Bitcoin - Positioning For Price Discovery Uptrend 2?

Crucial retest is in progress

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

Bitcoin Setting Itself For Upside?

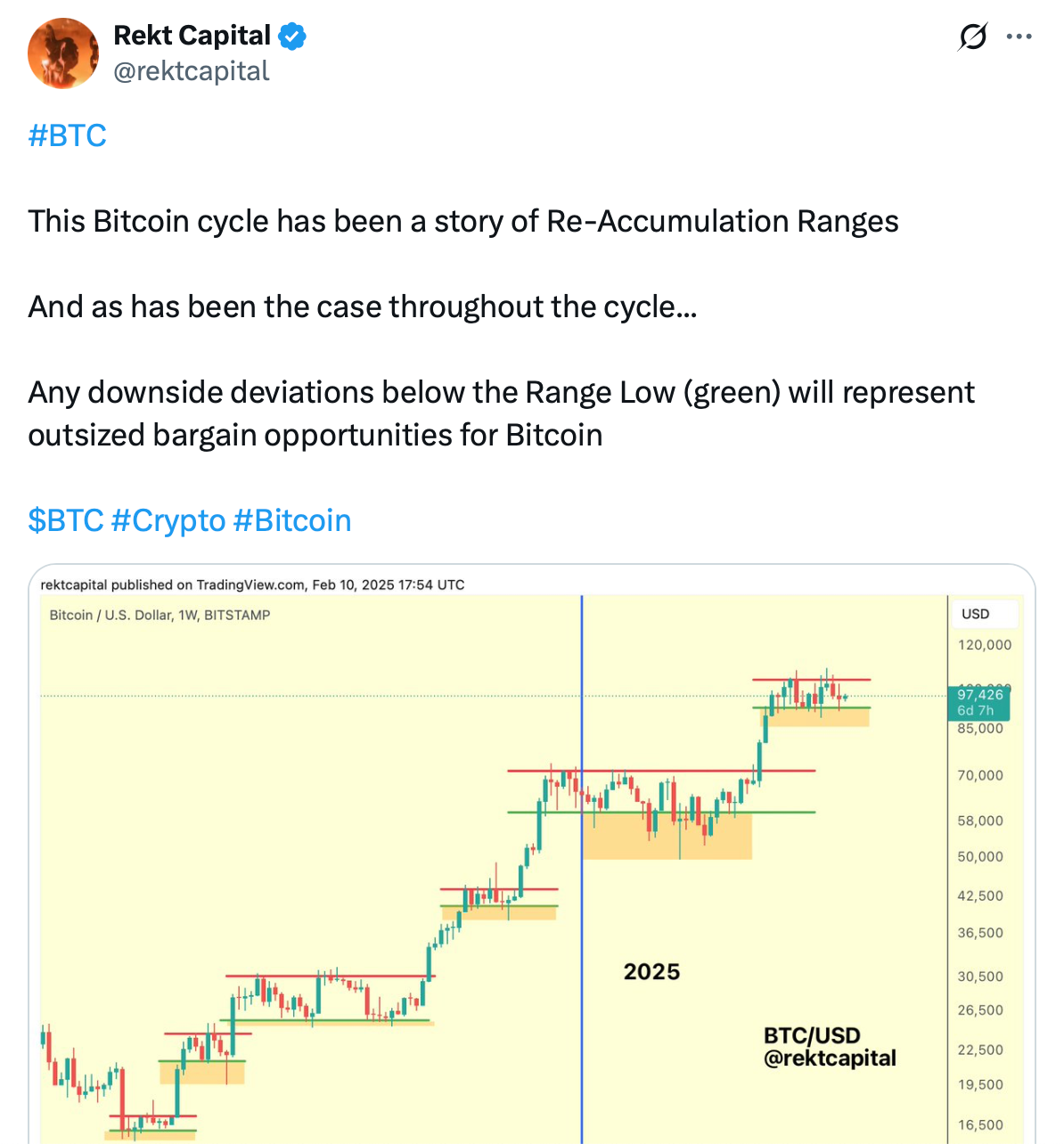

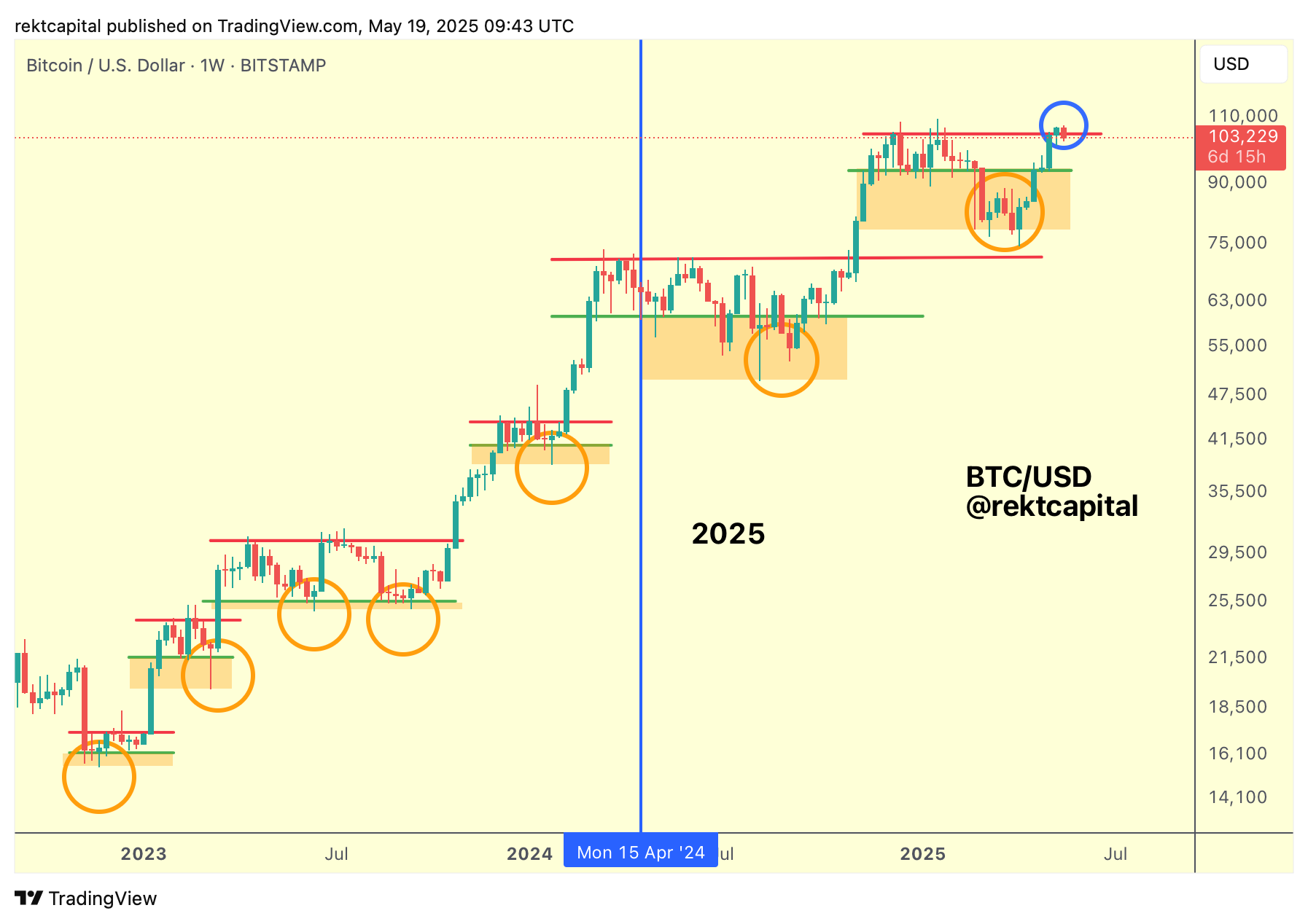

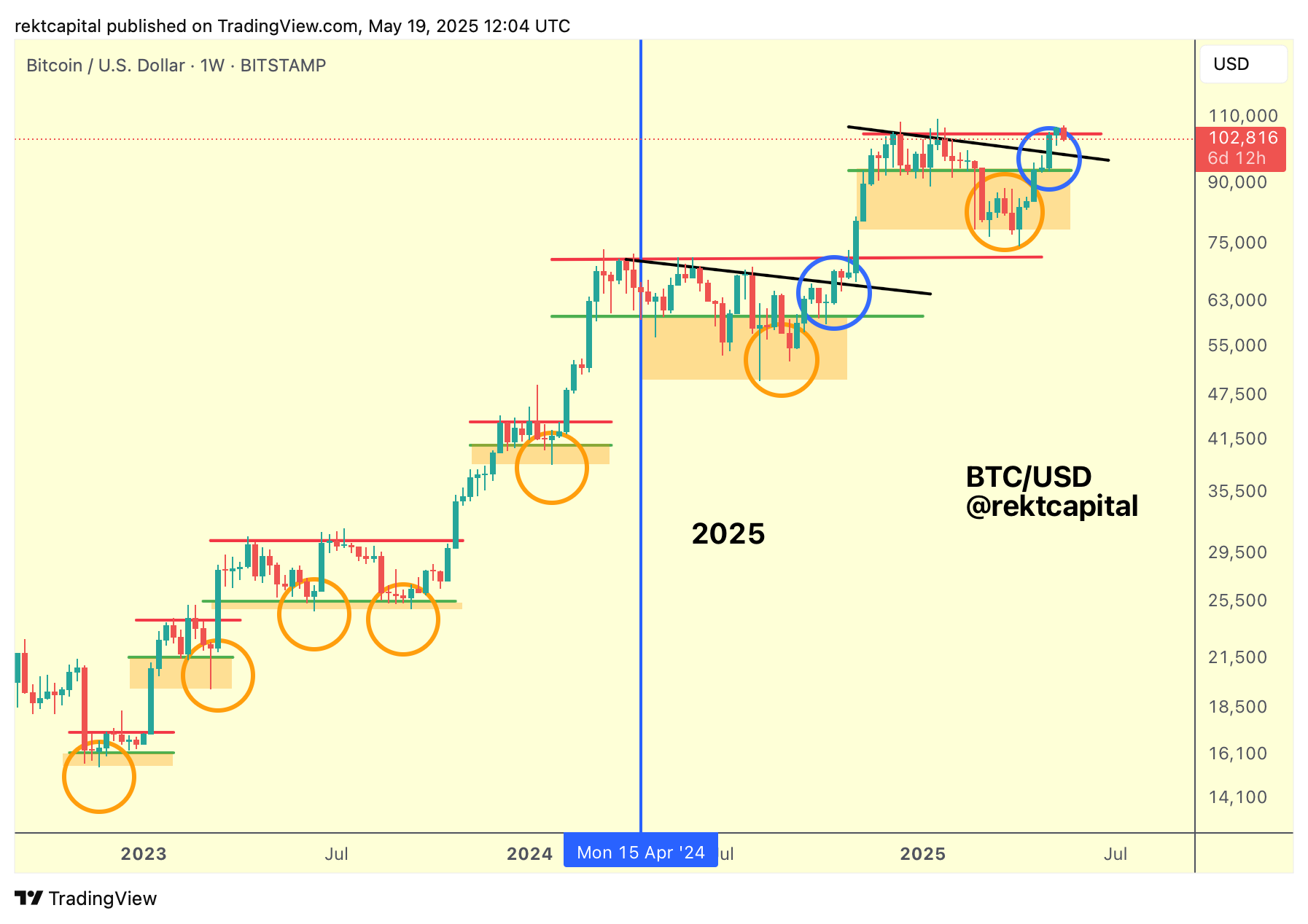

Earlier this year, I posted a tweet about how Bitcoin tends to a) form Re-Accumulation Ranges and b) downside deviate below them (orange circles):

Bitcoin has not only concluded that Downside Deviation, not only revisited the Range High of the ReAccumulation Range, but also Weekly Closed above that all-important resistance.

Technically, Bitcoin is performing all the right things in terms of confirming a breakout from this ReAccumulation Range.

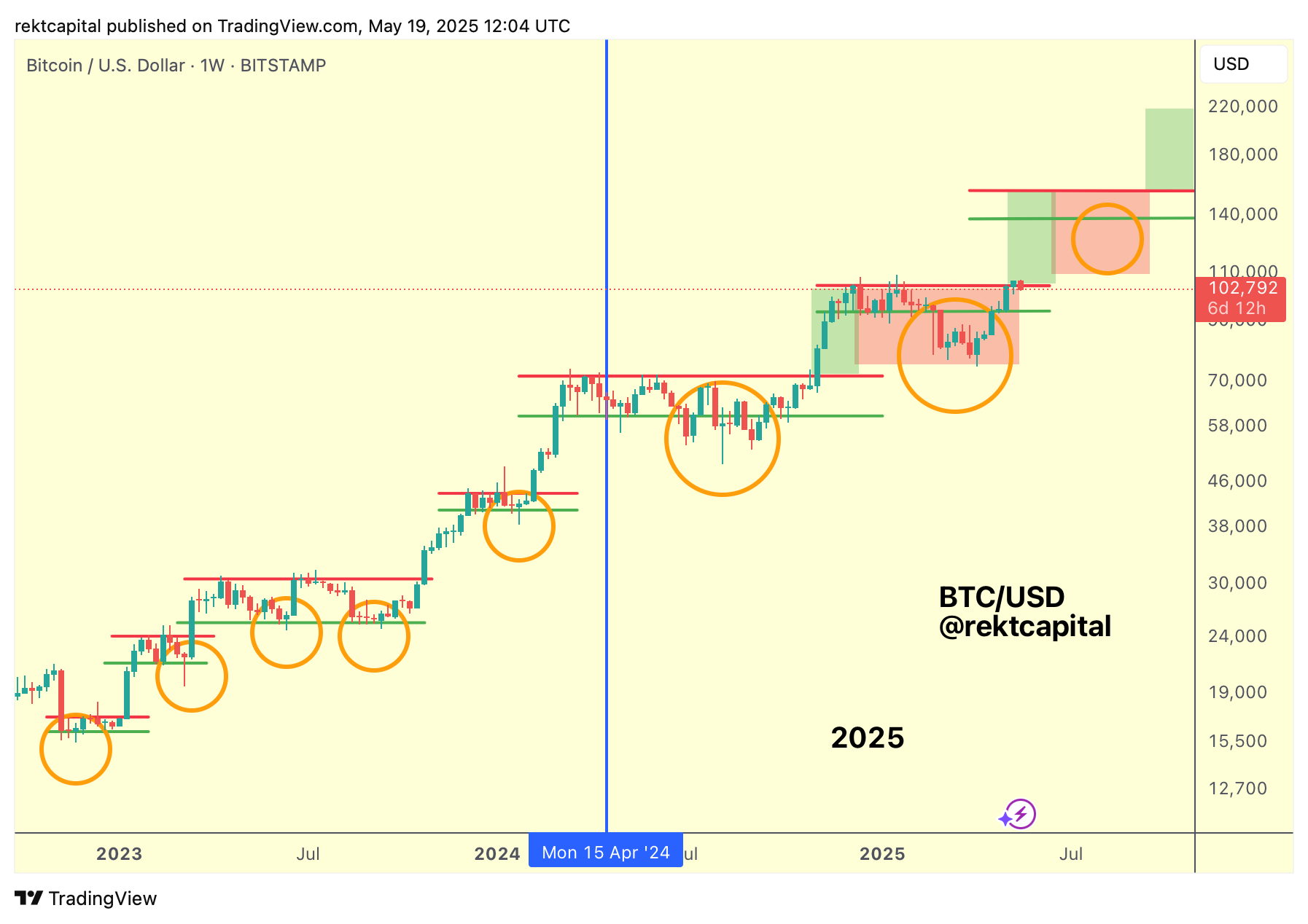

The Weekly Close has occurred above the Range High resistance and now Bitcoin needs to post-breakout retest it into new support to enable additional upside into new All Time Highs and transition into Price Discovery Uptrend 2 (green), as per the Bitcoin Roadmap below:

So Bitcoin needs to turn the ReAccumulation Range High of $104500 into new support this week.

Of course, at the moment it is looking like a volatile retest, but it is only Monday after all.

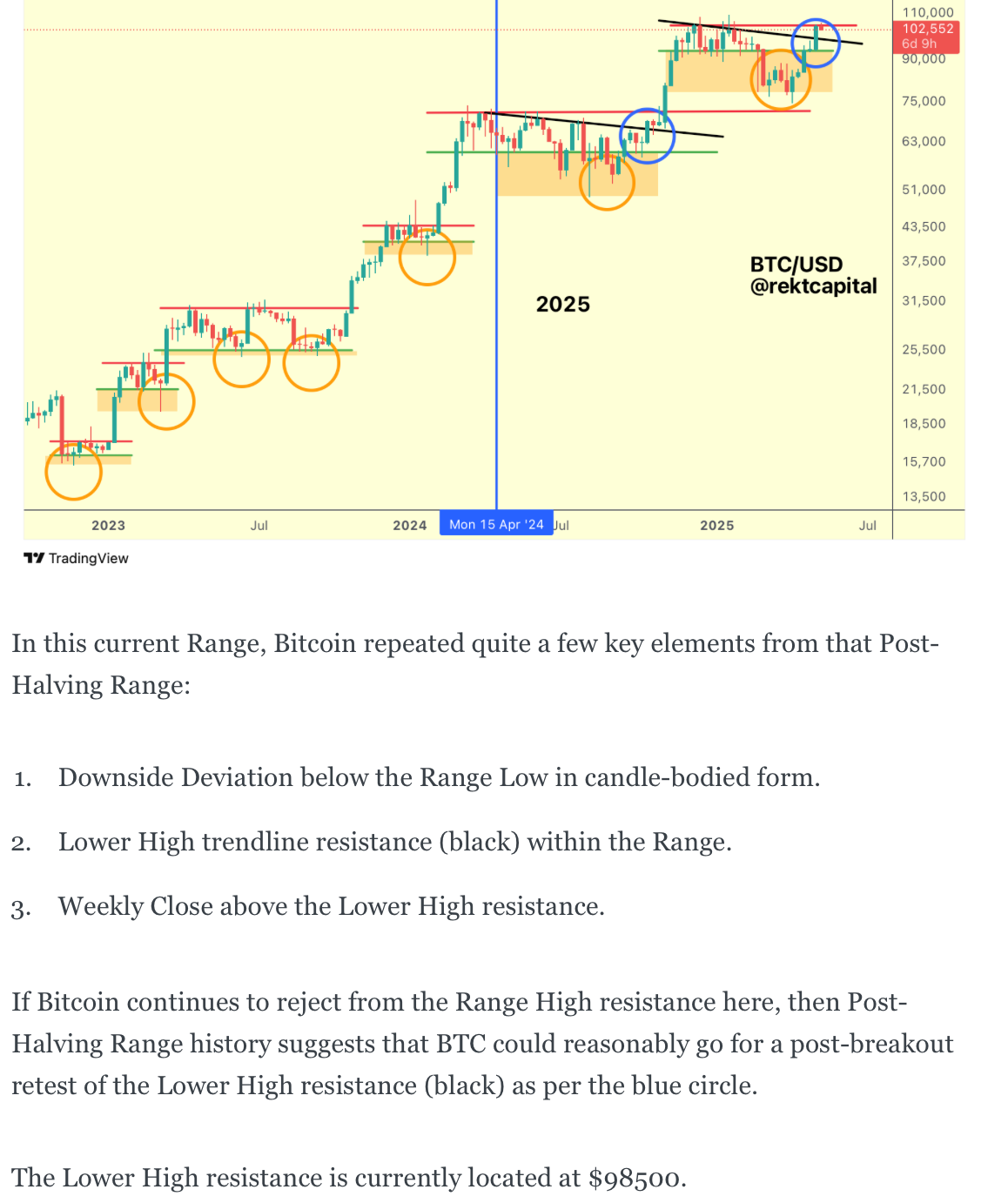

Last week, we spoke about how Bitcoin in this current Range was repeating many of the qualities from the Post-Halving ReAccumulation Range.

Here's that analysis from last week:

Here's today's analysis:

Bitcoin dipped into $100800 last week before pressing beyond the Range High resistance of $104500 and Weekly Closing above it.

So Post-Halving ReAccumulation Range history suggested that price could dip into the $98.5k Lower High (black) and a dip did indeed occur, though it missed the Lower High by ~2%.

Could we say history has repeated again?

There certainly was retesting intent but an actual picture-perfect retest never occurred.

It's always tricky in these sorts of scenarios, because price performed something in between: there was intent but there was no actual retest.

And these situations always leave a door open to another attempt, if at all needed.

Generally, the fact that BTC is above the Lower High (black) means that that would be a floor on any deeper pullback and the Range High of $104500 would technically be the ceiling, but with the Weekly Close that just occurred, it looks like price is preparing to breach that ceiling.

So if the $104500 resistance turns into support this week, then probably that Lower High won't need to be tagged.

Downside wicking below $104500 as part of a volatile retest of the Range High resistance would occur, but could such a wick be as long to go into the Lower High?

It feels doubtful on an emotional level but if we remain logical and assign a figure to what that downside wick would be then that would only be a -6% wick which doesn't seem too far-fetched at all.

Here's another way of looking at things:

Bitcoin is trying to retest the ~$104500 level but also the ~$102500 level; both of these are key Weekly resistances, the first from December 2024 and the second from January 2025.

Technically, both of these resistances are in the process of being retested into new support.

And any downside wicks as part of a volatile retest would see price offer intent of retesting towards the Lower High (black) which represents the ~$98k level this week.