The Bitcoin Re-Accumulation Range - Part 2

Crucial aspects about this ReAccumulation Range that you need to know about

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Upcoming Monthly Candle Close

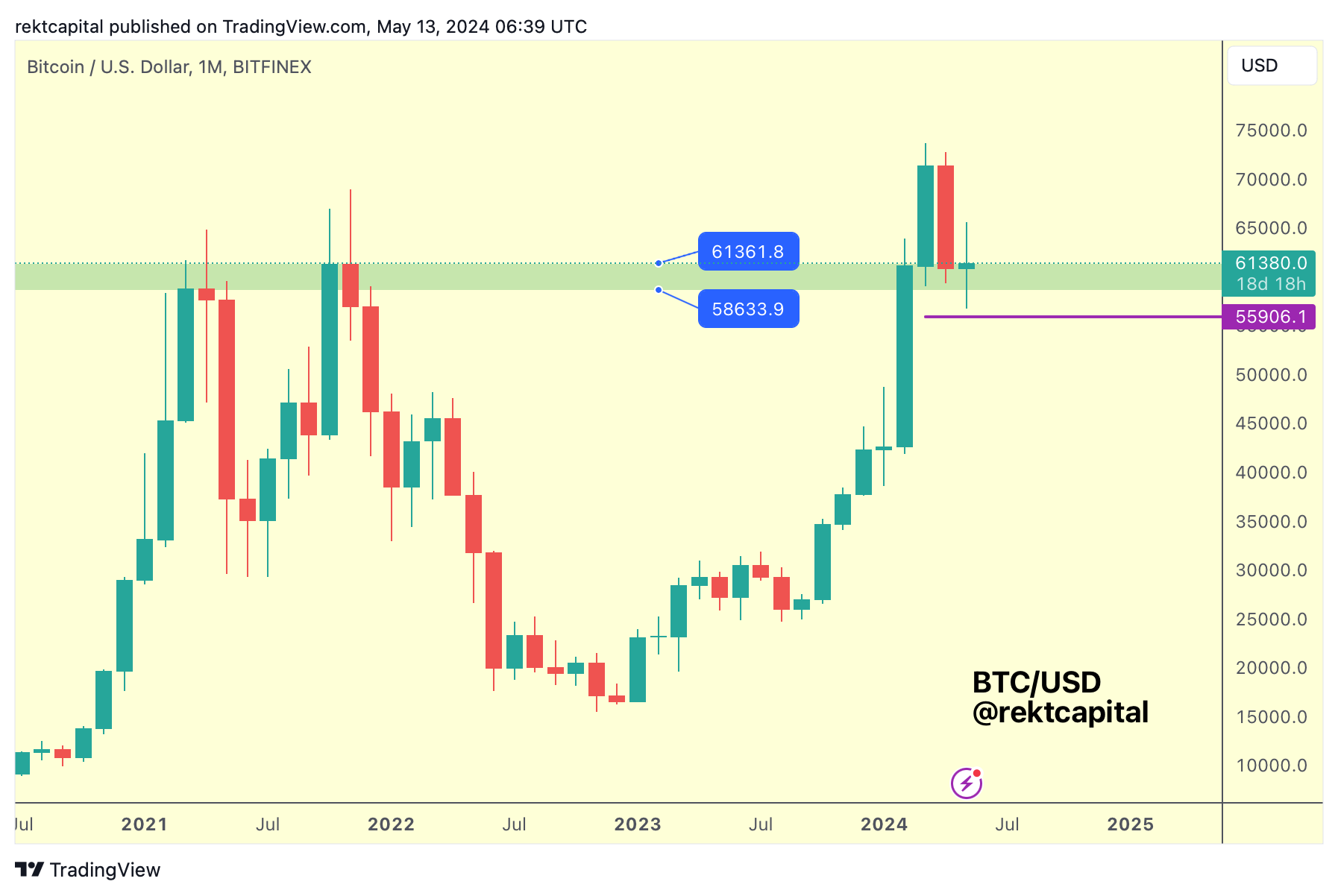

Earlier this month, we discussed how Bitcoin would be retesting a key old All Time High resistance area as new support, while allowing for potential downside wicking below said area in the process.

Here is that chart from mid-May:

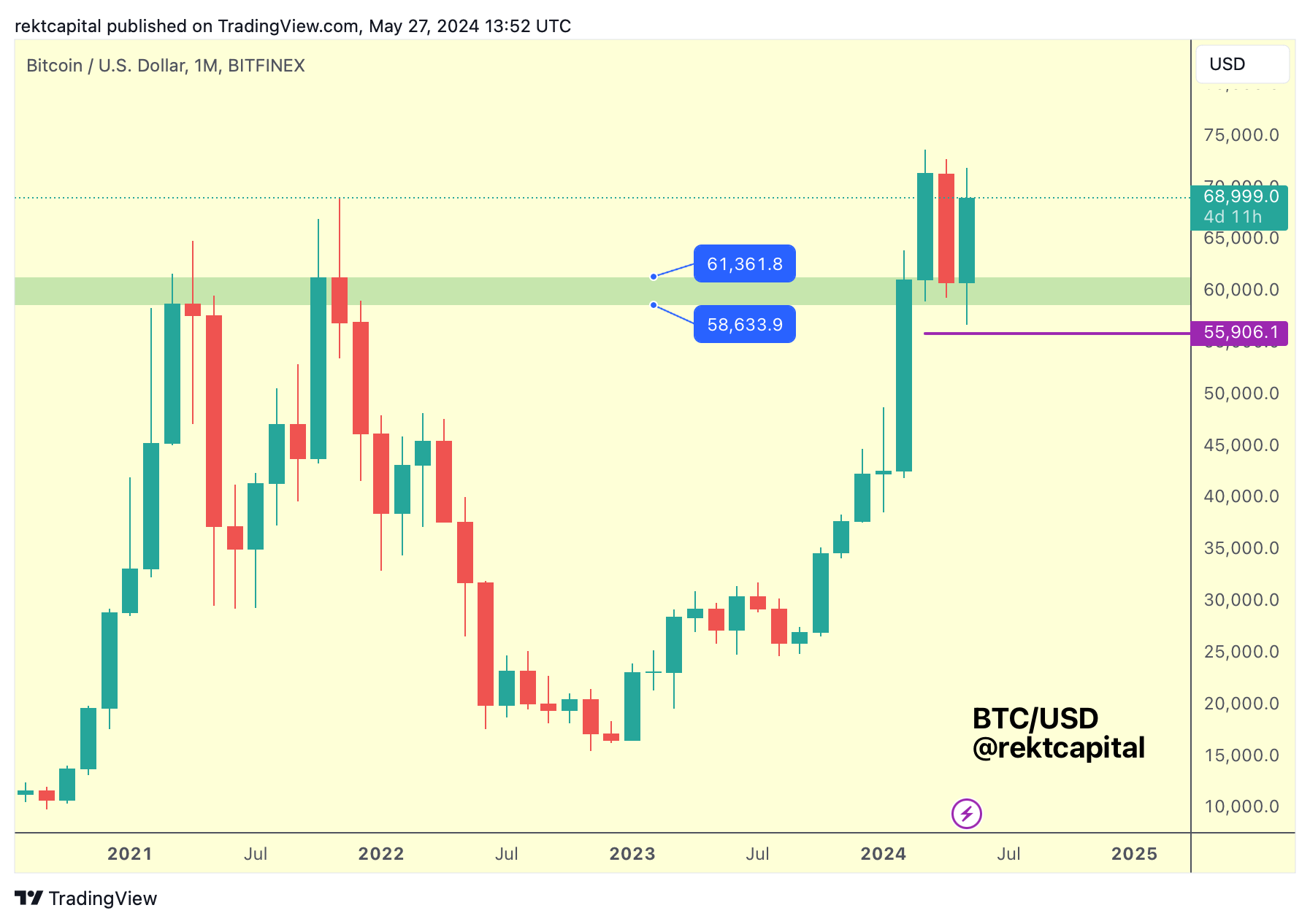

And here is today's update to this chart:

Of course, Bitcoin has successfully retested this old area of resistance as a new area of major support.

But in successfully retesting this area as support, BTC rallied to revisit the ~$70000 level which is acting as new resistance.

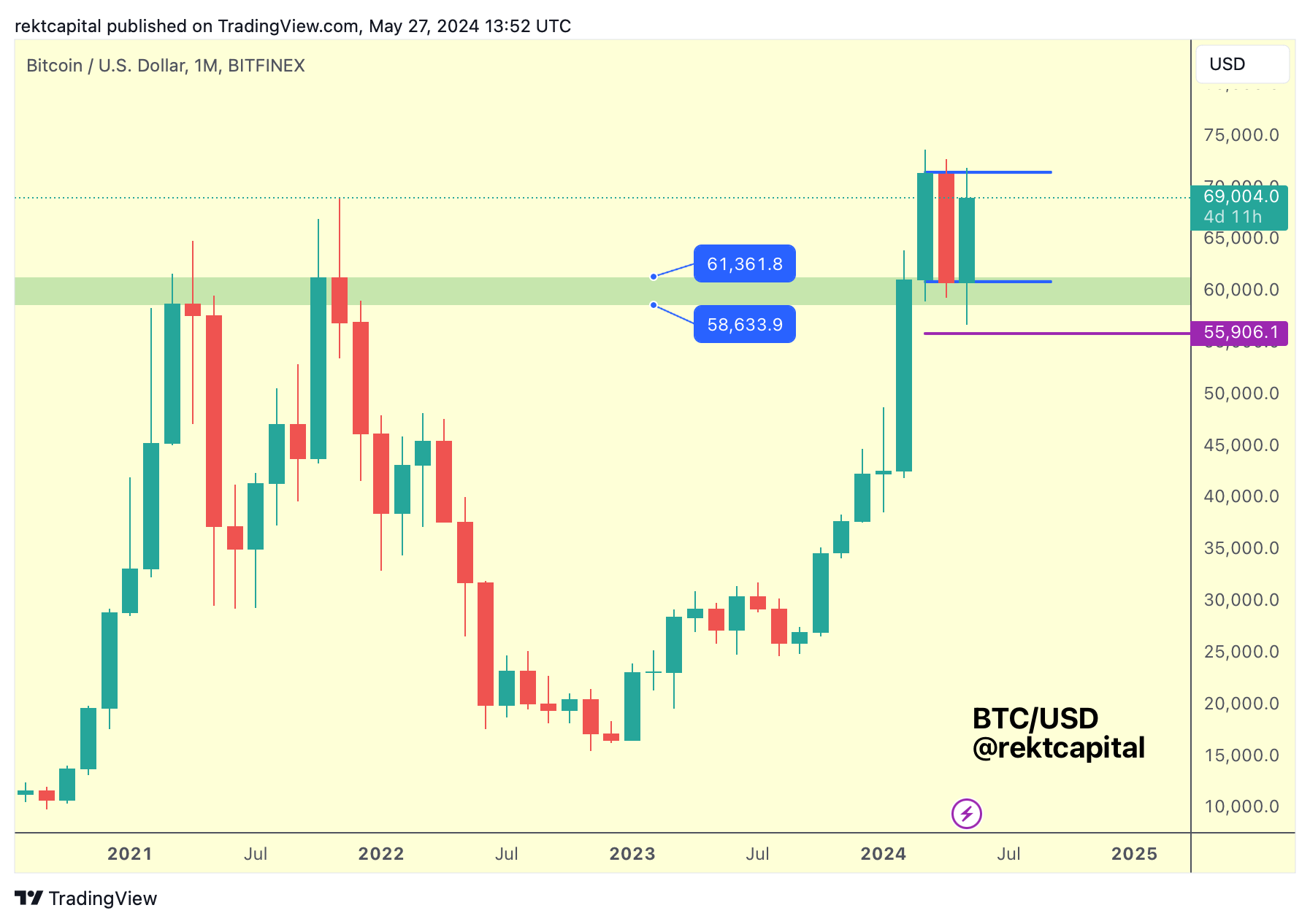

And this new resistance is presented in blue below:

BTC rejected from here and is forming an upside wick in its current Monthly Candle.

But it's clear that BTC is forming a range at these highs on the Monthly timeframe, which isn't new to us - we've been covering the Weekly ReAccumulation range for quite some time, predicting the prices this range would cover already before the Halving.

But the fact that the range is developing itself clearly on the Monthly timeframe is only further crystallising this ReAccumulation range, solidifying it at key psychologically round levels: $60000 and $70000, with wicks to either side of the range.

While this Range has been going on for almost 2.5 months now on the Weekly timeframe, on the Monthly timeframe this range is starting to look like a Monthly Bull Flag - a typical bullish continuation structure.

A Monthly Close just like this would of course re-confirm the $70000 level as resistance but more importantly, it would sentence BTC to further consolidation inside this range.

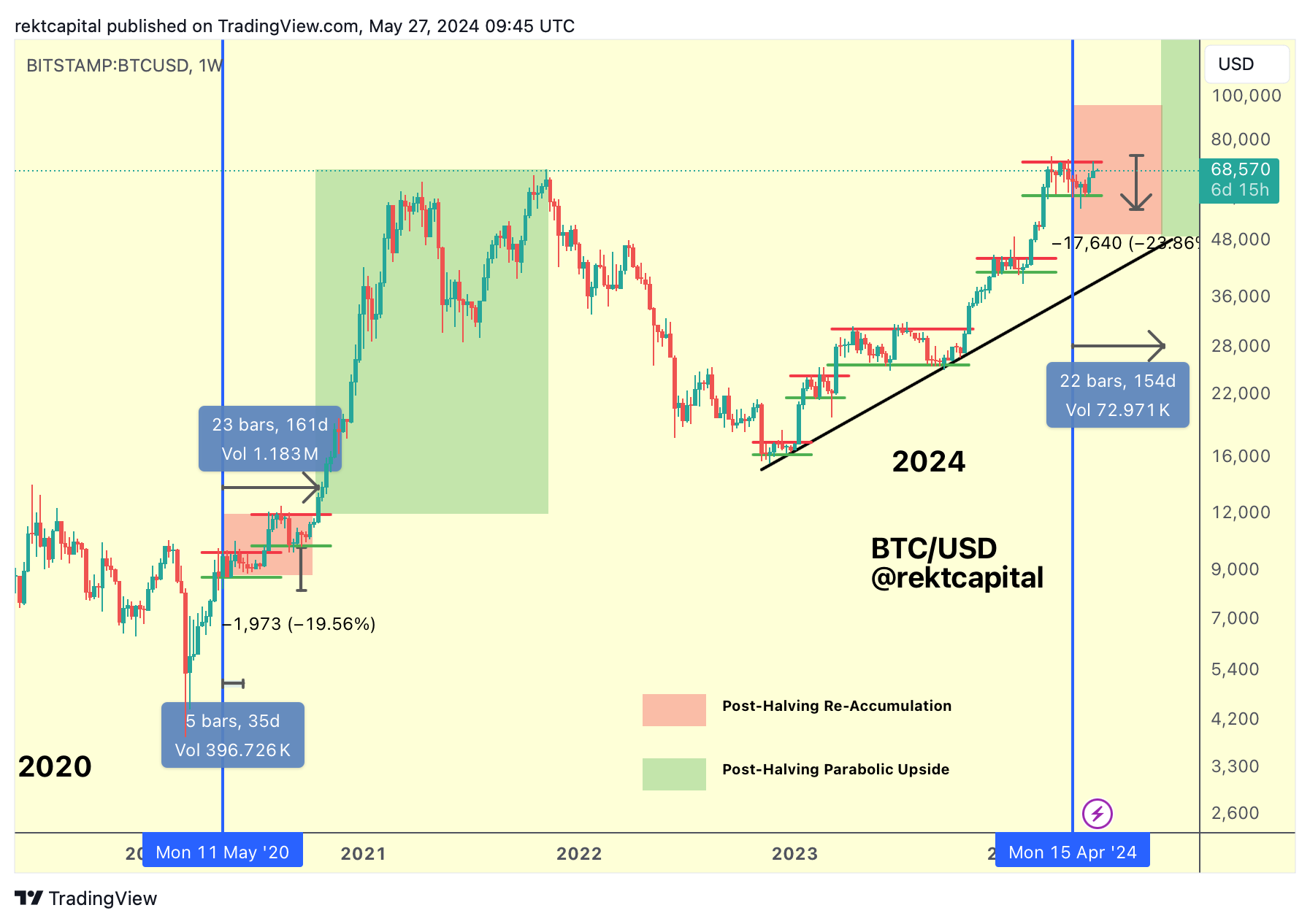

The Re-Accumulation Range

With the latest Weekly candle close occurring below the Range High, Bitcoin is going to likely continue holding this range, and we already have this signal before the official Monthly close. A Monthly Close below the resistance would only further confirm that BTC will continue its consolidation going forward.

This isn't out of the ordinary of course, because historically BTC would breakout from a Post-Halving Re-Accumulation range only 160 days after the Halving.

Bitcoin is soon going to begin only its 40th day after the Halving, which just goes to show how much more this consolidation could still carry on for.