How Much Time Left Until Breakout?

Everything you need to know about the ReAccumulation Phase

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

New Monthly Candle Close

The new Monthly Candle Close is in and it hasn't been a trend-shifting one.

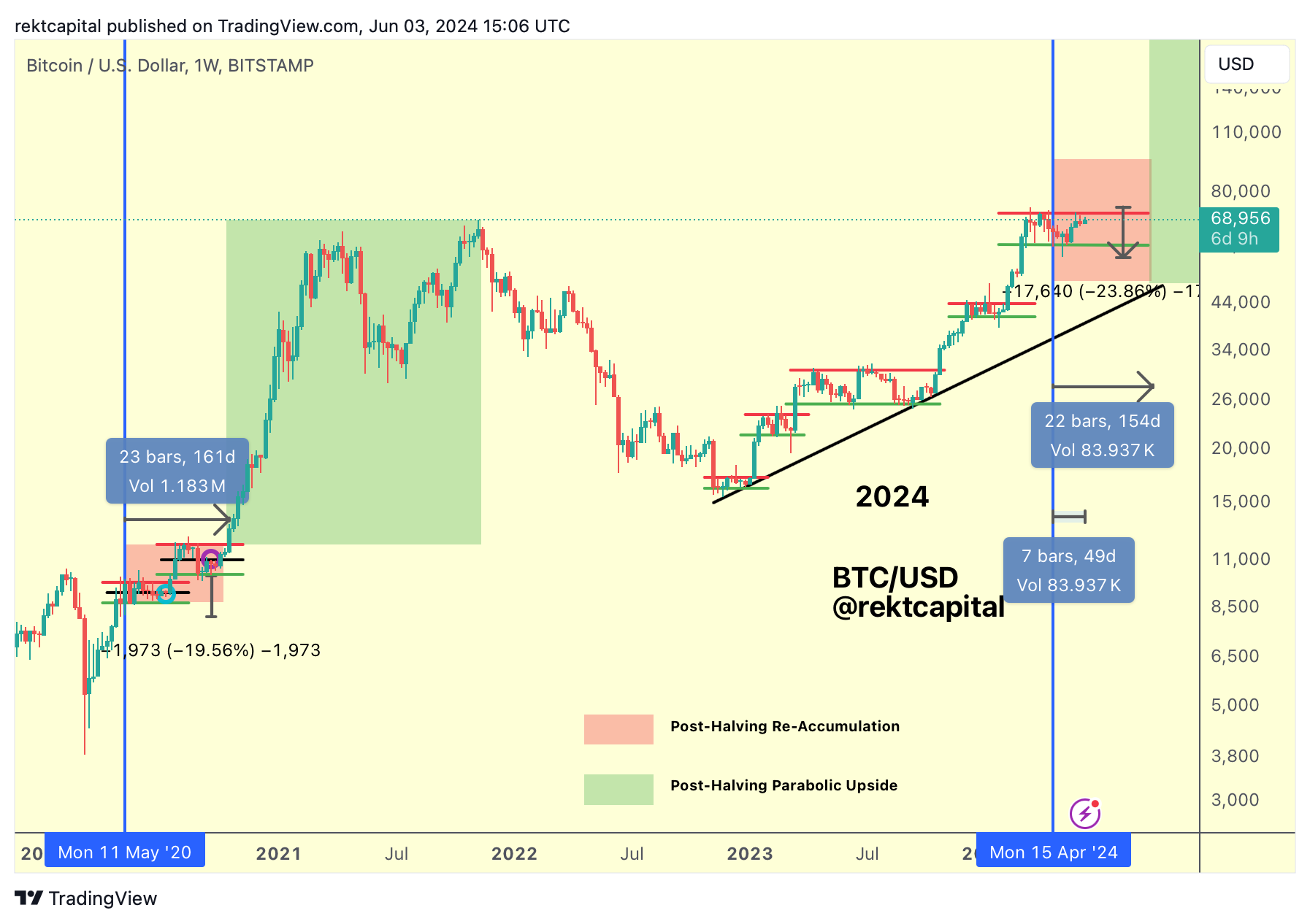

Macro-wise, Bitcoin still continues to remain inside a sideways Re-Accumulation Range, something that is a historical tendency in the 150 days after the Halving.

However, one of the major takeaways from the new Monthly Close is that Bitcoin has confirmed a successful retest of the old All Time High region as new support.

Bitcoin has been able to hold this old All Time High area as support for three months now.

First, Bitcoin retested this area in March to rally to new All Time Highs.

Then, Bitcoin pulled back into this region for a retest, holding there and demonstrating stability there.

And in the month of May, Bitcoin overextended to the downside on that retest but then launched into a revisit of $71500.

Of course, this is positive for the macro uptrend, especially since retesting old All Time Highs as new support is something Bitcoin has never done this early after the Halving.

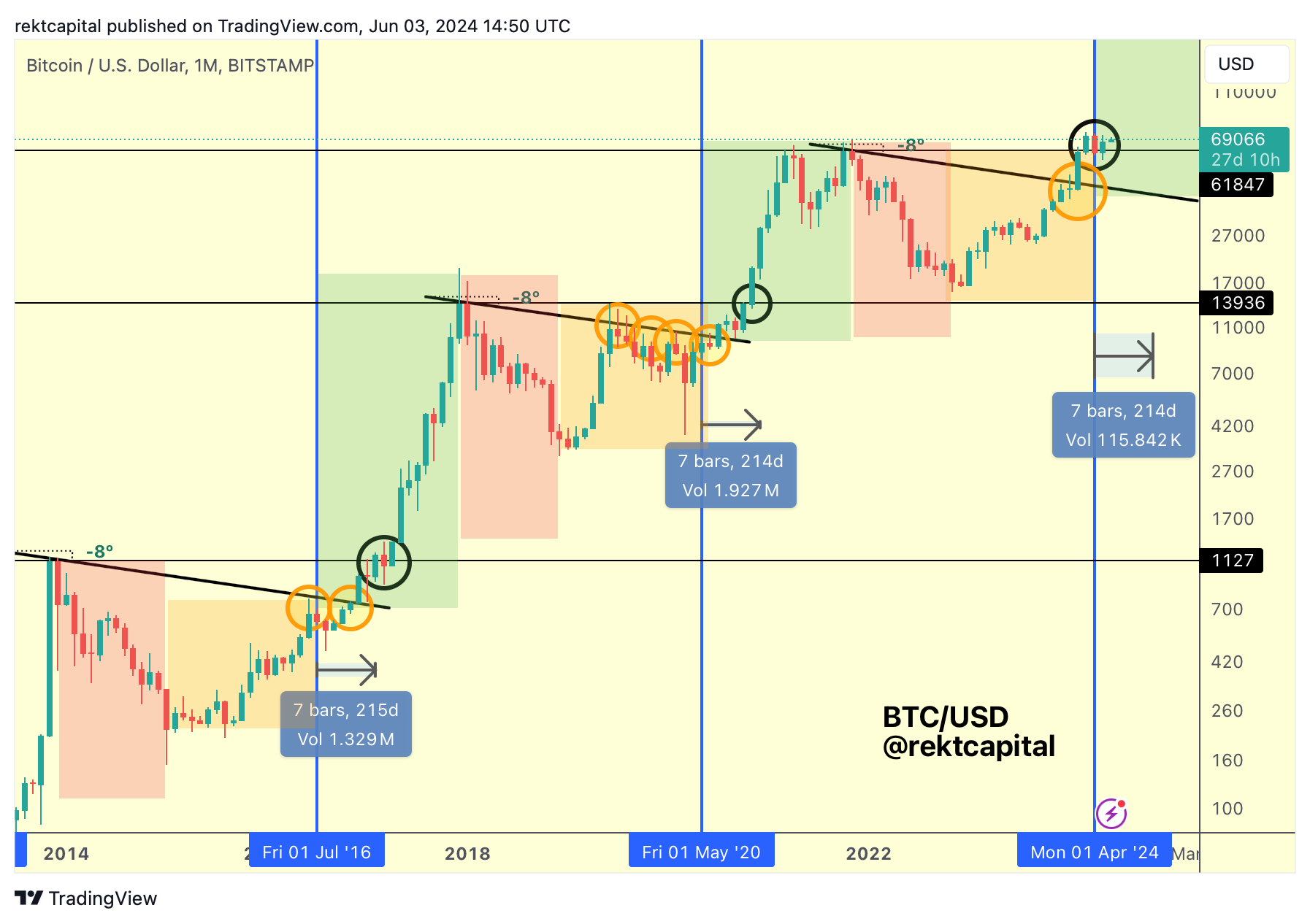

Historically, Bitcoin tends to retest the old All Time High area as new support some 214 days after the Halving, as per the black circles across time.

However, this is a process that Bitcoin has began even in the Pre-Halving period, demonstrating that Bitcoin is ahead of schedule by standards of traditional Halving Cycles.

So even though Bitcoin has been consolidating for the past 2.5 months or so, it still has been performing critical technical feats way ahead of schedule.

And in fact, even though Bitcoin has slowed down in recent months, Bitcoin's rate of acceleration in this cycle is still over 170 days.

Bitcoin has slowed down, but it still remains accelerated in the grander scheme of the cycle, which is why it needs to continue slowing down even more, if it wants to resynchronise with traditional Halving cycles.

If investors are getting bored or frustrated with Bitcoin's current price action, it would be even healthier for this cycle for investors get even more bored and frustrated by this price action, because history is suggesting Bitcoin needs to consolidate until September to fall in line with traditional cycles.

After all, Bitcoin has consolidated inside its ReAccumulation Range for 49 days after the Halving:

Whereas historically, Bitcoin tends to breakout over 150 days after the Halving.

What would you do if the market offered 100 days more of this type of price action?

Of course, Bitcoin would go against the grain of history with a Weekly Close above the Range High of the ReAccumulation Range.

But until then, there's reason to believe history may repeat with an extended consolidation period after the Halving, which could translate into an additional 100 days of this sort of price action going forward.