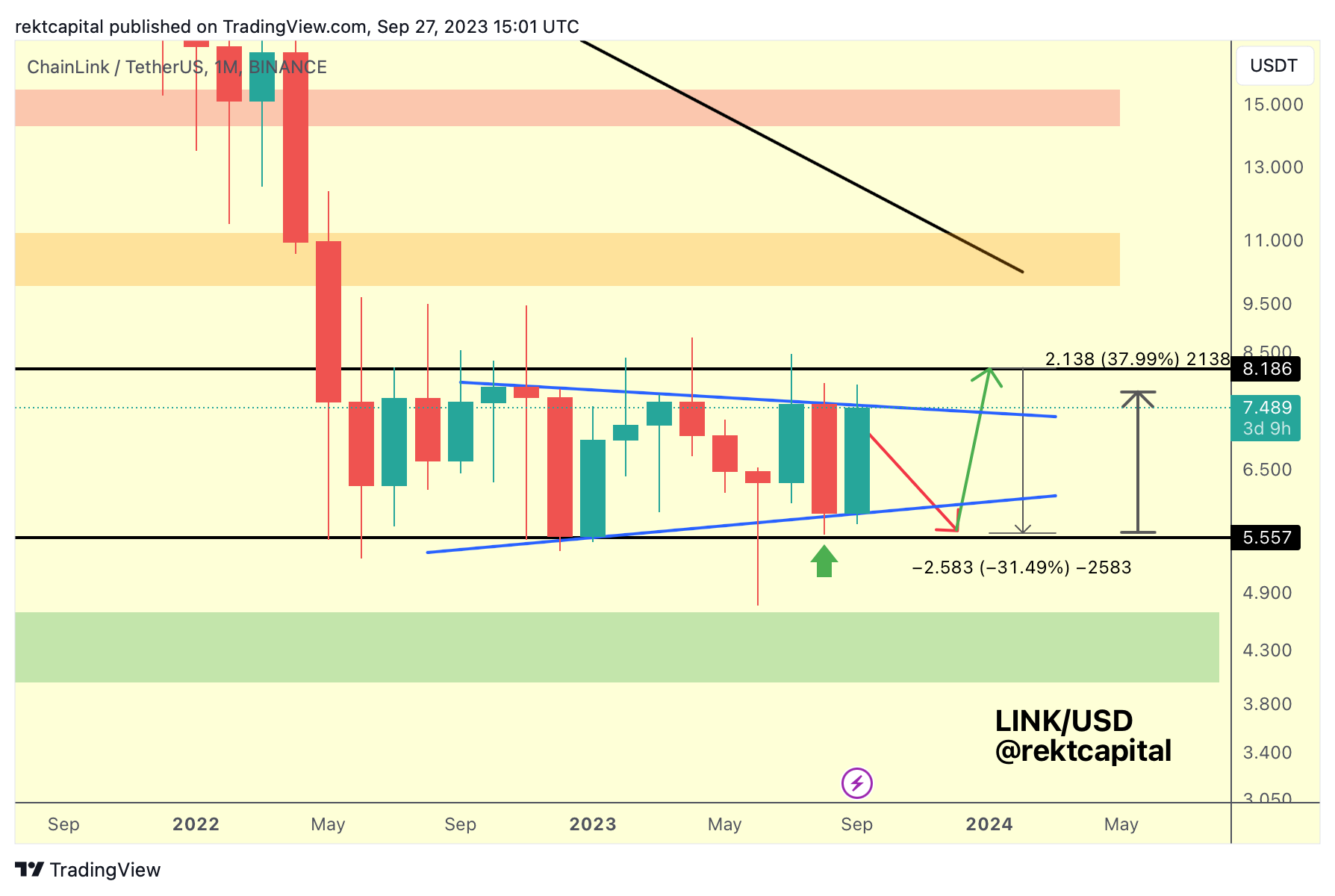

And finally - here is today's update:

LINK has perfectly rebounded from the Range Low and has come very close to revisiting the Range High resistance.

LINK has rallied +38% since rebounding from the bottom of its range.

Technically, any upside wicking beyond this point could get closer to signalling the end of the intra-range move.

Overall, anything near, at, or just beyond the Range High resistance has been the point of maximum financial risk for Chainlink - at least over the past year-or-so that LINK has been inside this range.

Of course, at some point LINK will breakout from this Macro Range.

But until that occurs here are a few things to keep an eye on.

Number one:

Is LINK forming a new Lower High and Higher Low within the range?

What this may precede is lessening volatility within the range due to price compression within this emerging triangular market structure.

Price compression precedes volatility which is good for long-run as that would probably precede a breakout from the Macro Range.

However this may change the complexion of the intra-range swing trades that we've been publicly and consistently performing here in the Newsletter.

That is, instead of rebounding from Range Low and rejecting at Range High, price may transition to a rebound from Higher Low to reject at the Lower High - and price could continue this consolidation within the blue pattern as price coils in towards the apex of the triangle in preparation for a breakout move.

The other thing to keep in mind - number two:

Is Chainlink on the cusp of breaking its Macro Downtrend?

A Weekly Close above the Macro Downtrend and a successful retest of it as new support would confirm an end to the Downtrend and the beginning of a new Macro Uptrend.

And if that occurs - then the above analysis on the blue triangle could become invalidated as price would have a better chance at breaking out from the Macro Range.

However - if LINK fails to confirm a breakout beyond the Macro Downtrend then price may have to drop lower inside its Macro Range for further consolidation.

Failure to Weekly Close above the Macro Downtrend would end up as an upside, FOMO wick beyond the Macro Downtrend resistance which is what happened a few months ago and that preceded a rejection.

Key takeaways:

- Monthly Close below the Range High resistance of the Macro Range would probably a) sentence LINK to further price consolidation inside the range and b) as a result, see downside within the range to revisit the Range Low over time

- Weekly Close below the Macro Downtrend would likely confirm further downside inside the Macro Range; Weekly Close above the Macro Downtrend could see price challenge the Macro Range High resistance for a Range Breakout.