The Curious Role of Time For Bitcoin

When Could Bitcoin Peak In This Bull Market?

The Curious Role of Time…

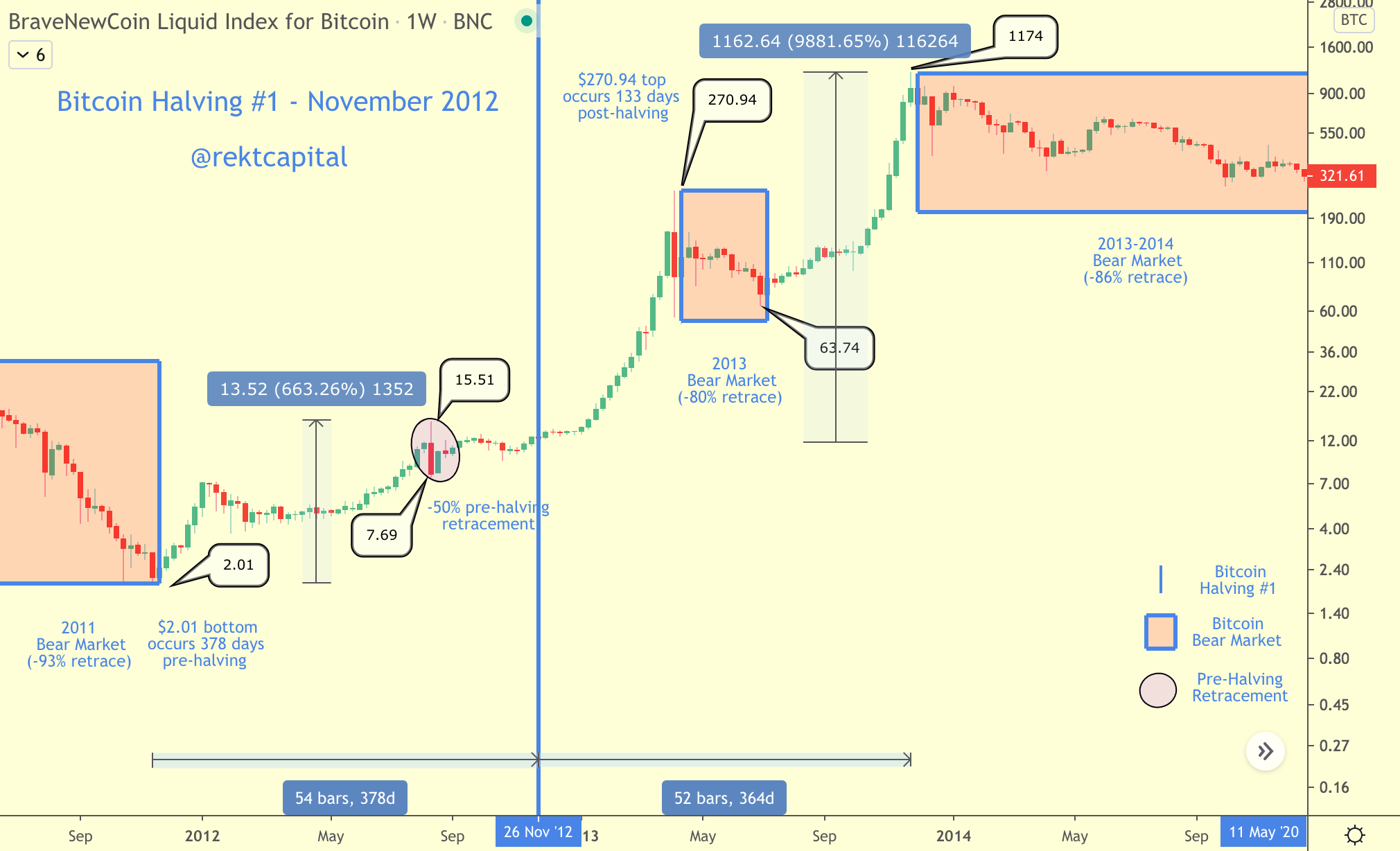

Here’s a curious observation…

It took roughly the same amount of time for Bitcoin to bottom prior to Halving #1 (i.e. 378 days) as it took for Bitcoin to rally before topping out after its second post-Halving #1 Market Cycle (i.e. 364 days).

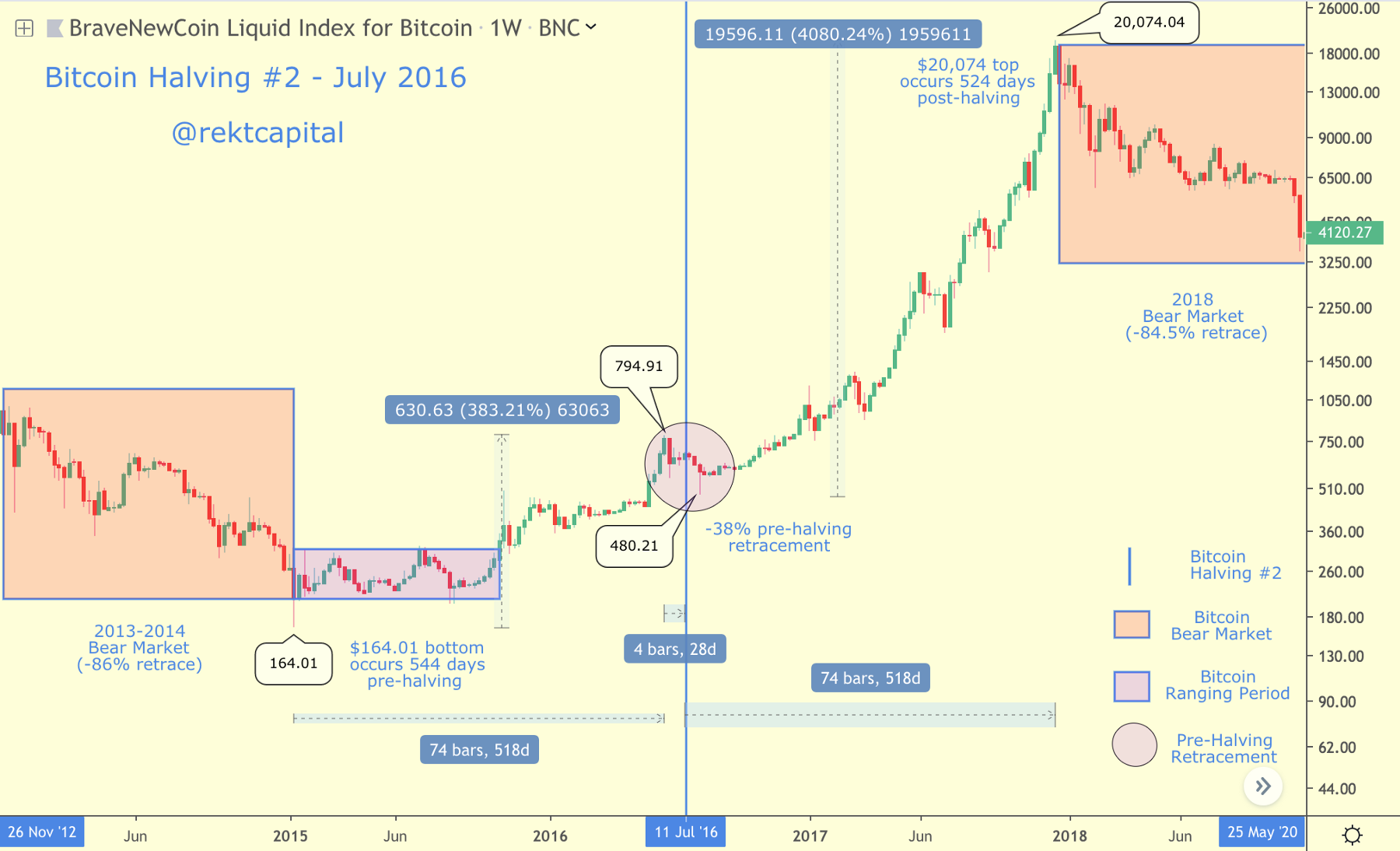

This curious role of time prior to and after Halving #1 is also evident in the context of Halving #2:

It took roughly the same amount of time for Bitcoin to bottom prior to Halving #2 (i.e. 546 days) as it took for Bitcoin to rally before topping out after its second post-Halving #1 Market Cycle (i.e. 518 days).

What if this curious role of time continues in the context of Halving #3?

Bitcoin bottomed 511 days prior to Halving #3.

Should Bitcoin rally for 511 days after Halving #3, that would mean that Bitcoin would peak in early October 2021.

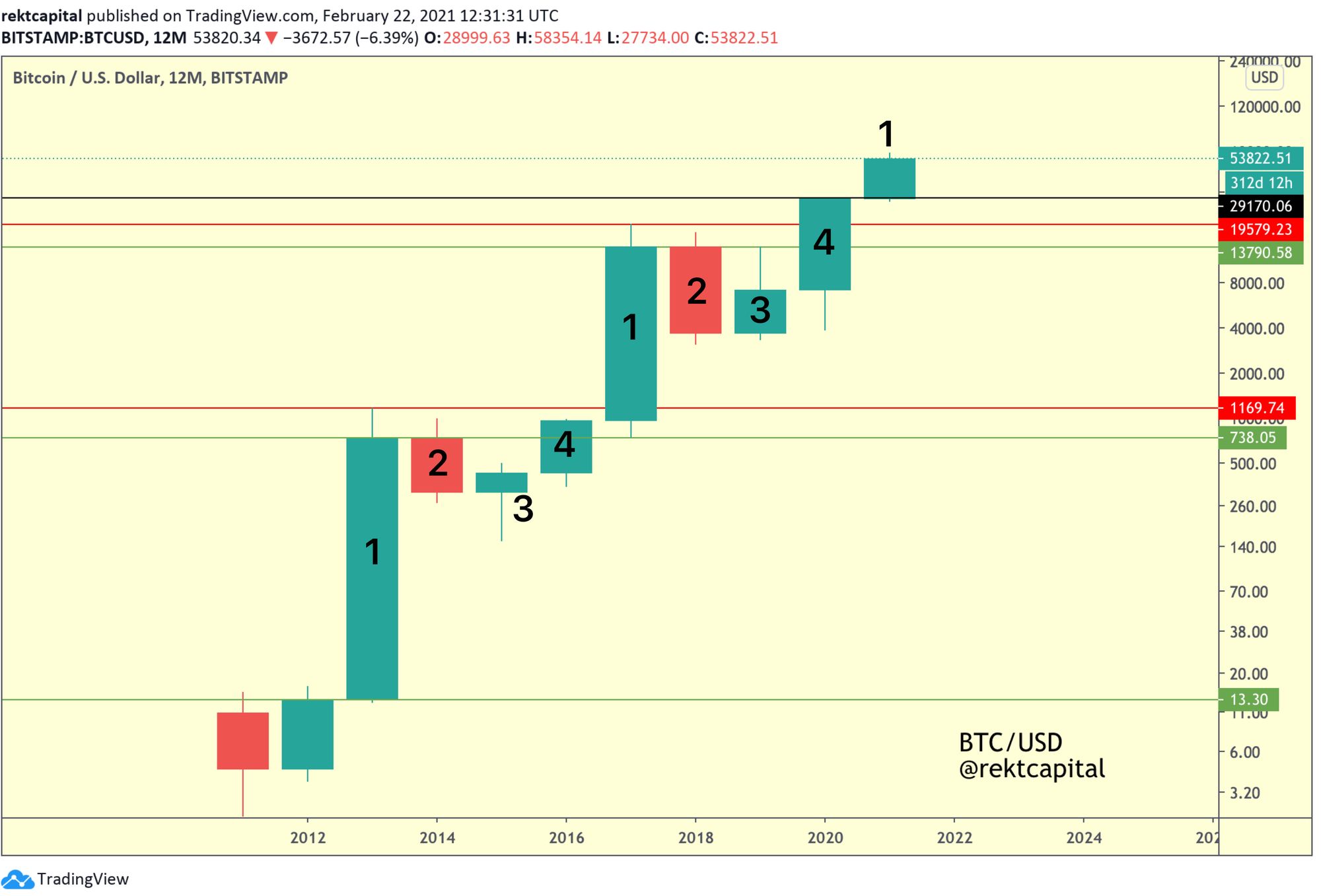

The Bitcoin Four Year Cycle theory appears to support this:

It suggests Bitcoin’s price will experience exponential growth in 2021 (i.e. Candle 1) & peak before the end of the year.

After all - every Candle 1 has a short upside wick, demonstrating that price closes lower than peak.

If you liked this nutshell of insights - I guarantee you’ll love the newsletter where I feature more extensive, in-depth analysis.

Feel free to Subscribe today for $6.99 a month. Readers of the newsletter tend to say it has been their best Crypto investment yet: