Welcome To Week 16

Awaiting Vital Weekly Confirmation

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

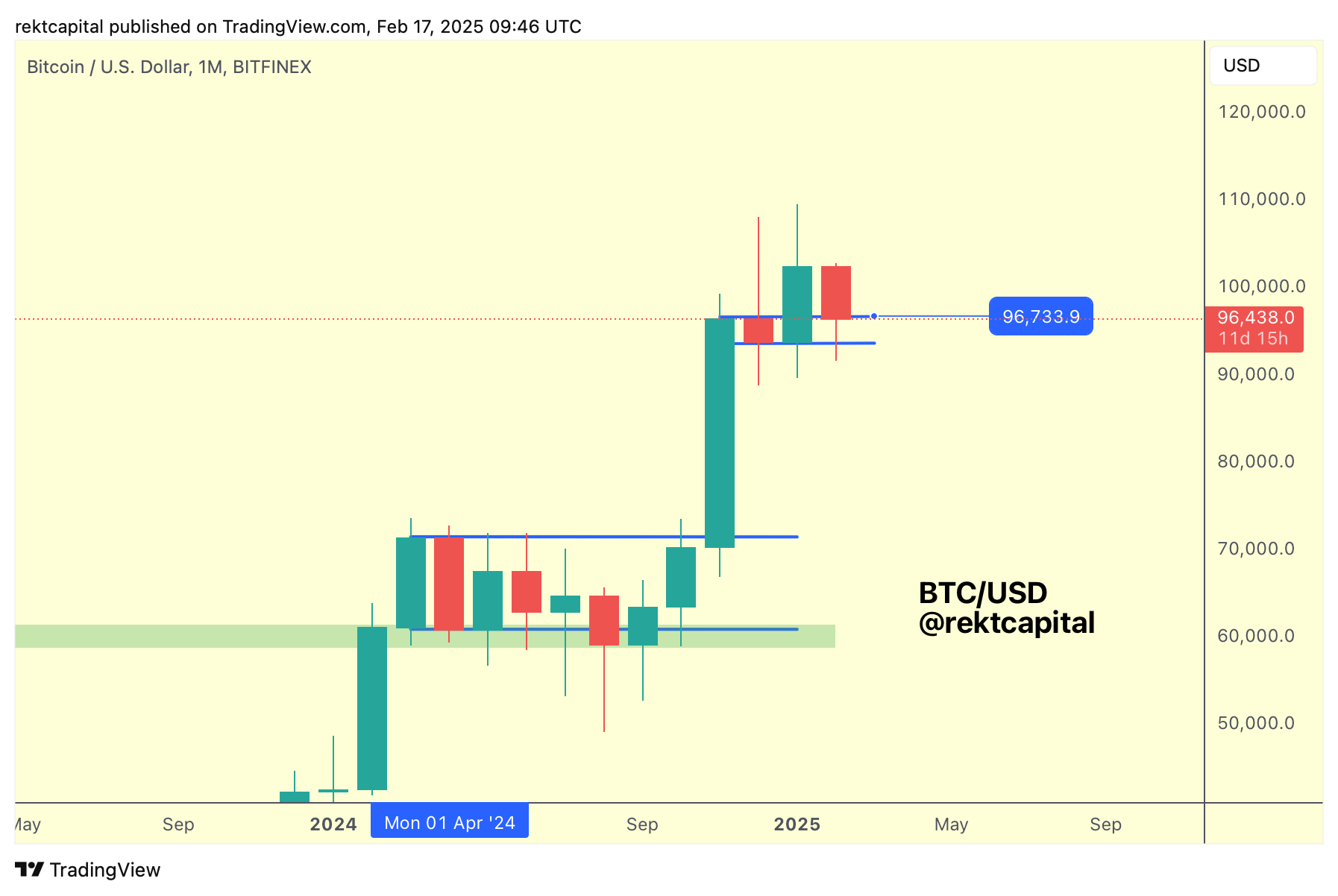

Bitcoin's Monthly Bull Flag

In terms of the Monthly Bull Flag, Bitcoin is still in the process of retesting its top into new support as part of a post-breakout retest:

Bitcoin is at this Bull Flag top right now, having produced a downside wick to tag the Flag Bottom earlier this month.

Overall, BTC has been producing downside wicks not just these past few months while in and around the Bull Flag but price has also been producing these wicks in almost if not all Monthly Candles of the past year or so.

Downside wicks have been a natural part of price action for BTC over the past year and so seeing this volatility around the current monthly market structure is not out of the ordinary.

What is most important is how BTC ultimately Monthly Closes relative to this Bull Flag top and a Close above the top would render the retest as successful and price would be positioned for trend continuation.

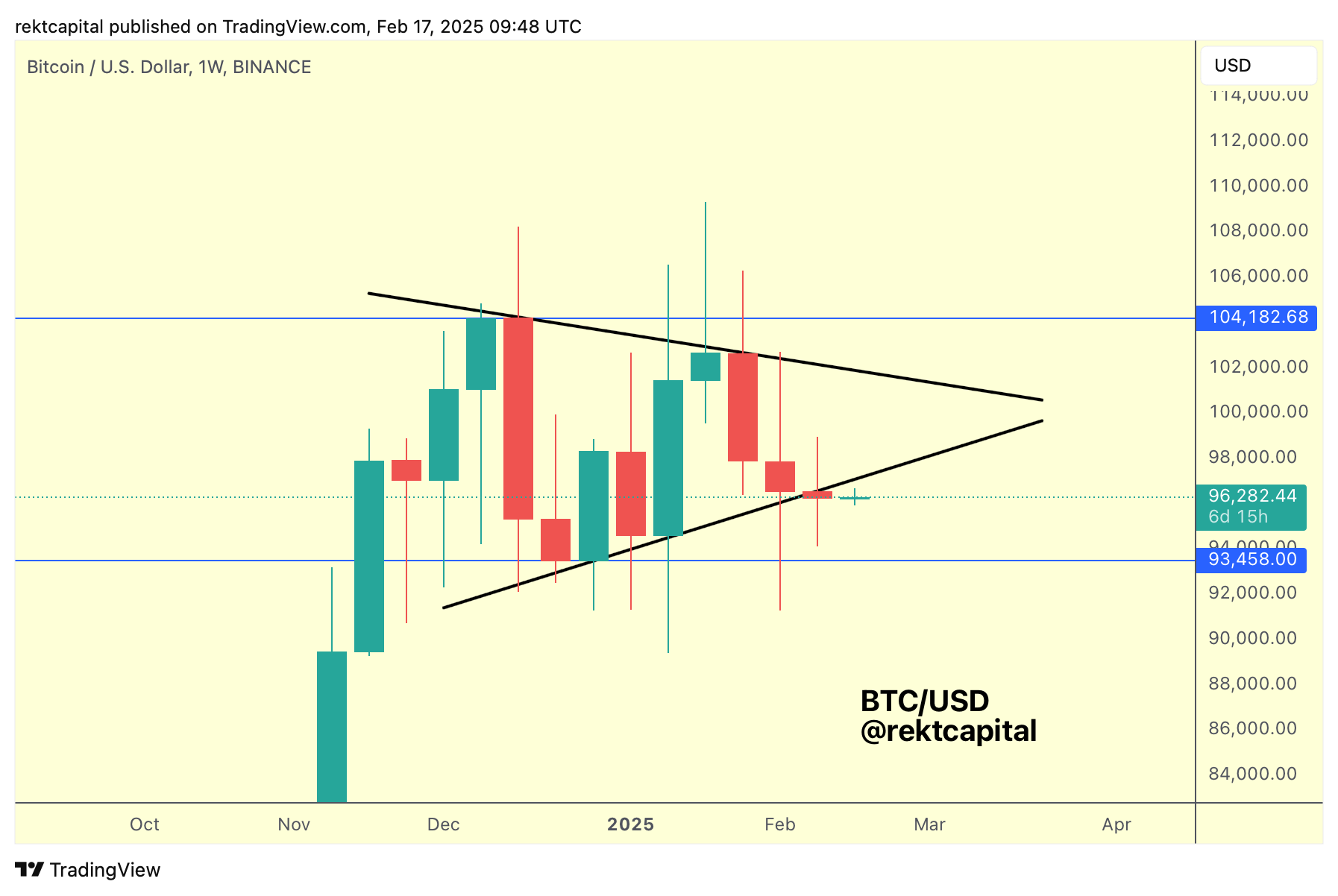

The Weekly Range

On the Weekly, Bitcoin is simply consolidating inside its Weekly Range between $93500 and $104000.

Within that range, price is developing clear Lower High resistance and Higher Low support trendlines.

However, given BTC’s lack of price progression in recent weeks, BTC looks like it may be losing the Higher Low as support as a mere function of time.

In other words, the Higher Low is an inclining support and price needs to produce upside to at least follow it so if that upside isn’t occurring, then just via time can price lose the structure by merely edging out from it.

BTC needs to reclaim the Higher Low via a Weekly Close above it later this week to avoid being positioned for downside continuation to the lower parts of the Weekly Range to as low as $93500.