Rekt Capital's Altcoin Watchlist

Features analysis on 6 Altcoins: WOO COTI MATIC BAND UNI VET

Welcome back to the Rekt Capital Newsletter!

Announcement - New Year's Period Content Schedule

I hope you've had a wonderful Christmas Holiday season. With the New Year's holiday period just around the corner, I’d like to briefly talk about how this will affect content on the Rekt Capital newsletter.

Here is the New Year's Holiday schedule:

- Wednesday 27th of December = Altcoin Watchlist As Usual

- Thursday 28th of December = Hall of Fame Tech Stock Thursday As Usual

- Friday 29th of December = No Coverage (New Year’s Period)

- Monday 1st of January, 2024 = No Coverage (New Year’s Eve/Day)

- Tuesday 2nd of January, 2024 = No Hall of Fame "Deep Dives" (New Year’s Period)

- Wednesday 3rd of January, 2024 = Everything goes back to normal

Therefore please be advised that there will be no newsletter and/or Hall of Fame coverage on the 29.12, 1.01, and 2.01.

Wishing you a restful, peaceful Holiday season

~ Rekt Capital

Let's dive into today's Altcoin Watchlist.

In today’s edition of the Rekt Capital Newsletter, the following cryptocurrencies will be analysed & discussed:

- Woo Network (WOO)

- Polygon (MATIC)

- Coti (COTI)

- Band Protocol (BAND)

- UniSwap (UNI)

- VeChain (VET)

Let’s dive in.

Woo Network - WOO/USDT

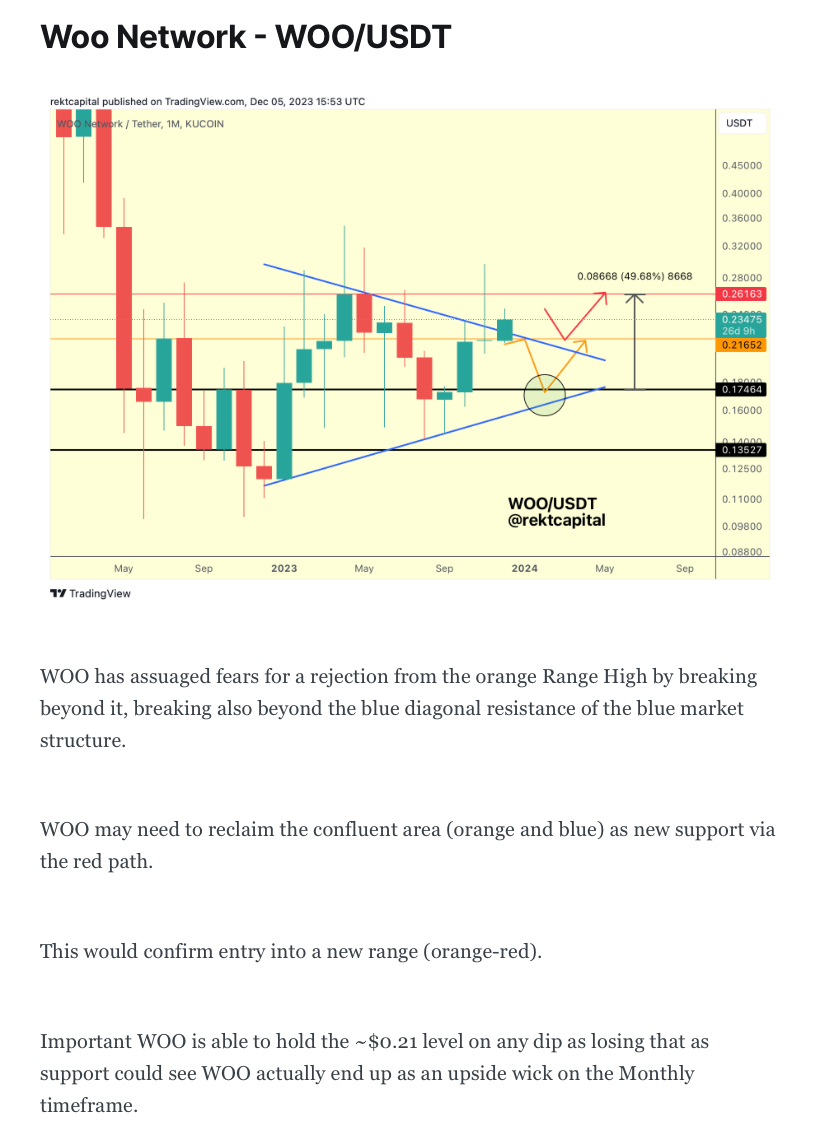

Earlier this December in the Altcoin Watchlist, we discussed a crucial retest for WOO:

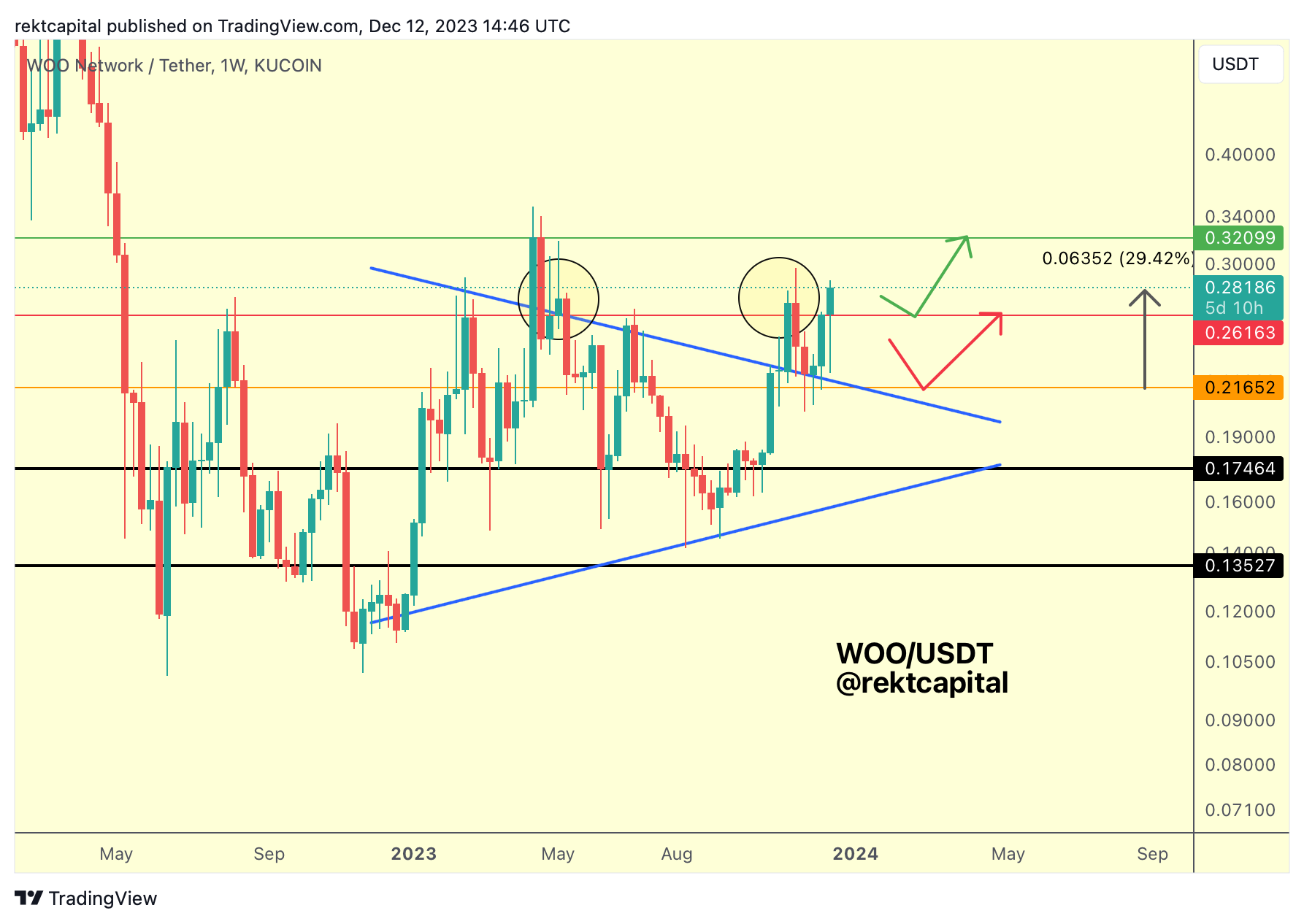

The following week, we spoke about how it was successful to enable a +29% rally but also how another retest was on the horizon (green path):

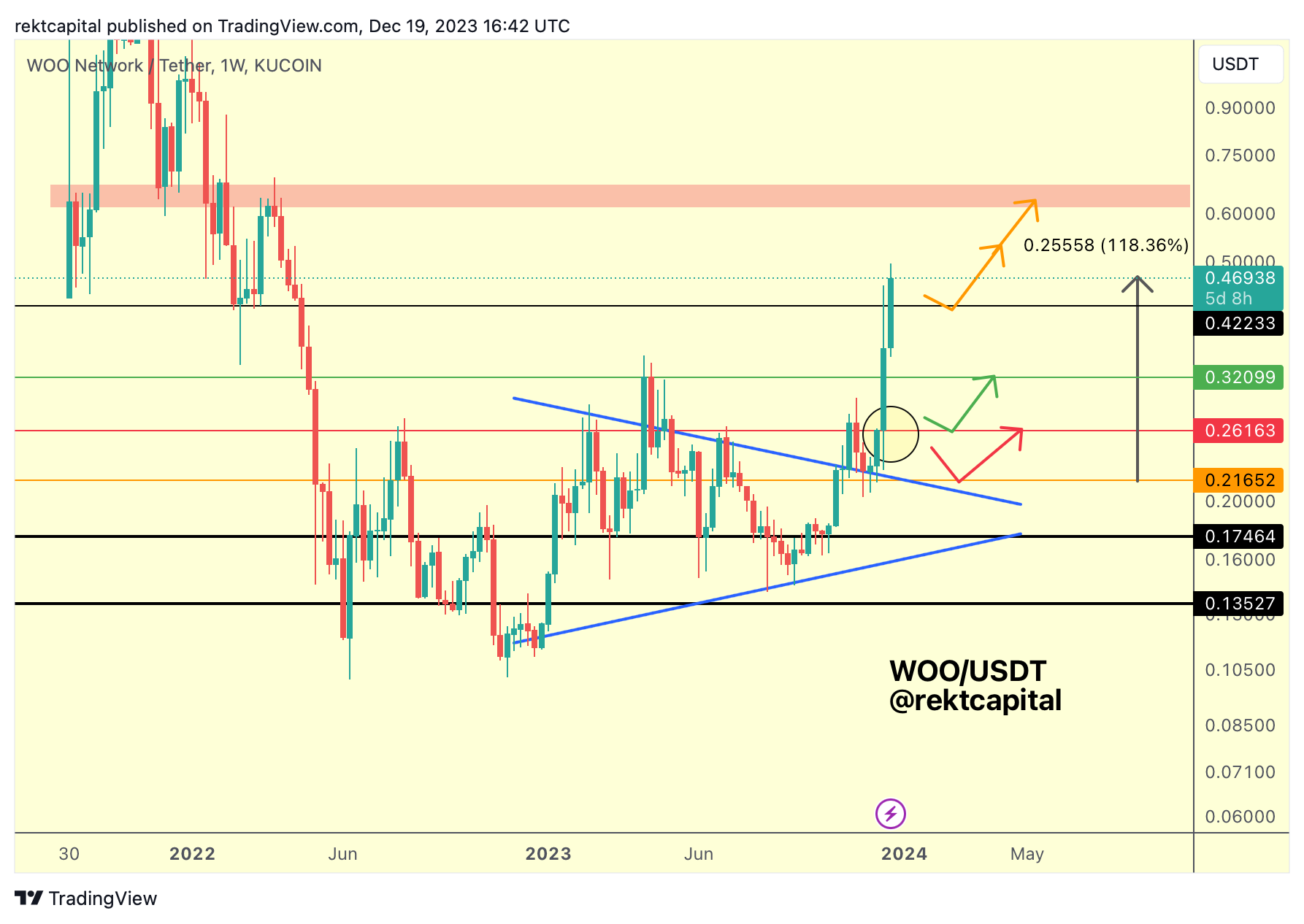

And before Christmas we talked about WOO's phenomenal +118% breakout from its macro pattern and how it was positioning itself for a potential retest:

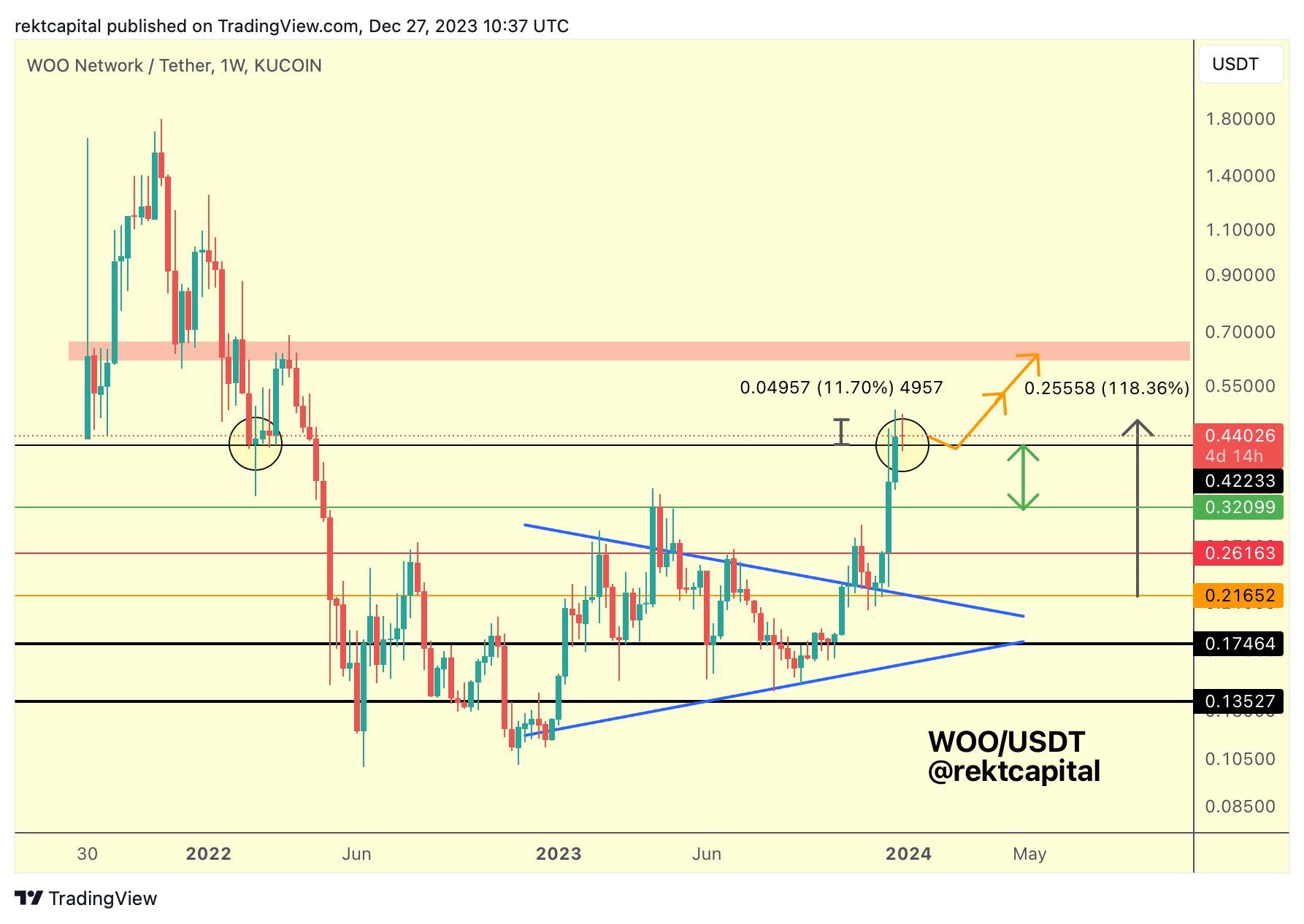

And here's today's update:

WOO performed a Weekly Candle Close above the black $0.42 level of resistance, which is already a notable technical step to take towards positioning price for further continuation.

In performing this Weekly Close, WOO has positioned itself for a retest of the black level and in fact this retest is now underway.

WOO is retesting this level as new support as we speak, offering a +11% rebound from black earlier this week.

If history is any indication (yellow circle from 2022), WOO could perform a volatile retest at these levels.

After all, in 2022 WOO experienced a long downside wick during its retest back then before rebounding strongly to the upside.

Of course, that was then and this is now - right now, WOO has enjoyed an over +100% rally to the upside, with very little pullbacks in between.

WOO may very well be setting itself up for a retest but it's very important to also have measures put in place to protect the gains that we have achieved over the past few weeks that we have been following WOO together.

Because losing the black $0.42 as support would see WOO drop into the green-arrowed range that price had almost completely skipped past on its way up but nonetheless serves as a Volume Gap that never really saw much price action get entertained here.

Losing black as support could reasonably open WOO up to a period of re-accumulation inside the green-arrowed range.

However, WOO is still holding the black $0.42 as support, the retest is in progress, and as long as price stability here is showcased (and it is thus far) then WOO's positioning is titling more so to the upside than downside from here.

Polygon - MATIC/USDT

A few weeks ago, we spoke about how MATIC needed to retest the top of its macro pattern as new support to rally higher:

And here's this week's analysis:

MATIC has rallied +44% to the upside following its successful retesting of the top of its macro market structure.

MATIC has confirmed a breakout from its main pattern and has only just entered into a new macro uptrend.

If MATIC is able to Monthly Close above the blue resistance of $1.07 then MATIC would be able to rally even higher without much interruption, especially since price has just broken out from its post-breakout re-accumulation period:

That Re-Accumulation period was an Ascending Triangle and it would be healthy if price were to dip via the orange path into the top of this pattern to confirm the recent breakout.

That's something that could reasonably occur in the short-term, however long-term MATIC has broken it Macro Downtrend and confirmed a new Macro Uptrend that should see price rally to new highs over time.