Bitcoin - What Now?

How Low Could Bitcoin Drop?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

The Bitcoin Breakdown

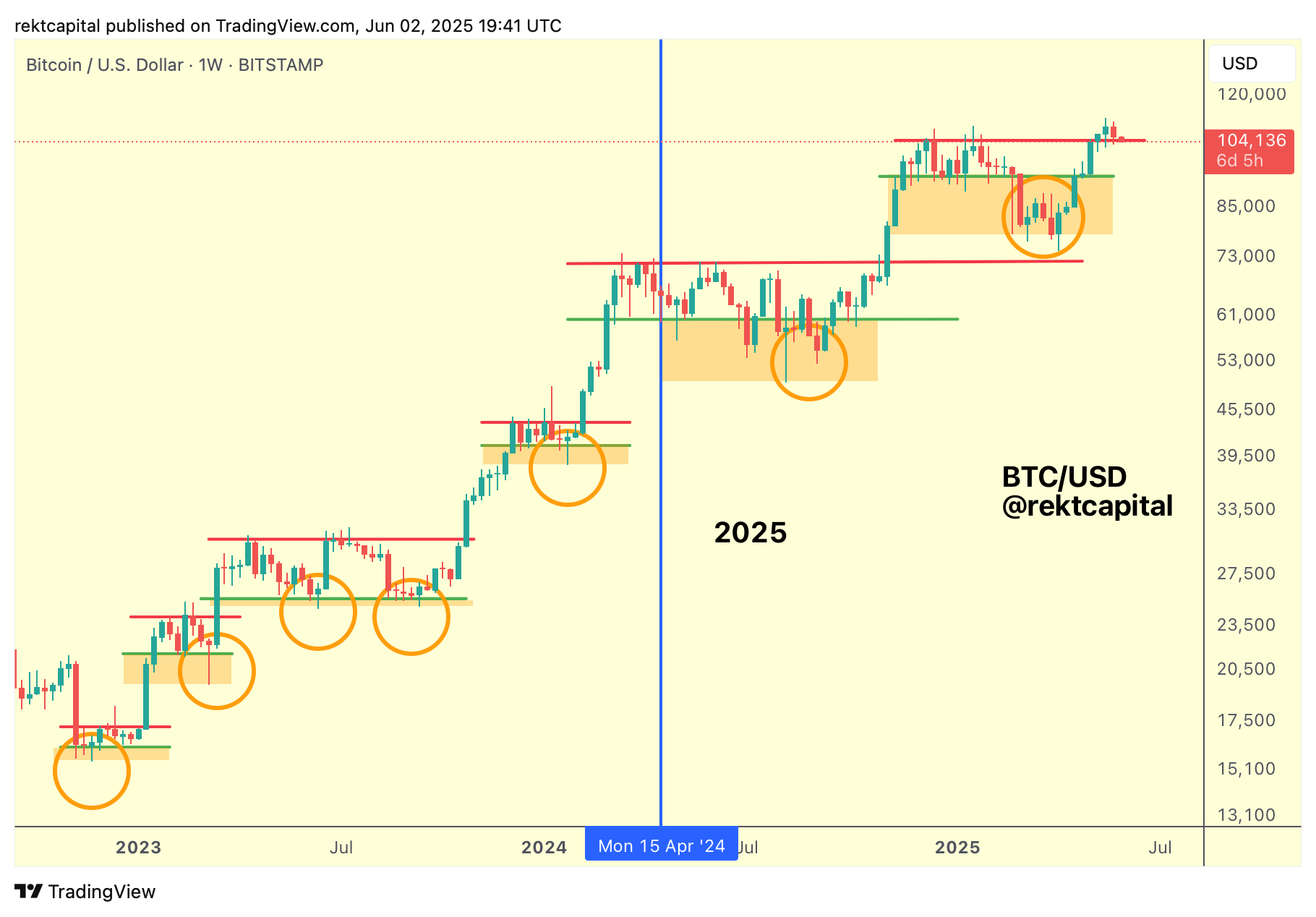

Over the past few weeks, we've been talking about how Bitcoin has been positioning itself for a breakout from its ReAccumulation Range over the past almost full 7 weeks.

Earlier this June, Bitcoin Weekly Closed above the ReAccumulation Range High to put price in a predicament to post-breakout retest the old Range High resistance into new support:

Price would then go on to retest the Range High as new support for almost 7 weeks.

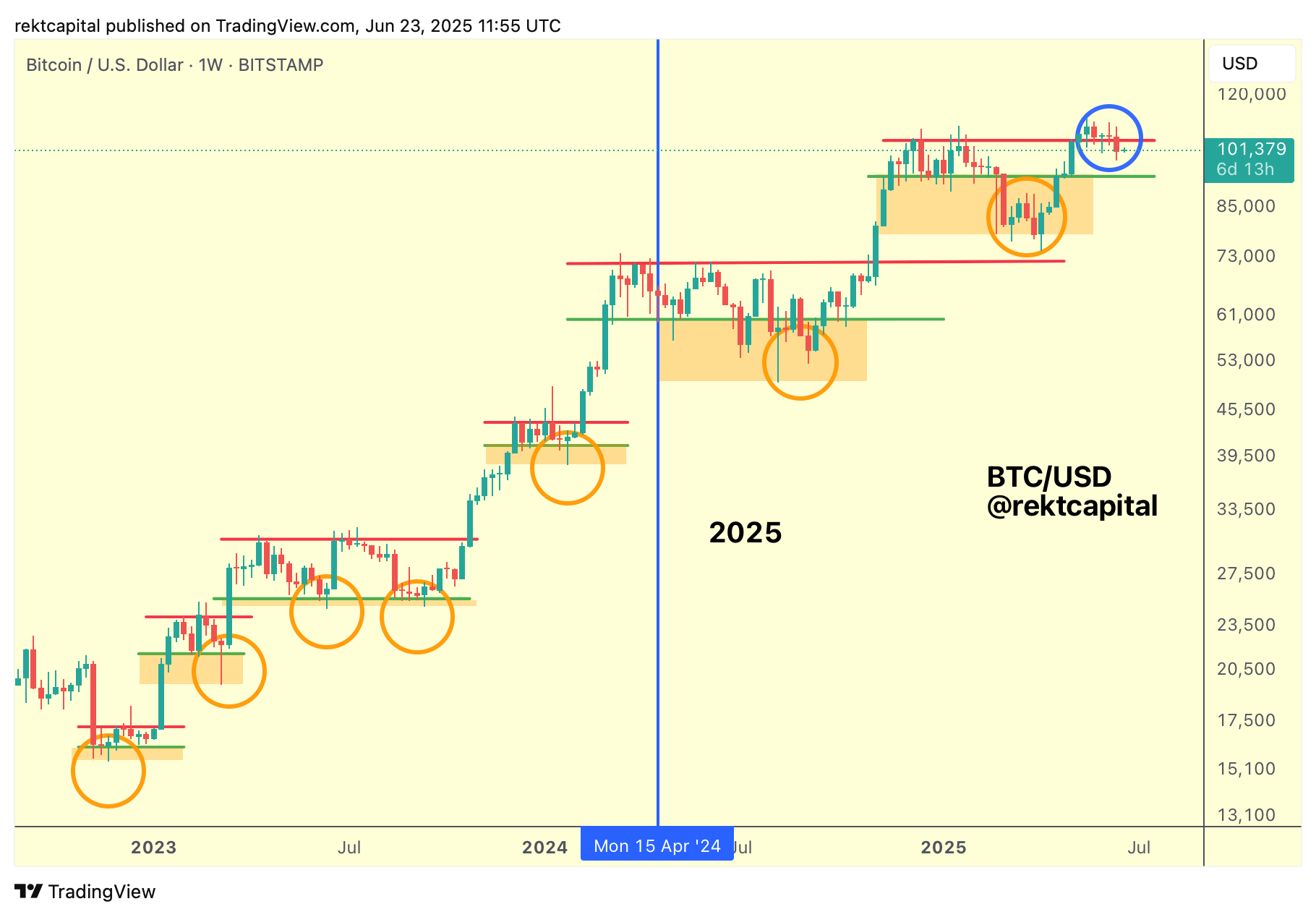

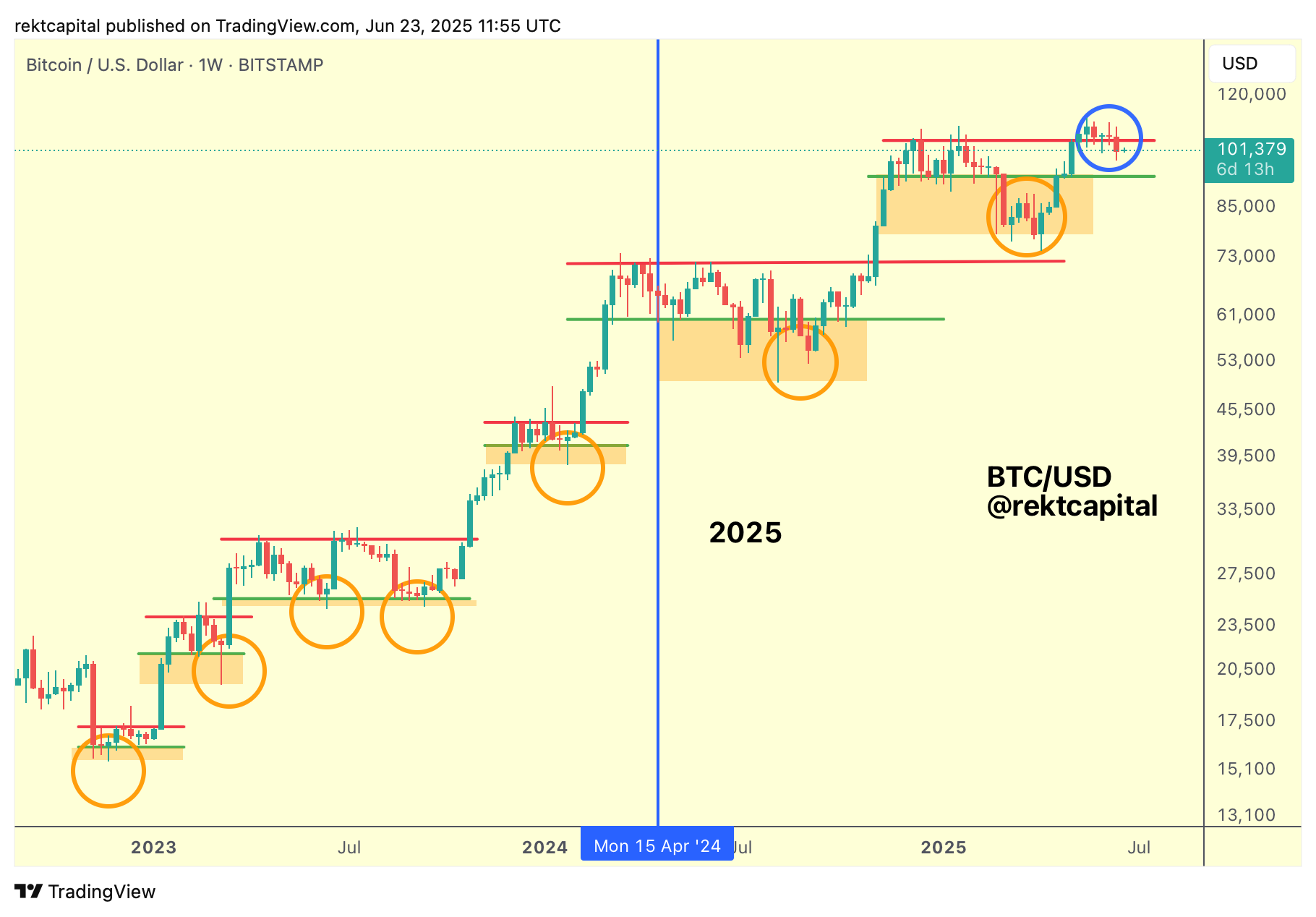

Most recently however, Bitcoin has lost that key Range High level of $104400:

Here's today's update:

Bitcoin has Weekly Closed below the $104400 level and as a result, technically price is positioned for what could be a relief rally into the $104400 to turn it into new resistance; once that level is confirmed as new resistance, price would then enter additional downside continuation.

But it just emphasises how confirmed breakdowns are a 3 step process: Weekly Close below the level, turning of the level into new resistance, and then confirmed downside continuation.

Yes, Bitcoin has Weekly Closed below the $104400 level, but it hasn't turned $104400 into resistance, and it has thus not confirmed additional downside continuation.

But let's step back from the technicals for a moment, especially when we consider how much this cycle has been a cycle of downside deviations.

The Downside Deviations

Bitcoin has developed 6 Re-Accumulation Ranges in this cycle and in 4/6 of them, price would downside wick below then before rallying higher.

And in 2/6 of them, Bitcoin would produce multi-week periods of downside deviations.

Interestingly, all ReAccumulation Ranges that experienced downside wicking below their respective Range Lows were Pre-Halving Ranges whereas all Re-Accumulation Ranges with multi-week downside deviations occurred after the Halving.

However, each time these downside deviations occurred, via downside wicks or actual multi-week deviations, they would always occur below the ReAccumulation Range Low.

What's more is that these Range Lows would actually not turn in any viable resistances to sustainable reject prices; most of the breakdowns would occur by virtue of losing the Range Low as support rather than seeing price reject due to the Range Low turning into new resistance.

Right now, this current breakdown is occurring from the Range High and it's the first time we are seeing this type of deviation in this cycle.

And this potential downside deviation is occurring by virtue of the Range High failing its retest into a new support, but it will be crucial to watch out for whether this Range High actually turns into a new resistance or not.

The Monthly Retest

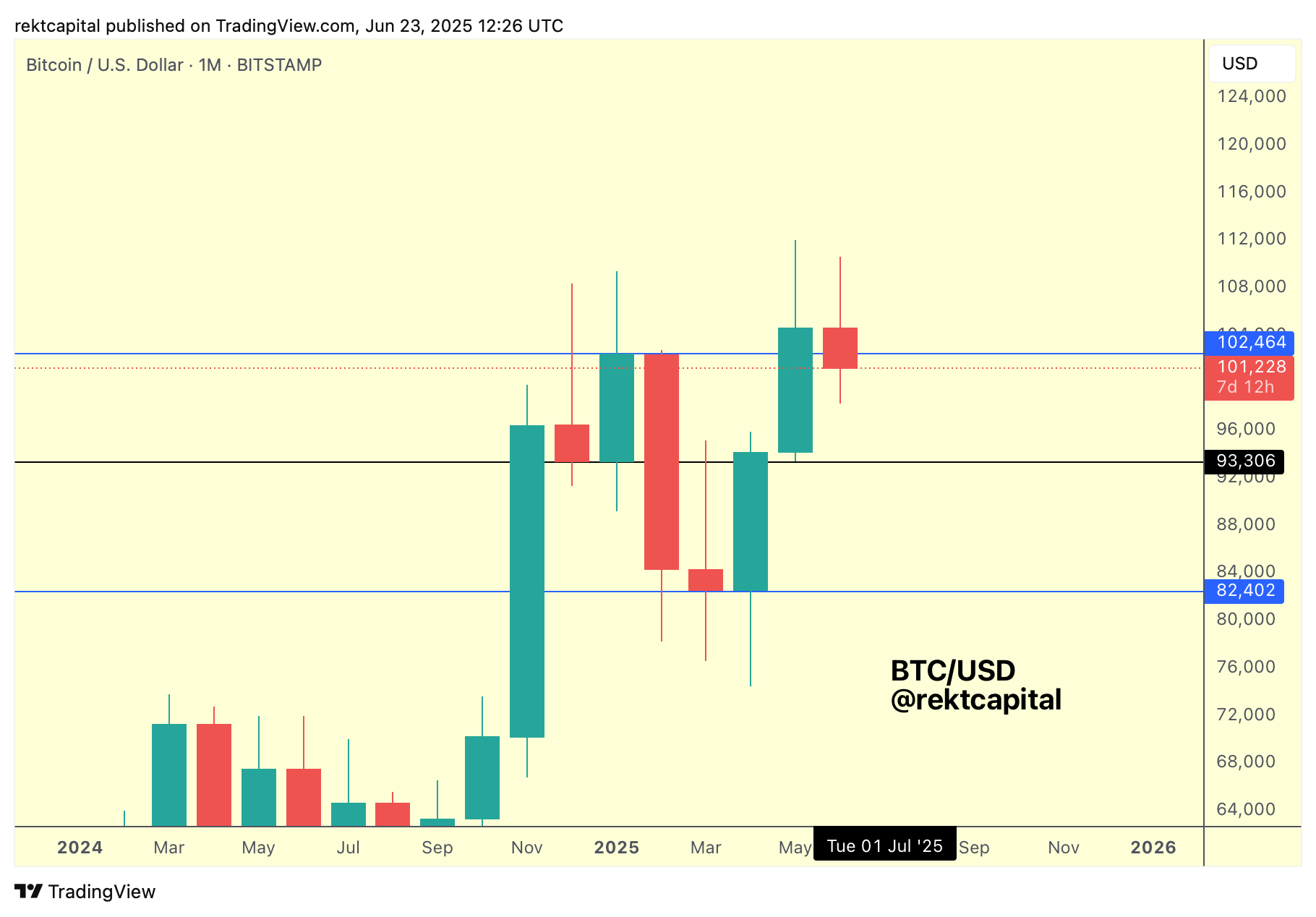

There have been two important retests playing out over the past several weeks.

There was the Weekly Re-Accumulation Range High retest of $104400 which we've now seen fail though not fully confirm a bearish breakdown.

And there's the second one which concerns the Monthly timeframe and we've discussed since late May.

Here's the analysis from May 26th:

Here's today's update:

Bitcoin is in the process of a (volatile) retest of the blue Range High of ~$102450.

And a Monthly Close above this level would be crucial to emphasising the retest as successful.

But it just goes to show that Bitcoin is generally retesting the $102450-$104400 cross-timeframe demand area.

So if the Weekly retest of $104400 is failing but the Monthly retest of $102450 becomes successful, then the chances for a downside deviation below the $104400 level increase.