Altcoin Newsletter #160

Features ETH LINK ROSE COTI CHZ THETA

In today’s Altcoin newsletter I cover 6 different Altcoins, specifically:

- Ethereum (ETHUSD & ETHBTC)

- Chainlink (LINK)

- Oasis Protocol (ROSE)

- Coti (COTI)

- Chiliz (CHZ)

- Theta Token (THETA)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Ethereum - ETH/USD & ETH/BTC

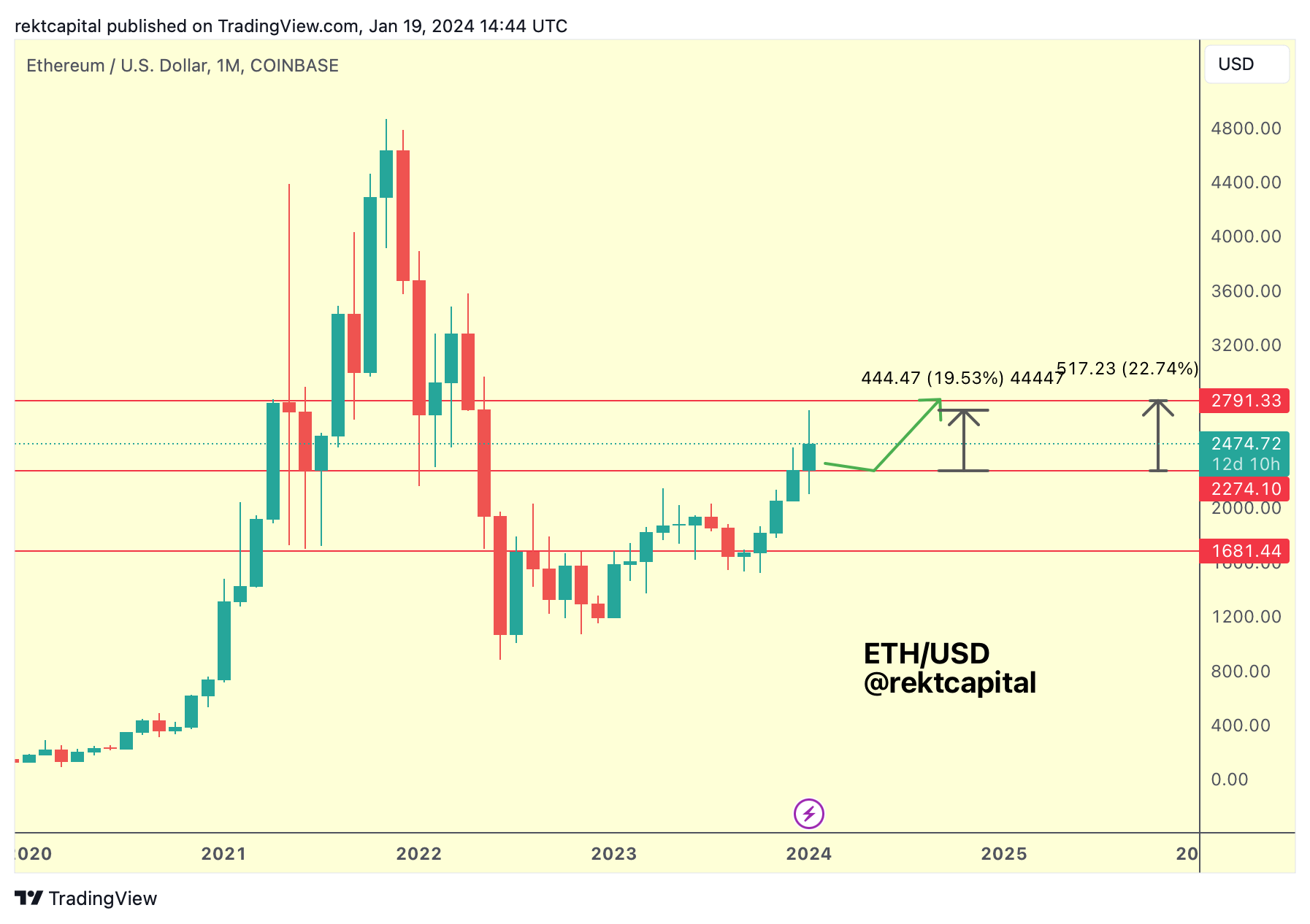

Over the past few weeks, I'd anticipated a +20%-or-so move to the upside for Ethereum on its USD pair on Twitter X:

And here's today's update:

Ethereum performed a +19% move across the entirety of its red-red range, revisiting the Range High area, pretty much completing its +22% move from Range Low to Range High, narrowly missing the top of the range by some +2%.

Is this move over?

Historically, whenever ETH had revisited this Range High resistance, it would then drop back into the Range Low in the following month.

It's for this reason that it's possible ETH could dip into the Range Low once again, essentially to repeat the green path move.

But could this retest be a volatile one?

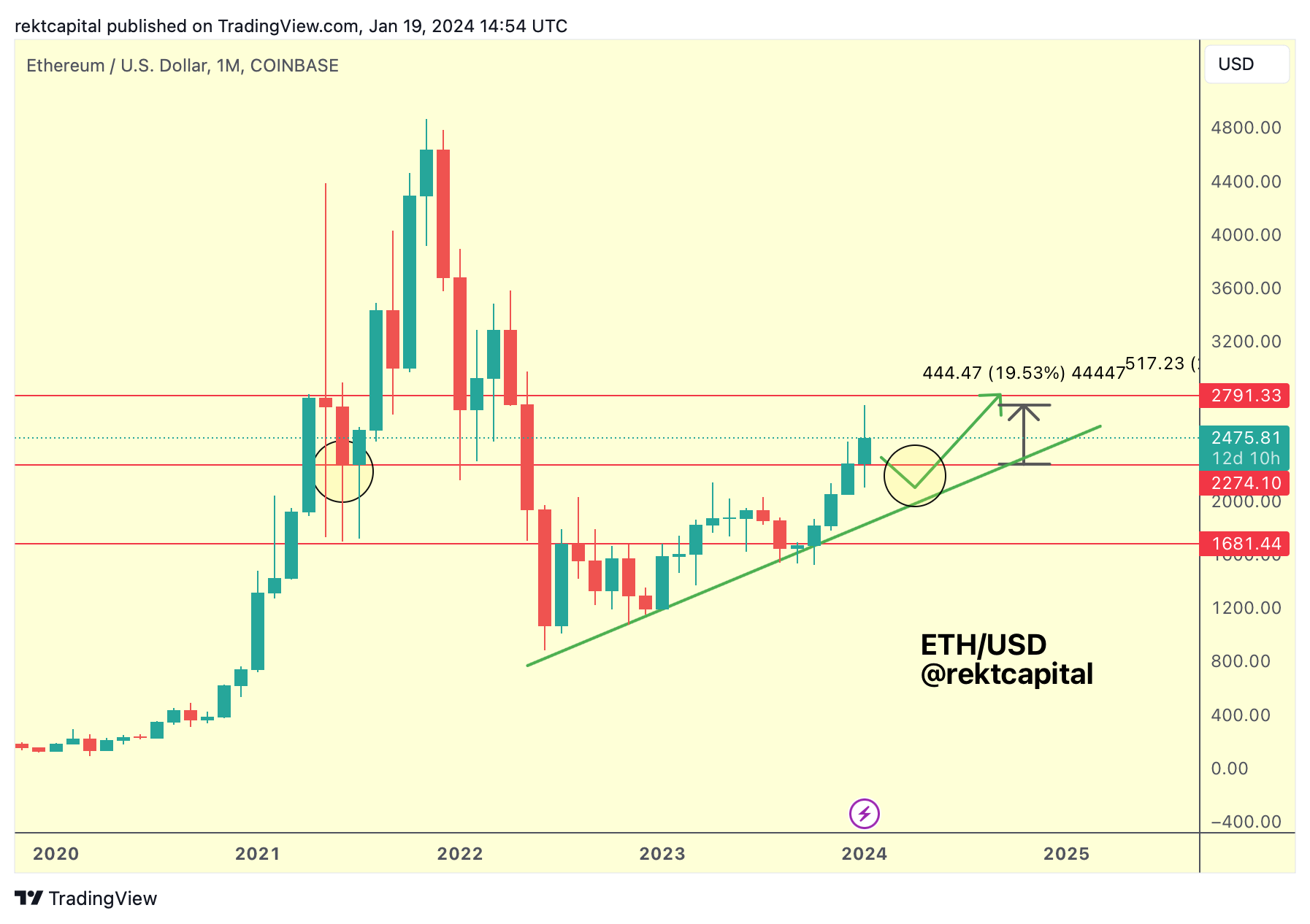

Because if we look to early 2021, ETH produced downside volatility during the retest of the red $2274 Range Low:

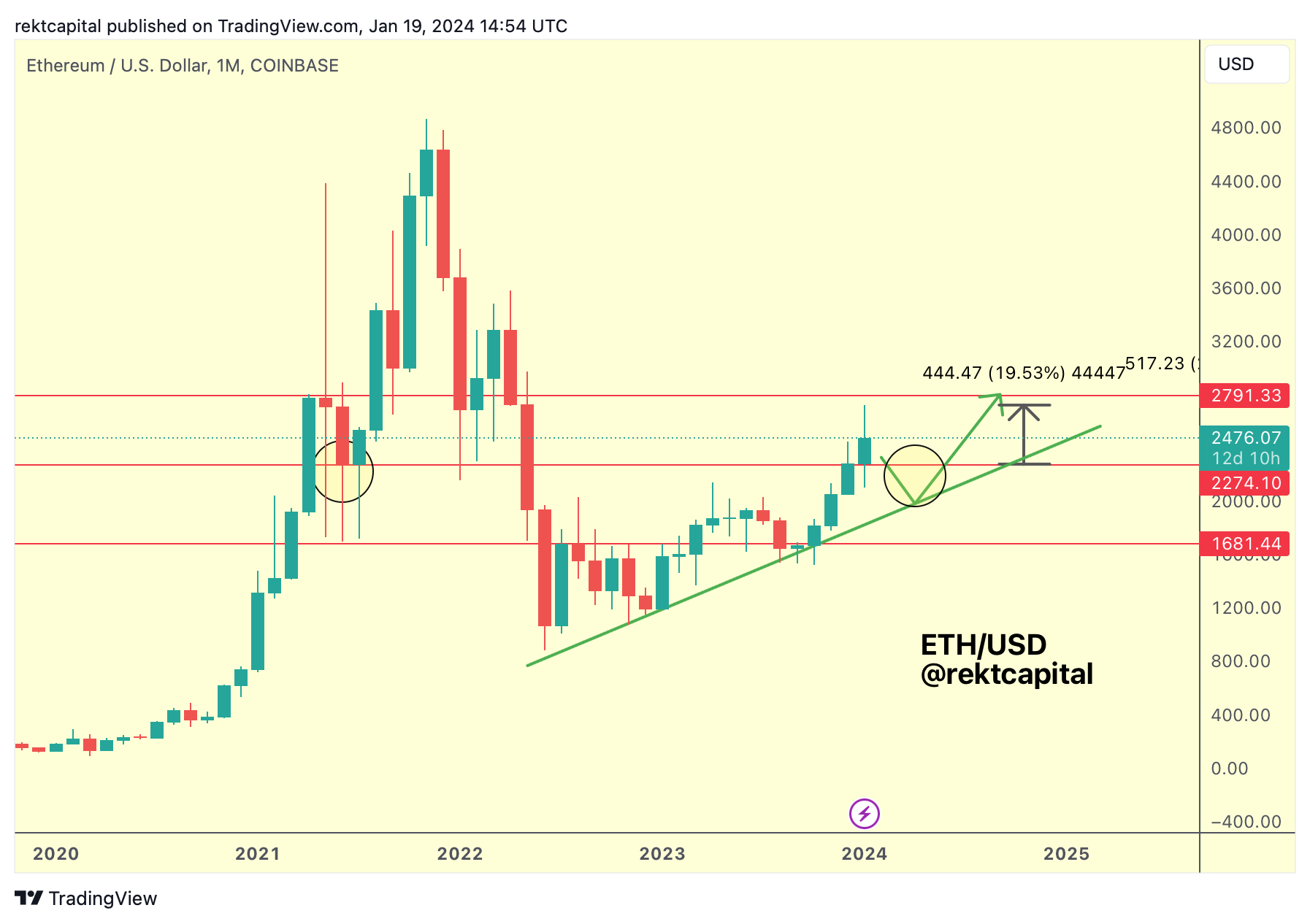

So if the retest is a volatile one, similar to what we saw last month, ETH could drop into the very low $2000s as per this adjusted green path.

However if we see an even more volatile retest there, then the green macro Higher Low could come into play as a key support in the highs $1900s:

It all depends on the extent of volatility at this Range Low support, which is difficult to assess ahead of time; after all, how can we assess the level of emotionality ahead of time?

Though we may know to pay attention to key levels, we never truly know the extent of the extreme nature of emotion that will be experienced around a particular level.

In sum, it looks like ETH may have concluded its move for this month, but because it is inside a range, maybe it's time for a consolidatory in the other direction, this time towards the Range Low.

Inside a range, price tends to move in a sinusoidal fashion, from Range Low to Range High back to Range Low and then to Range High for as long as it needs to before confirming the next major trend.

This $2740-$2791 (red-red) range has acted as a re-accumulation range in the previous cycle.

Could it become one of the same in this cycle as well?

Ethereum - ETH/BTC

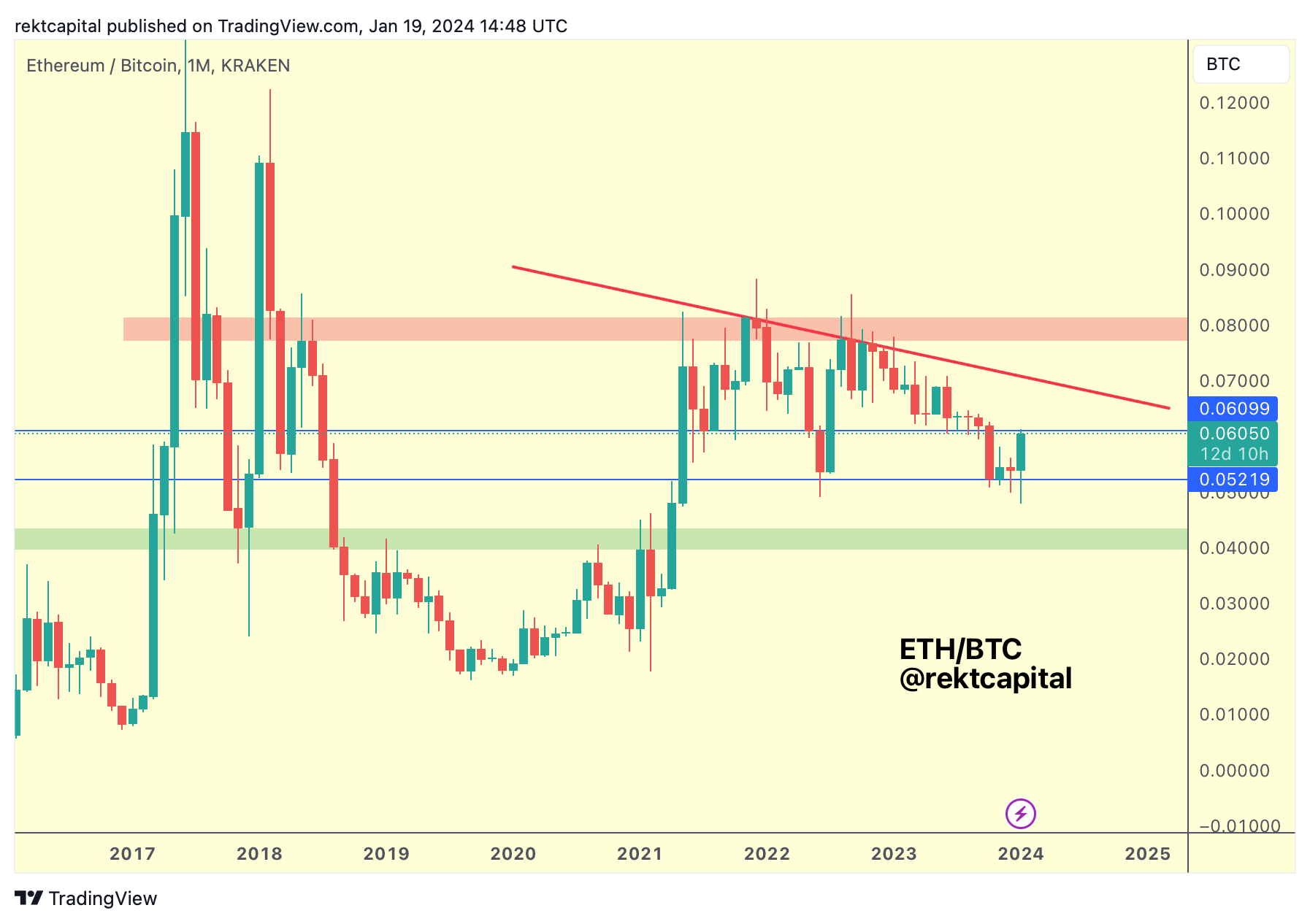

As for the BTC pairing for Ethereum, ETH is also ranging but in a very different context.

Let's unpack this chart.

ETHBTC has been in a Macro Downtrend since the dawn of 2022 (red diagonal resistance).

A few months ago, ETHBTC broke down into the blue-blue range.

Losing this range would see ETHBTC drop into the green historical demand area; in late 2017 ETHBTC experienced tremendous buy-side pressure there and then this same region acted as a strong resistance for ETHBTC from late 2018 to early 2021.

If ETHBTC were to ever revisit the green area, surely there'd be a strong reaction from there.

That said, we can only debate about that area for the time being as ETHBTC is still holding its blue-blue range.

If ETHBTC were to reclaim the blue Range High as a new support on the January Monthly Close, then price would have a legitimate chance at challenging the red Macro Downtrend over time.

The problem with that is as follows however - a few months ago, ETHBTC broke down from the blue Range High level and it looks like price has flicked up now to possibly turn it from old support into new resistance.

If this happens, ETHBTC could reject back into the Range Low, as part of its consolidation.

Until ETHBTC is able to confirm a trend, it will continue within this blue-blue range as part of its non-trend (i.e.sideways price behaviour).