Bitcoin - The Road to $70,000

What happens next?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

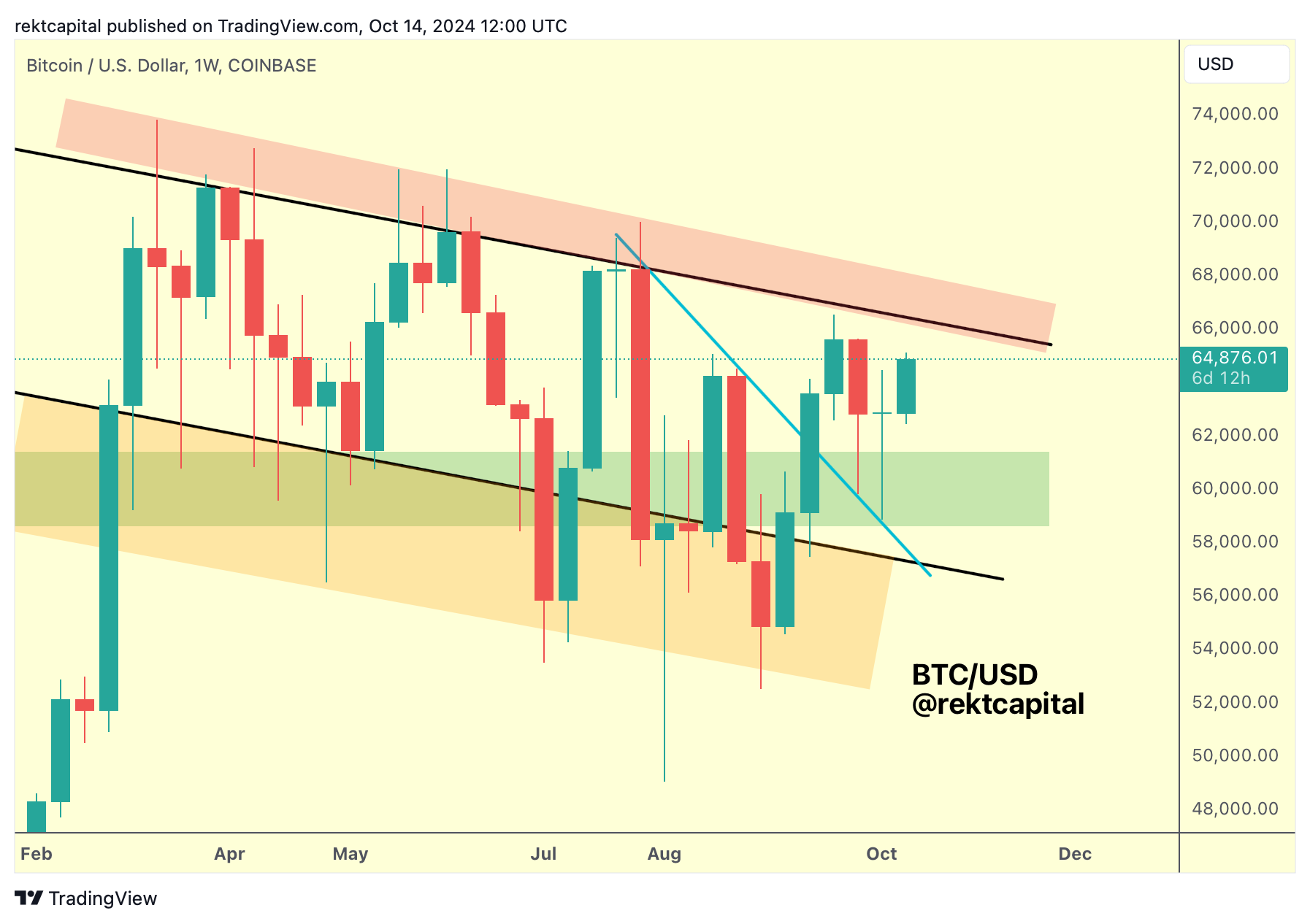

Bitcoin's Pivotal Successful Retests

Over the past two weeks, Bitcoin has been able to retest the Downtrend (light blue) dating back to late July as support:

Bitcoin has successfully retested this Downtrend as new support for two consecutive weeks.

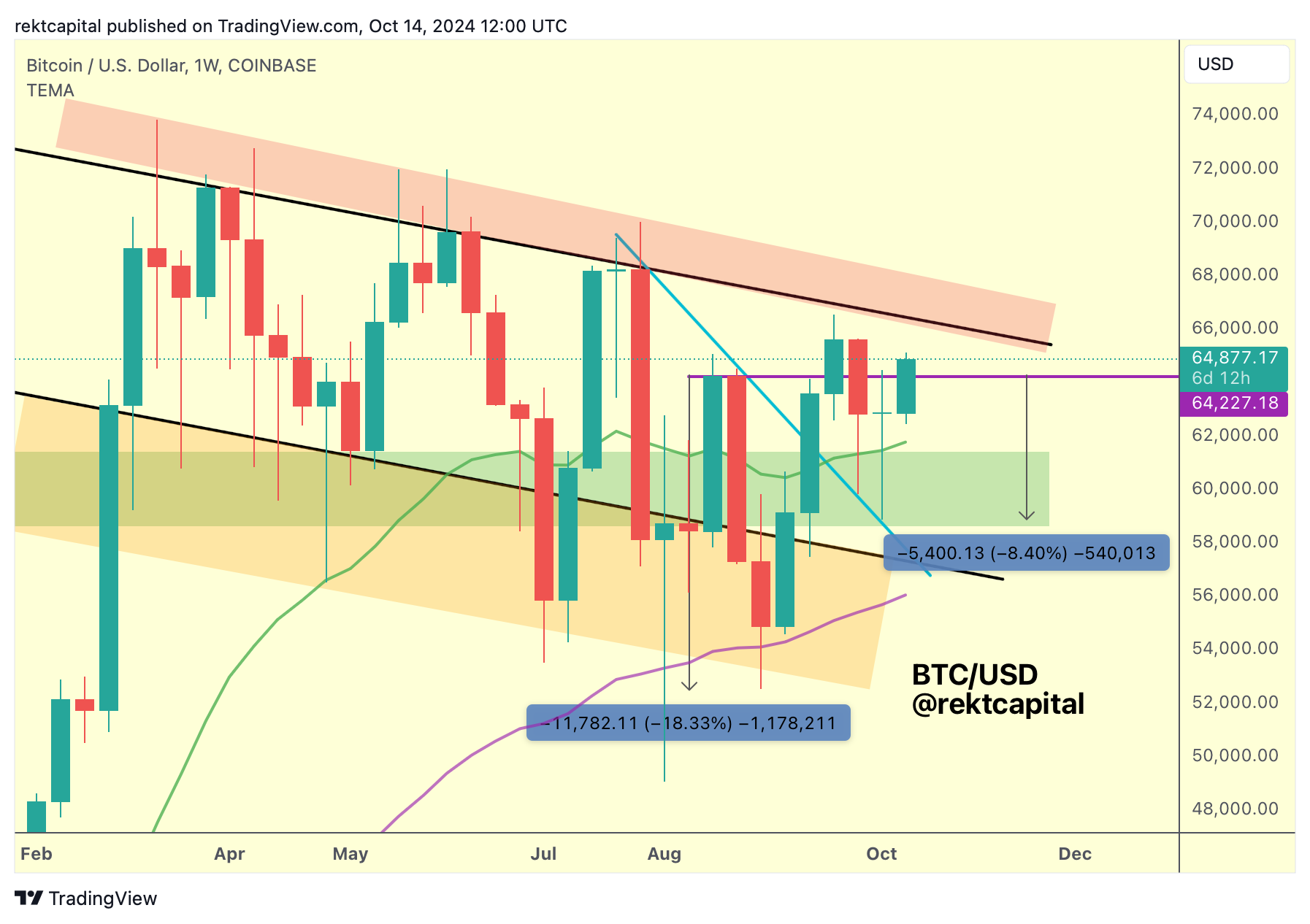

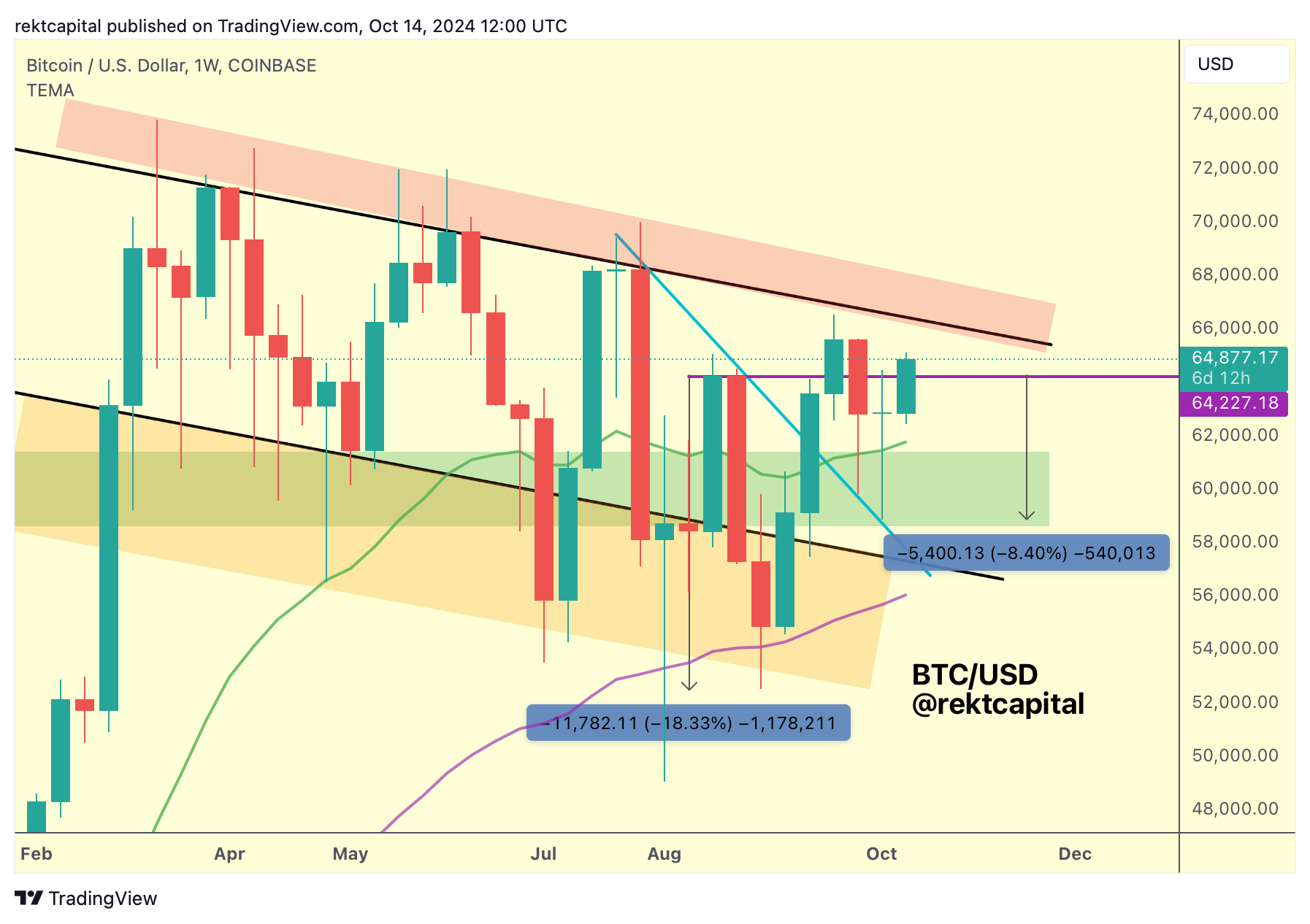

Not only that, but Bitcoin has also been able to perform a volatile retest of the 21-week Bull Market EMA (green):

Notice how the bottom of the green boxed area is confluent with the July Downtrend retest and the retest of the 21-week EMA is confluent with the top of the green box.

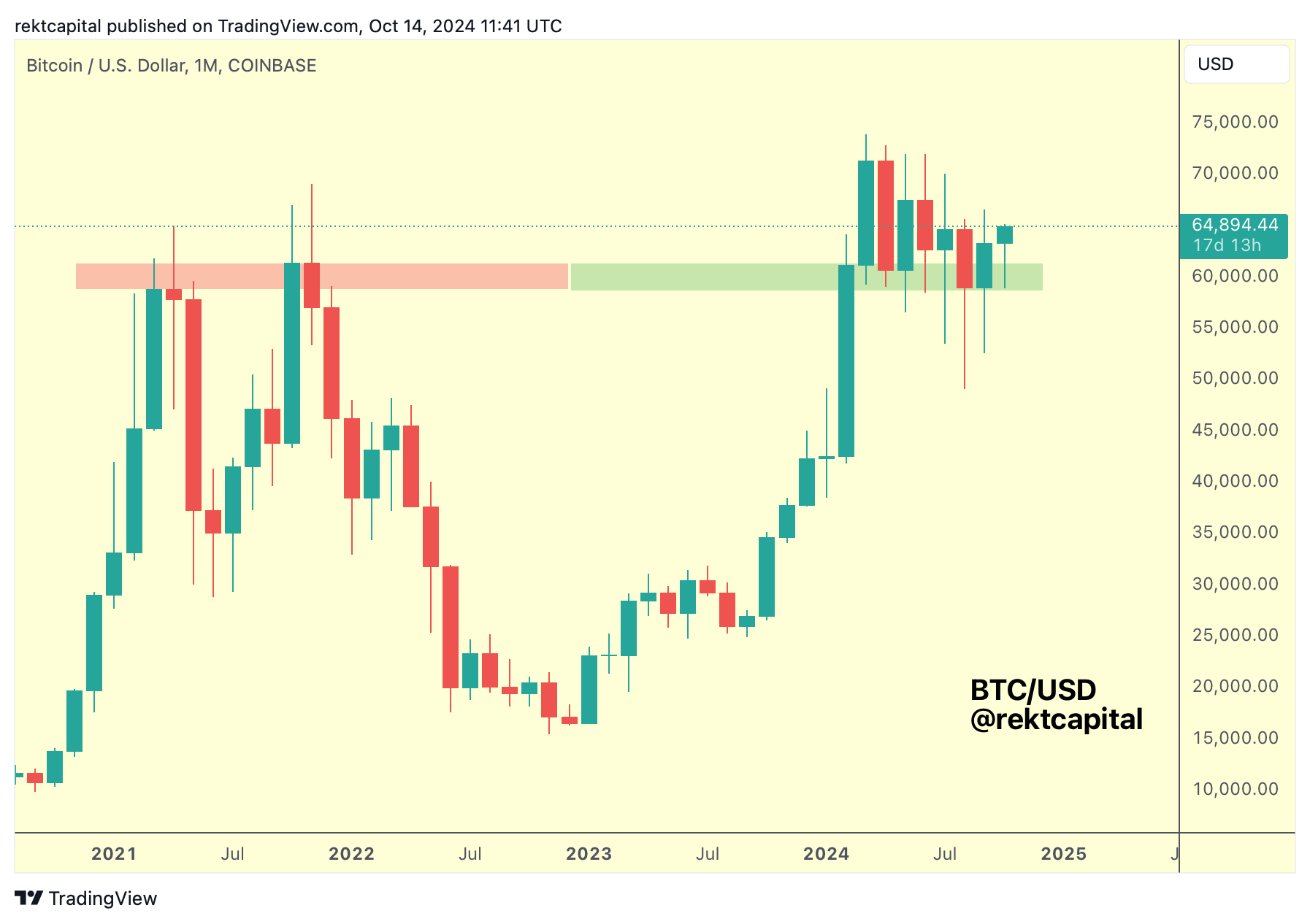

This green box is the Monthly old All Time High demand area:

Bitcoin has been able to solidify a support in this overall green area and it has done so at a Higher Low compared to last month's downside wicking lows as well as August's downside wicking lows as well.

The Weekly Downtrending Channel Top

Following the successful retests of key levels, Bitcoin is now challenging the August highs again (purple, $64200).

And given the strength in Bitcoin's recovery since the successful retest of the Downtrend and 21-week EMA, there are clear signs that the August highs are weakening as a resistance.

After all, when BTC rejected from the August highs in August, price dropped -18% whereas this current retracement period appears to have ended at the -8.5% mark.

A Weekly Close above the August highs (purple) followed by a retest of them into support would pose significant buy-side pressure on the Downtrending Channel Top (red resistance); in fact, if these technical feats occur on the Daily timeframe, then this process could accelerate.

Because if the August highs are weakening as resistance, then it's possible the Downtrending Channel Top is also weakening as a resistance as well.

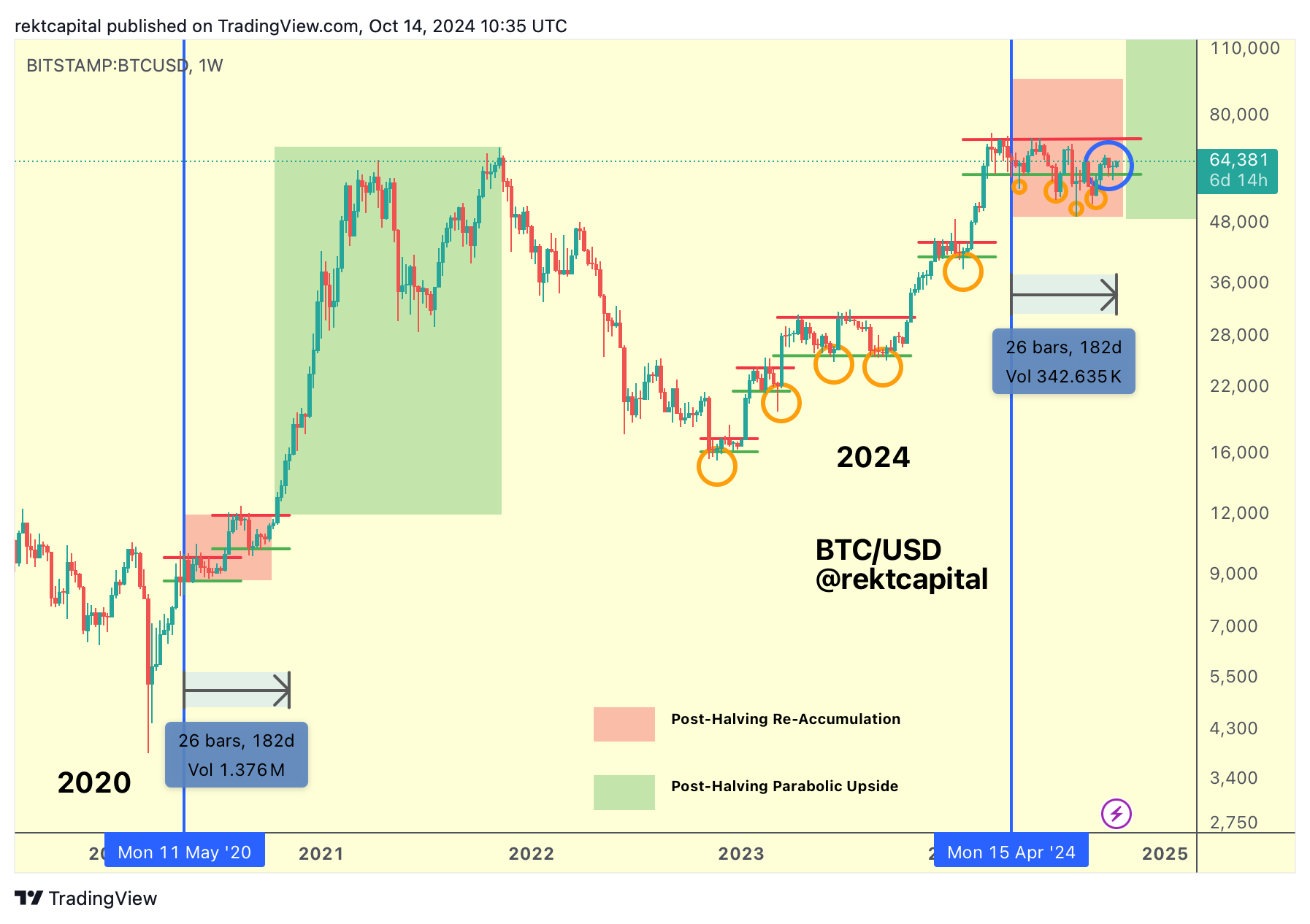

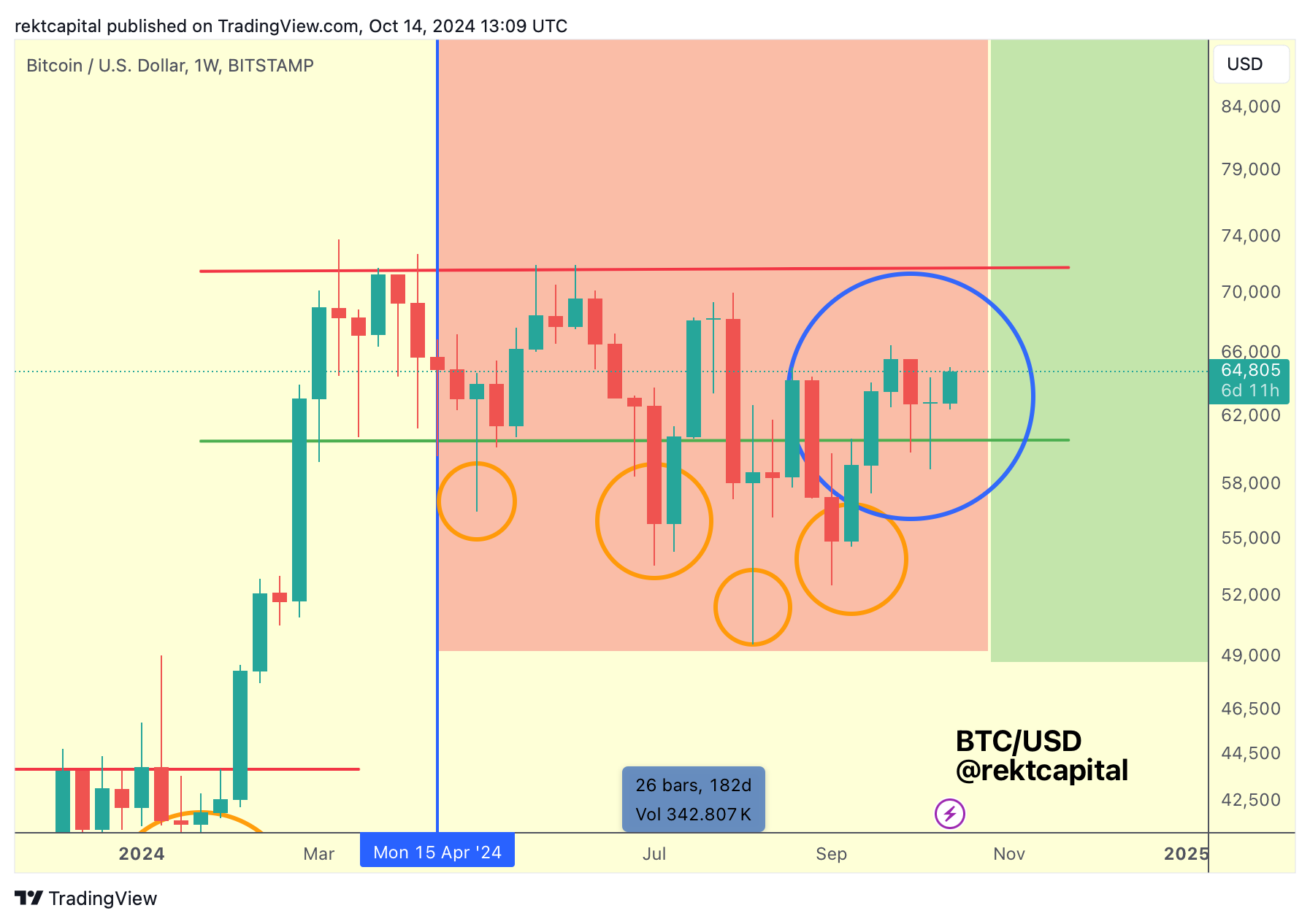

The Weekly ReAccumulation Range

Bitcoin has successfully reaffirmed its support at the Weekly ReAccumulation Range Low of $60600 (green):

As a result, having built a firm base at the Range Low, Bitcoin is now positioned for a move across the entire Range overall.

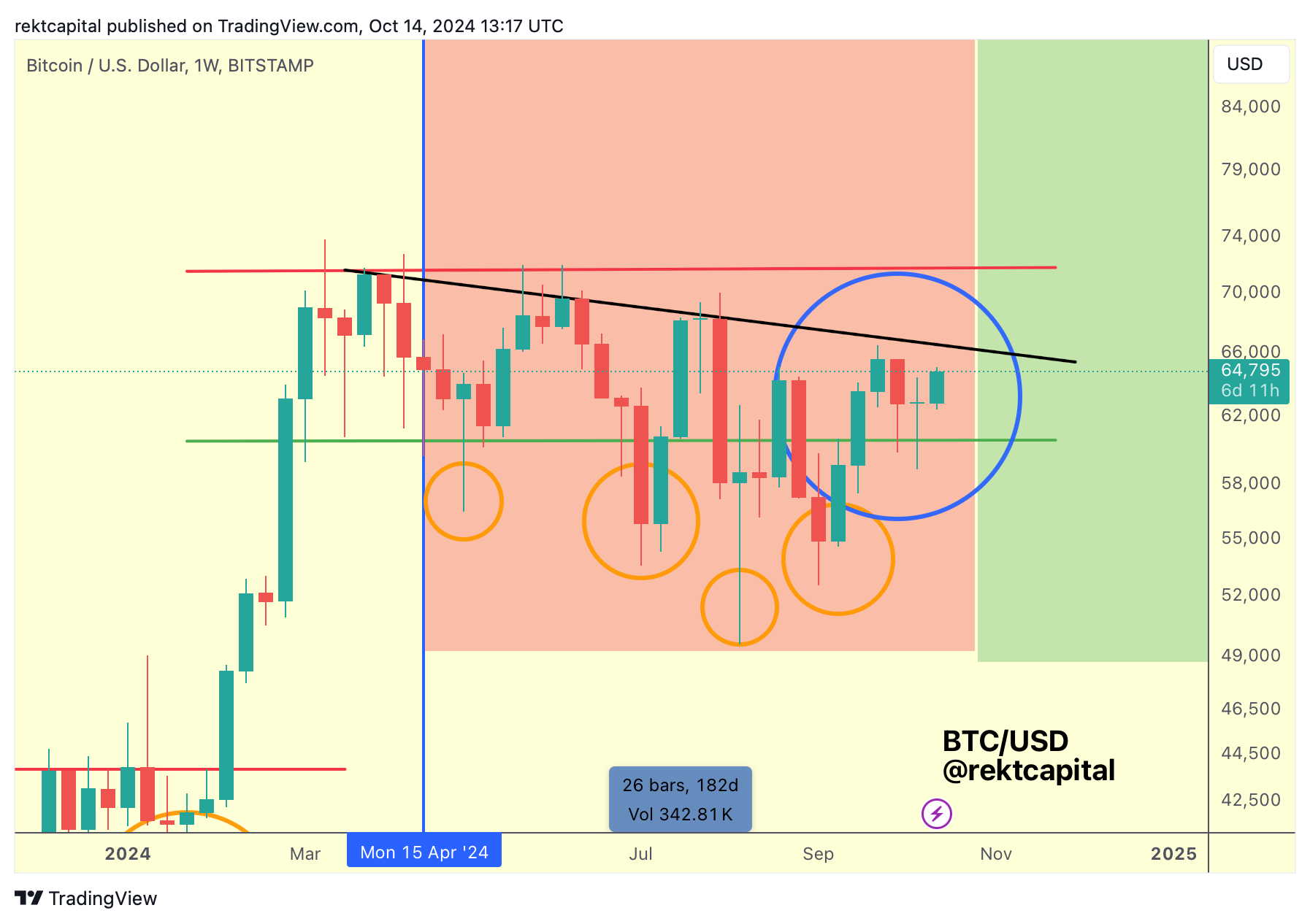

Of course, the only thing stopping Bitcoin from doing this is the series of Lower Highs dating back to mid-March 2024 (black):

However, given how Bitcoin's rejection from the Lower High from a month ago has almost completely been recovered since, there's reason to believe that the Lower High may not be able to reject price for too much longer.

Breaking this diagonal resistance would open price up to a revisit of the ReAccumulation Range High at ~$71300 (red) for a legitimate challenge of breaking out into new All Time Highs.