Altcoin Newsletter #97

My exclusive commentary on 8 Altcoins

Welcome to the Rekt Capital newsletter, a resource for people who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Every Friday, I host an Altcoin TA session where I share my exclusive commentary on the price action of a wide variety of coins, requested by valued premium members of the Rekt Capital Newsletter.

I share charts on 8 coins today.

I'm excited to announce my partnership with Bitget crypto exchange! 🔥

Bitget is the world's largest crypto copy trading platform, official partner of Juventus Football Club and top 5 crypto derivatives exchange in volume as listed on CoinMarketCap!

To celebrate, Bitget has been very kind to arrange another special promo for valued readers of the Rekt Capital Newsletter.

Sign up using my link to Bitget and you will get:

• Up to $8000 sign up bonus 🔥

• 15% discount on ALL futures trading fees 🔥

• 0 fees on ALL spot market pairs 🔥

Sign up to Bitget using my link and make the most of this special promo:

In today’s Altcoin newsletter, I cover 8 different Altcoins, specifically:

- Algorand (ALGO/USDT)

- Elrond (EGLD/USDT)

- Chainlink (LINK/USDT)

- Syntropy (NOIA/USDT)

- Cosmos (ATOM/USDT)

- Yearn Finance (YFI/USDT)

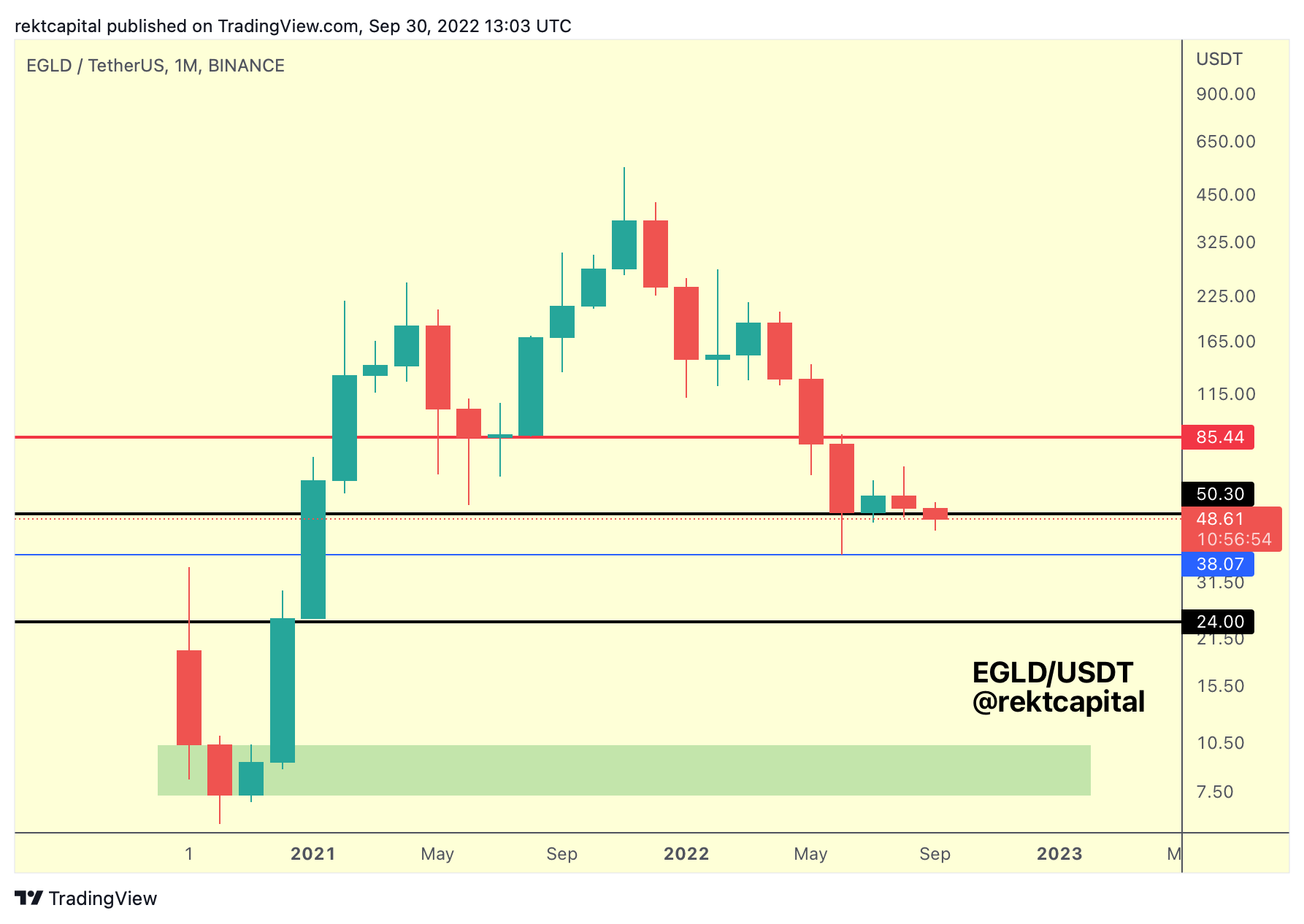

- Basic Attention Token (BAT/USD)

- Quant (QNT/USD)

Let’s dive in.

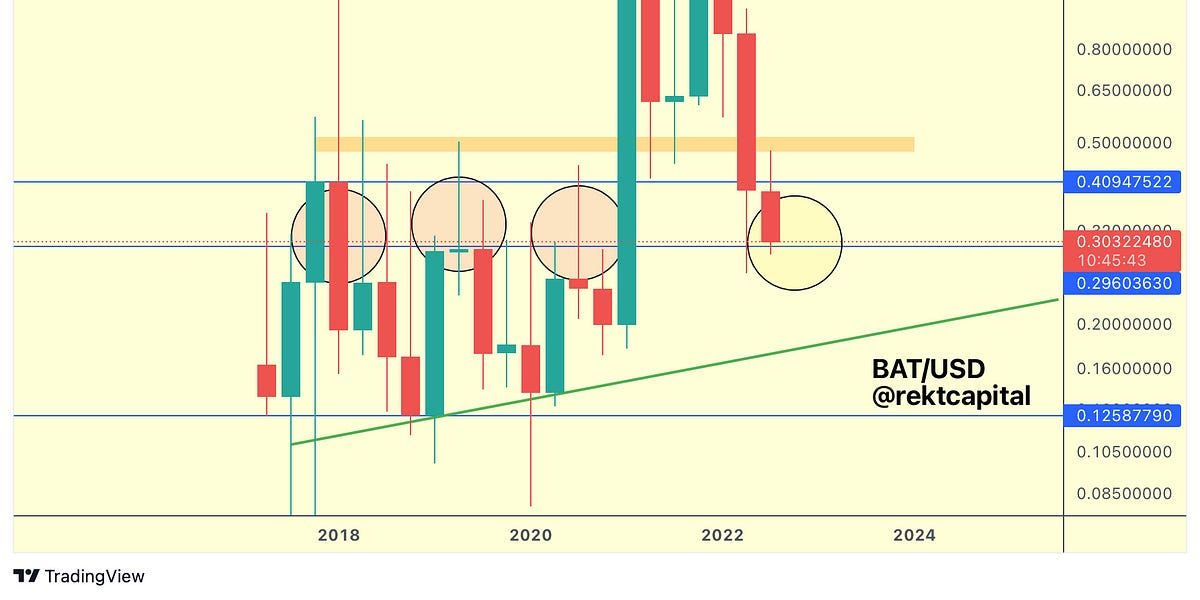

Algorand - ALGO/USDT

ALGO flipping this current black level into resistance would send ALGO down to the black level down below.

Lose that black $0.25 level and ALGO would drop to the green box.

Generally, this current Quarterly candle looks like it wants to flip black into resistance before further downside.

Of course, 3M Close above black $0.35 and $0.50 (blue) would be next.

It’s all about how the 3M Closes relative to this current $0.35 black level that will dictate bias.

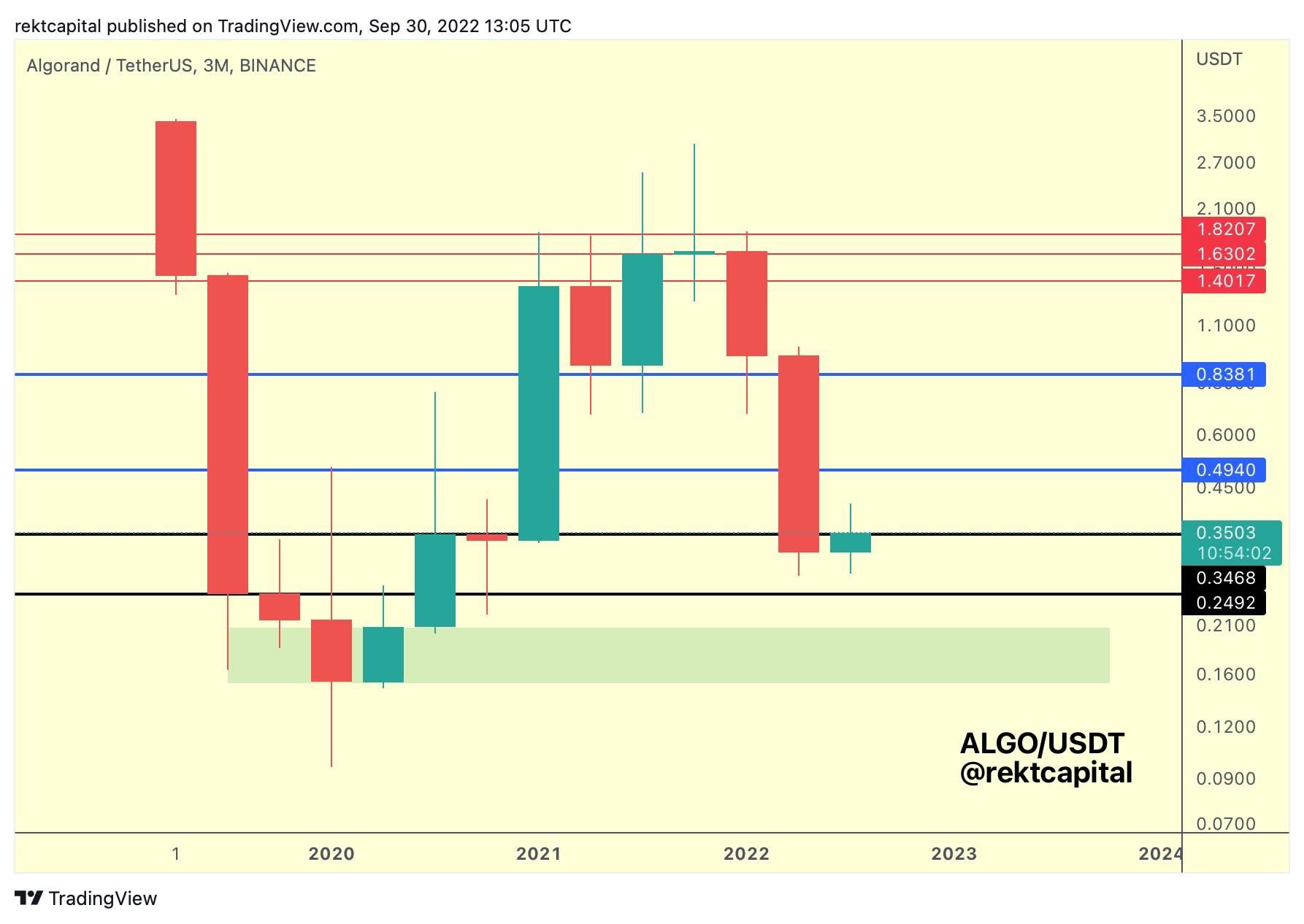

Elrond - EGLD/USDT

EGLD is slipping away from this black support.

Monthly Close below it and what was a weak support for the past four months will flip into resistance which would likely reject EGLD to the blue level down below.

That blue level may not stand much of a chance, perhaps aside from mustering a rebound back into the black level, if at all.

Generally, EGLD rejecting from black here means that EGLD is entering the black-black range, which is relatively wide.

Worst yet reasonable case scenario: EGLD goes to $24.