Bitcoin - How Deep Could Bitcoin Retrace? PART 2

The Phases of the Bitcoin Halving - Deep Breakdown & Analysis

Bitcoin - The Macro Diagonal

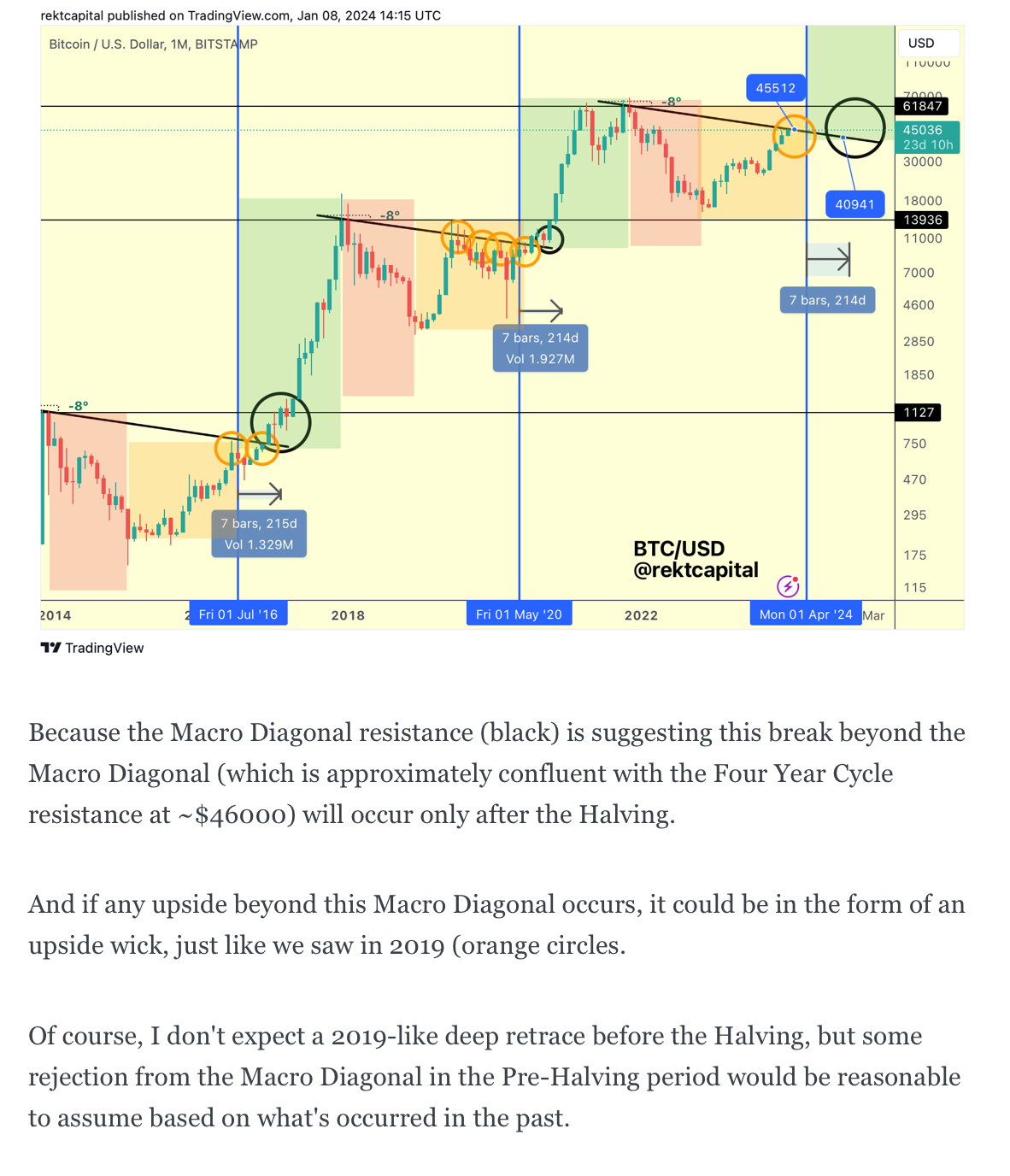

Over the past few weeks, we've spoken about how price could reject from the Macro Diagonal.

Here's a chart from early January:

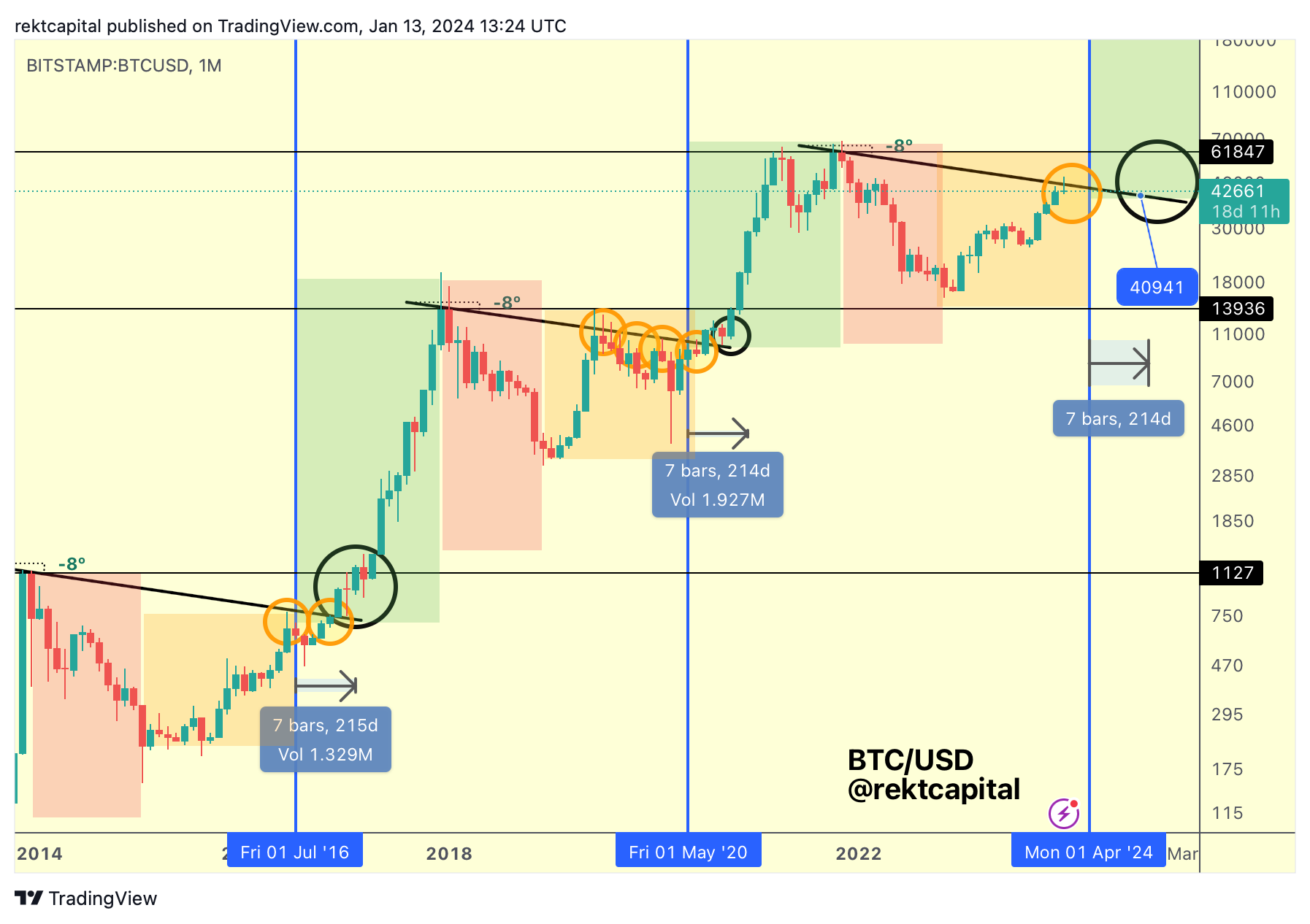

Here's the same chart from mid-January:

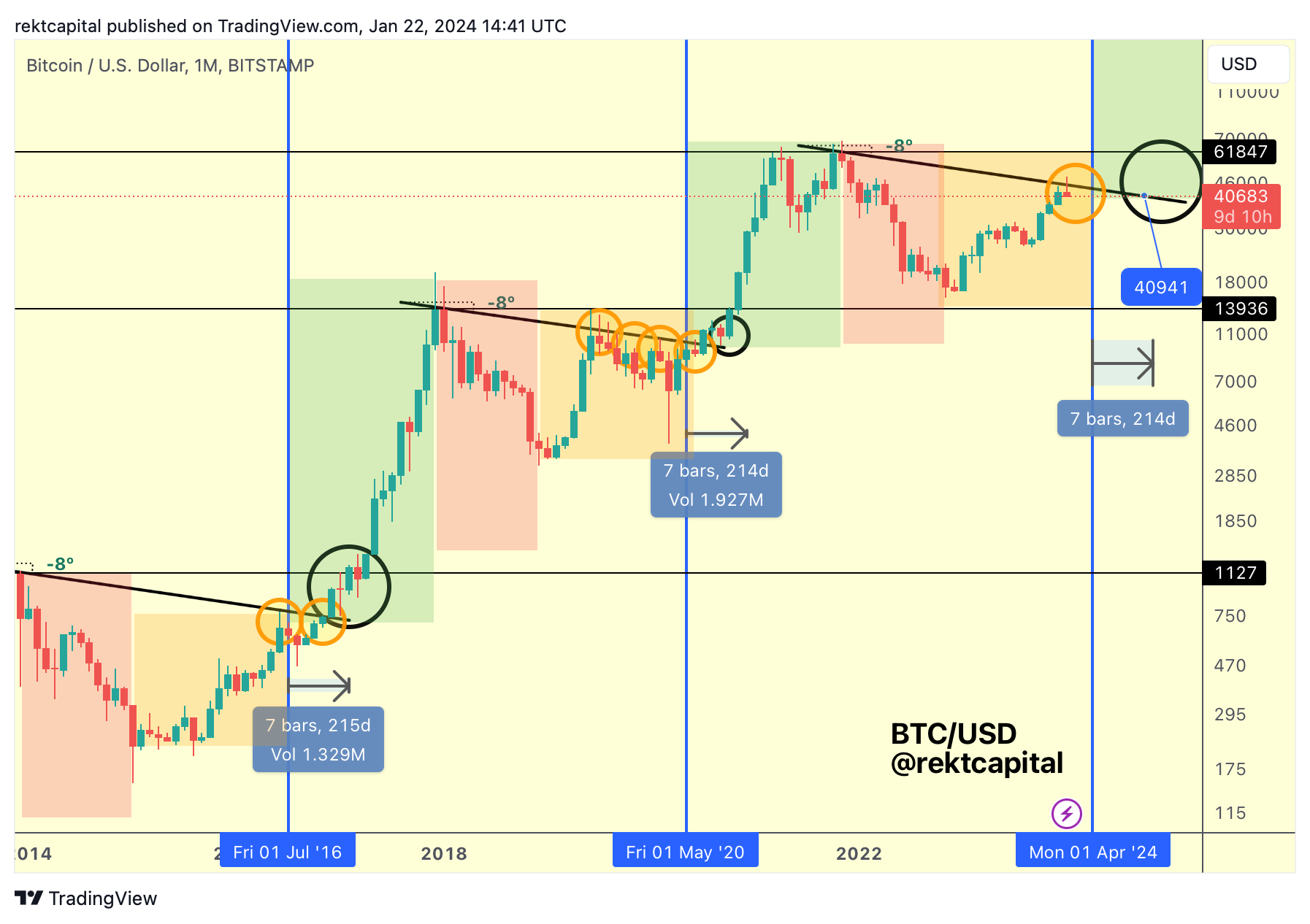

And here's the same chart from today:

The Macro Diagonal is acting as a point of rejecting, as it always tends to in the Pre-Halving period.

But it's important not to become short-sighted or too focused on this current downside.

The bigger picture is that this downside will likely facilitate the next uptrend.

Whether that's the Pre-Halving rally which historically tends to occur around 2 months before the Halving (light blue box, i.e. mid-to-late February in this cycle).

Or whether that's the Post-Halving rally but within a Re-Accumulation Range (red).

Or whether that's the parabolic Post-Halving rally which tends to occur many months after the Halving itself (green).

It's clear that any downside is necessary to facilitate the positive price changes that lay ahead.

In essence, have three final bargain-buying opportunities for Bitcoin before Bitcoin enters its most parabolic phase of the cycle (green):

- Pre-Halving Retrace Part 1 (orange)

- Pre-Halving Retrace Part 2 (dark blue circle)

- Post-Halving Re-Accumulation (red)

Let's talk about each in more detail.

Pre-Halving Retrace Part 1 (Orange)

The Pre-Halving period/retrace Part 1 tends to occur around 100 days before the Halving.

And it is during this period where Bitcoin simply tends to retrace.

In 2024 thus far, this pullback is -18% deep.

In 2020, this was -63% which was obviously impacted by the Black Swan event of COVID-19.

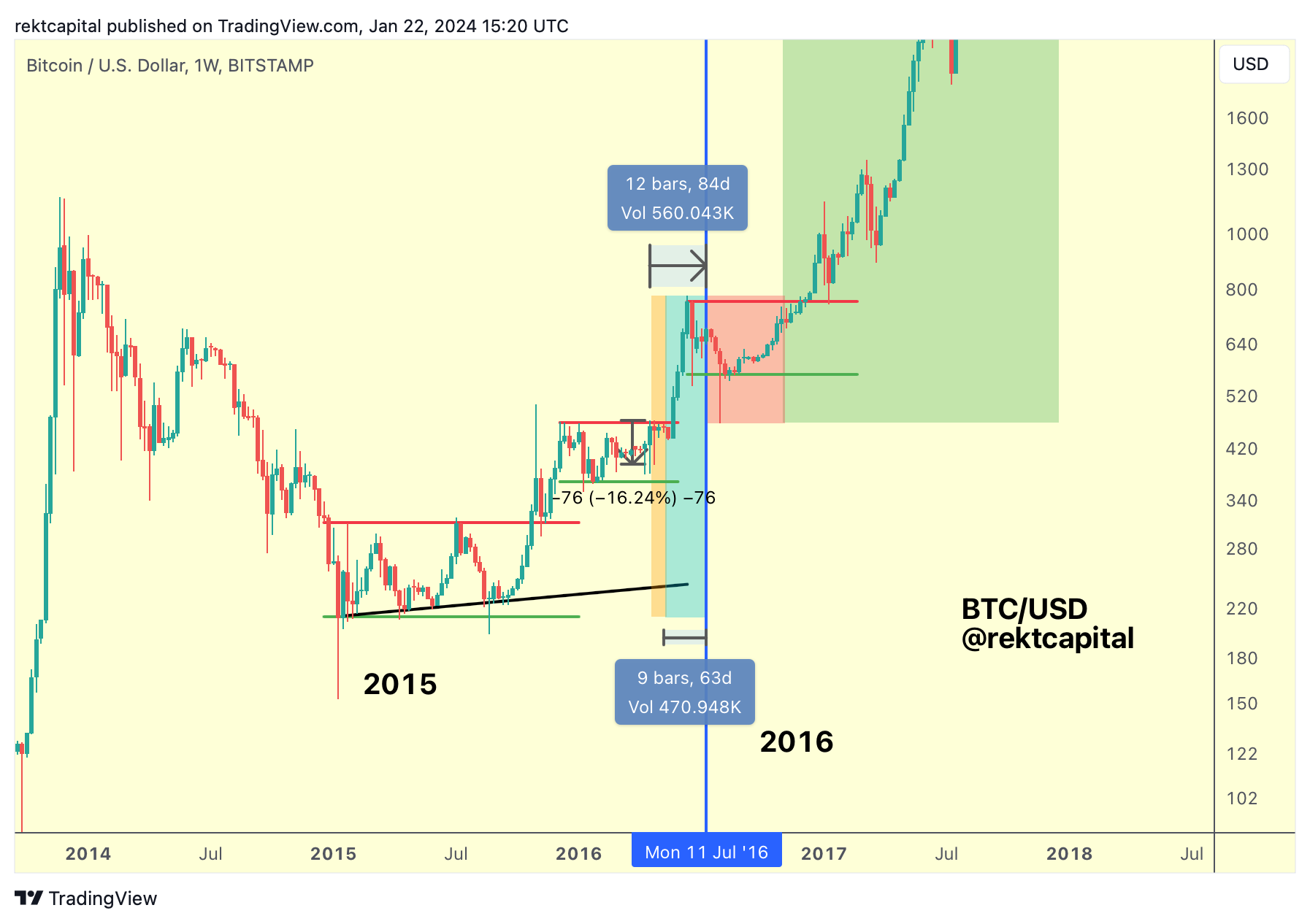

And in 2016, this downside was -16%:

The key takeaway here is the following Principle:

Principle #1 - Bitcoin tends to retrace ~100 days before its Halving

Whether that's -16% in 2016...

Whether that's -63% in 2020...

Or whether that's -18% in 2024 thus far...

There tends to be a retrace during this period.

One quick objection many tend to make: "but in 2020 it was a Black Swan event"

And that is true; perhaps that's why the downside was much more extreme than in 2016 and even now in 2024 for example.

It's highly unlikely that we'd see a -63% retrace at this point in the cycle again.

But it bears repeating that downside simply tends to occur during this period in the cycle.

Don't get lost in focusing on retracement depth; focus on the fact that a retrace tends to occur during this period and that this retrace precedes upside over the mid-to-long run.