The Bitcoin Post-Halving "Danger Zone" Is Over - Part 2

Re-Accumulation Range Low Is Protected

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

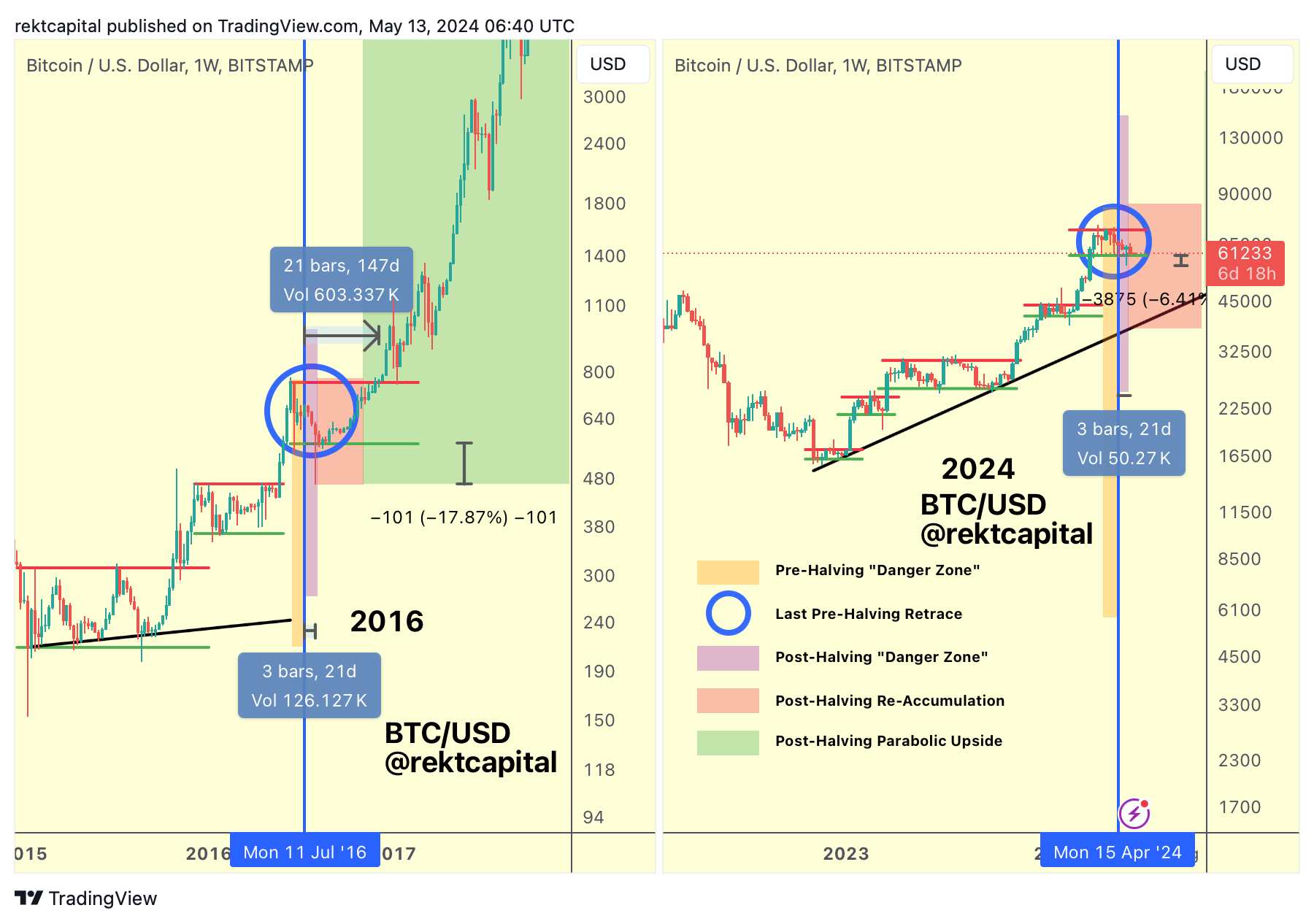

The Post-Halving "Danger Zone" Is Over

The Post-Halving "Danger Zone" (purple) represents a three-week window after the Halving where historical downside wicks below the Re-Accumulation Range Low tend to occur, specifically and most notably in 2016.

In 2016, Bitcoin produced a downside wick of -17% below the Re-Accumulation Range Low three weeks after the Halving.

In 2024, this current cycle, BTC repeated history and produced a -6.5% downside wick but this time two weeks after the Halving.

In any case, BTC had satisfied the "Danger Zone", at least from a price action perspective.

But now we can confirm that BTC has also satisfied the "Danger Zone" from a time perspective as well because the three-week window is officially over.

Overall - the Post Halving "Danger Zone" is over.

So what does that mean exactly?

History suggests it means that Bitcoin will no longer produce downside volatility below its current Re-Accumulation Range.

And if that indeed turns out to be the case over time, then the Bitcoin correction should be over and price should be able to maintain itself above $60,000 going forward.

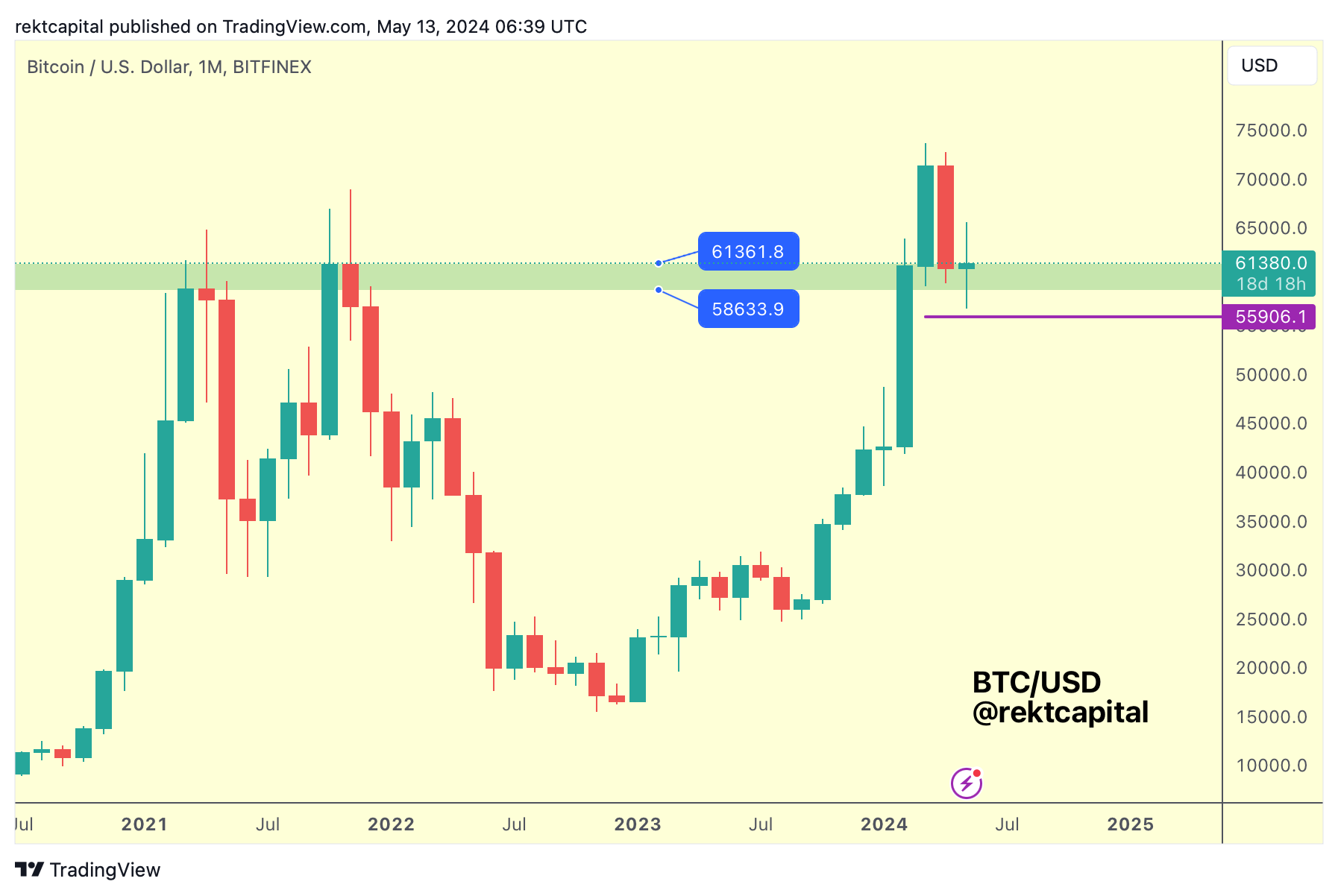

Retest of Old All Time High Resistance

Late last month, we covered the downside wicking scenario on the Monthly timeframe as well:

Here is today's update to this chart:

Essentially, Bitcoin has successfully retested a major area of old resistance into new support, and downside wicked very close to that anticipated $56000 region (purple).

The retest was successful, despite the fact that the rebound that occurred last week has been cancelled out to an extent.

Price-strength confirmation continues to persist at these levels and the support is still holding.