Bitcoin - Principles of Price Discovery

Understanding the phases of Price Discovery

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

Bitcoin's Short-Term Ranges

Hello and welcome back to the Rekt Capital Newsletter after the holidays.

I hope you're had a fantastic holiday season in the company of family and friend and wish you a very Happy, Happy New Year.

It has been a Happy New Year for Bitcoin thus far as it has enjoyed consecutive green candles for all of 2025 thus far.

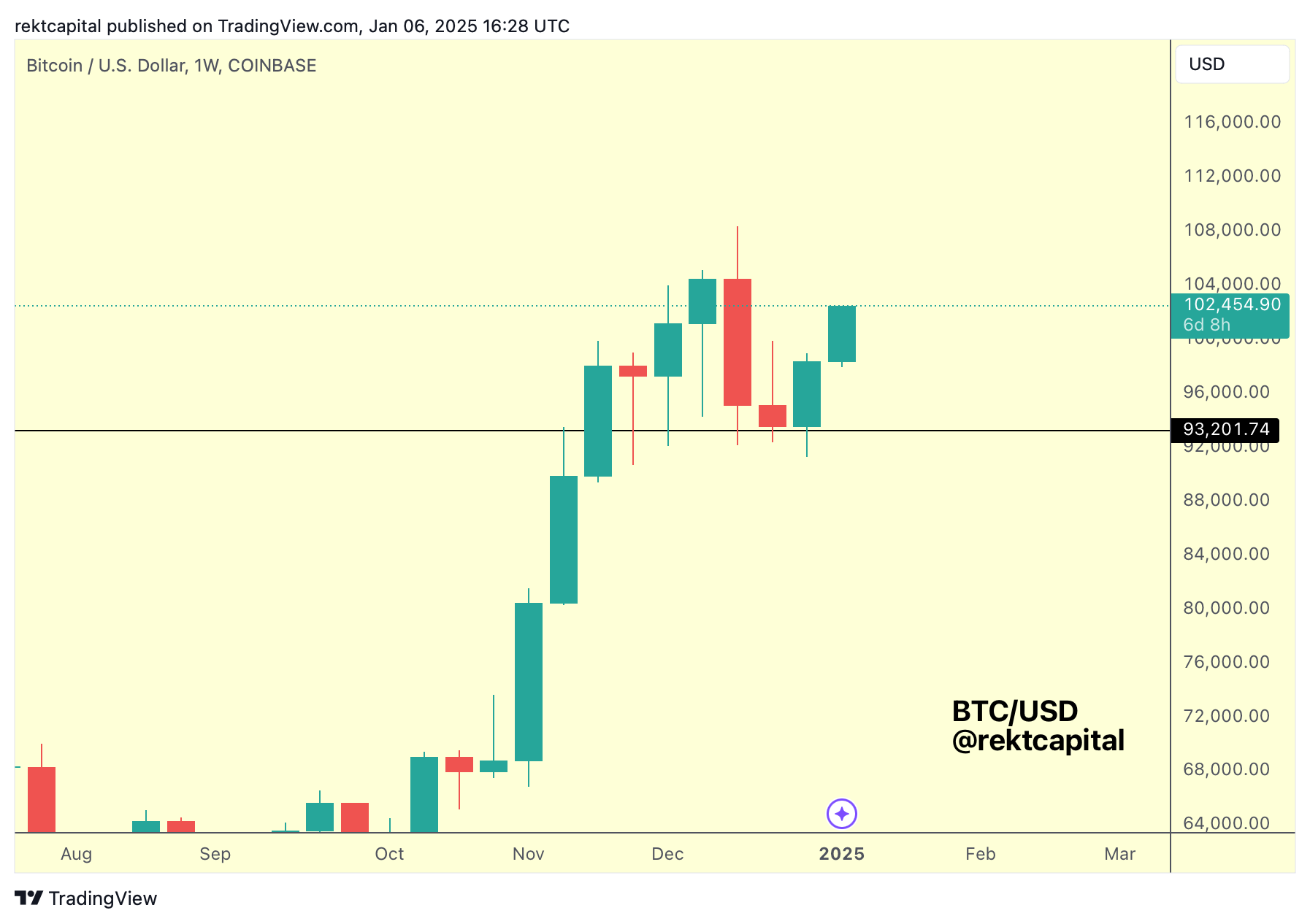

Throughout this January, BTC has traversed the entirety of its $91000-$101000 range, rallying from the blue Range Low to the black Range High and trying to break out from the range entirely.

A Daily Close above the $101k (black) resistance followed by a retest would likely confirm a breakout from this range.

Early December price action (green circle) shows that that technical confirmation has been the magic key when it comes to confirming upside into the mid-$100,000s.

Let's see if BTC can reproduce those results in the coming days.

In the meantime, let's talk about some crucial takeaways that we've learned over the past few weeks:

$93,200 is a Strong Support

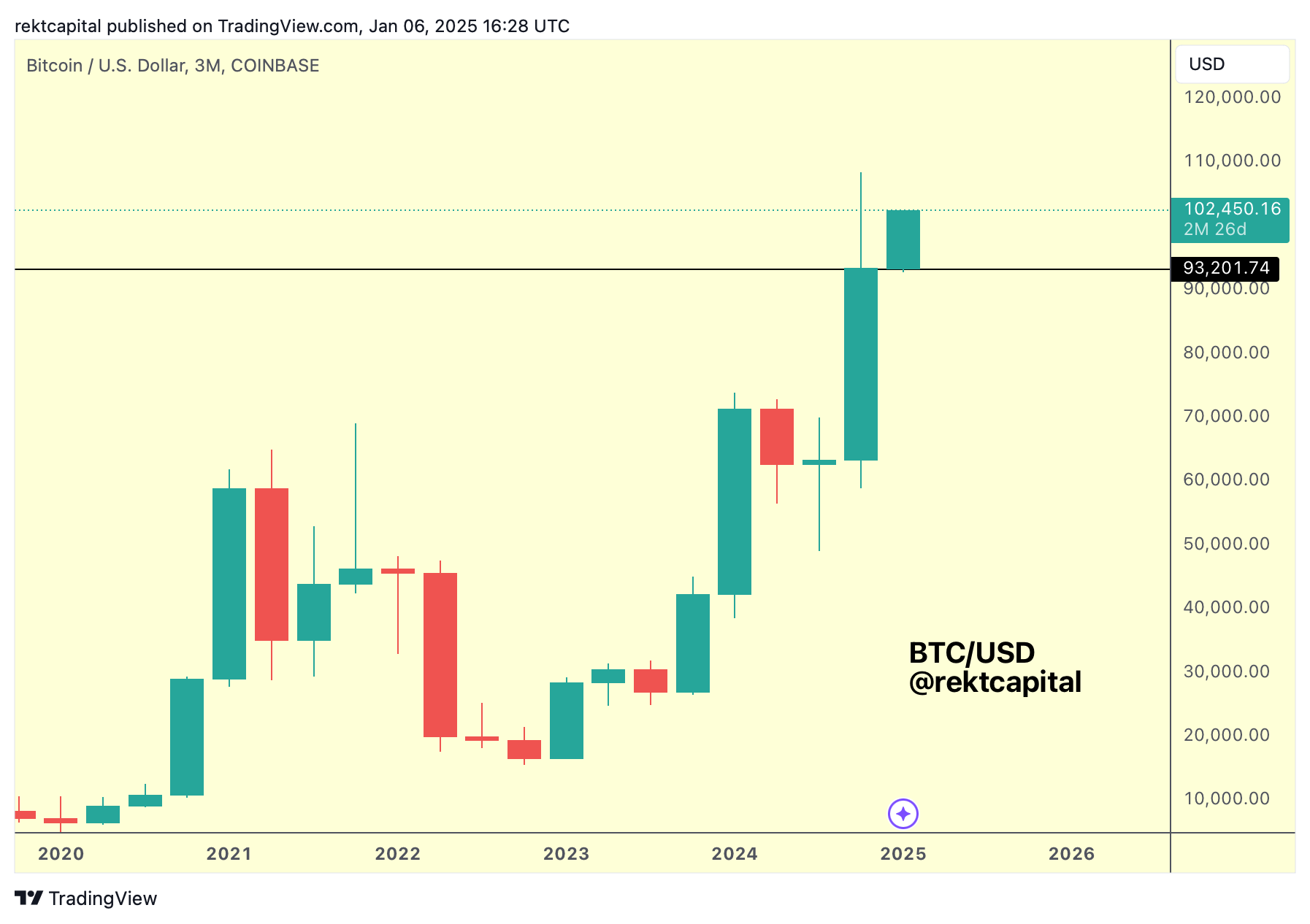

If we look at the Quarterly timeframe, it is clear that the $93200 (black) level is a crucial level:

The Q4, 2024 close just below said level means it ended the Quarter as a resistance but already this Q1, 2025 price is experiencing support there.

This level is an important level on the Quarterly but also on the Monthly as well:

It has acted as the base on this most recent -15% pullback, as the Weekly also shows:

All in all, the $93200 is a strong, cross-higher timeframe level with a lot of confluence in that area.

As a result, it will be a region that will be difficult to lose as a support, if at all the chance comes again.

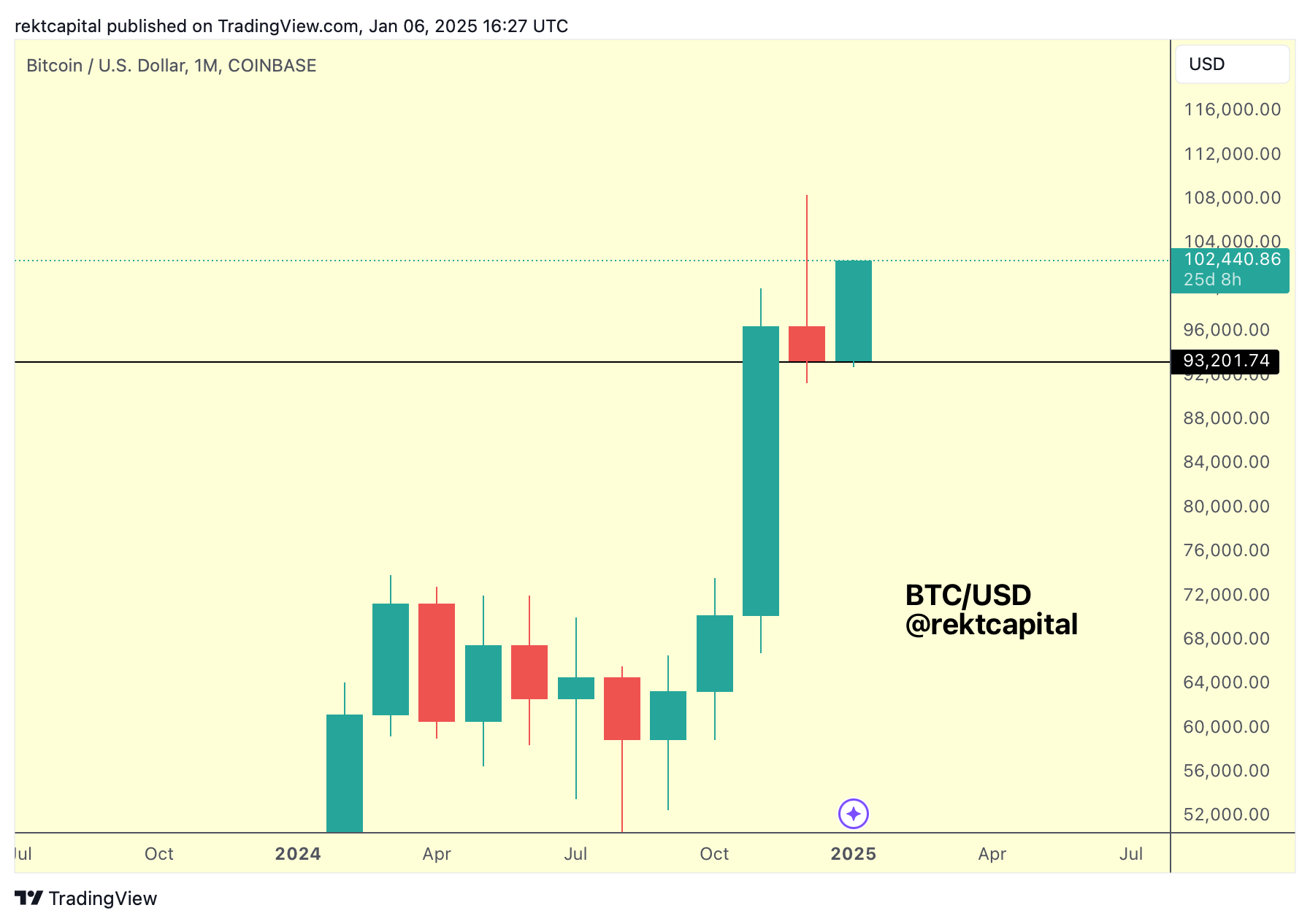

Monthly Bull Flag

The next key takeaway is that the $93200 level is actually the base of the Monthly Bull Flag that appears to be developing for BTC.

The top of the Bull Flag on the other hand is the $96450 level, which has seen upside wicks beyond over the past couple of months and would be a logical post-breakout retest area, should a dip arise this January.

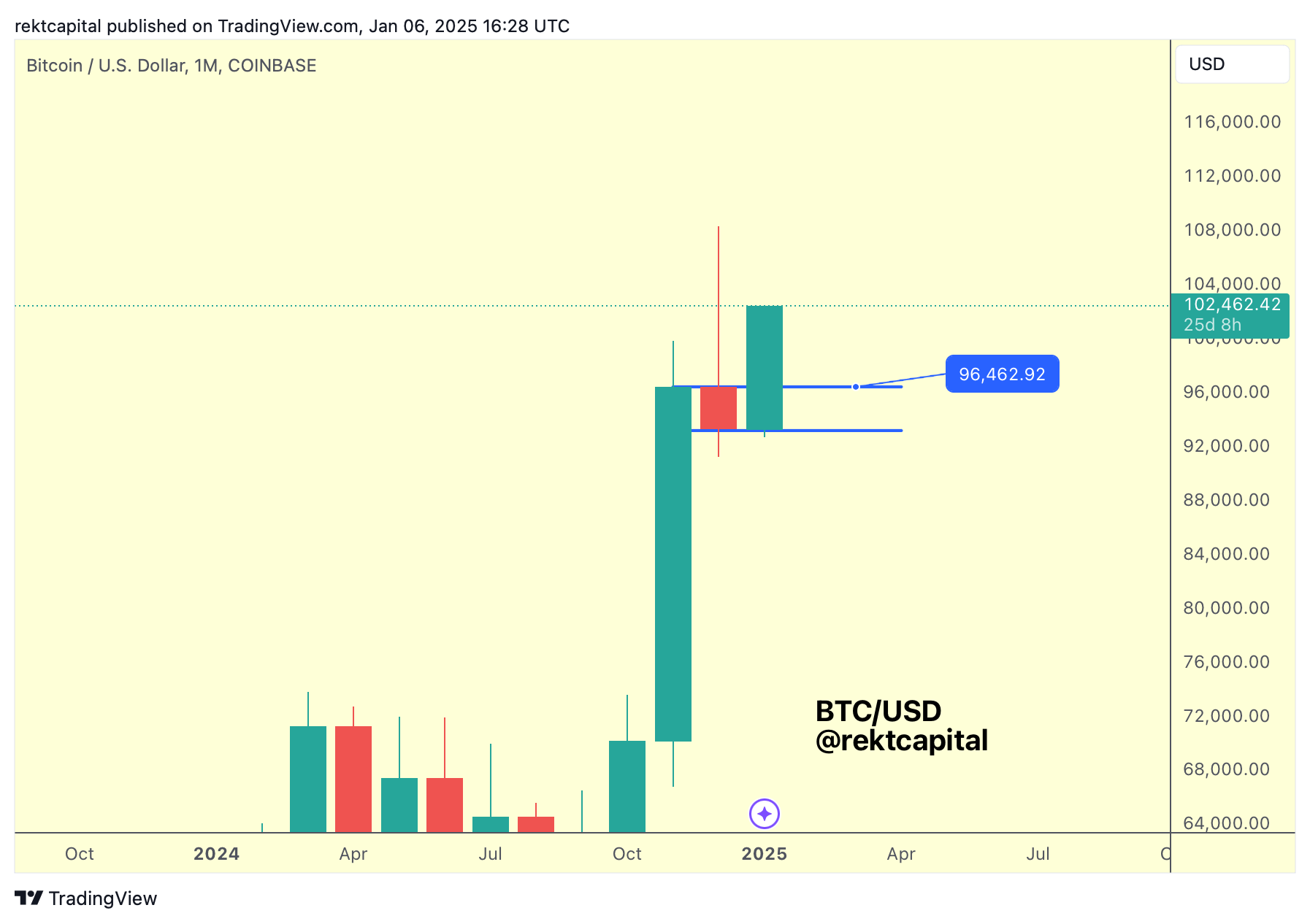

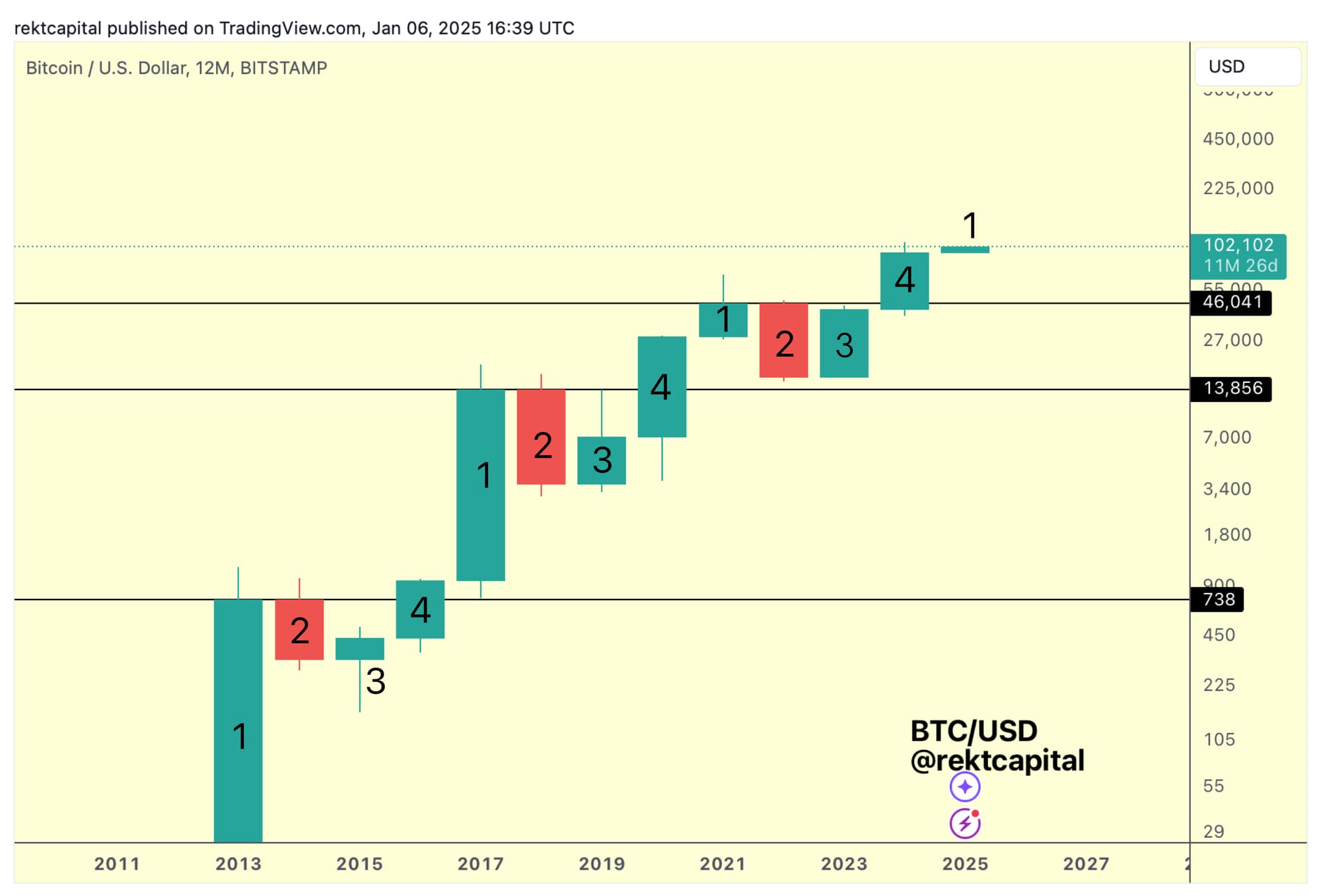

A New Four Year Cycle Has Begun

A new 4-Year Cycle has begun.

Candle 4 (i.e. a Halving year 12-month Candle) has come to an end and a new Candle 1 (i.e. Bull Market peak 12-month Candle) has begun.

As a result, it's important to keep in mind that while Parabolic Upside still lays ahead, this will be the final year in this current Bull Run before the 2026 Bear Market inevitably begins.

The most Parabolic phase in the cycle in Candle 1 comes around every 4 years.

It's time to make it count.