Bitcoin: Pre-Halving Analysis (Part 1)

A comprehensive look at Pre-Halving years

Welcome to the Rekt Capital newsletter, a place for people who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Monthly Timeframe

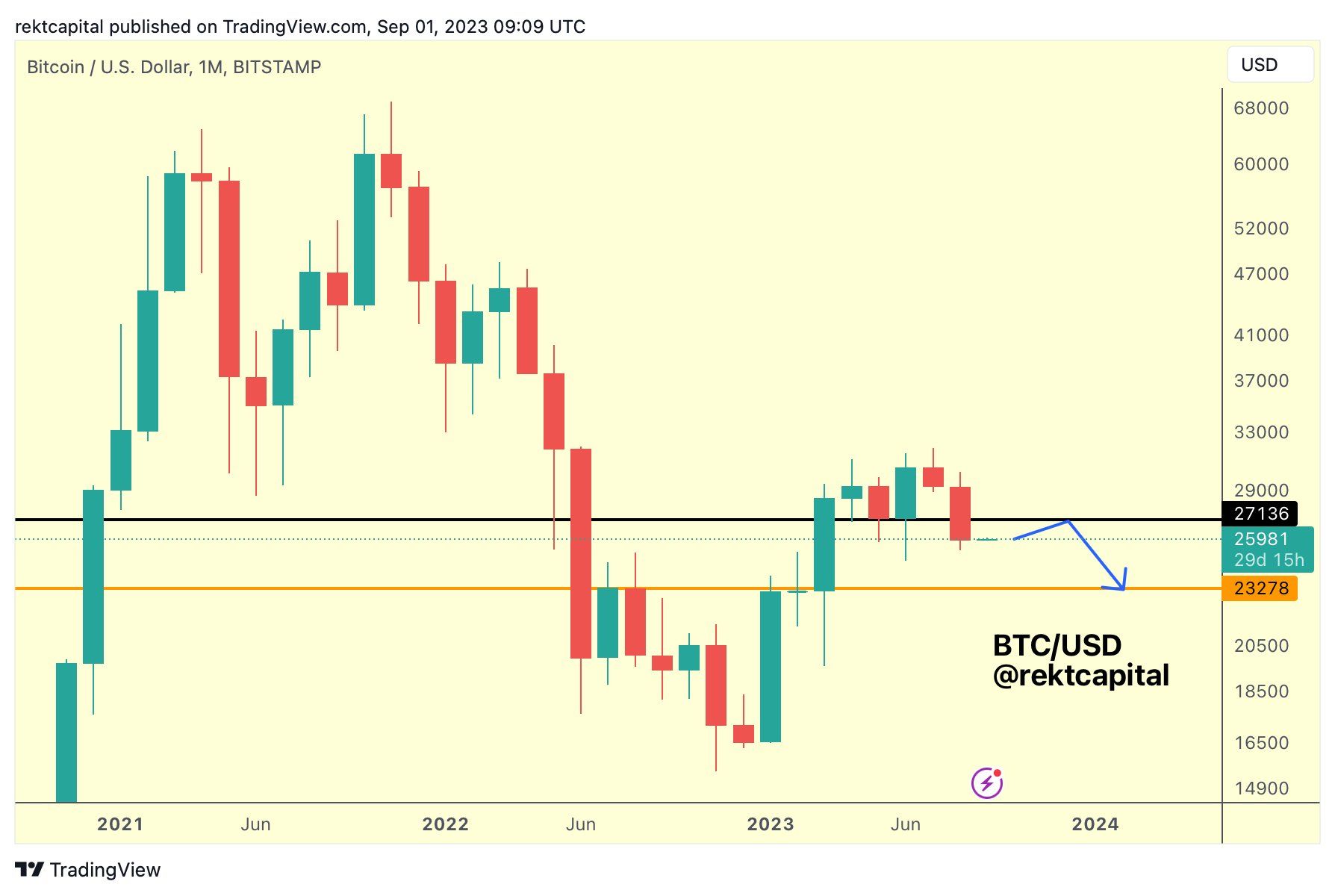

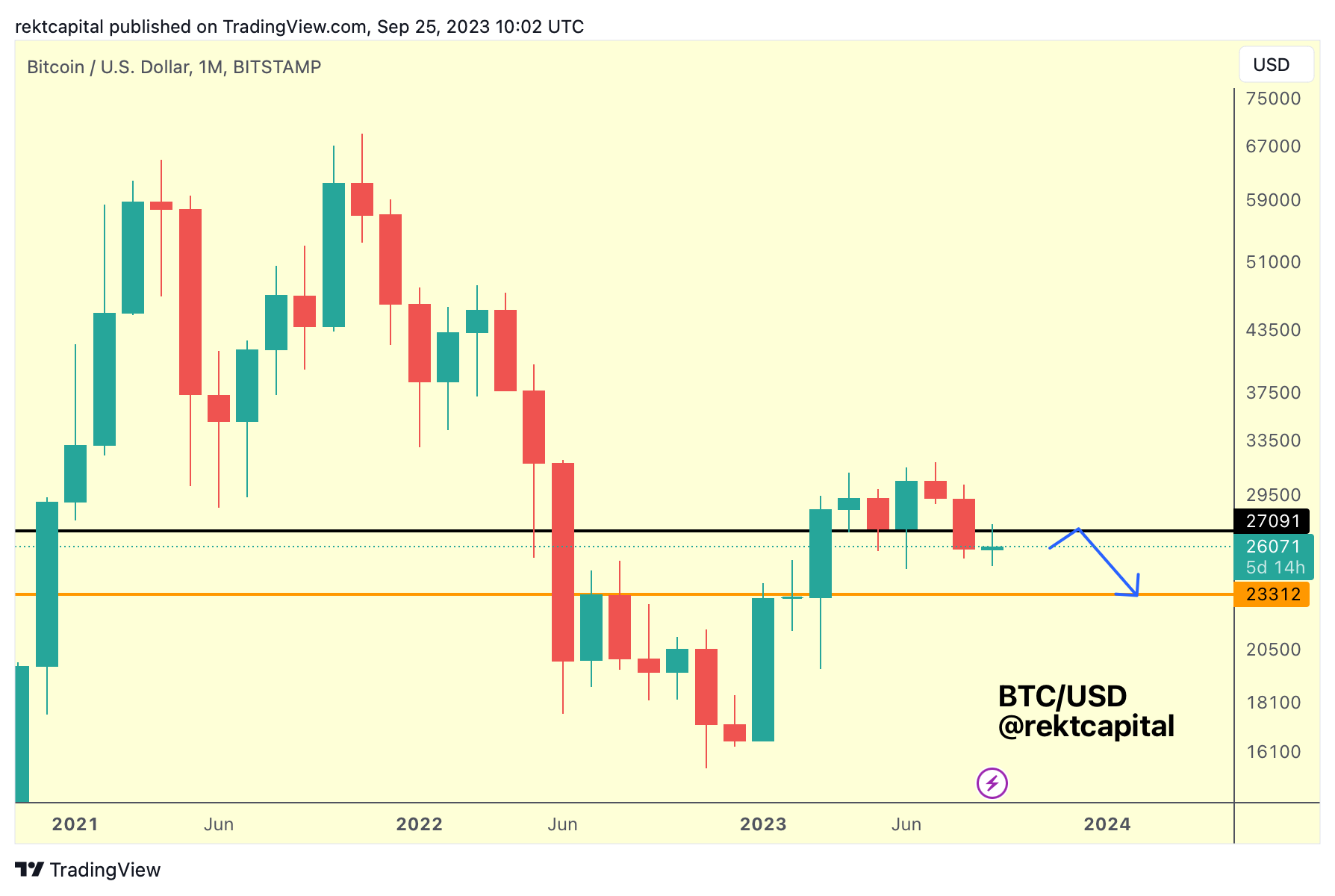

Was September all about turning an old Monthly support into a new Monthly resistance?

Given how BTC has presented itself this month - the answer to that questions looks like "yes":

Bitcoin looks like it has confirmed this ~$27150 level into new resistance and a Monthly Close below black would confirm that.

This is the first time ever that this level has acted as resistance, which is a historic technical feat in of itself.

After all - in the past (late 2020, early 2021) price blasted through this level.

And in the more recent past - price tried to hold there as support for a few months but ultimately failed.

But this is the first time BTC is rejecting from this level which is acting as resistance.

And this is important to emphasise because we also don't know what sort of a resistance this is: a weak one or a strong one?

It's clear however that if black continues to act as a point of rejection, price could get dragged down to the next Monthly level at ~$23300 (orange).

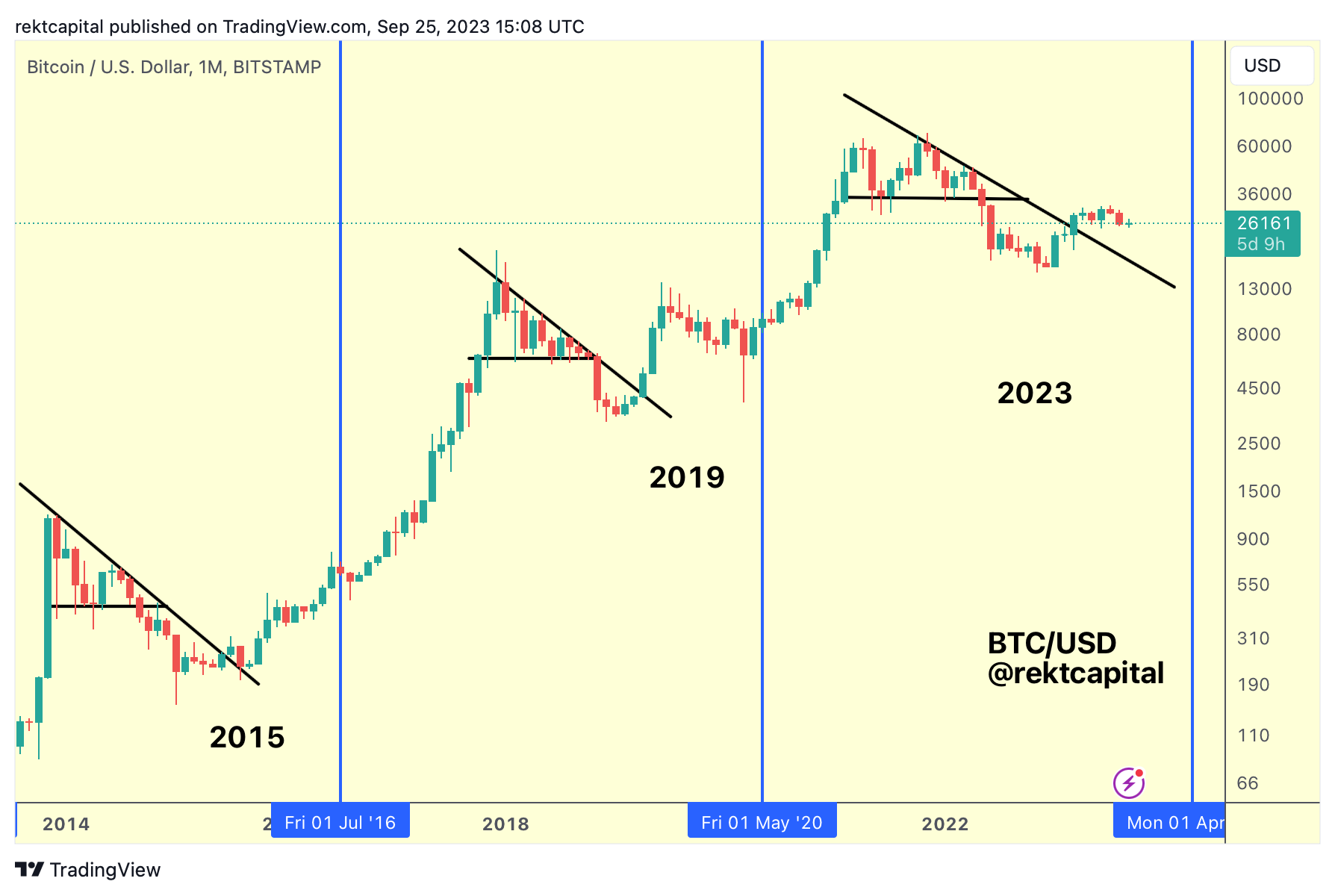

The Macro Perspective

Make no mistake however - Bitcoin is still in a new Macro Uptrend.

Bitcoin broke its Macro Downtrend several months ago and while the upside hasn't been too exciting ever since, it's important to emphasise that upside upon breakout beyond the Macro Downtrend rarely is in the grander scheme of things.

In 2015, BTC saw an initial push up before consolidating for months going into the Halving.

Only close to and after the Halving did things really pick up.

In 2019, yes price rallied quite exuberantly but also retraced equally exuberantly in the months that followed the Local Top in June 2019.

Close to and after the Halving is where things really started to pick up however.

And in 2023, BTC broke out and rallied to the upside but momentum has slowed since the initial push up.

If 2015 or 2019 are anything to go by, then the next coming months going into the Halving will likely be uneventful.

If 2015 were to repeat, then BTC could simply consolidate at these highs going into the April 2024 Halving, perhaps enjoying a bit more upside closer to the event.

But if 2019 were to repeat, then perhaps a period of downside awaits for Bitcoin, only to resolve also closer to or around the Halving event.

Which option will it be?

Will Bitcoin repeat 2015?

Or will Bitcoin repeat 2019?

For the time being - 2023 resembles 2019 in more ways than one which is why BTC's current price predicament favours downside.

However chances are that 2023 will simply become its own cycle, borrowing elements from both 2015 and 2019.

But if there's one takeaway from this edition of the newsletter - it should be this:

Any downside in the Pre-Halving period (orange) needs to be made the most of in preparation for Post-Halving price appreciation: