Altcoin Newsletter #148

Features TOMO DOT NEAR PRIME OCEAN WOO

Before jumping into today’s newsletter issue, I wanted to show you how you can become an expert in conducting technical analysis 🚀

Using these technical skills to achieve financial freedom and build the lifestyle that you dream of is exactly why I made the Rekt Capital Masterclass.

If you missed my previous emails, I’m running an Early Black Friday Sale:

50% Off The Rekt Capital Masterclass: 4 Courses in 1 Bundle 🔥

You get:

- Bitcoin Investing Course worth $297

- Altcoin Investing Course worth $297

- Cryptocurrency Technical Analysis Course worth $297

- Cryptocurrency Risk Management Course worth $297

A total value of $1,188, but you get ALL of these courses in one bundle for only $498.50…

Total savings: $689.50

These FOUR courses will teach you the fundamentals of conducting profitable technical analysis in the crypto markets so that you can benefit from both long and short term opportunities that can only be spotted with the most powerful tool: TA.

You being here shows me that you want to level up your trading and investing skills.

So, take the opportunity and the future will thank you for it! 👊

But hurry - the offer ends in 3 days... ⏰

In today’s Altcoin newsletter I cover 6 different Altcoins, specifically:

- TomoChain (TOMO)

- Polkadot (DOT)

- Near Protocol (NEAR)

- Prime (PRIME)

- Ocean Protocol (OCEAN)

- Woo Network (WOO)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

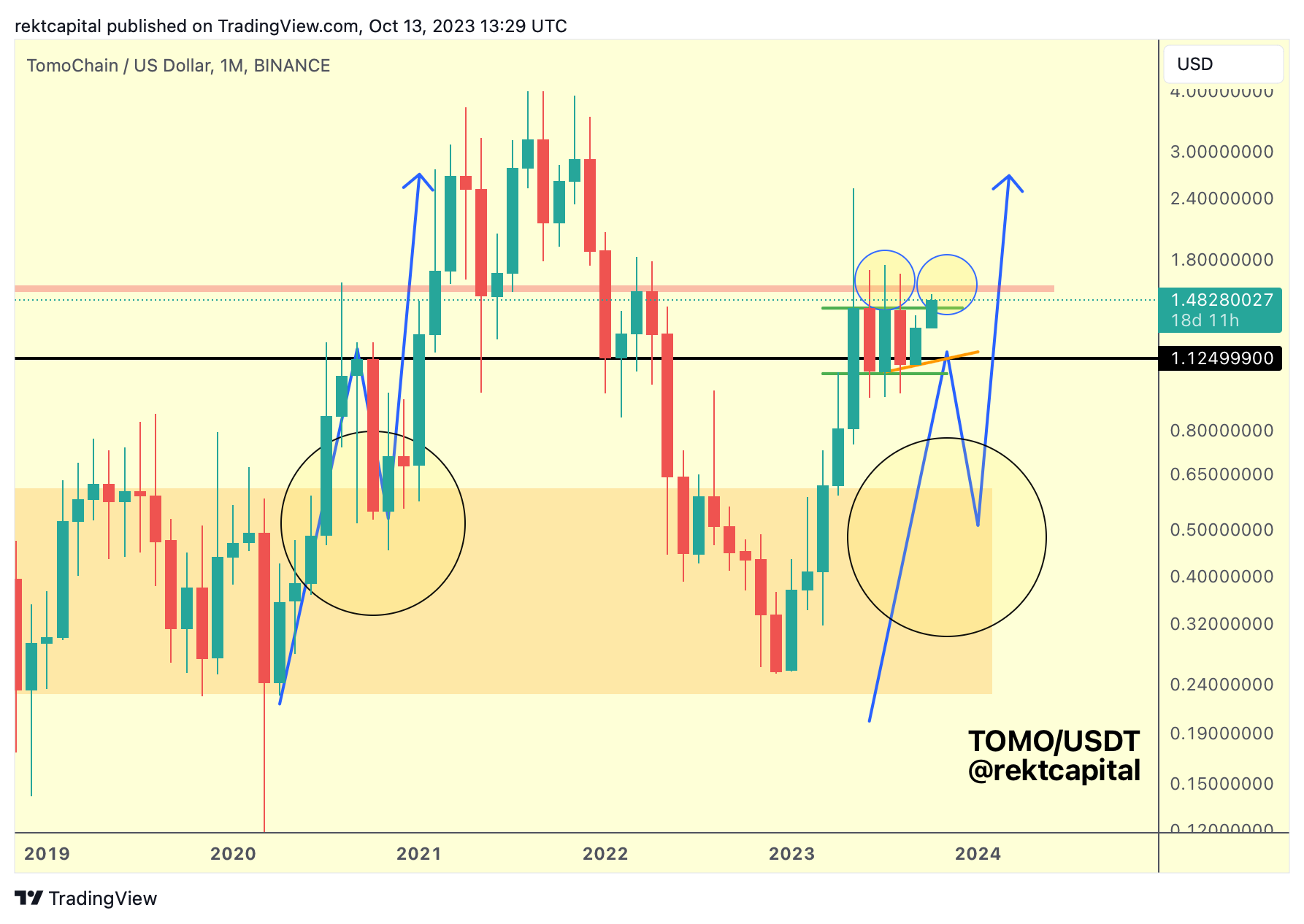

TomoChain - TOMO/USDT

TOMO has been consolidating for months at these highs, each time trapping FOMO buyers via upside wicks beyond the green Range High above and capitulating panic sellers via downside wicks below the green Range Low.

In recent months, TOMO has formed a Higher Low (orange) within the green Range here and now price is trying to press beyond the green Range High.

Could TOMO form an upside wick here?

It's possible which is why a Monthly Close above the green Range High is needed or at the very least a successful retest of that same level - either are needed to propel TOMO into the red resistance area to try to break it.

At this time, there is reason to believe that this green range may be acting as a Re-Accumulation Range.

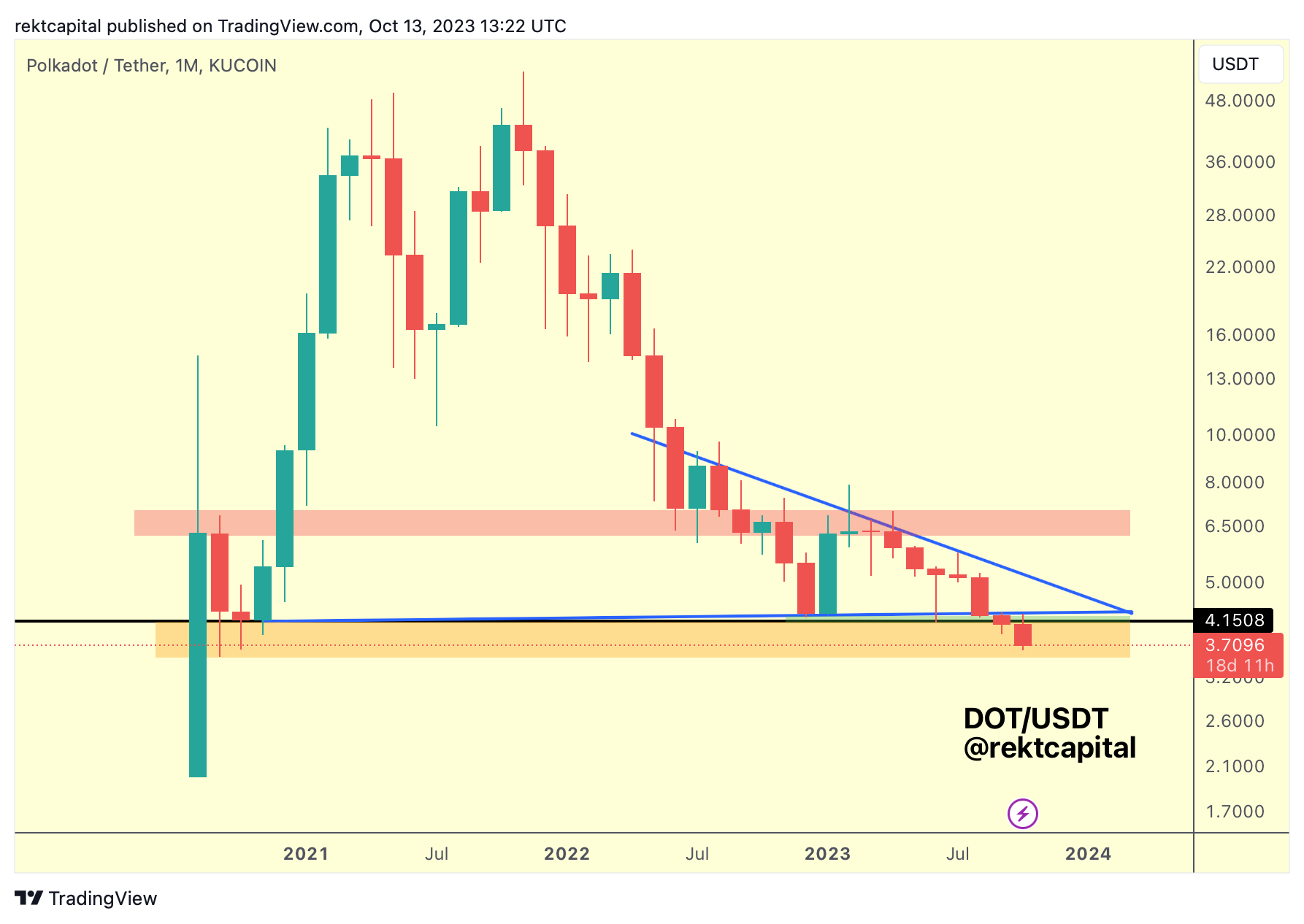

Polkadot - DOT/USDT

Last month, Polkadot Monthly Closed below the black level which was a confluent level with the bottom of the blue triangular market structure.

And this month, price upside wicked into this level to flip it into new resistance before confirming further downside continuation into the orange area.

The orange area acted as a historical demand area in late 2020 whereas now it is failing to generating that same sort of support from buyers.

The bottom of the orange area may be retested as support in the future and in the event of little reaction, DOT may actually lose this region with time in an effort to establish an Accumulation Range at new lows.