Is Bitcoin Preparing Itself For Extra Downside?

Downside Targets For This Bitcoin Pullback

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

The Re-Accumulation Range Resistance

In recent weeks, we've discussed how Bitcoin was at the Range High of the ReAccumulation Range it is currently in.

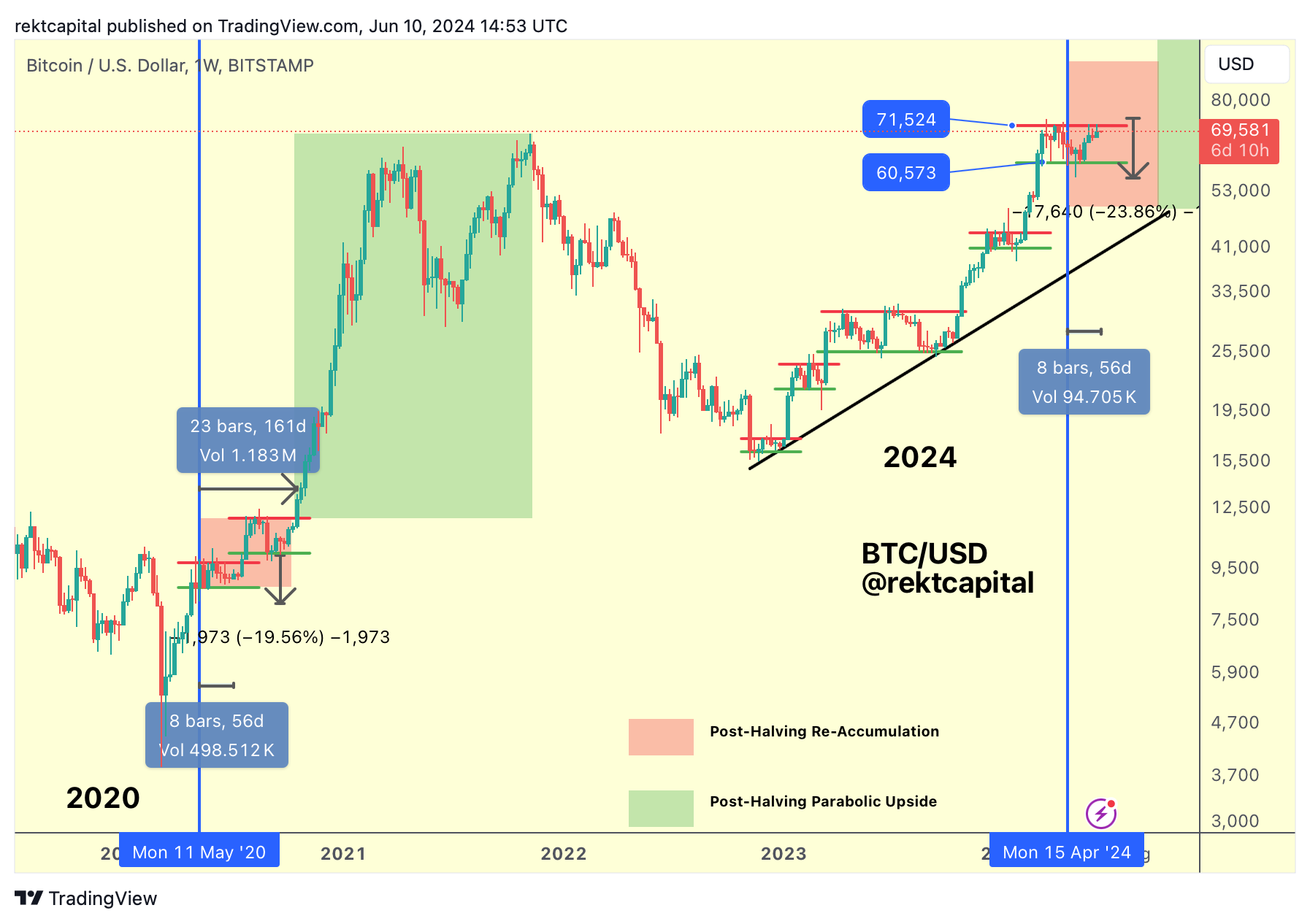

Here's last week's chart:

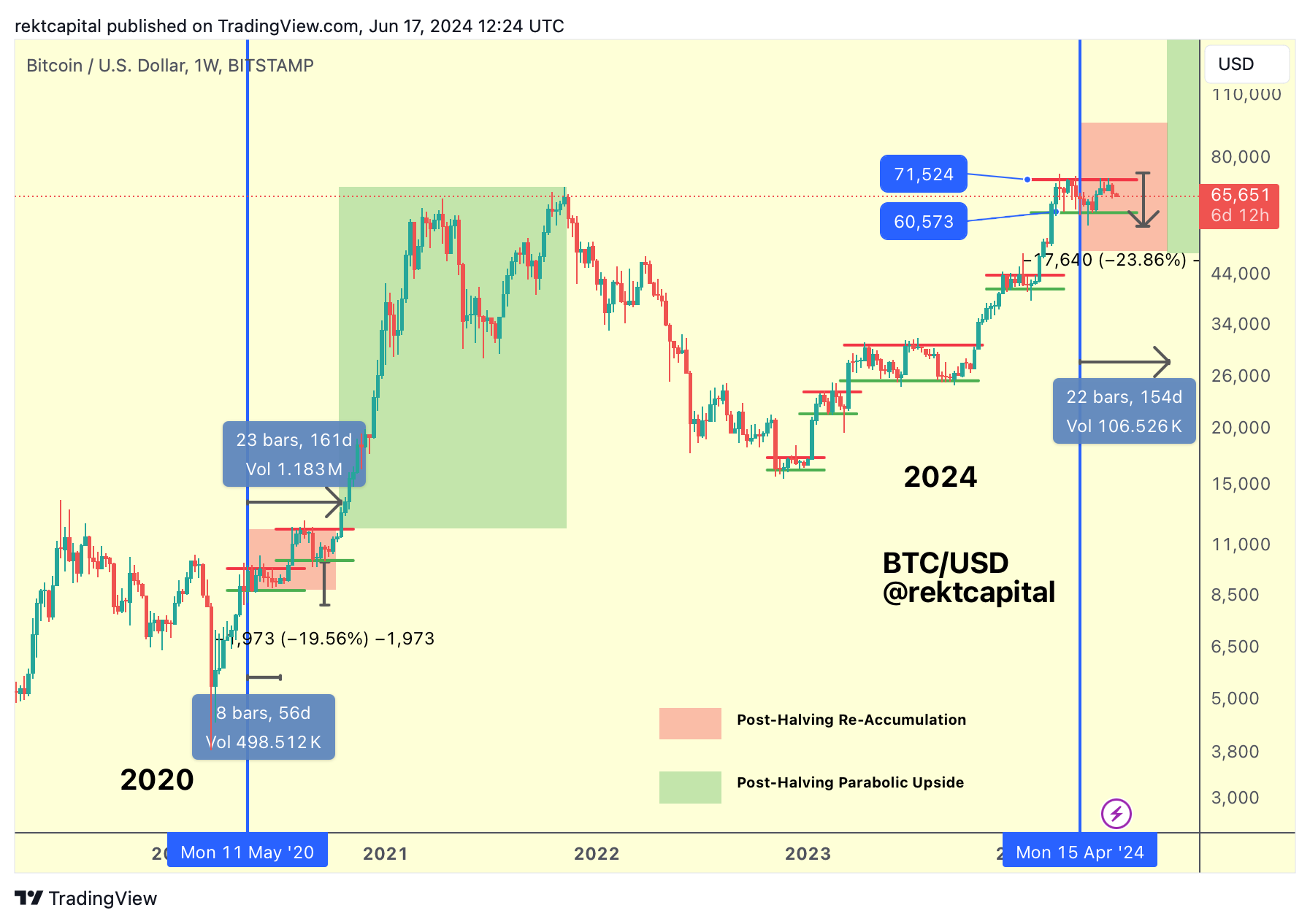

And here's this week's chart:

Bitcoin has rejected from the Range High of the ReAccumulation, diving deeper into the Range itself.

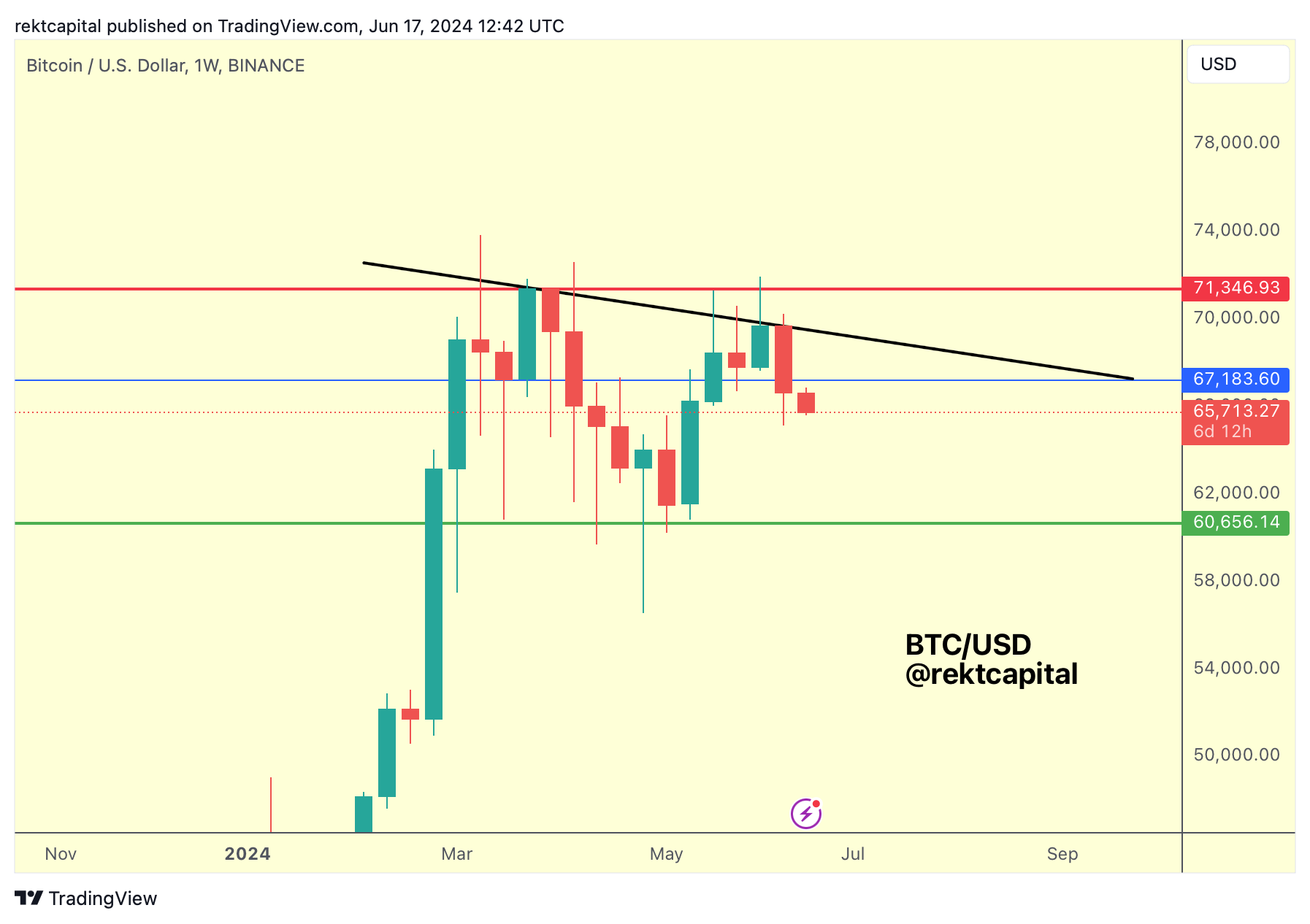

Last week we spoke a lot about the emerging Lower High resistance, which was creating resistance at a lower price level compared to before:

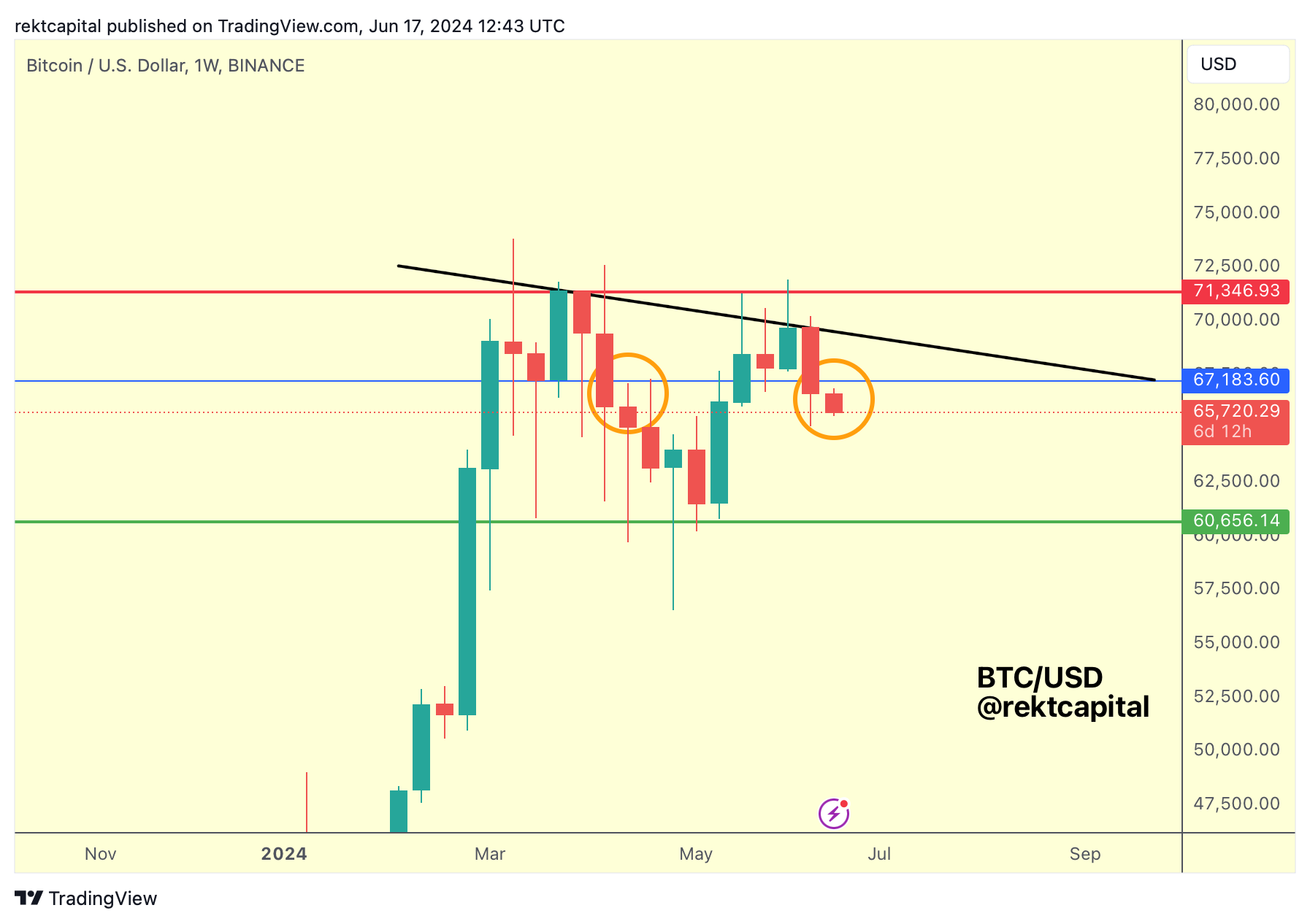

And here's today's update on that chart:

Bitcoin has since rejected from this Lower High resistance.

So it is confirmed - the resistance is occurring at progressively lower and lower levels.

Before, rejection would occur at the ~$73000 resistance and recently it occurred at the ~$71500 resistance.

Sellers are weighing down on price, eager to sell at lower levels when the chance comes during rallies.

But we're also seeing that the blue ~$67200 level isn't offering the same support as before.

In early March, BTC rebounded strongly from the blue level initially, before losing it as support, whereas in late May that rebound-producing quality was much weaker.

It comes as no surprise then that BTC has Weekly Closed below this blue level and since it has already transitioned from a fairly decent support to a weak one, it makes sense that it may continue its evolution into a new resistance in the near future, should BTC soon relief rally from current prices.

After all, we've seen this happen before, in the not so distant past:

A Weekly Close below the blue level has preceded rejections from here, where the blue level would transition into a new point of rejection.

Bitcoin is potentially setting itself up for the same fate.

In today's newsletter, we'll discuss what these price changes mean on the macro scale and what to expect going forward.