Altcoin Watchlist

Features analysis on Altcoins such as VET ETH UNI THETA COTI CHZ

Welcome back to the Rekt Capital Newsletter.

In today’s edition of the Rekt Capital Newsletter, the following cryptocurrencies will be analysed & discussed:

- VeChain (VET)

- UniSwap (UNI)

- Theta Token (THETA)

- Coti (COTI)

- Chiliz (CHZ)

- Ethereum (ETH)

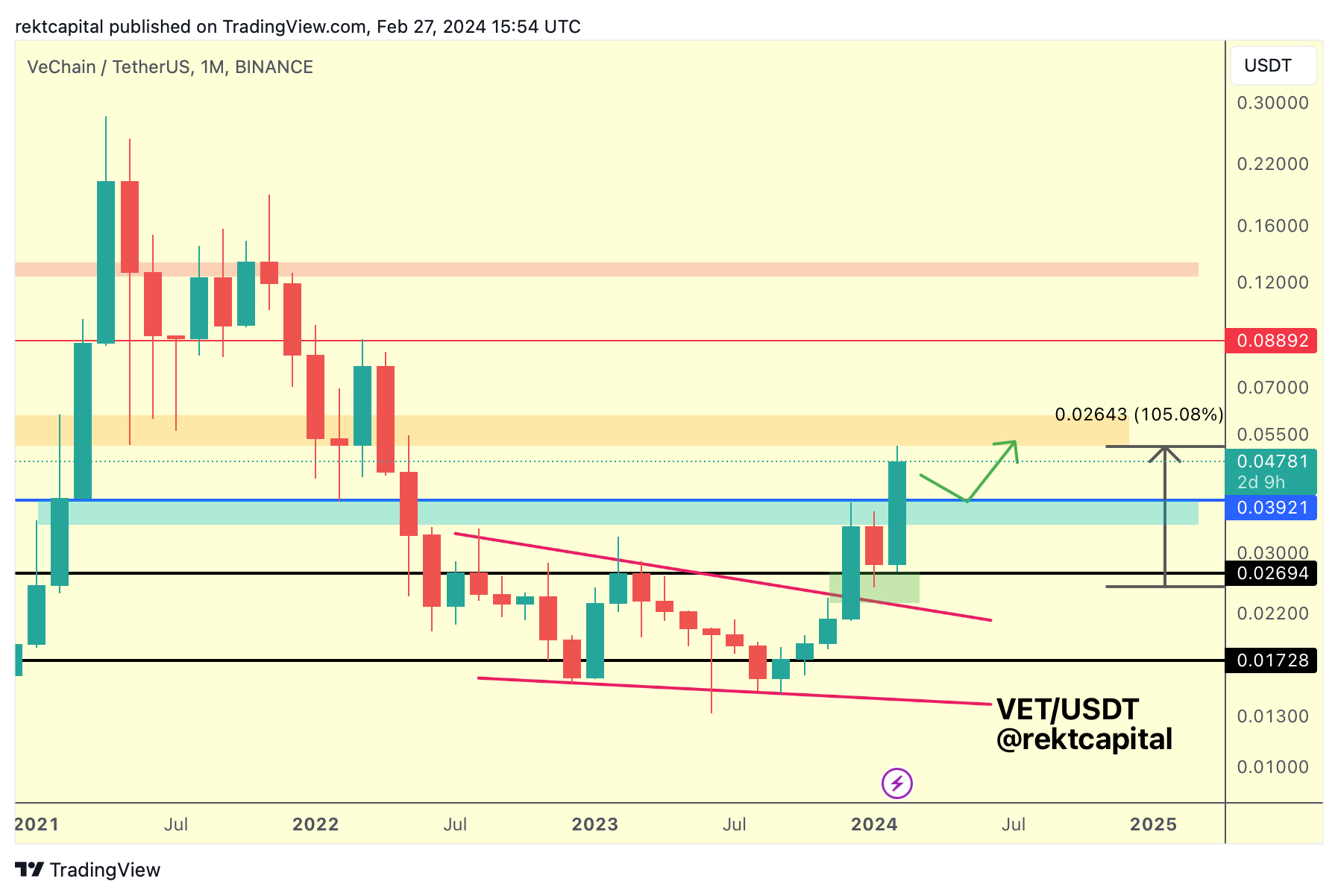

VeChain - VET/USDT

We've been covering VeChain for several weeks now.

So let's sum up the key technical moments that took place up to today.

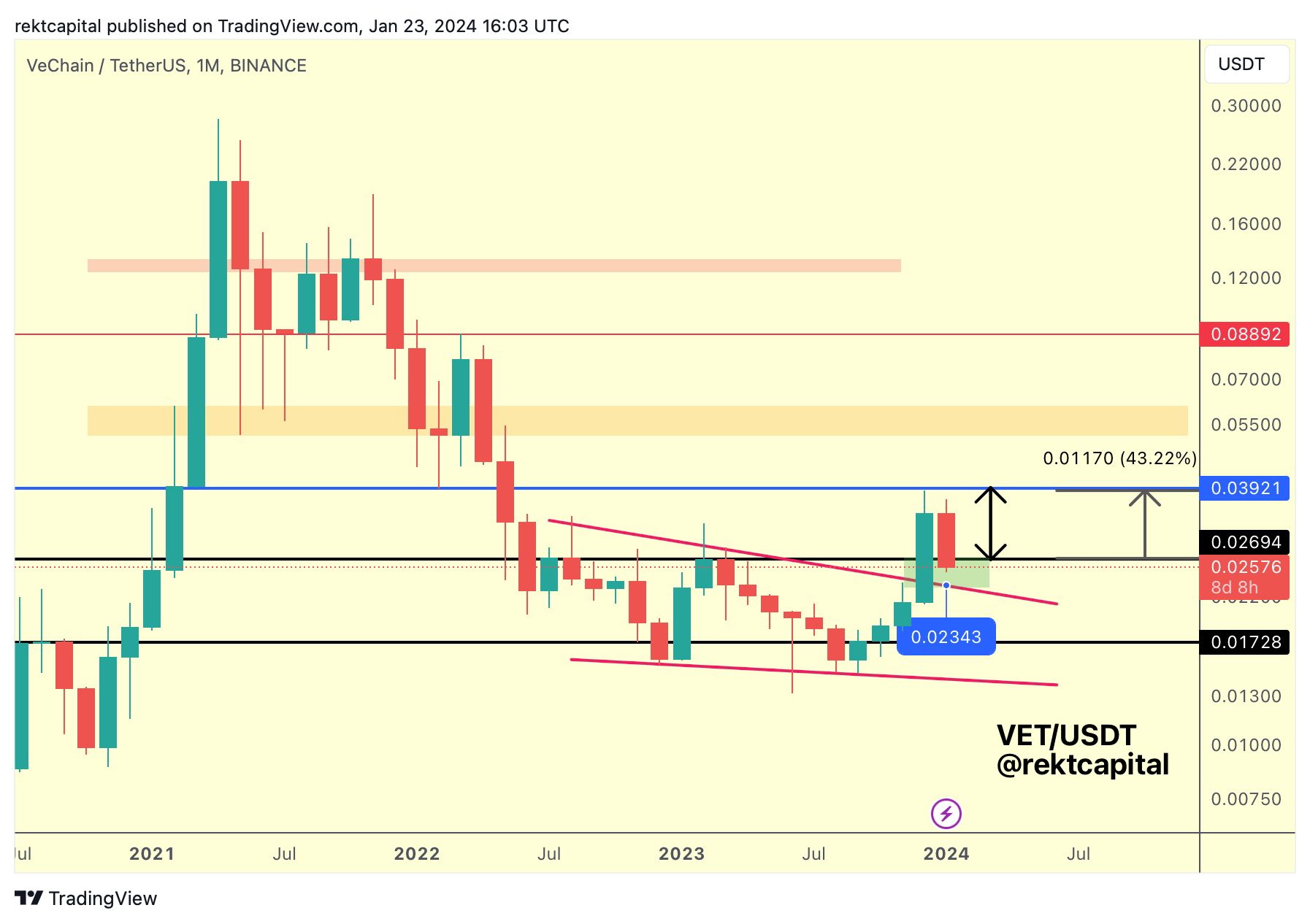

Firstly, the slight deviation below the black Range Low into the buy area:

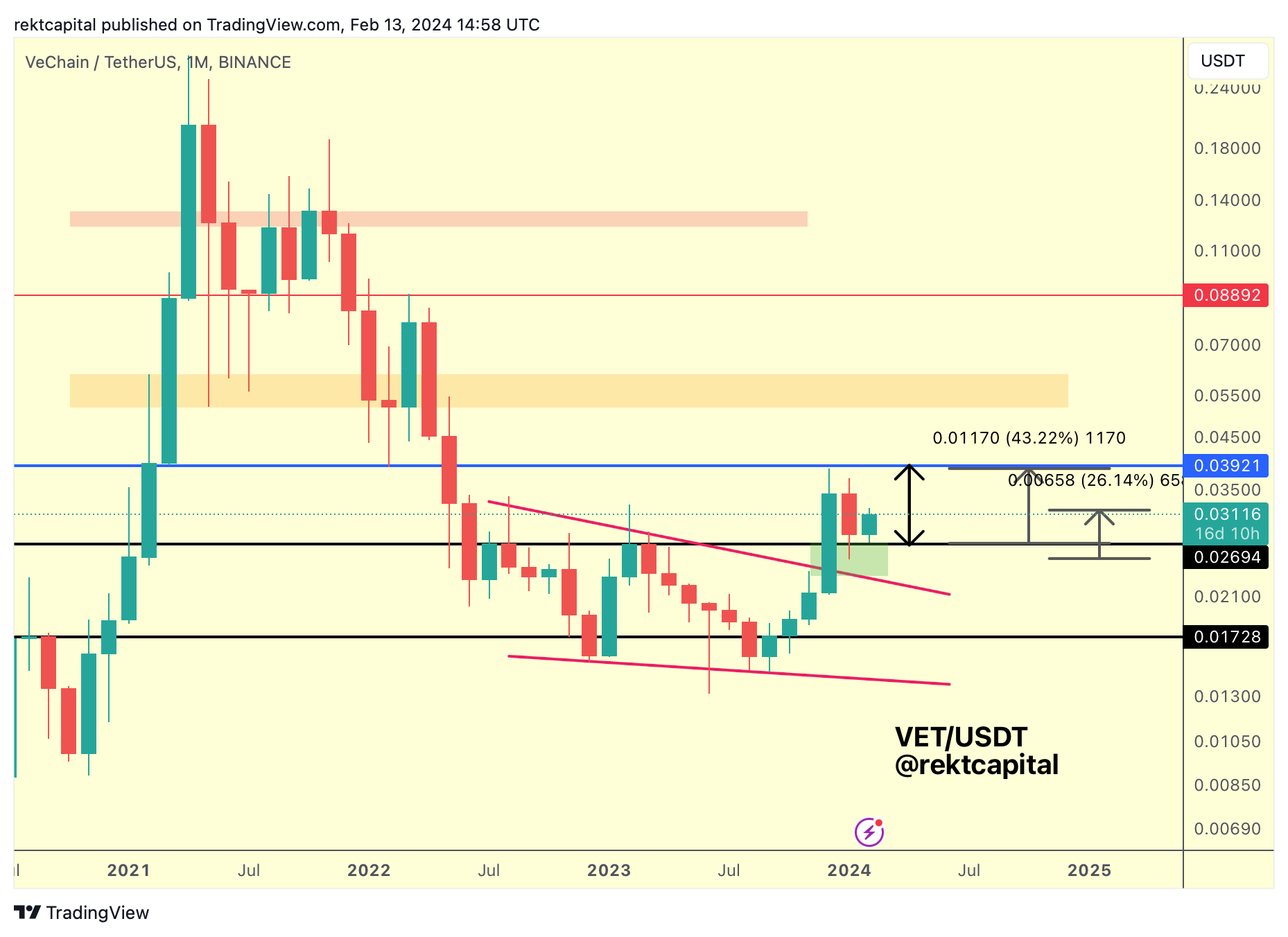

Then price-strength confirmation and stability at the Range Low:

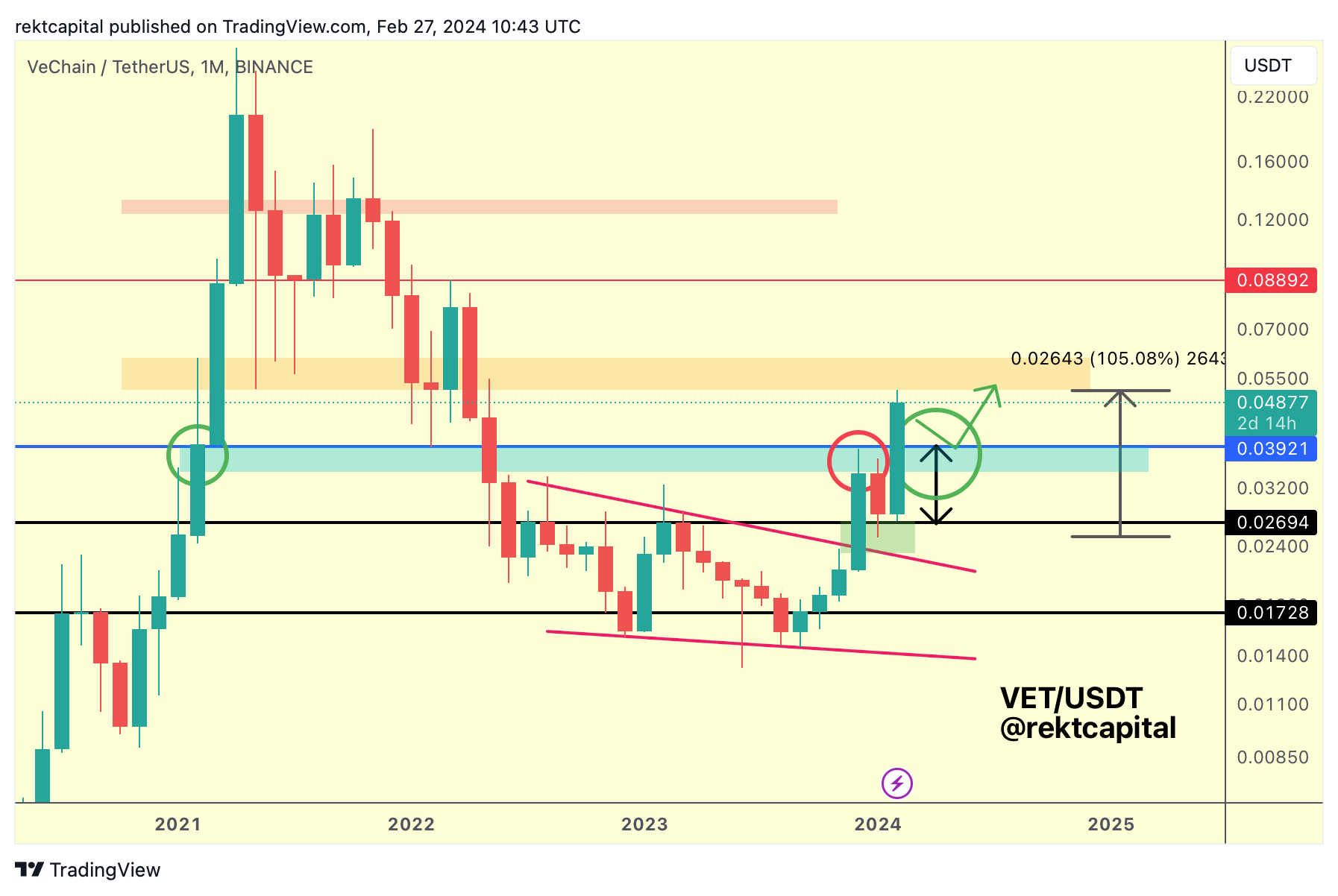

Followed by a breakout from the macro range, finally:

Before talking about a pullback so as to successfully retest the Range High resistance as new support to confirm a breakout to the orange resistance above:

Here's today's update:

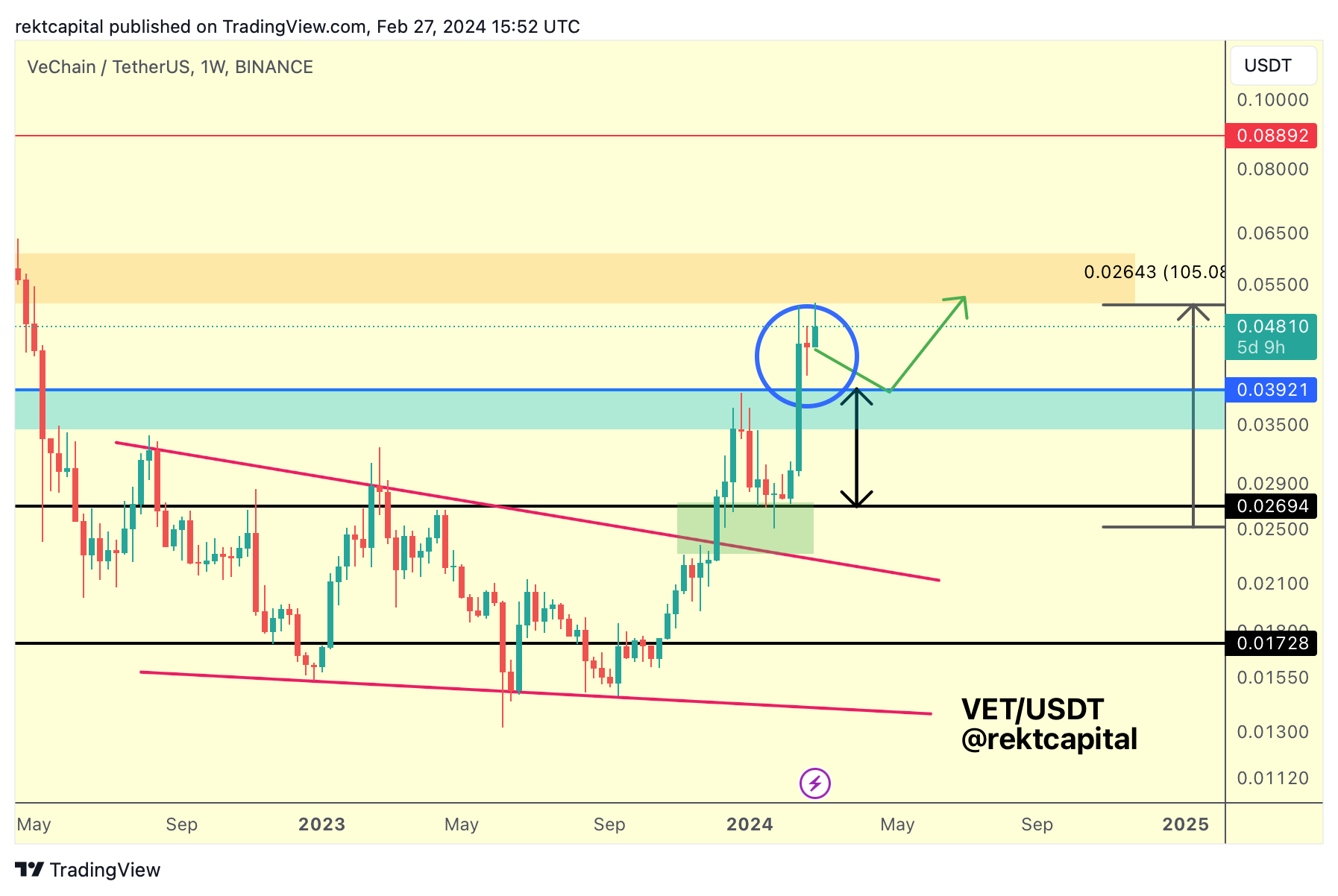

VET indeed dipped with the intent to retest the Range High, however there was no picture-perfect retest, narrowly, very narrowly missing out on that picture-perfect contact.

Nonetheless, technically that is the retest satisfied and it preceded further upside to revisit the orange resistance as per the outlined green path.

In retesting this Range High, VET not only confirmed further upside towards the next immediate resistance area (orange box) but positioned itself for a very positive Monthly Close as well:

Of course, the bullish scenario would be for VET to Monthly Close inside the orange area of resistance; that would be the easy option.

For the time being however, let’s assume it won’t do that and VET will instead Monthly Close below the orange resistance.

In this case, VET may very well have confirmed a new macro range; this time however, this Range Low of this range would be the old Range High from the previous range (light blue area).

In essence, VET would’ve broken out from one macro range to enter another.

In this case, there would technically be scope for downside into the Range Low area as part of normal, range-bound consolidation.

In the event that VET doesn’t pullback into the old Range Low but happens to reclaim the orange resistance as support, then VET would skip this consolidation and ascend higher.

The way I see it is if VET offers another pullback into the light blue area, it would be part of setting up the next uptrend, in the same way that it did before this recent breakout.

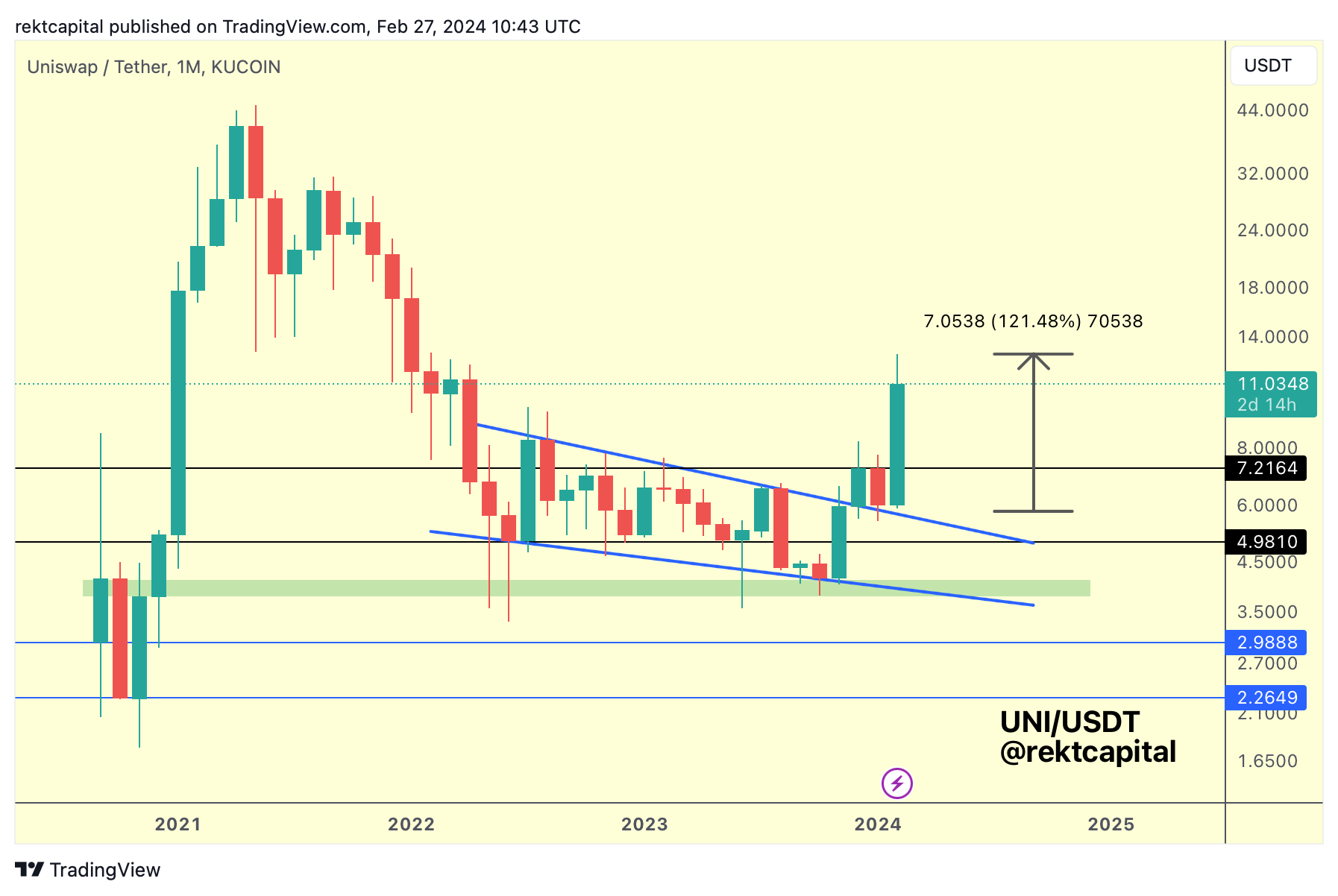

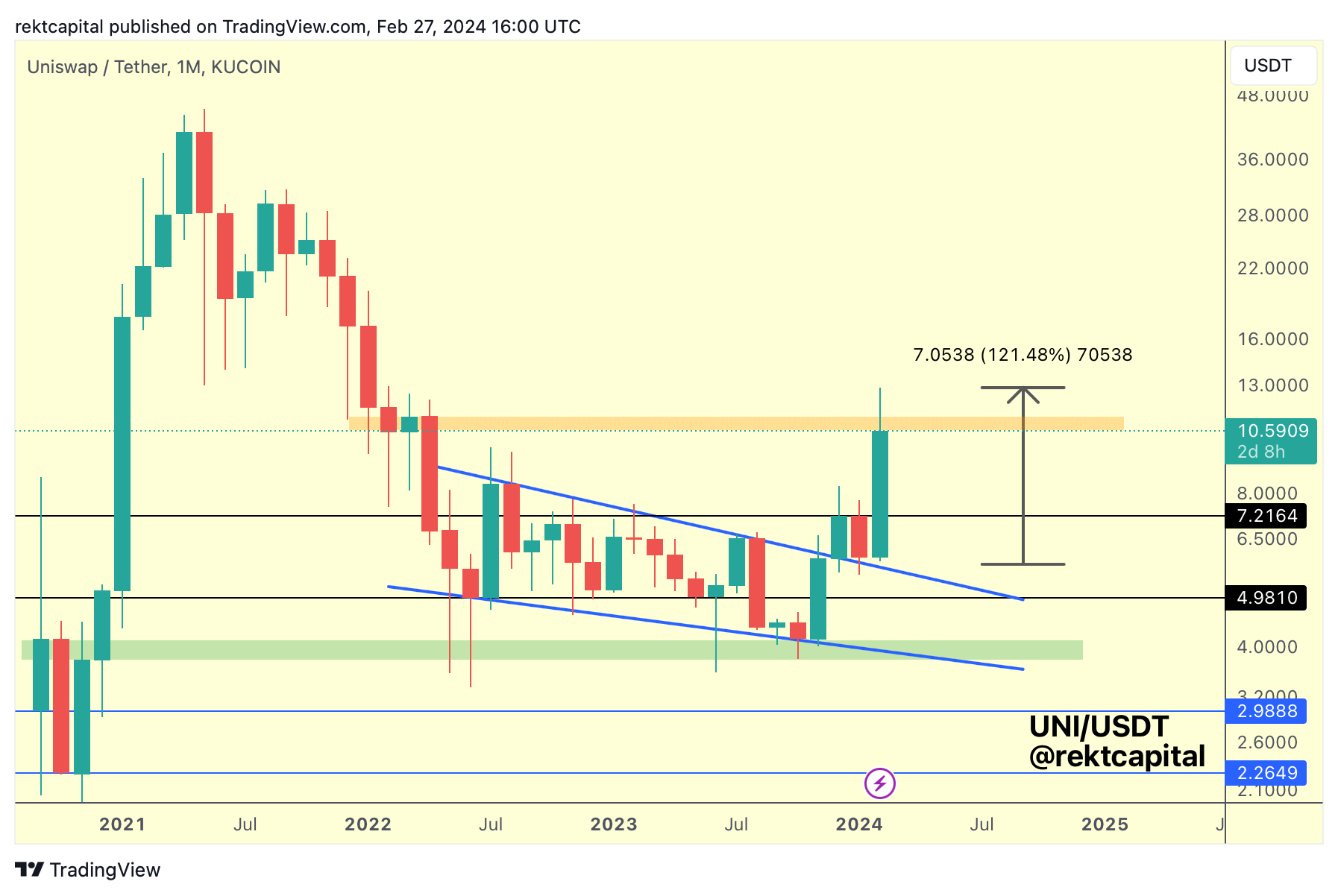

UniSwap - UNI/USDT

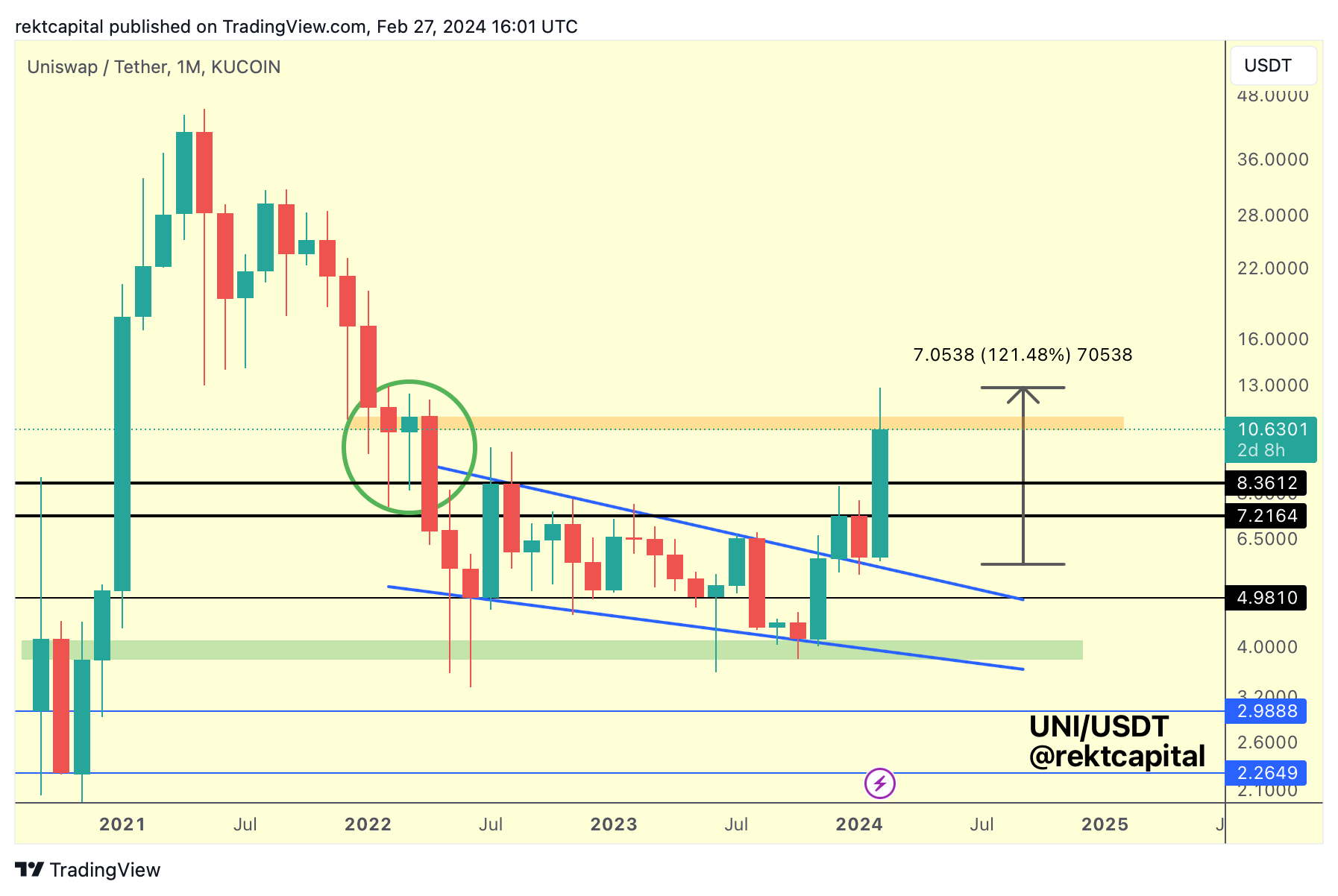

UniSwap is an Altcoin we’ve been covering for several weeks and we’ve often compared it to THETA which has shared an technical identical setup.

Let’s first start with UNI where we discussed the post-breakout retest:

UNI had broken out from its blue Falling Wedge and since that time, we were preparing for its retest attempt and the trend continuation that would come after it.

UNI has since rallied a phenomenal amount, fully confirming its new macro uptrend upon breakout from the macro pattern:

Now that UNI has confirmed its new macro uptrend, the direction over time is simply going to be up.

That being said, it’s worth considering possibilities for short-term fluctuations.

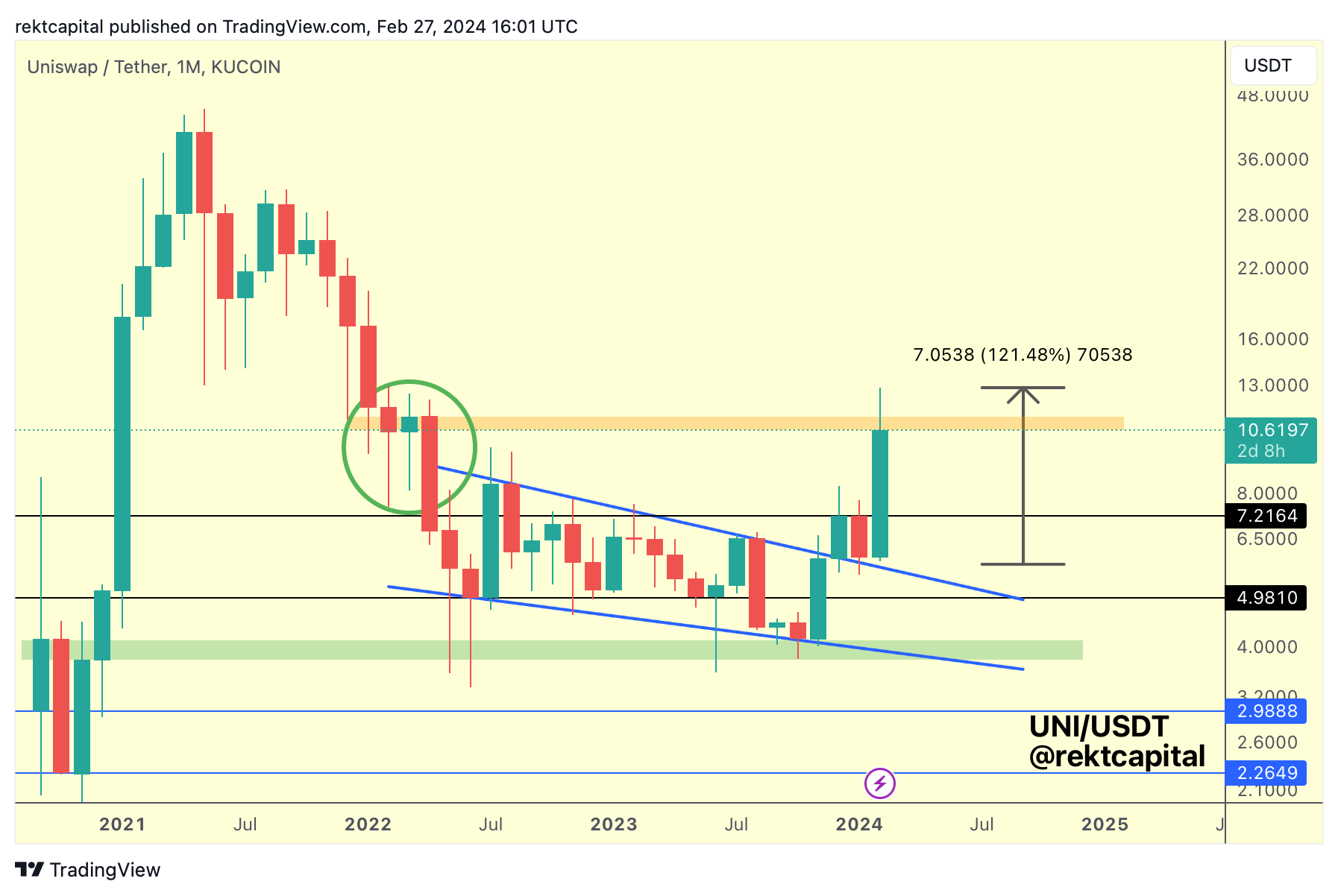

On this breakout, UNI has rallied into a previous area of historical demand (orange):

However this area hasn’t acted as strong support in the past, preceding a breakdown that would see price drop into Bear Market Bottom levels.

Since it wasn’t a support, it’s easy to think that this region won’t act as an equally strong resistance.

After all – in early 2021 UNI broke to new highs beyond this region without even a slight disruption.

This time of course there is additional price history but the benefit here is that this region of old support could be reclaimed as one and this would be the next trigger UNI would need to offer to confirm additional upside from here.

That being said, in terms of dipping opportunities, that old historical support showcases that volatile downside wicking tends to occur here (green circle):

Should UNI display that same level of volatility upon trying to retest this region as new support, there would be scope for dips into the low $8.00s (e.g. $8.36) and if UNI really overextends to the downside, maybe even closer to the $7.21 level:

Generally, those two thick black Monthly levels will be areas to watch for and downside wicking during a retest attempt of the orange resistance area at current price levels.