Rekt Capital's Altcoin Watchlist

Features analysis on 6 Altcoins: WOO COTI MATIC BAND UNI VET

Welcome back to the Rekt Capital Newsletter!

Announcement - Christmas Content Schedule

With the Christmas Holidays just around the corner, I’d like to briefly talk about how this will affect content on the Rekt Capital newsletter.

Here is the Christmas Holiday schedule:

- Wednesday 20th of December = As Usual

- Friday 22nd of December = No Coverage (Christmas Holidays)

- Monday 25th December = No Coverage (Christmas Day)

- Tuesday 26th December = No Hall of Fame "Deep Dives" (Christmas Bank Holiday/Boxing Day)

- Wednesday 27th of December = As Usual

- Thursday 28th of December = Hall of Fame Tech Stock Thursday As Usual

- Friday 29th of December = No Coverage (New Year’s Period)

- Monday 1st of January, 2024 = No Coverage (New Year’s Eve/Day)

- Tuesday 2nd of January, 2024 = No Hall of Fame "Deep Dives" (New Year’s Period)

- Wednesday 3rd of January, 2024 = Everything goes back to normal

Therefore please be advised that there will be no newsletter and/or Hall of Fame coverage on the 22.12, 25.12, 26.12, 29.12, 1.01, and 2.01.

Wishing you a restful, peaceful Christmas Holiday season

~ Rekt Capital

Let's dive into today's Altcoin Watchlist.

In today’s edition of the Rekt Capital Newsletter, the following cryptocurrencies will be analysed & discussed:

- Woo Network (WOO)

- Coti (COTI)

- Polygon (MATIC)

- Band Protocol (BAND)

- UniSwap (UNI)

- VeChain (VET)

Let’s dive in.

Woo Network - WOO/USDT

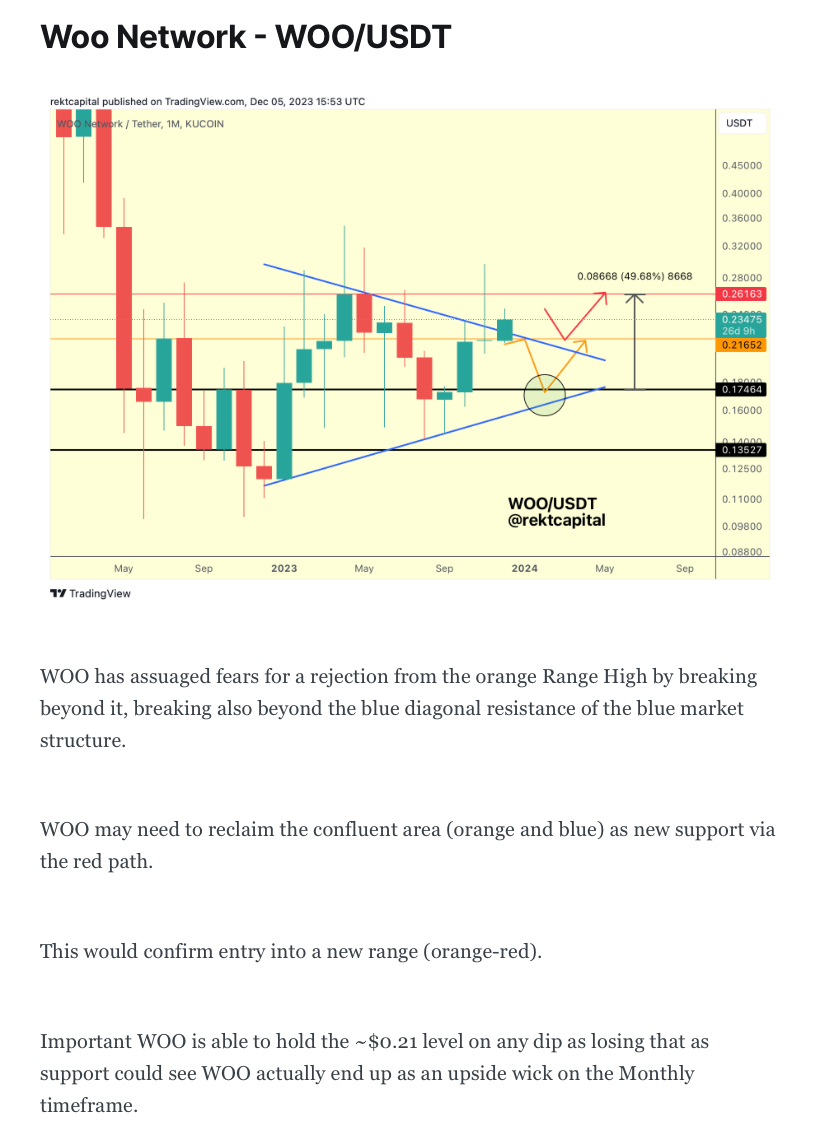

Two weeks in the Altcoin Watchlist, we discussed a crucial retest for WOO:

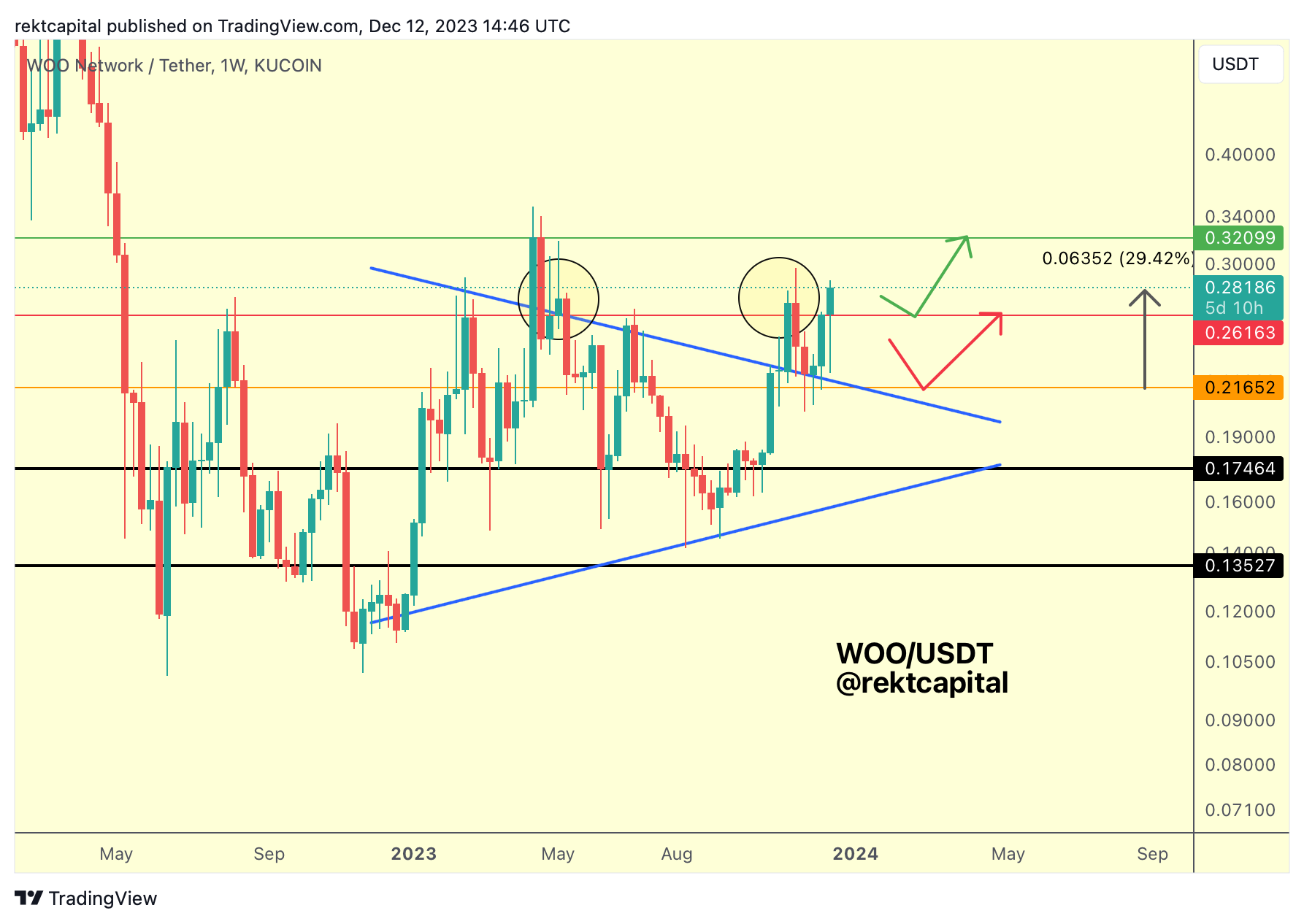

The following week, we spoke about how it was successful to enable a +29% rally but also how another retest was on the horizon (green path):

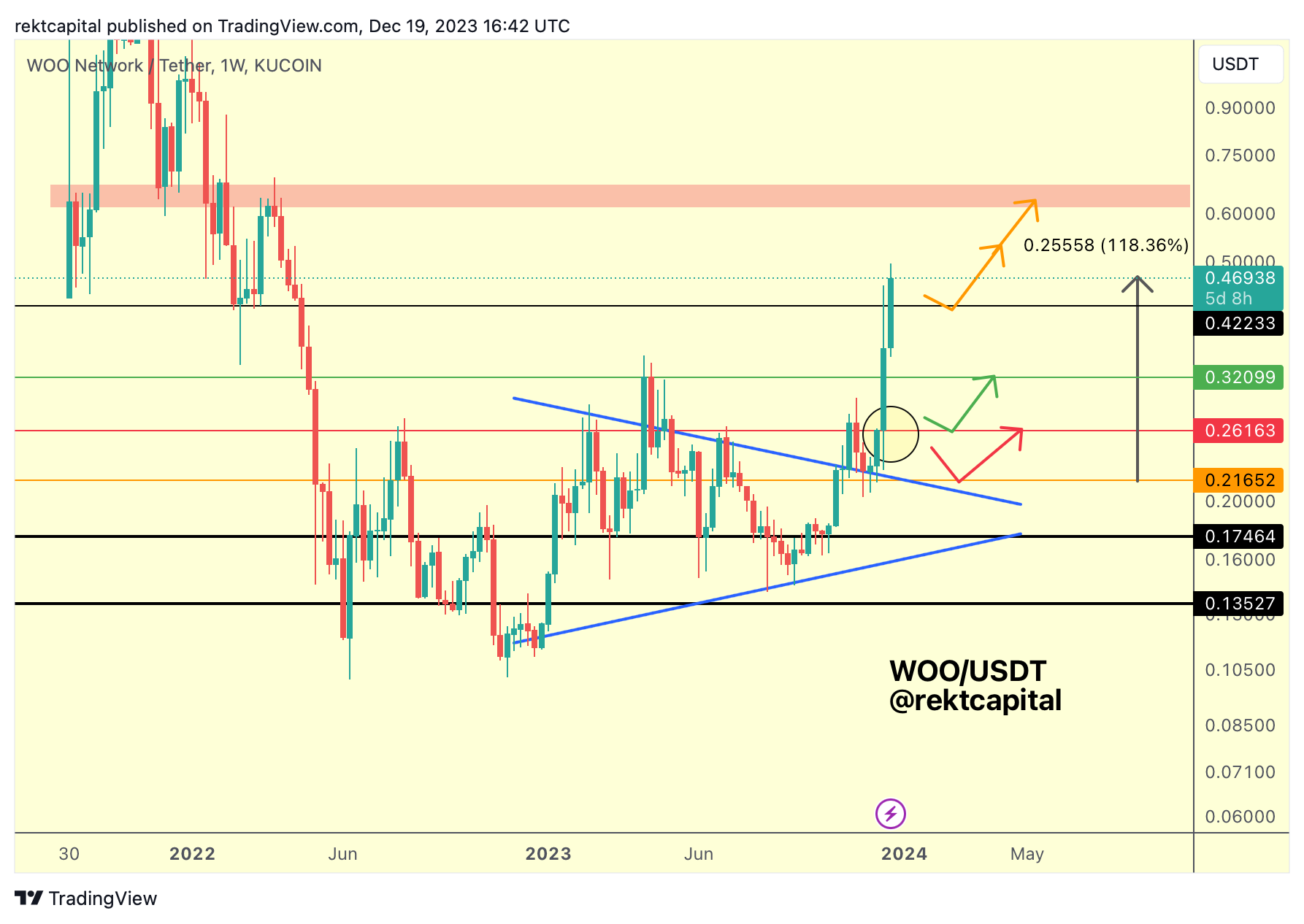

And here's today's update:

WOO not only followed the green path - it tore right through it.

Generally, WOO has rally +118% since breaking out from its macro triangle (blue).

So what's next for WOO?

WOO needs to hold the $0.42 black level as support if it wants to turn said level into a new Range Low.

Turning black into a new Range Low would likely enable a move via the orange path, as high as the red resistance above.

WOO has had four green weeks in a row so if somehow WOO upside wicks beyond this black $0.42 resistance but fails to reclaim it and even Weekly Closes below it again like last week, then perhaps a drop to the green $0.32 would be on the cards.

Let's see how WOO behaves relative to the $0.42 level this week.

Coti - COTI/USDT

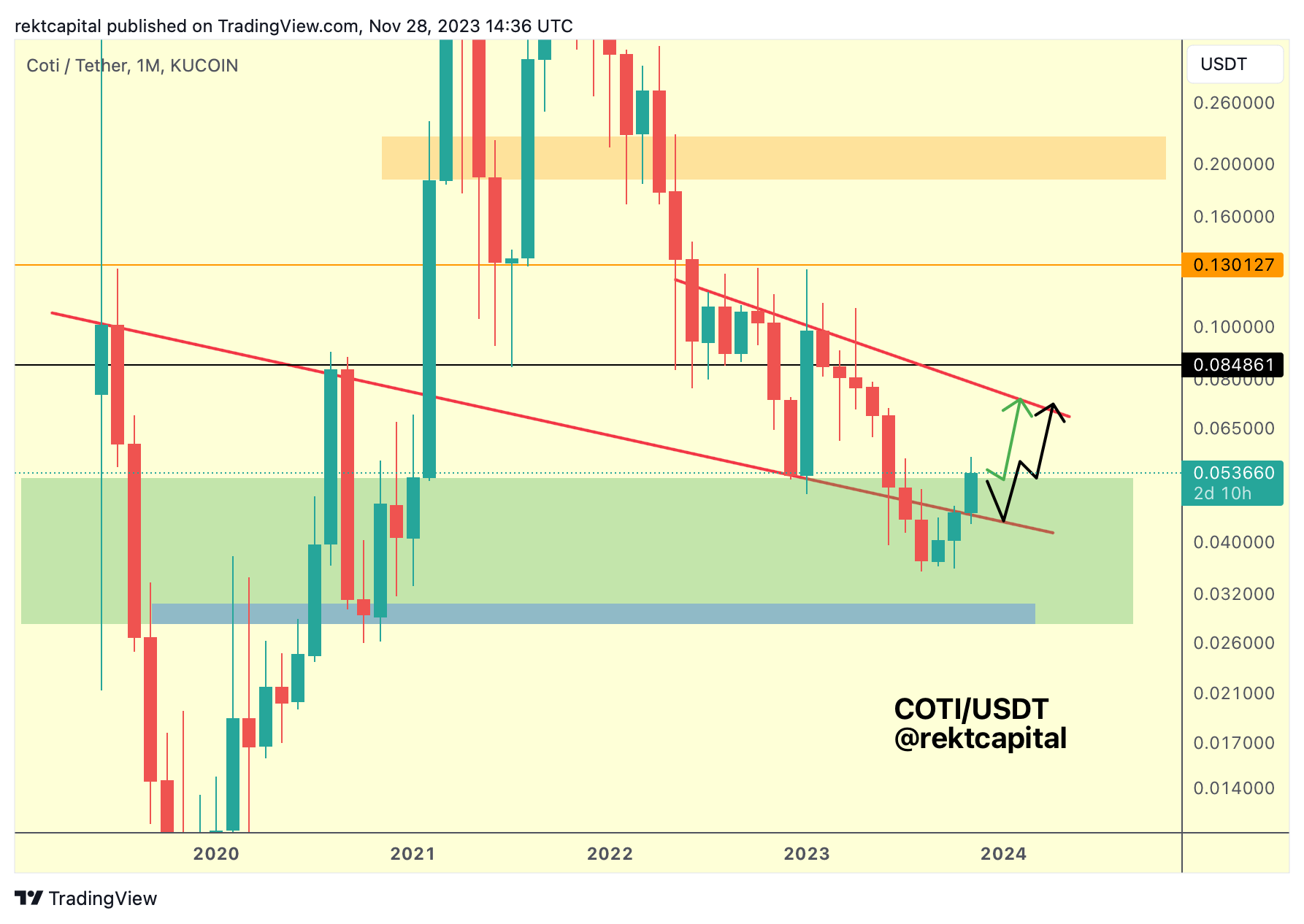

We've been covering COTI for a few weeks now, starting with the crucial Monthly Close in November:

Followed by the early December analysis talking about a successful retest of the top of the green historical demand area:

And finally today's update:

COTI has rallied +40% to revisit the red Channel Top.

Technically, COTI has followed-through on its entire intra-pattern move via the green path as anticipated.

At this stage, really important COTI doesn't print upside wicks beyond the Channel Top resistance like earlier this year of even late in 2022.

As that could signify strong resistance that could set COTI up for a pullback period within the red Channel, possibly to the lower parts of it.

Monthly Closing above the Channel Top followed by a retest of it would be bullish; even Weekly Closing followed by a retest of the Channel Top would be bullish.

COTI is at a crossroads when it comes to its next trend but with the luxury of being +40% up since late November.