How Much Could Bitcoin Rally Prior To Its Upcoming Halving?

What to expect prior to the next upcoming Halving

Hello crypto traders and investors,

Before we jump into today’s newsletter issue, I need to remind you of the Early Black Friday offer that’s available right now.

This is the biggest one so far – The Rekt Capital Masterclass: 4 Online Courses in 1 Bundle 🚀

For $299, you get:

- Bitcoin Investing Course worth $199

- Altcoin Investing Course worth $199

- Cryptocurrency Technical Analysis Course worth $149

- Cryptocurrency Risk Management Course worth $249

A total value of $796, but you get ALL of these courses in one bundle for only $299…

Saving yourself $497 and get 63% off 🤑

Upon purchase, you unlock lifetime access to the courses and you can watch them any time.

Only 5 days left until the offer expires ⏳

The Bitcoin Halving

Here are a few core principles we need to account for when thinking of the Bitcoin’s price in the context of the Bitcoin Halving.

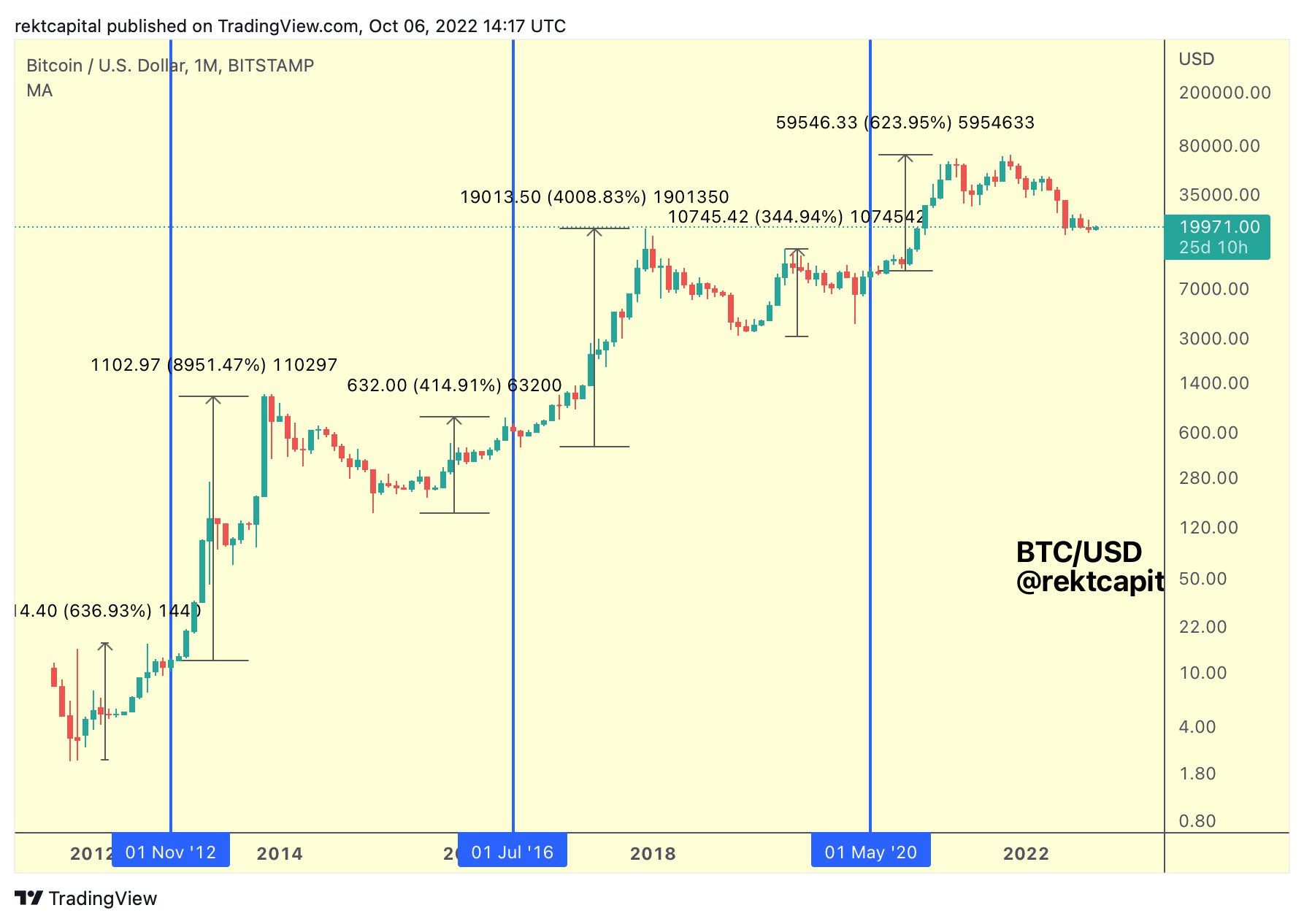

Firstly - diminishing returns.

Principle 1:

Returns prior to and after the Halving seem to be diminishing with each Halving.

Pre-Halving 1 returns amounted to +636%.

Pre-Halving 2 returns amounted to +414%.

Pre-Halving 3 returns amounted to +344%.

And of course post-halving returns.

Post-Halving 1 returns amounted to +8950%.

Post-Halving 2 returns amounted to +4000%.

Post-Halving 3 returns amounted to +623%.

And as a result, the conclusion appears itself that secondly - Bitcoin tends to rally most after the Halving.

Principle 2:

Bitcoin rallies more after the Halving than before.

But also the exponentiality of the uptrend is different post-Halving compared to pre-Halving.

The amount of ROI that BTC generates pre-Halving is lesser than post-Halving but at the same time it takes roughly the same time for BTC to generate that pre-Halving ROI vs the amount of time it takes for BTC to generate post-Halving return.

This makes sense - the Bull Market gets progressively more euphoric as it goes on and so the exponentiality of the uptrend post-Halving sees price grow more but what’s interesting is this takes a similar amount of time.

Principle 3:

Bitcoin rallies less pre-Halving and more Post-Halving, but these moves take a similar amount of time.

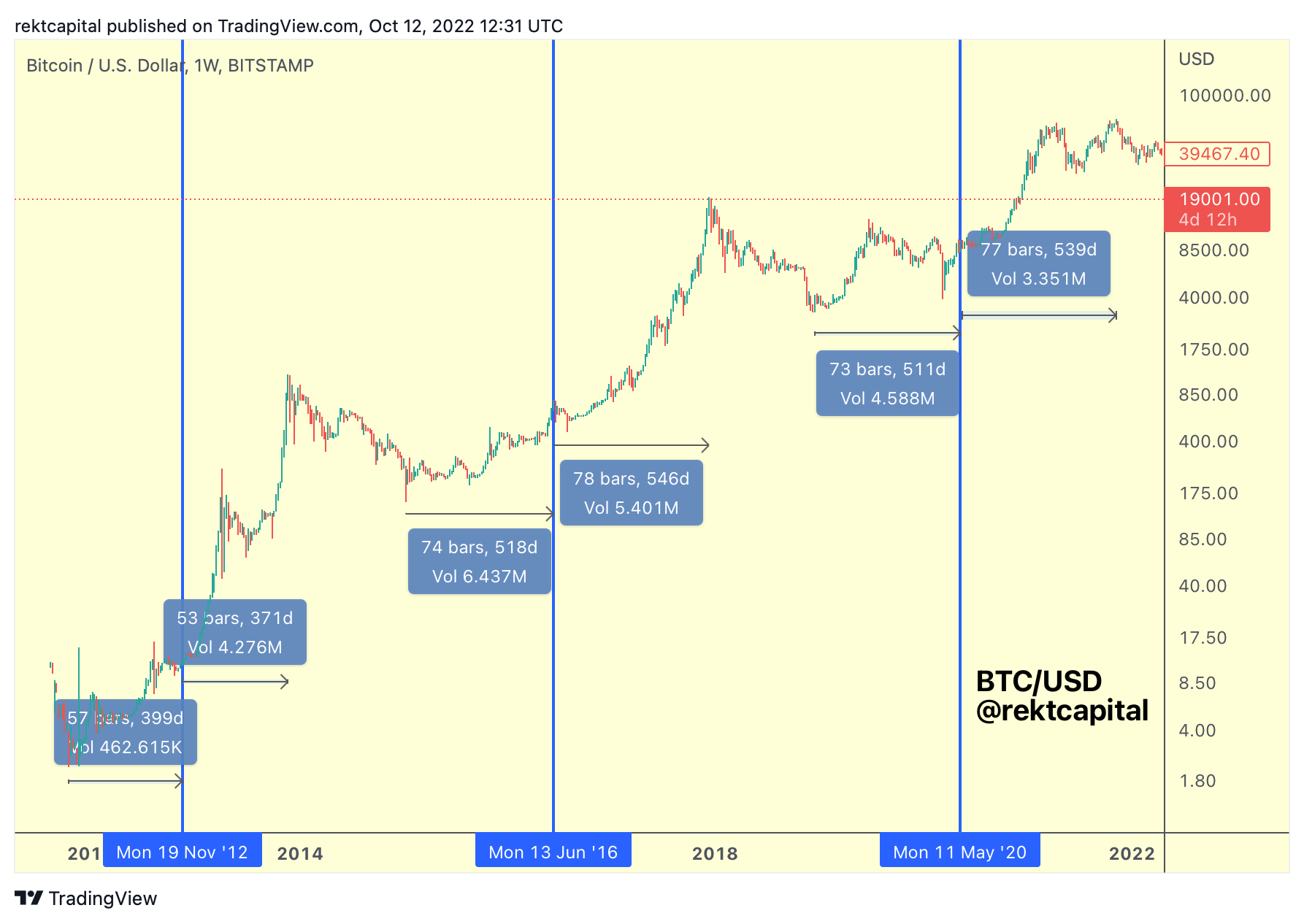

In a nutshell:

Pre-Halving 1, it took 400 days to rally +636%.

Post-Halving 1, it took 371 days to rally +8950%.

Pre-Halving 2, it took 518 days to rally 414%.

Post-Halving 2, it took 546 days to rally +4000%.

Pre-Halving 3, it took 511 days to rally 344%.

Post-Halving 3, it took 539 days to rally 623%.

More Principles…

Here are some more principles when it comes to price in the context of the Halving:

Principle 4:

Bitcoin tends to bottom anywhere between 400 to 518 days before the Halving.

And by the same token, what can be said about post-Halving growth?

Principle 5:

Bitcoin tends to top out anywhere between 371 to 546 days after the Halving.