Stock To Flow Deviation #6

When could Bitcoin peak in this cycle?

Welcome to the Rekt Capital newsletter, a resource for people who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

I write research articles just like this one every Monday for subscribers of the Rekt Capital newsletter.

Today’s edition is an up-to-date analysis of Bitcoin’s price action in the context of the Stock To Flow model and is free to everybody to read.

In case you missed the analysis on Bitcoin’s upside deviations beyond the Stock to Flow line, check out Part 1 here, Part 2 here, and Part 3 here.

And if you’d like to receive cutting-edge research like this straight to your inbox during this Crypto Bull Market - feel free to subscribe for $10 a month:

Stock To Flow Deviation #6

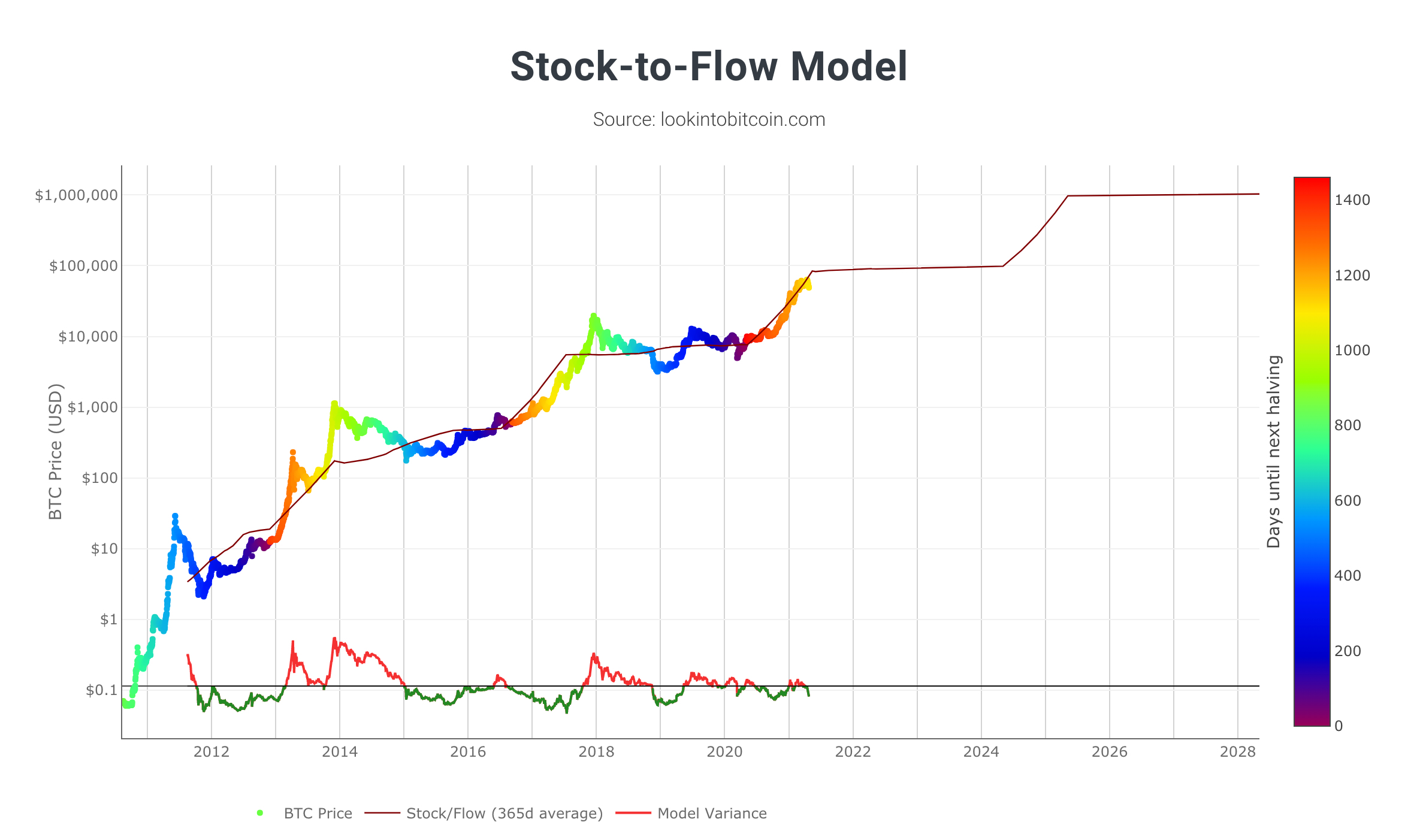

The Stock to Flow model created by Plan B quantifies the scarcity of Bitcoin and has been a reliable long-standing predictor of Bitcoin’s price trajectory.

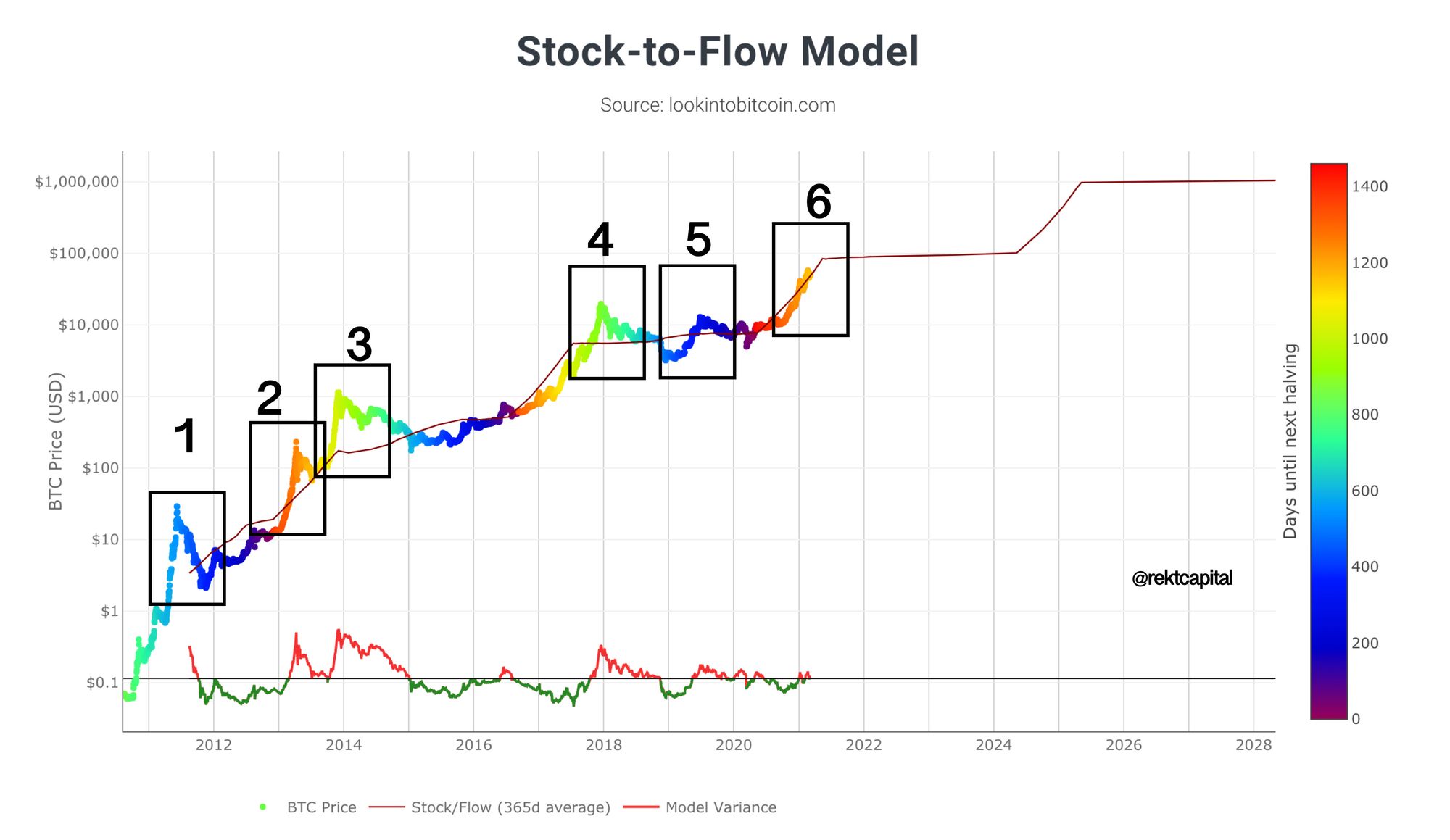

And historically, upside deviations in Bitcoin’s price beyond the Stock to Flow line precede Bull Market Tops, as discussed in my Stock to Flow series.

But what needs to be emphasised is that once the actual price deviation beyond the S2F line occurs, there is a certain amount of time where Bitcoin will be rallying towards the upside to reach a peak in the Bull Market.

In other words, the moment the upside price deviation beyond the S2F line begins - that’s the moment when the countdown on the Bitcoin Bull Market starts.

In Part 1 and Part 2 of the Stock to Flow series, we looked at historical price deviations in an effort to better understand how much might price upside deviate beyond the S2F line going forward.

But there has been no upside deviation as of yet - which is why the more important question at this time isn’t how much could price deviate…

It’s when might this deviation occur.

When Will The Deviation Occur? May 2021?

In Part 3 of the Stock to Flow series, I spoke about how Bitcoin was still perfectly following the ascending Stock to Flow line.

But for an actual price deviation to occur beyond the Stock to Flow line - the S2F line has to slow down and give Bitcoin’s price a fighting chance of exacting that deviation.

After all - if both Bitcoin’s price and the Stock to Flow line keep climbing in tandem, there’s little chance for Bitcoin to deviate from the S2F line.

So when could BTC deviate beyond the S2F line, at the earliest?

According to the S2F line, the S2F line would level out in mid-May 2021.

After all - Bitcoin’s best chance of deviating beyond the Stock to Flow line would be when the Stock to Flow line isn’t ascending. A constant, stagnating, levelled out Stock to Flow line would give BTC that opportunity.

At it seems like mid-May 2021 is when that BTC would get that chance.

But it needs to be emphasised - this isn’t when BTC would peak, at the earliest.

Remember, the beginning of an upside deviation and the actual peak of an upside deviation are two completely different phenomena, as mentioned earlier.

This will be Bitcoin’s sixth upside deviation.

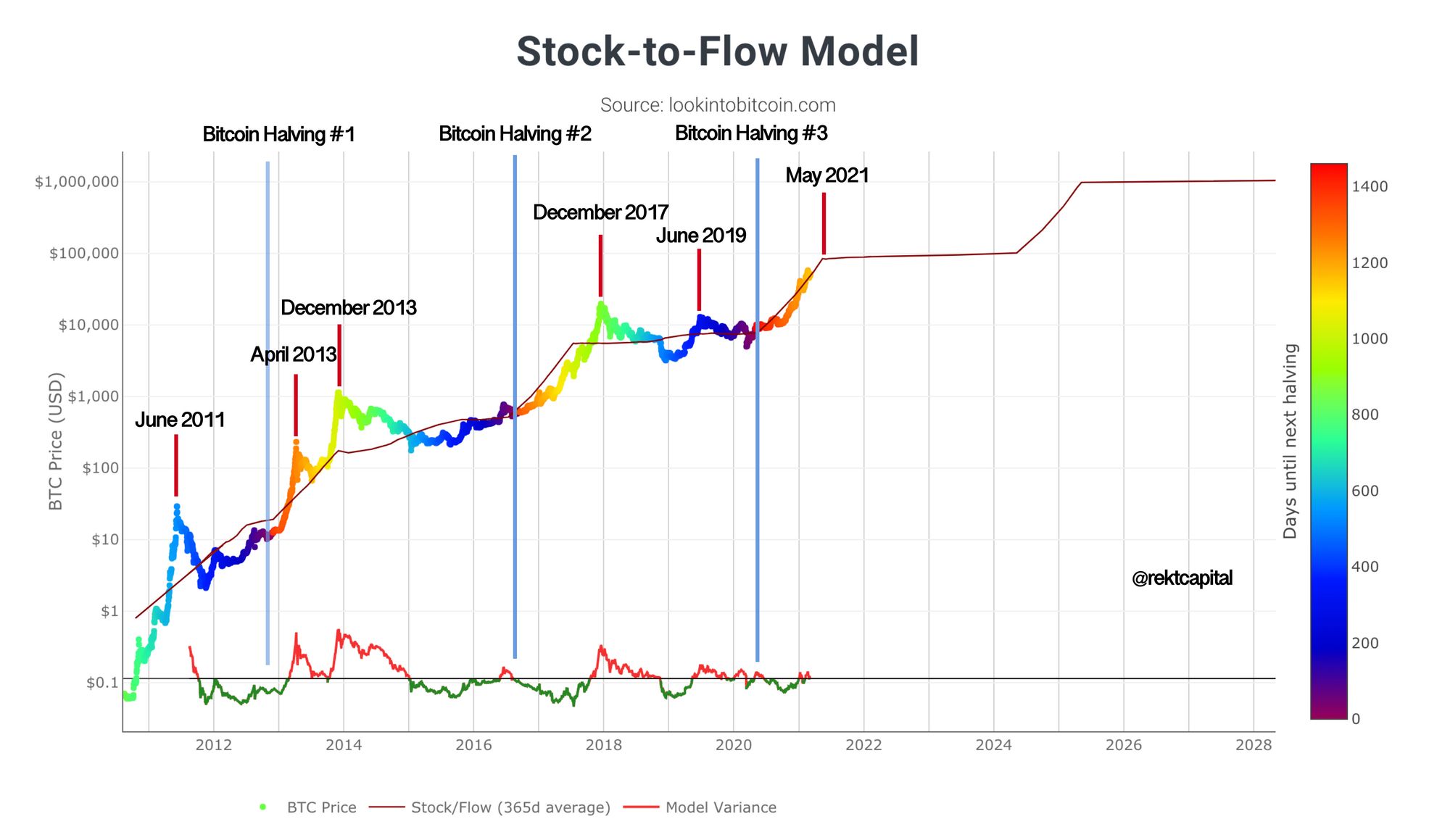

And in the past, Bitcoin has exacted an upside deviation that peaked in Quarter 2 three times out of a possible six:

- June 2011

- April 2013

- June 2019

That said, it’s important to stress that the June 2019 deviation was insignificant, as discussed in Part 2 of the series.

Therefore in actuality, Bitcoin exacted two upside deviations that peaked in Quarter 2 out of a possible five (with June 2019 being an insignificant deviation).

Whereas the other two upside deviations peaked in Quarter 4, specifically in Decembers:

- December 2013

- December 2017

So out of all valid upside deviations - Bitcoin has peaked in Quarter 2 twice and at the end of Quarter 4 twice.

Judging by standards of history, there’s a 50:50 chance of Bitcoin peaking in Quarter 2 vs peaking in Quarter 4.

So let’s then talk about when a Bitcoin peak is more likely to take place in this Bull Market:

Peak Soon vs Peak Later…Which Will It Be?

Back in late March when I published Part 3 of the Stock to Flow series, I highlighted Bitcoin’s current price predicament in the context of the Stock to Flow line.

Back then in late March, Bitcoin was perfectly following the Stock to Flow line. That is, both Bitcoin’s price and the S2F line were ascending.

Here’s an excerpt from Part 3 about this:

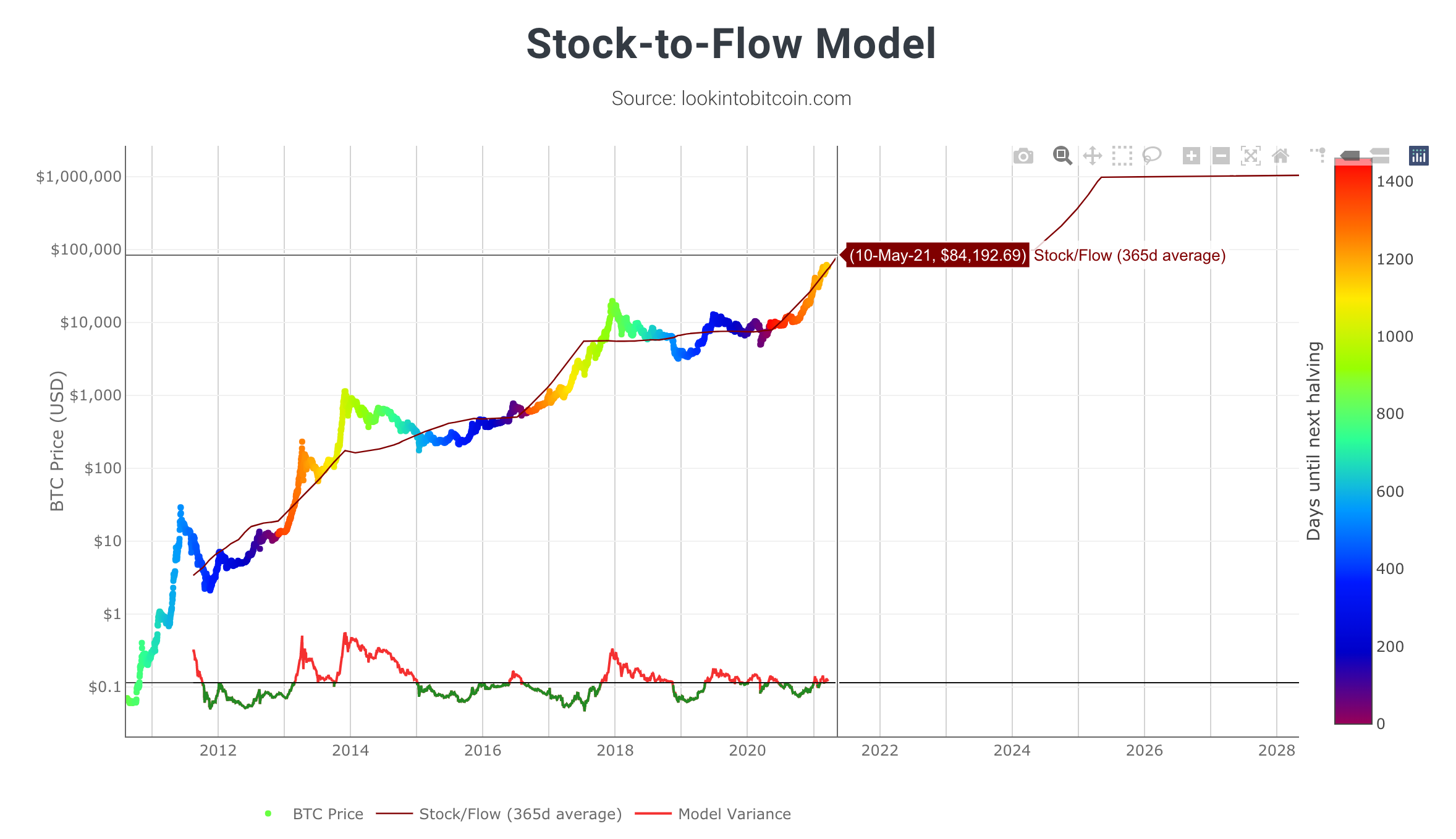

“Therefore if Bitcoin’s price action continues to perfectly follow the Stock to Flow line as it has been for the past several months, that will mean that Bitcoin will begin to upside deviate beyond the Stock to Flow line at around the time that the S2F line flattens.

So if Bitcoin’s bullish momentum doesn’t slow until May, then Bitcoin will likely begin its upside deviation in ~mid-May, effectively eclipsing the ~$84,000 price level.”

But here’s something else that I emphasised which is really important in the context of Bitcoin’s bullish momentum coupled together with the ascending Stock to Flow line:

“However, if Bitcoin’s current bullish momentum does slow down (for example, Bitcoin would retrace or form an extended consolidation period), this could result in Bitcoin decoupling from the currently ascending Stock to Flow line, in which case Bitcoin’s price would find itself temporarily below the Stock to Flow line.”

So let’s now look at the most up-to-date BTC price chart superimposed on the Stock to Flow model:

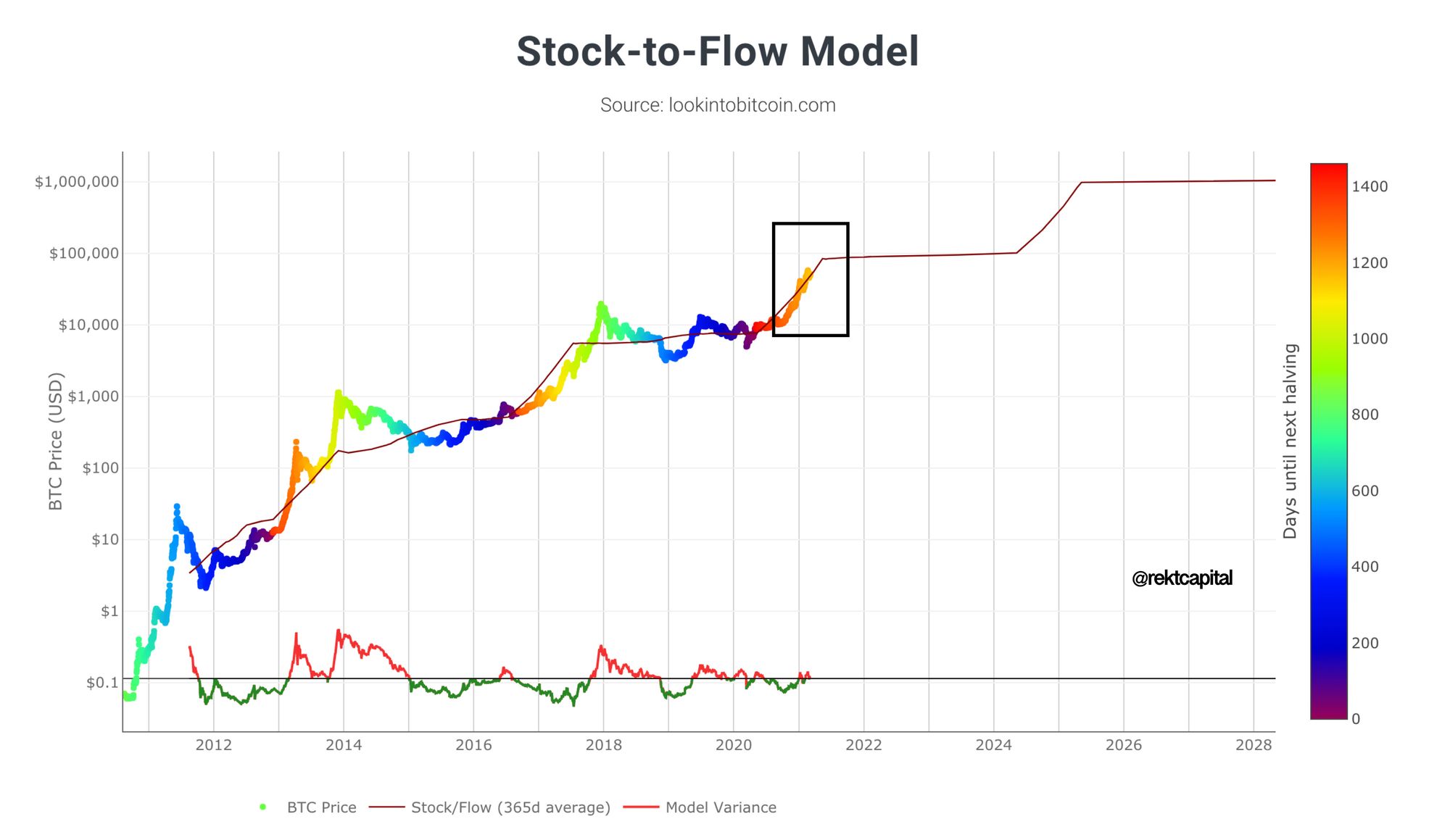

As you can see, BTC’s price seems to be forming a downward-facing arch, finding itself below the Stock to Flow line at this time.

And while BTC was perfectly following the Stock to Flow line for months…

Now it looks like Bitcoin is dipping below it.

Bitcoin’s bullish momentum has clearly slowed down.

And while the Stock to Flow line will likely flatten in mid-May…

In its current predicament, Bitcoin doesn’t look set to perform an upside deviation beyond the S2F line at that time.

Should BTC have been able to sustain its bullish momentum, mid-May would’ve been the earliest time BTC would have been able to deviate beyond the S2F line.

But we now know that BTC is most likely not ready to perform that deviation beyond the S2F line.

Mid-May Upside Deviation Is Cancelled

The fact that BTC has slowed down in its bullish momentum means that the earliest window for BTC to perform an upside deviation beyond a flattening out Stock to Flow line has most likely closed.

But that doesn’t mean that Bitcoin’s chances of regaining strength in its overall macro Bull Trend are over.

Think about it this way:

An upside deviation in Bitcoin’s price beyond the Stock to Flow line would kickstart the countdown for the Bitcoin Bull Market.

But if Bitcoin was able to slowdown its bullish momentum via consolidation or a correction (time has showed us that it was via a correction)…

That essentially prolongs the Bitcoin Bull Market.

In the context of the Stock to Flow line, Bitcoin slowing down in its bullish momentum just means that Bitcoin will need to take a breather, regain its strength by healthily pulling back to lower price levels to gather some interested buyers, before challenging for an upside deviation once again.

And once Bitcoin is able to bottom on this current correction, its new uptrend will most likely come at a time when the Stock to Flow line will be completely flat.

In which case the next Bitcoin recovery in the macro uptrend will most likely be the one to break beyond the flat Stock to Flow line and begin its upside deviation - and kickstart the countdown on the overall Bitcoin Bull Market.

Is The Bitcoin Bull Market Already Over?

It almost goes without saying but it’s probably best to say it anyway:

In the context of the Stock to Flow model - the Bitcoin Bull Market is not over.

In the context of the Stock to Flow model - the Bitcoin Bull Market ends once there is a substantial upside deviation in price beyond the S2F line.

And that upside deviation hasn’t happened yet.

In fact, only recently has BTC begun to pull back away from the Stock to Flow line after perfectly following it for several months.

But what we need to reiterate is that Bitcoin’s goal in the context of the Stock to Flow line isn’t to trend-follow the Stock to Flow line and simply mirror its movement, aligning perfectly with it at all times…

Bitcoin’s goal in the context of the Stock to Flow line is to deviate beyond or below it, this way marking out Bull Market tops or Bear Market bottoms.

So while Bitcoin’s bullish momentum has likely temporarily slowed down and therefore extended the time we have to wait for a BTC price deviation beyond the Stock to Flow line to mark the Bull Market peak… that doesn’t mean that we’ve seen that Bull Market peak already.

In fact, according to Stock to Flow principles - we have yet to see it happen.

Thank you for reading.

Thank you for reading this free edition of the Rekt Capital newsletter.

Hopefully this special edition gave you a powerful idea as to the level of quality, detail, and dedication that you can expect as a valued subscriber of the Rekt Capital newsletter.

I write research articles like this every Monday for subscribers of the newsletter.

So if you’d like to receive cutting-edge research like this straight to your inbox, feel free to subscribe for $10 a month: