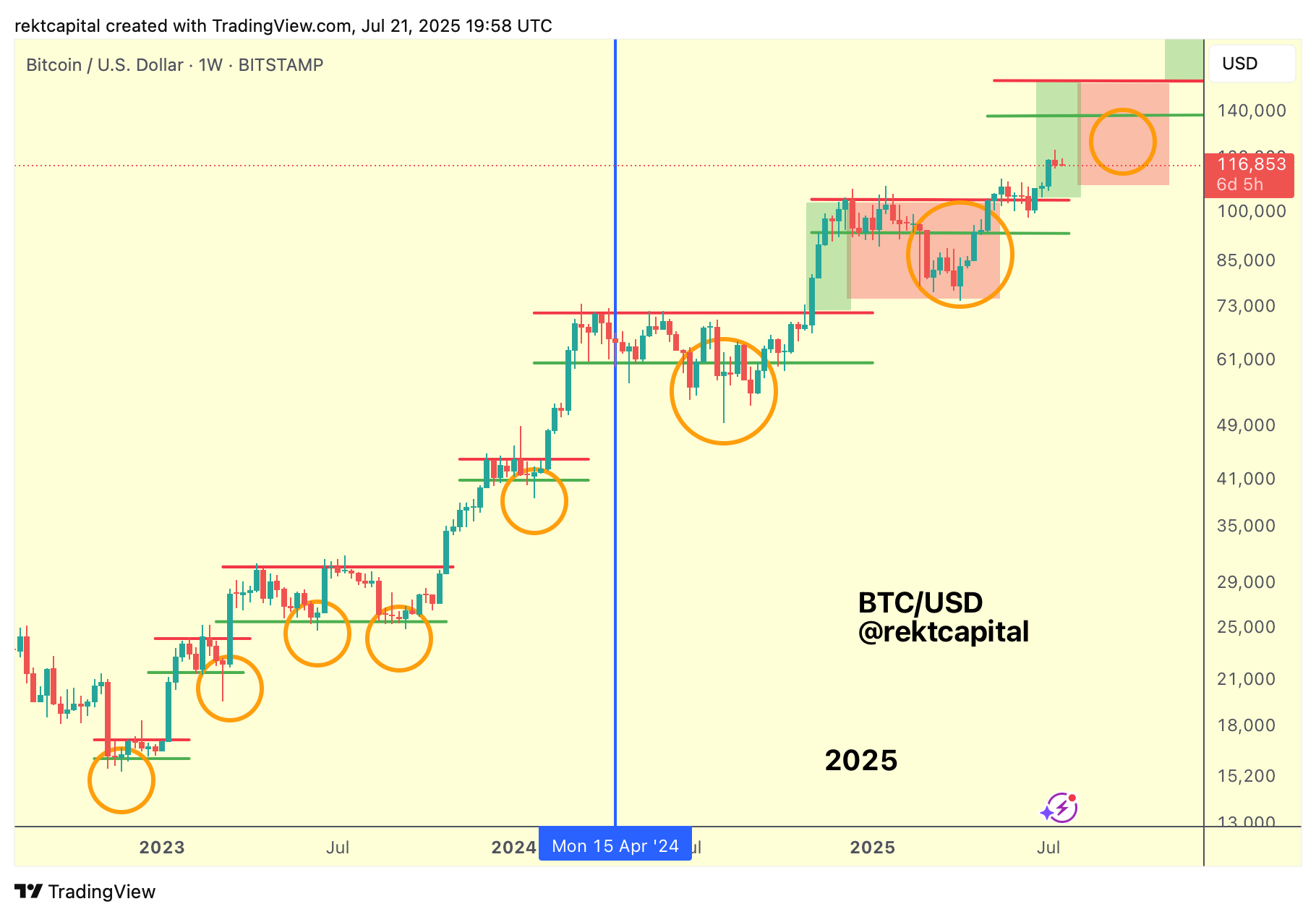

Price Discovery Uptrend 2 - Cycle Analysis

Historical Price Discovery phases

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

How Deep Could Bitcoin Dip?

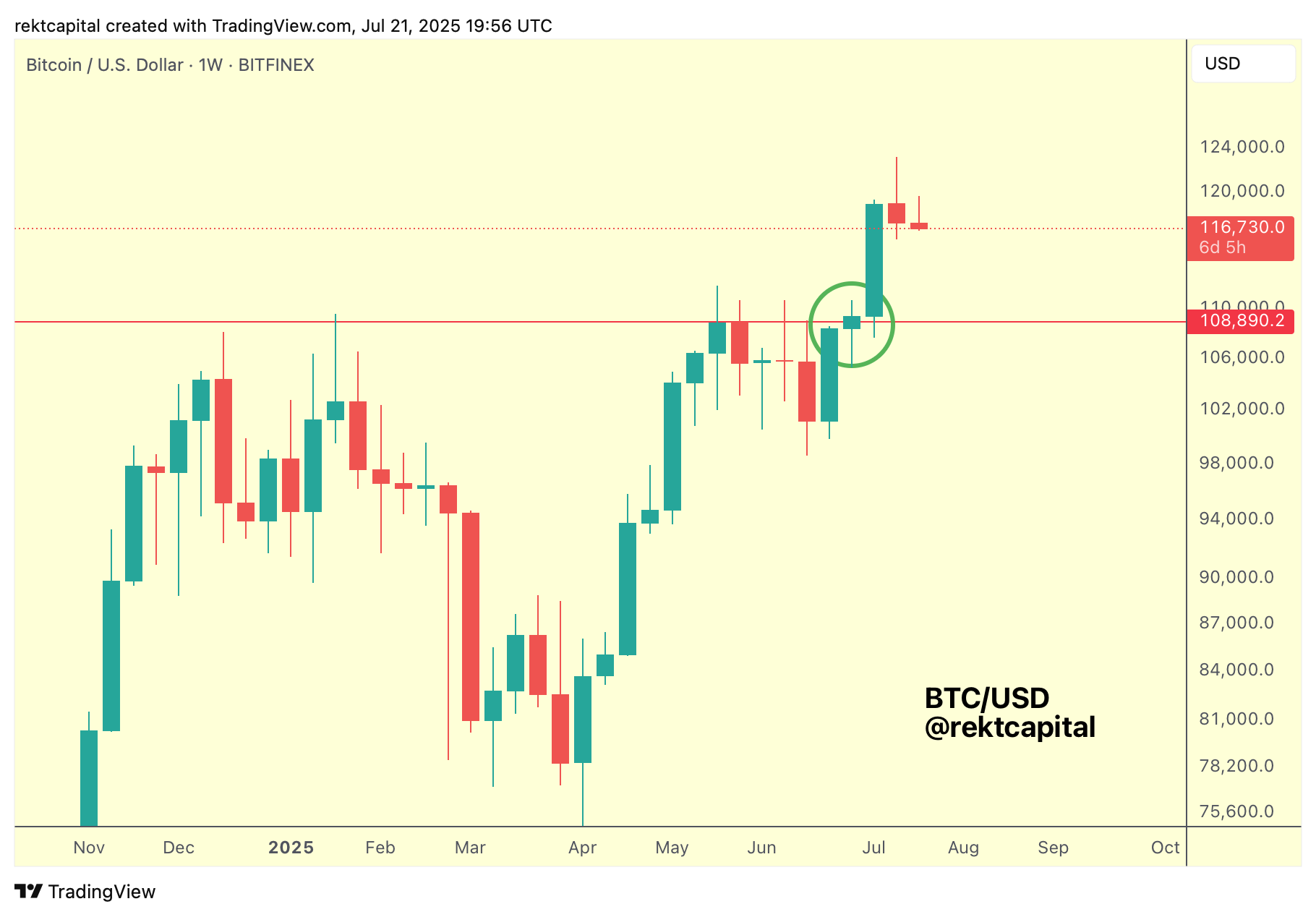

Ever since Bitcoin successfully retested the final major Weekly resistance (red) into new support, price hasn't really looked back.

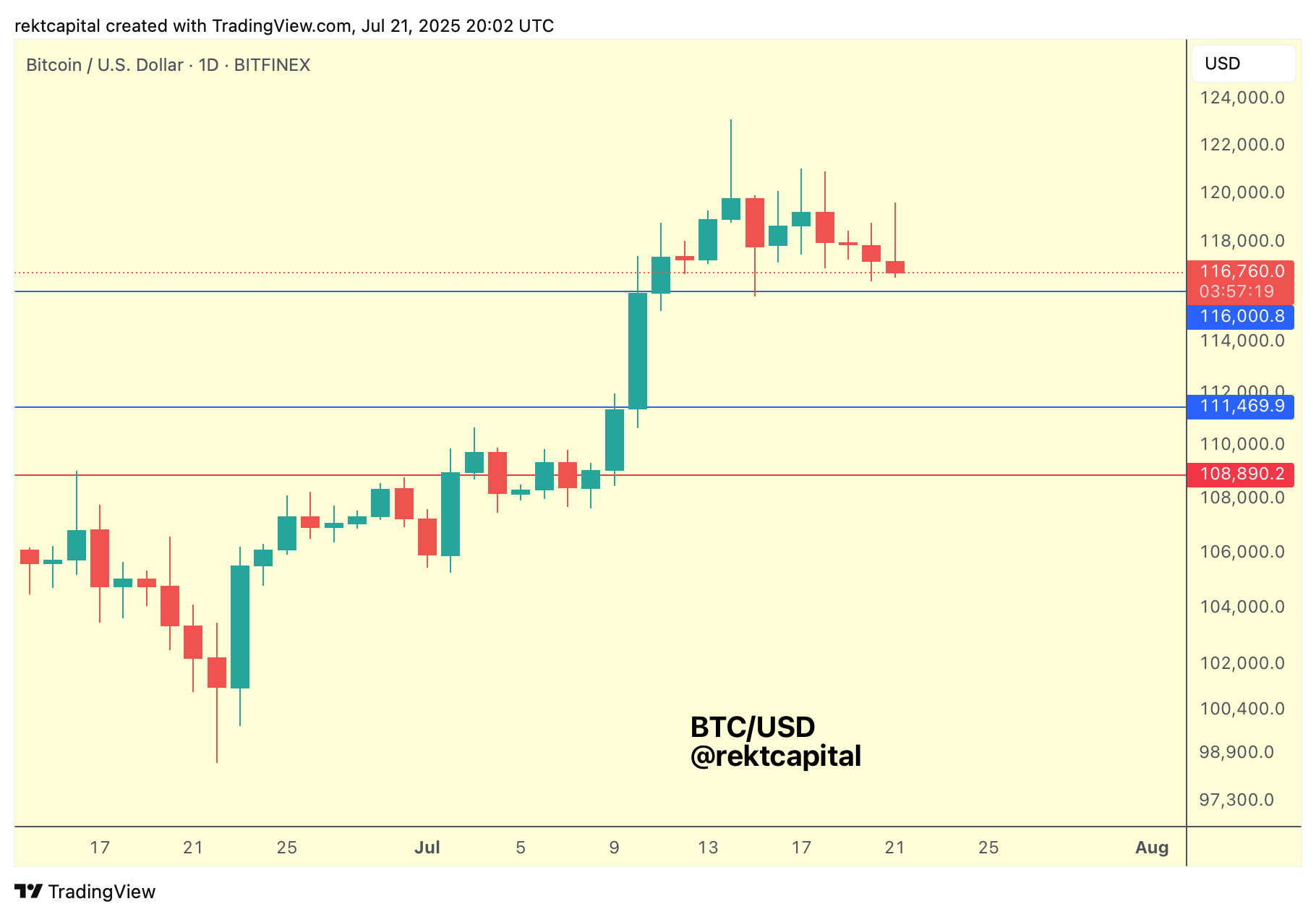

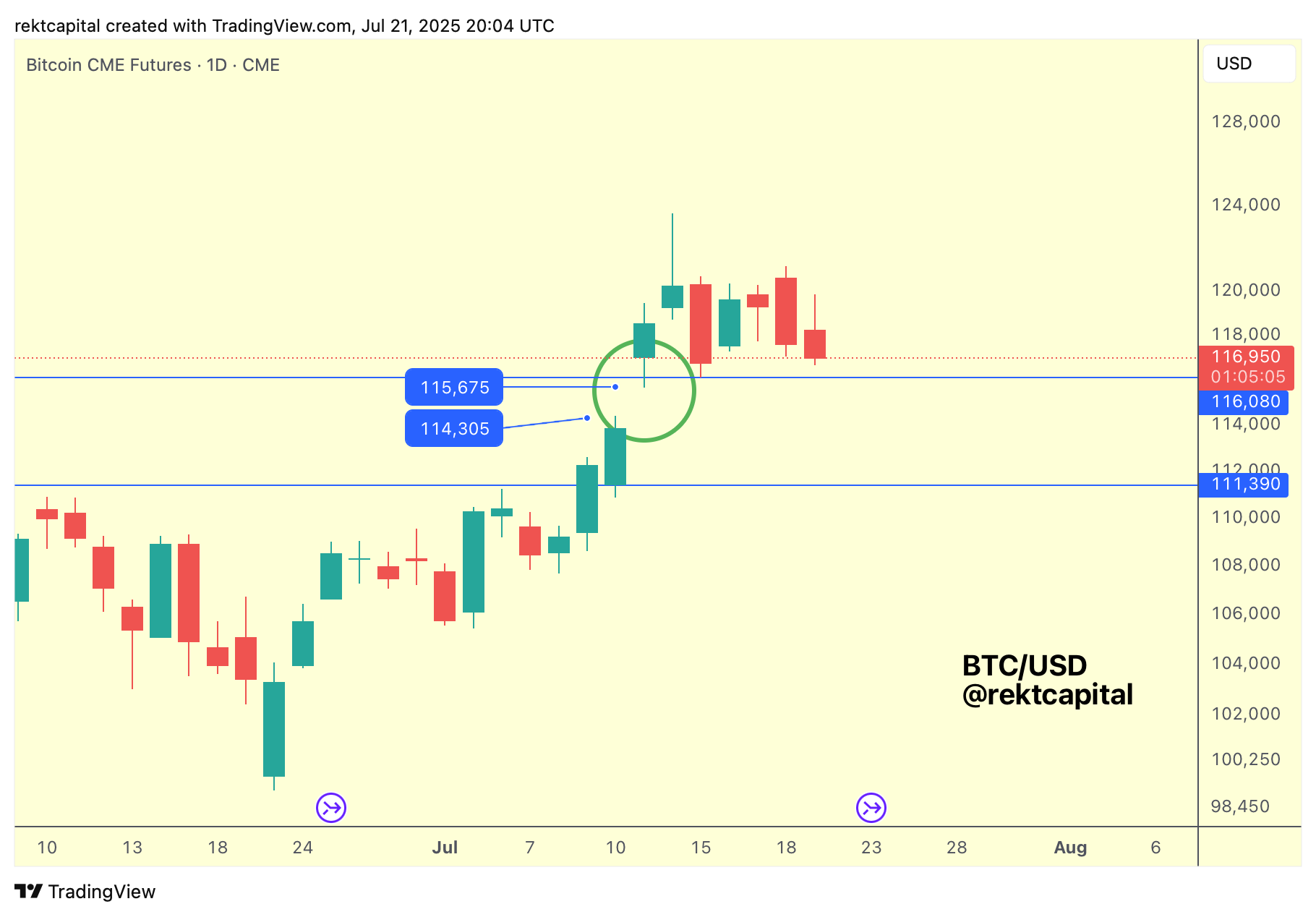

Which is why it's important to understand dipping areas for price and at the moment the only way to do that successfully is by looking at the Daily timeframe:

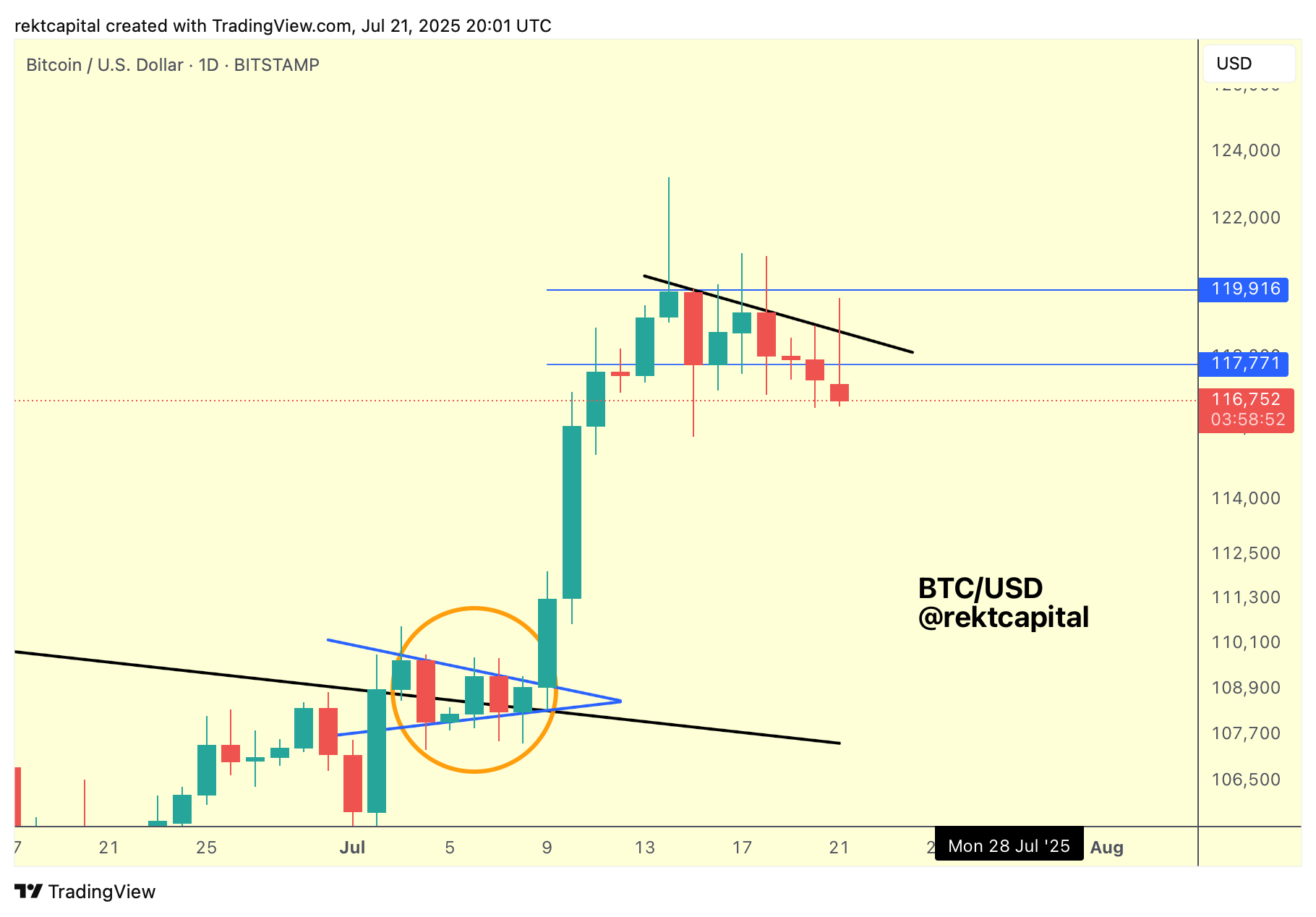

First thing is first - Bitcoin has been in a short term Range on the Daily but has been plagued by Lower Highs (black).

More, BTC has Dailed Closed below the Range Low (blue) and today price has upside wicked into said Range Low to potentially turn it into new resistance.

Confirming a breakdown from here would thus see price drop into lower Daily levels:

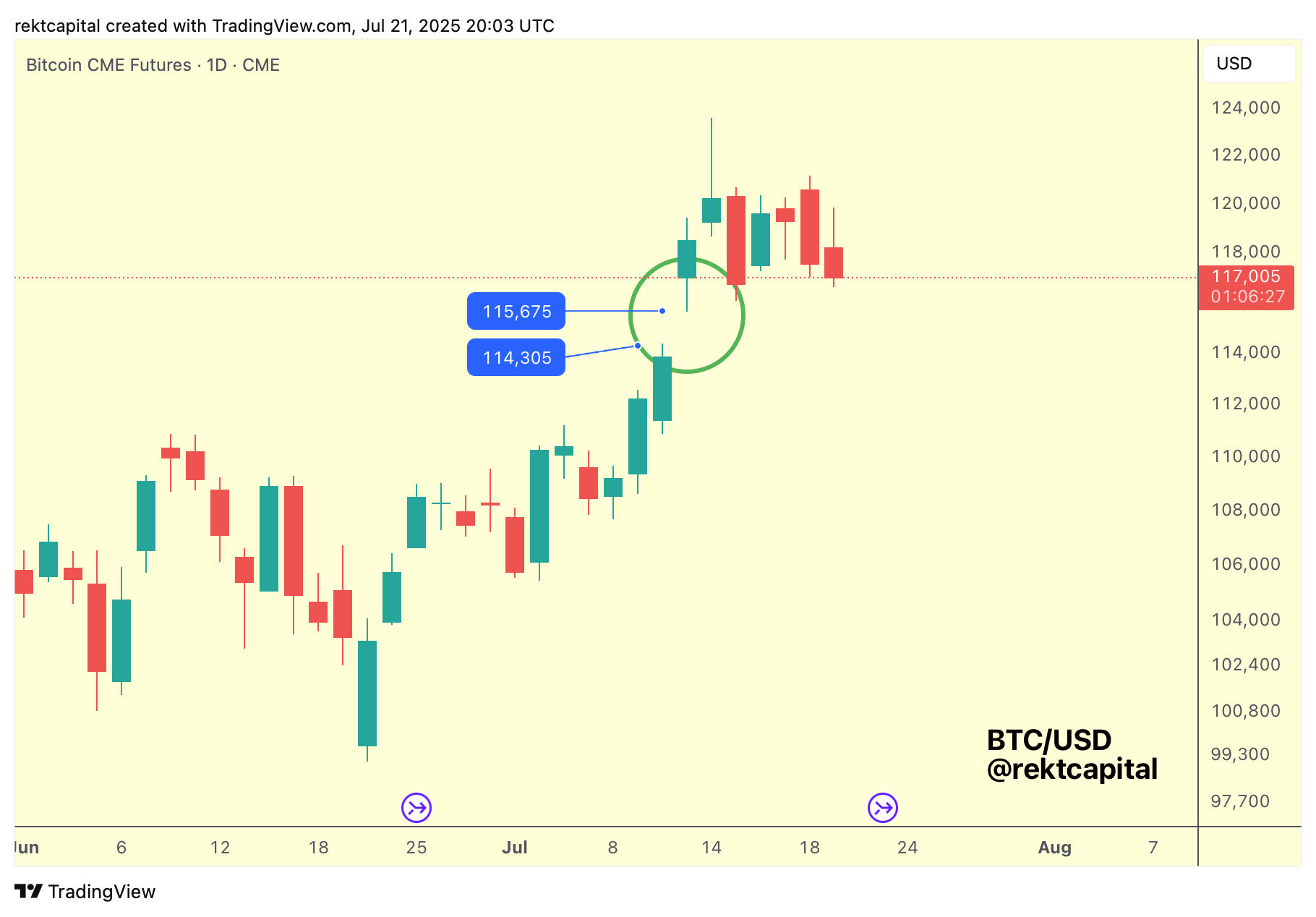

The key Daily levels are the 111k and $116k levels, but in saying that the Daily CME Gap resides between these two:

So in the end, this CME Gap takes up a big portion of space within what is a Daily Range between $111k and $116k:

Bitcoin hasn't been able to make new highs after finding support above the CME Gap so perhaps it has to fill it to garner the necessary buy-side pressure.

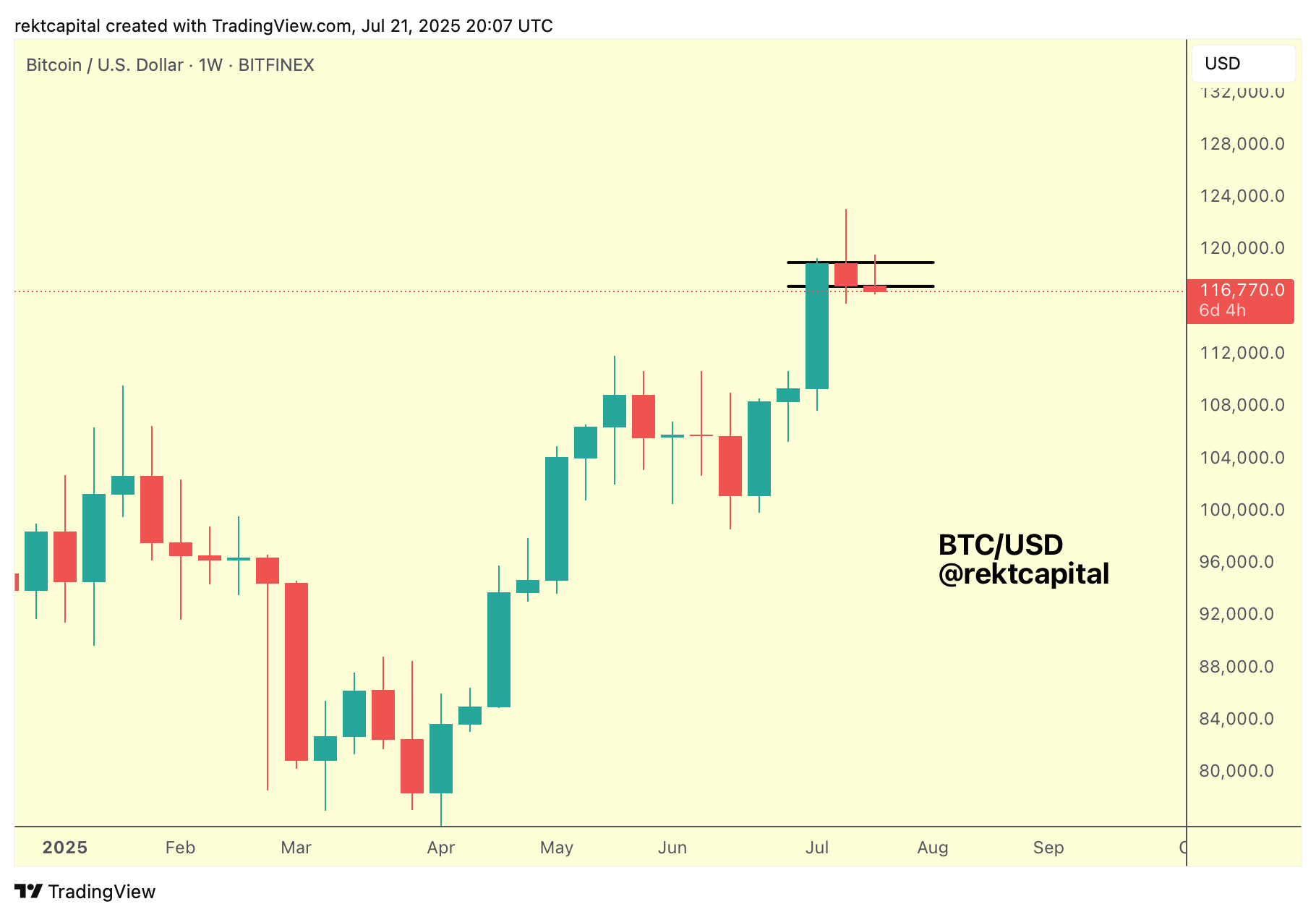

But the week is young and dips in uptrend are normal and so if price indeed manages to garner some buy-side interest at slightly lower levels, could it be that price rescues what could be an early-stage Weekly Bull Flag?

It may appear amusing to discuss a Bull Flag when price is pulling back and in fact below the pattern but the reality is that there is an entire week for Bitcoin to Weekly Close above the Bull Flag low of $117150.

If price is able to produce some price action into the Daily CME Gap then that would end up as a downside wick on the Weekly.

Let's not discount anything on the Weekly, especially since there are no Weekly levels between current prices at ~$110k and thus anything is possible.

The Bitcoin Roadmap

Bitcoin has now entered Week 3 in Price Discovery Uptrend 2 and last week we spoke about how the conservative plan would be to be optimistic and risk-on for Weeks 1-3 and from Week 4 start to become cautiously optimistic with scope for being concerned and (increasingly risk-off ) across Weeks 5-7.

And so going forward it will be important to understand how Bitcoin performed in Price Discovery Uptrend 2 in previous cycles and how that could inform things going forward.

Let's dive in.