The Bitcoin Dip Is Over

Enjoying the Pre-Halving Rally while acknowledging a future Pre-Halving Retrace

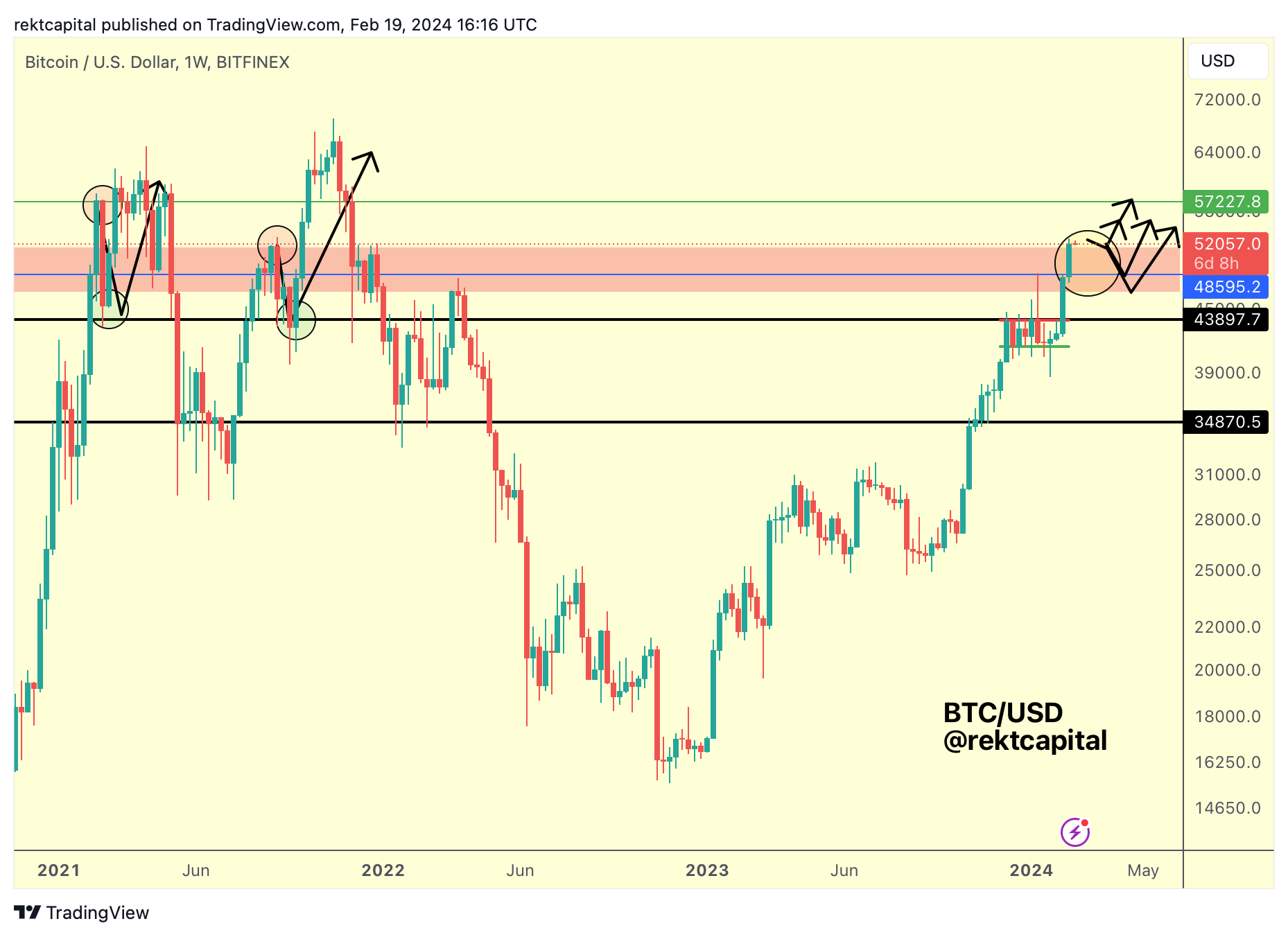

Last week, we spoke about Bitcoin being positioned for a retest of the top of the red box, for the first time ever:

And we also discussed deeper dipping scenarios as well, should that retest have failed:

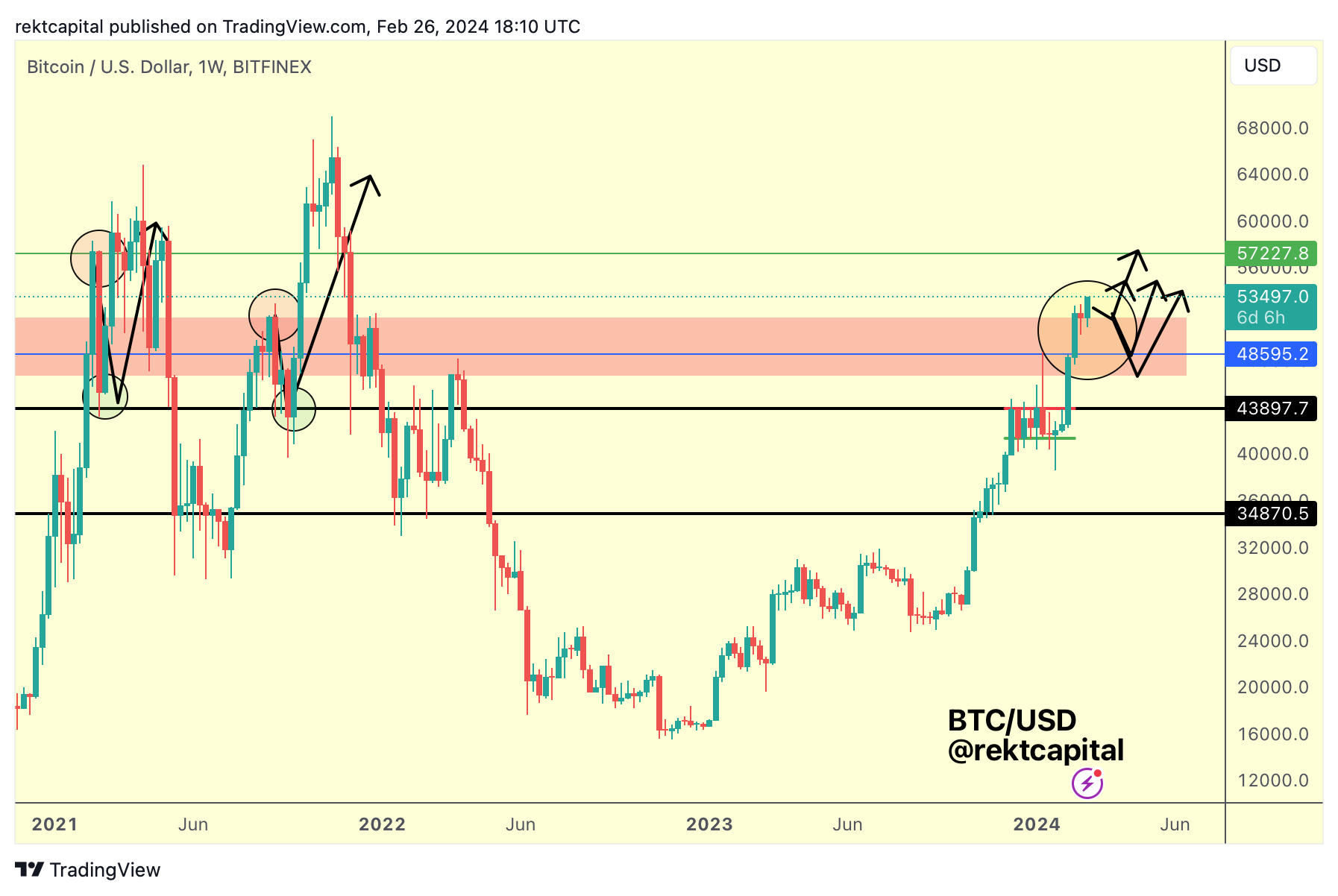

In the end, it looks like the retest was successful:

As a result, it looks like Bitcoin may very well be positioned for further trend continuation from here via the black path, following the successful retest here.

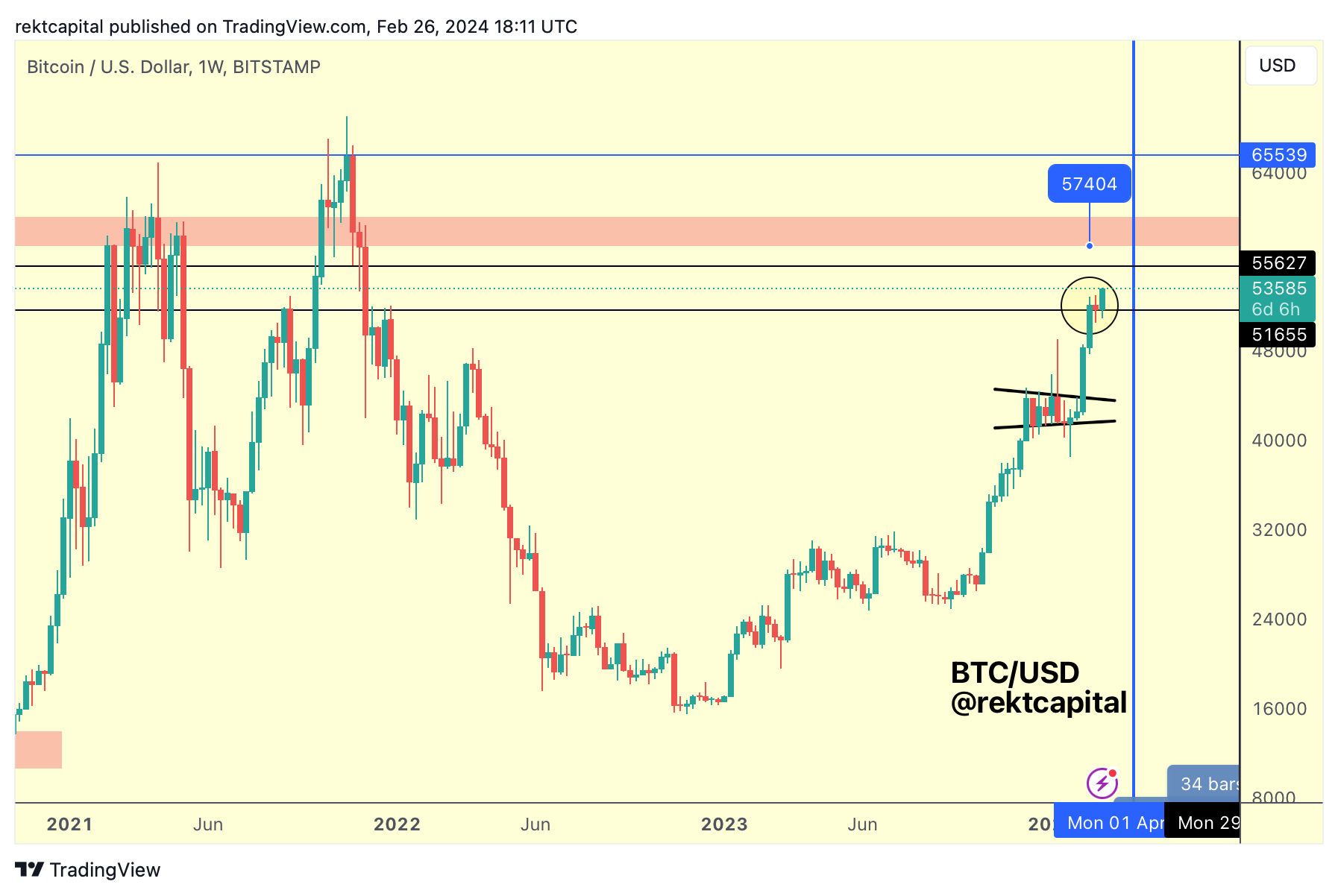

If we look at the above chart, breaking the $51655 level has historically preceded moves to at least the back $55627 resistance, with scope for upside into the bottom of the red box at $57404.

Essentially, it looks like BTC may be developing a range between these two black levels: $51655-$55627 which could become the home for another range at highs going into the Halving.

Such a development of a range here would definitely facilitate the Q1 Altcoin Hype Cycle:

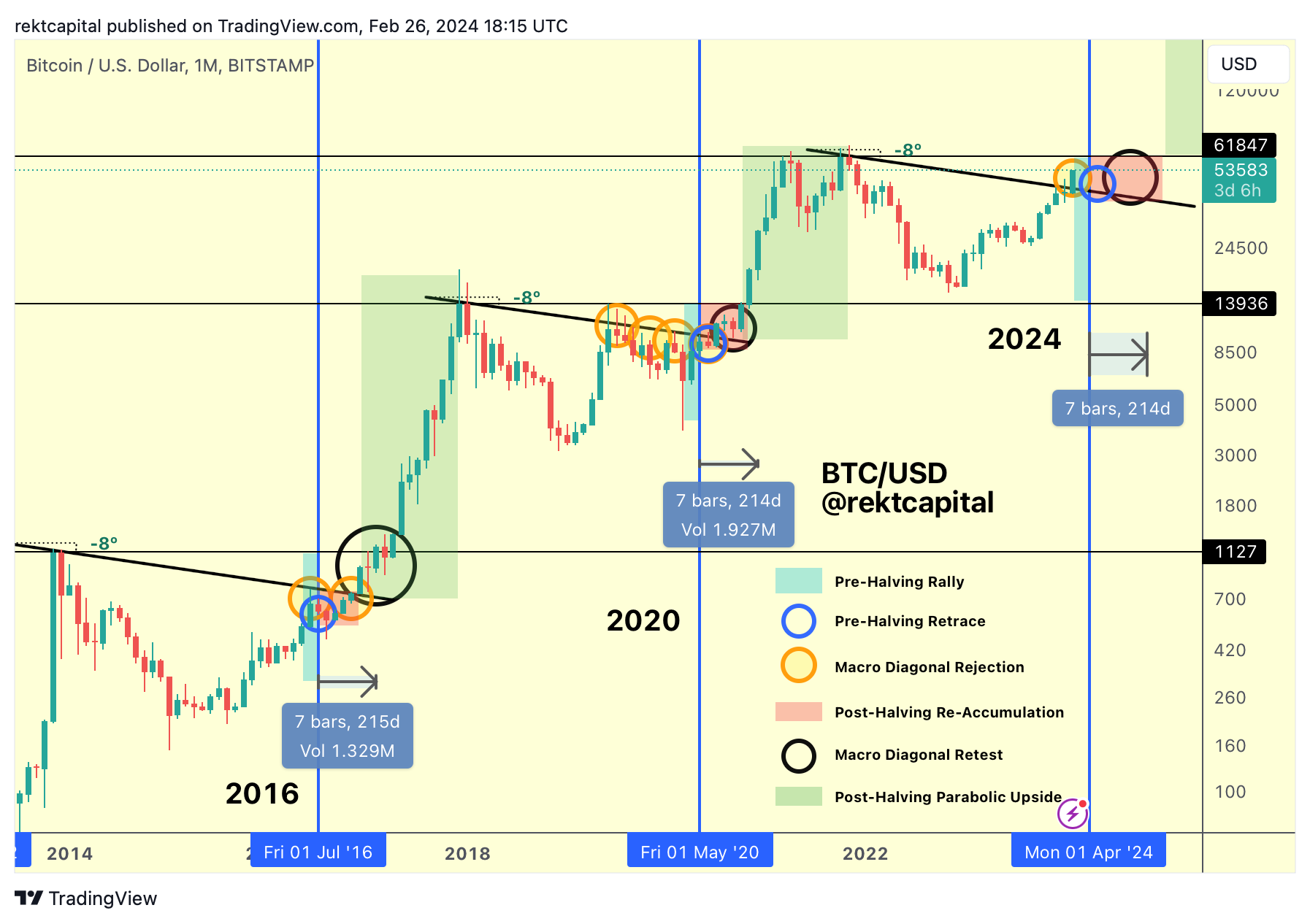

So clearly, the Bitcoin Pre-Halving Rally is still alive and well:

Technically, this Pre-Halving Rally could still continue for a few more weeks.

That being said, history suggests BTC shouldn't rally too much in this Pre-Halving Rally; if BTC were to develop a range here like mentioned earlier, history would get its wish and would repeat.

But Bitcoin is already going against the grain of history, especially when it comes to the Macro Diagonal:

Bitcoin is positioning itself for a historic Monthly Close beyond this Macro Diagonal.

For the first time ever, BTC has the chance to Monthly Close beyond this point.

So how do all these moving parts tie in together?

How can we reconcile them and what is the outlook going forward?

We'll address these questions in more detail in today's newsletter, with specific focus on the Bitcoin Halving phases.