Altcoin Newsletter #71

My exclusive commentary on 8 Altcoins

Welcome to the Rekt Capital newsletter, a resource for people who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Every Friday, I host an Altcoin TA session where I share my exclusive commentary on the price action of a wide variety of coins.

I share charts on 8 coins today.

In today’s Altcoin newsletter, I cover 8 different Altcoins, specifically:

- Litecoin (LTC/BTC)

- Tezos (XTZ/USD)

- Polygon (MATIC/USDT)

- Hathor (HTR/USDT)

- Theta Token (THETA/USDT)

- Solana (SOL/USDT)

- Hedera Hashgraph (HBAR/USDT)

- Cardano - (ADA/USD)

Litecoin - LTC/BTC

Litecoin has been consolidating in a downtrending channel since September 2019.

Over the past few weeks, LTC even lost the last known All Time Low price region where LTC bottomed in 2017 (red).

LTC is now trying to inch up but if LTC wants to develop any semblance of bullish momentum, it needs to first reclaim this red level as support.

Rejecting there could spell further downside inside this downtrending channel, whereby the already prolonged consolidation would continue.

For a new macro uptrend, LTC would need to Weekly Close above the green diagonal resistance.

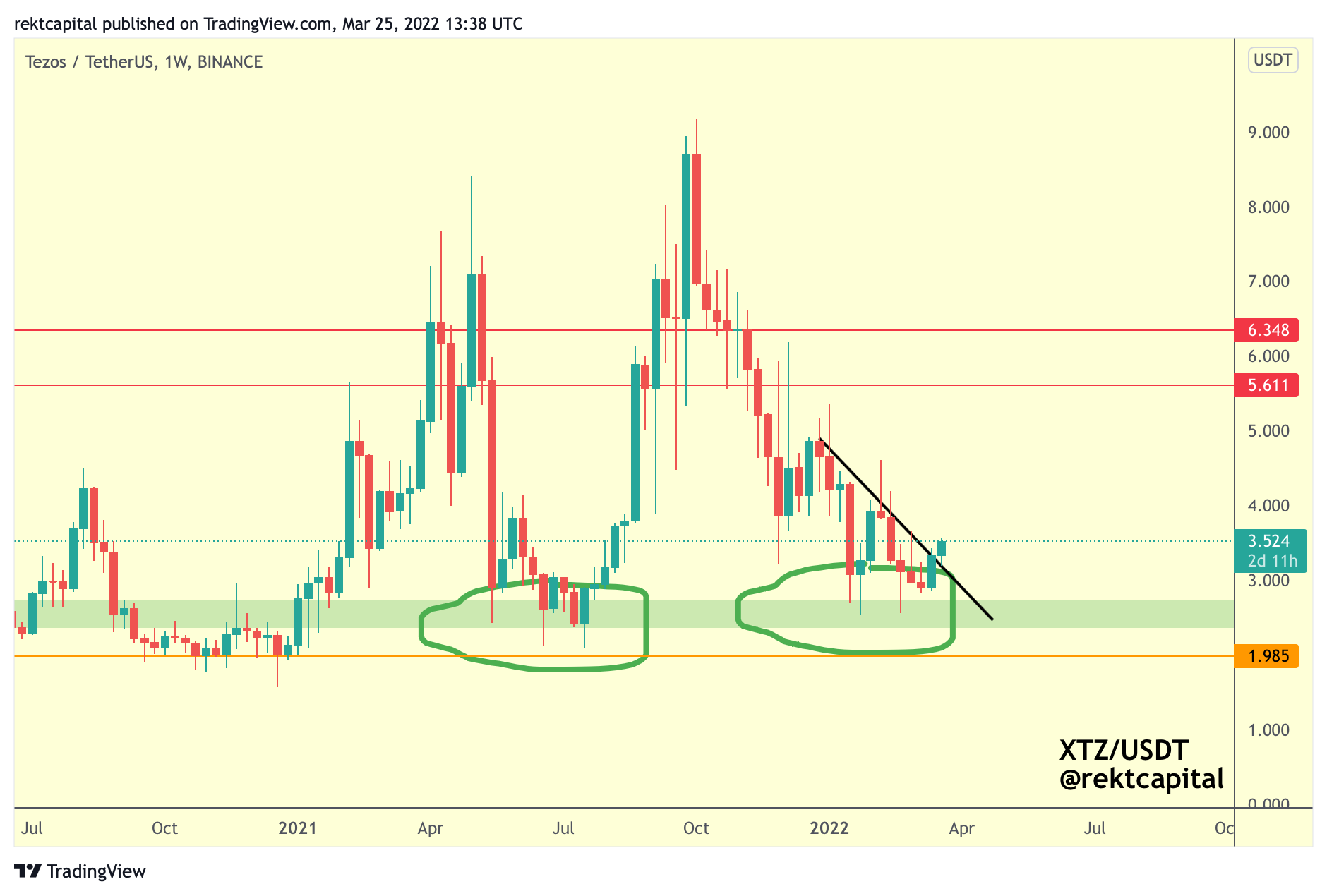

Tezos - XTZ/USDT

XTZ is making good progress from a historical demand area (green), which is promising, especially since the green area was a point of reversal for price in mid-2021 (green circle).

On top of that, XTZ has broken the multi-month trendline resistance (black) which dates back to late 2021.

XTZ will now try to retest this trendline as support and upon doing so successfully, XTZ could challenge for around the ~$4 region.

Generally, whenever multi-month downtrends get broken, new uptrends emerge.