Bitcoin's Four Year Cycle: An Extensive Analysis

A Detailed Breakdown of Bitcoin's Four Year Cycles

Welcome the Rekt Capital newsletter, a place for people who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis. Today’s newsletter edition is free for everybody.

I write research articles just like this one every Monday for subscribers of the Rekt Capital newsletter.

So if you’d like to receive cutting-edge research like this straight to your inbox, feel free to make the most of the early-bird discount of $5 a month and subscribe today:

In today’s research article, we’ll focus on dissecting Bitcoin’s Four Year Cycle in an effort to better understand Bitcoin’s current price predicament and gain insight into some of the more important technical steps price needs to achieve to ensure future exponential growth.

First, we’ll focus on breaking down the Bitcoin Four Year Cycle into distinct phases in the market cycle. We’ll emphasise the psychology that underpins each of these phases.

Then, we’ll emphasise the importance of the Bitcoin Halving in shaping Bitcoin’s Four Year Cycles.

Later, we’ll talk about what Bitcoin needs to technically achieve to open itself up to significant upside in 2021 so as to reach a new All Time High.

And finally, we’ll investigate how the Four Year Cycle brings to light some crucial observations about Bitcoin’s price behaviour and discuss how these observations could inform us as to its potential price growth in the future.

Bitcoin - The Four Year Cycle

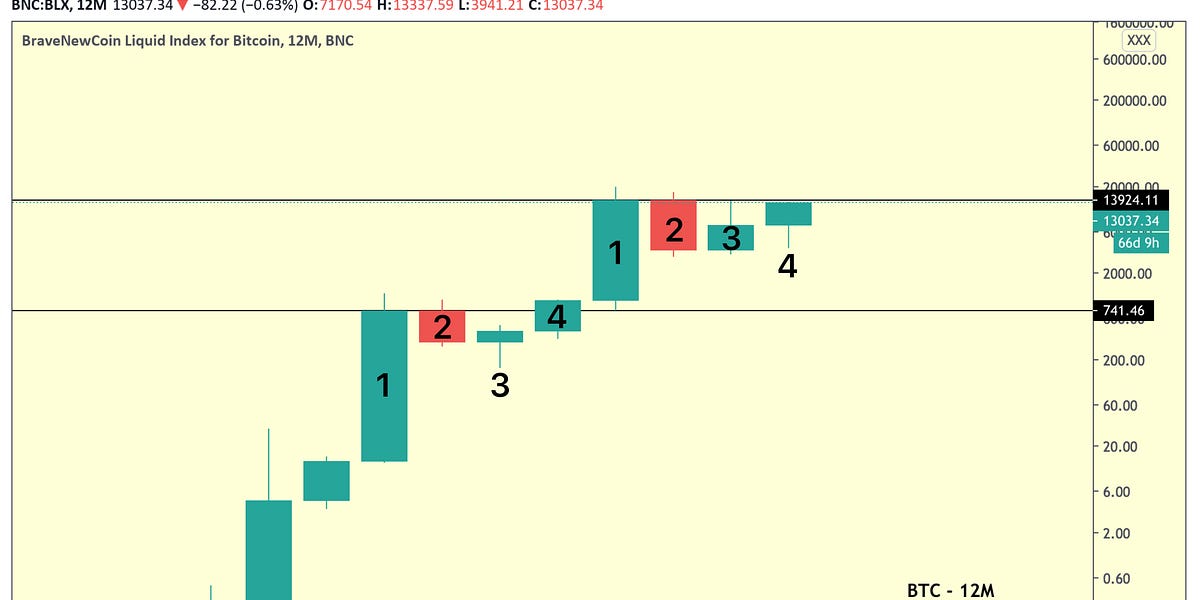

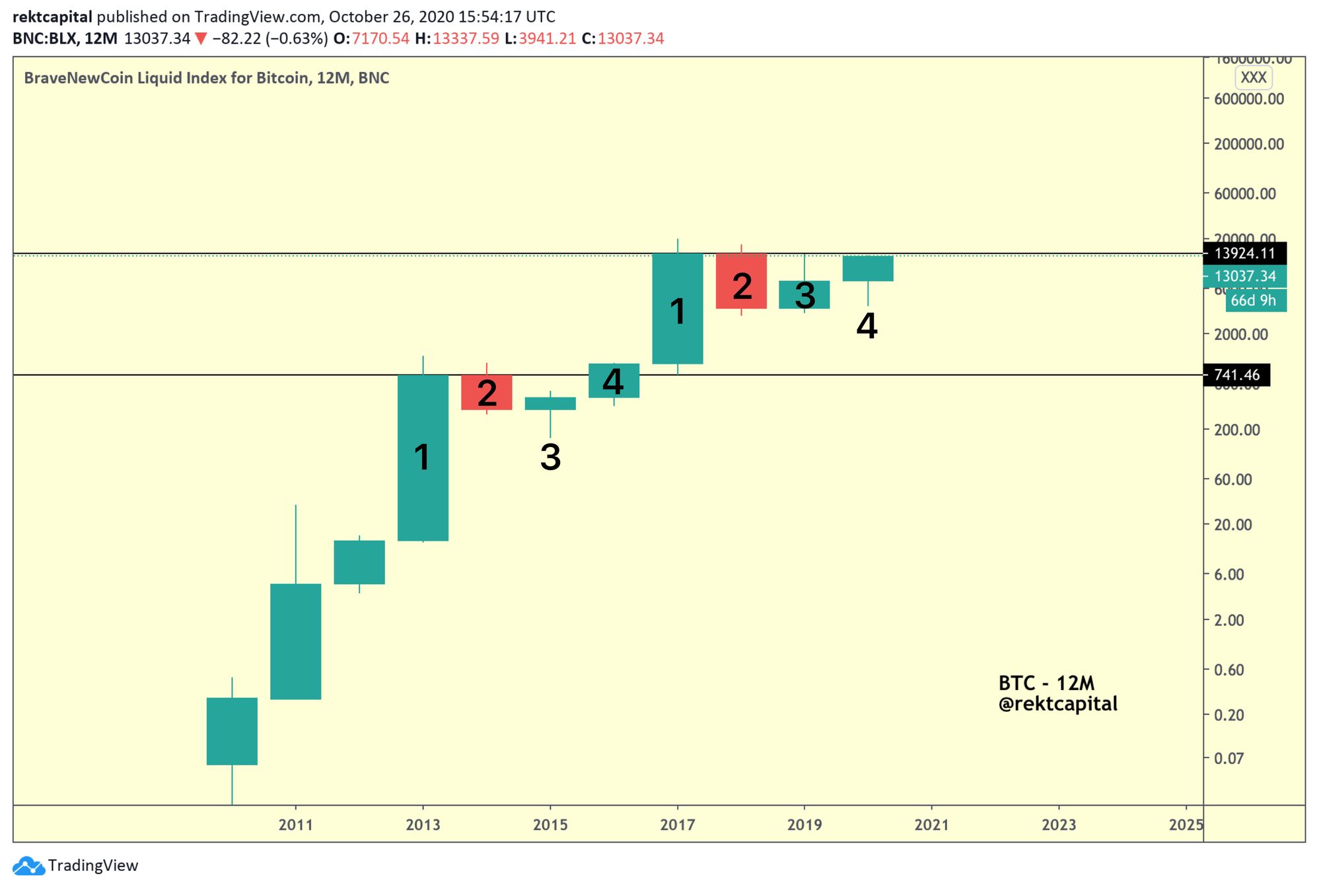

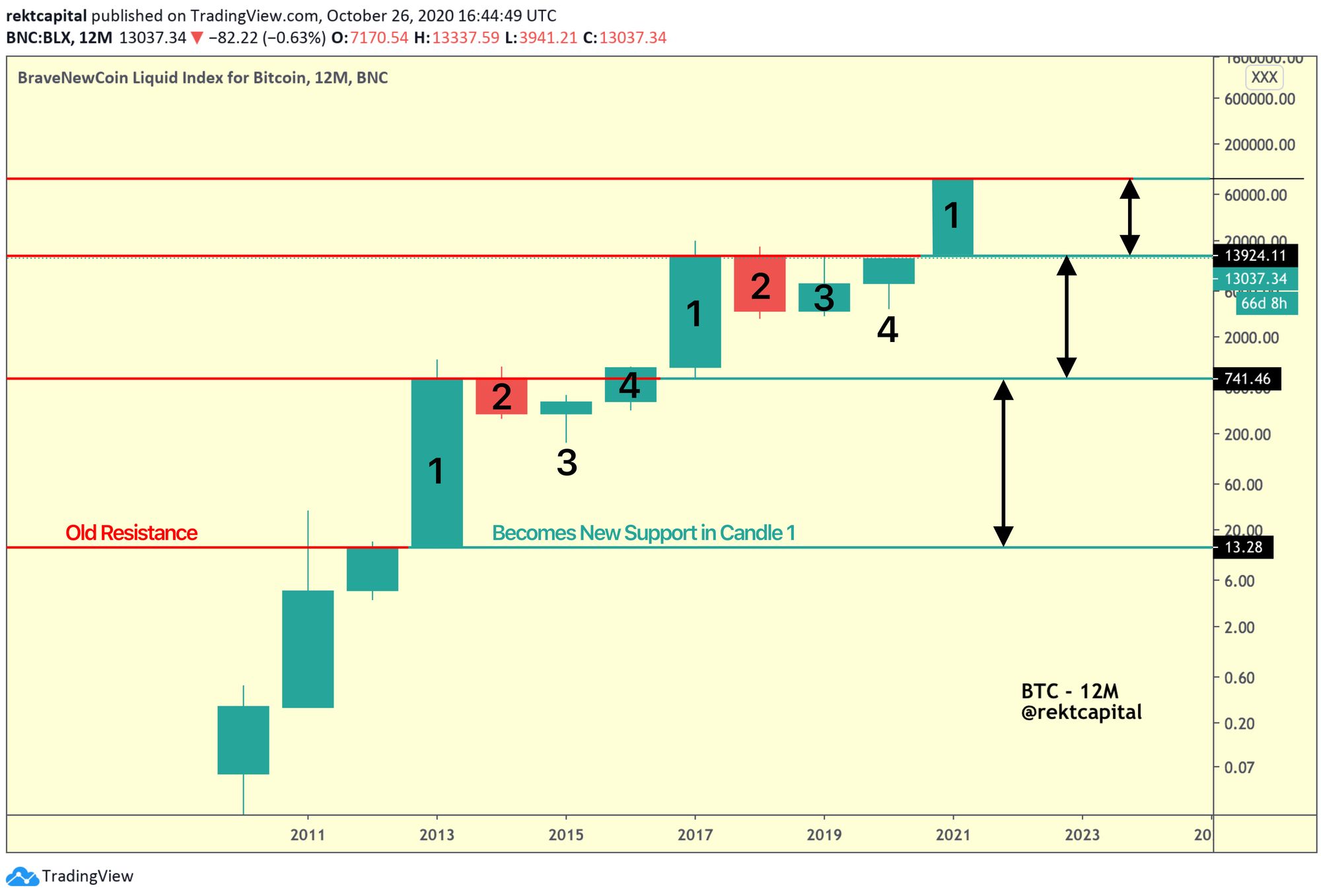

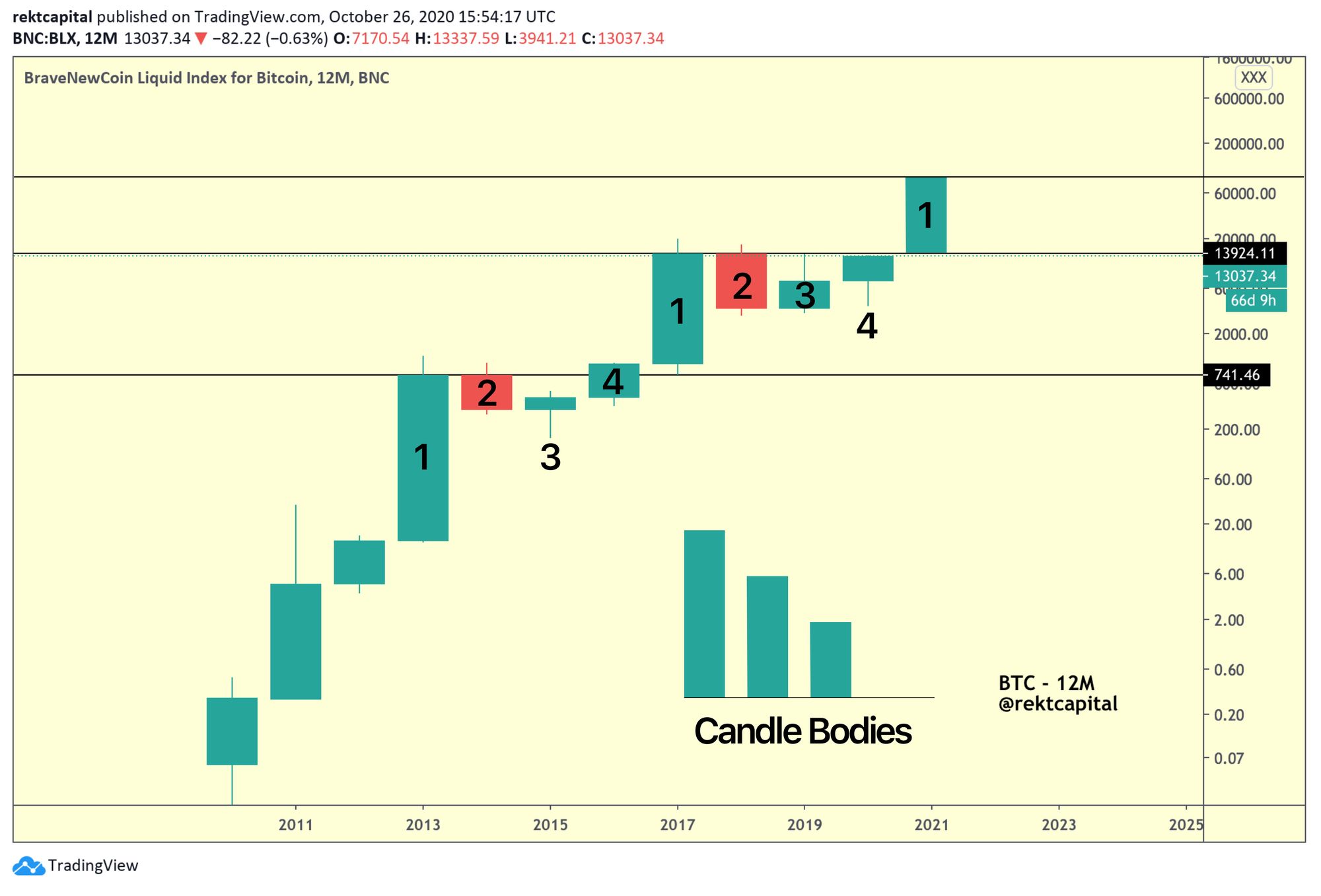

The twelve month candlesticks on Bitcoin’s price chart showcase a recurring theme to form Four Year Cycles.

Each twelve month candle denotes a specific phase in the Four Year Cycle.

Here is a breakdown of each of these phases:

Phase 1 — Exponential Highs

This candle highlights the exponential nature of the uptrend that leads Bitcoin to new All Time Highs.

It is at this stage in the market where investors are at their most euphoric and experience the most extreme form of “the fear of missing out.”

It is these extreme emotions that compel investors to buy at higher and higher prices. This prolongs the bull trend and presses price to new exponential highs.

This phase is also the “topping out” phase where Bitcoin reaches its new All Time High and price peaks.

Phase 2 — Correction

Following the euphoria of the previous twelve month candle, this phase corrects for the over-exuberance and overoptimism in the market.

It is during this time that Bitcoin sheds considerable valuation as a result of cascading sell-side pressure from profit-taking investors.

Bitcoin experiences a healthy retracement after an exponential growth cycle.

Phase 3 — Accumulation

After an extended correction in price, Bitcoin experiences waning sell-side momentum and begins to bottom out.

This is where bargain buyers tend to step in and accumulate Bitcoin at a deeply discounted prices. It is these types of buyers that form the very beginnings of new demand for Bitcoin.

Phase 3 happens to be the point of maximum financial opportunity for Bitcoin investors as the prospect of reward greatly exceeds the risk of downside.

Phase 4 — Recovery and Continuation

The bottoming out period is over and a new uptrend has been confirmed as price experiences trend continuation towards the upside.

In the context of Bitcoin’s twelve month candlesticks, historically this phase has been all about eclipsing a previous area of sellside pressure (i.e. “resistance” whereby sellers resist price from continuing to the upside; this level is denoted by a black horizontal line).

It is during this period where a twelve month candle close above that level of resistance is an important technical step in confirming a shift in market psychology at said level.

This level is a key psychological inflexion point that tends to spur strong emotions in the market and resulting buy-side momentum.

Upon a successful twelve month candle close, this is when market psychology at this key switches from selling to buying.

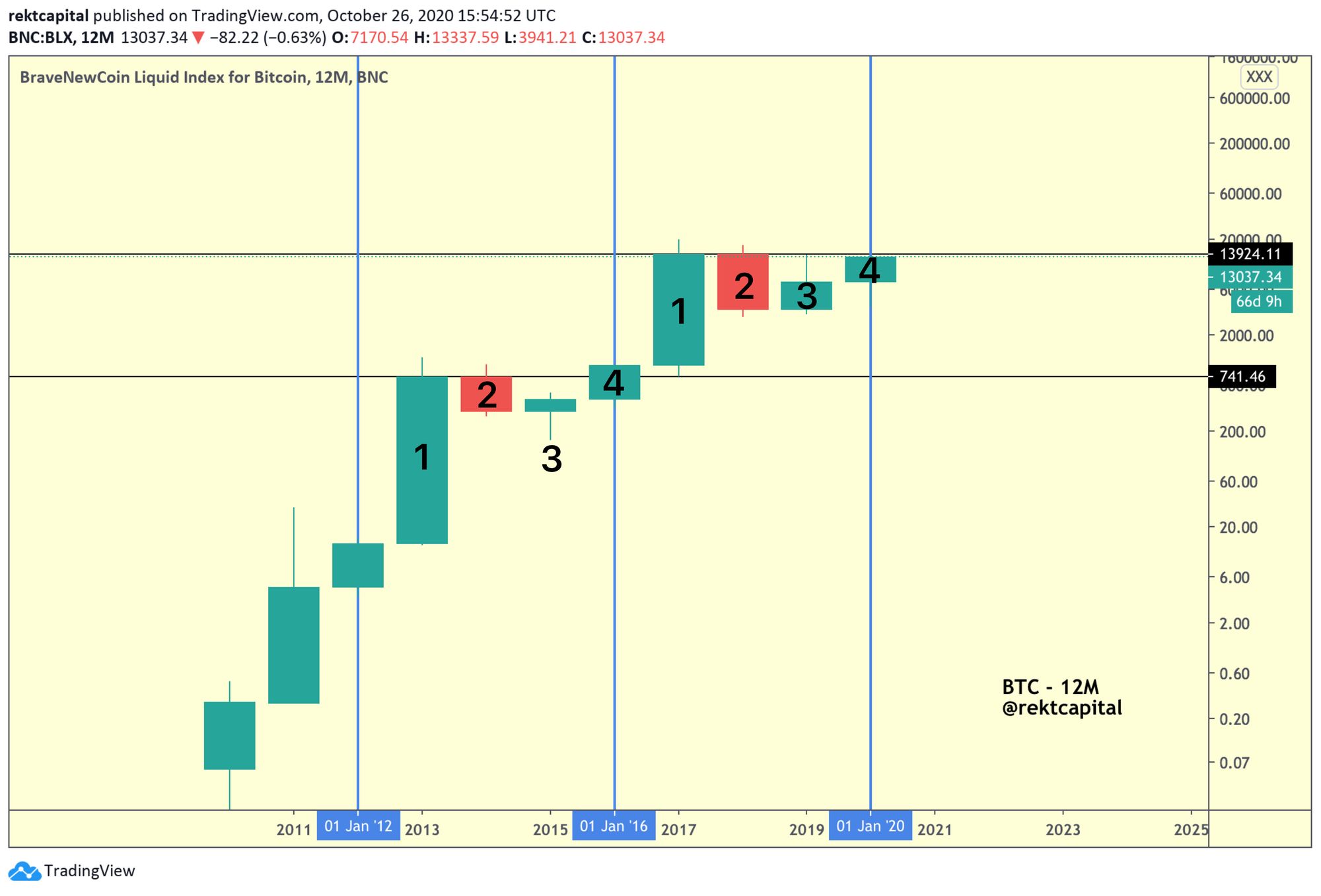

Bitcoin Halving and The Four Year Cycle

The Bitcoin Halving is an event whereby the amount of new Bitcoin that gets created every 10 minutes gets cut in half (denoted in blue on the price chart).

In May of this year, Bitcoin’s third Halving took place, reducing the block reward of 12.5 Bitcoin every 10 minutes to 6.25 Bitcoin.

Not only does the Bitcoin Halving mark a fundamental change in the Bitcoin protocol, but it also has tremendous ramifications for Bitcoin’s price as well.

Historically, Bitcoin has rallied exponentially after each of its Halvings.

Bitcoin rallied +3,400% after Halving 1 and 4,080% after Halving 2.

It is a fundamental catalyst that has played a significant role in propelling Bitcoin’s price to exponential highs.

And the fact that I’ve discussed the pre-Halving retrace in the context of Bitcoin’s Four Year Cycle is no coincidence.

Because the Bitcoin Halving events occupy a curious price positioning if we analyse them through the lens of the Four Year Cycle.

In the context of the Four Year Cycle, the Bitcoin Halving occurs in the “Recovery and Continuation” candlestick (i.e. Candle 4) and precedes the new exponential Candle 1 in the new Bitcoin Four Year Cycle.

In other words - the Bitcoin Halvings tend to occur a year prior to Bitcoin’s exponential rallies to new All-Time Highs.

Bitcoin Set For New All Time High In 2021

According to the 4 Year Cycle, Bitcoin is currently in Phase 4.

That means Bitcoin is in the final phase of its current Four Year Cycle.

And the primary aim of Phase 4 is to eclipse the previous resistance that effectively prompted a bear market for Bitcoin’s price a few years earlier (i.e. “Candle 2”).

That resistance is ~$13,900.

So for the 4 Year Cycle to continue to play out, Bitcoin needs to manage a twelve month candle close above the ~$13,900 price level by the end of 2020 so as to precede an exponential Candle 1.

At the time of this writing, Bitcoin is really not that far away from eclipsing ~$13,900.

Bitcoin’s current twelve-month candle still looks healthy, with a great deal of bullish momentum behind it.

It has taken the shape of a bullish hammer candlestick, resembling the bottoming out candle from the previous Four Year Cycle which preceded immense upside in of itself.

And hammer-shaped candlesticks tend to precede bullish trend reversals towards the upside.

As per the historical tendencies of the 4 Year Cycle, a twelve month candle close above ~$13,900 is the technical confirmation that is necessary to open Bitcoin up to a challenge and subsequent eclipse of $20,000 to reach a new All-Time High in 2021.

How Much Could Bitcoin Rally In 2021?

To address the question of where Bitcoin could rally to in 2021, we have to take into account a few noteworthy technical tendencies that can be observed by dissecting Bitcoin’s Four Year Cycle:

If BTC Breaks $13900 in 2020, BTC Will Not Eclipse $20000 in 2020

If Bitcoin manages to perform a twelve-month candle close above $13,900 that would mean Bitcoin would eclipse $13,900 this year to make a new cycle high, but not eclipse the old All Time High of $20,000.

Nonetheless, a twelve-month candle close above $13,900 that would open Bitcoin up to enter a new exponential Phase 1 in a new Four Year Cycle.

That is, a new All Time High would await in 2021.

Bitcoin To Turn $13,900 Into Support in Early 2021

Upon successful twelve-month candle close above $13900 in 2020, Bitcoin would attempt a retest of $13900 as support very early on in 2021, before embarking on a new exponential rally to establish a new All Time High.

This is a necessary technical prerequisite that Bitcoin has performed throughout history.

This is when key Four Year Cycle resistances (i.e. previously black horizontal levels) change from being a source of sell-side momentum (i.e. red horizontal level) to a source of buy-side pressure (i.e. green horizontal level)

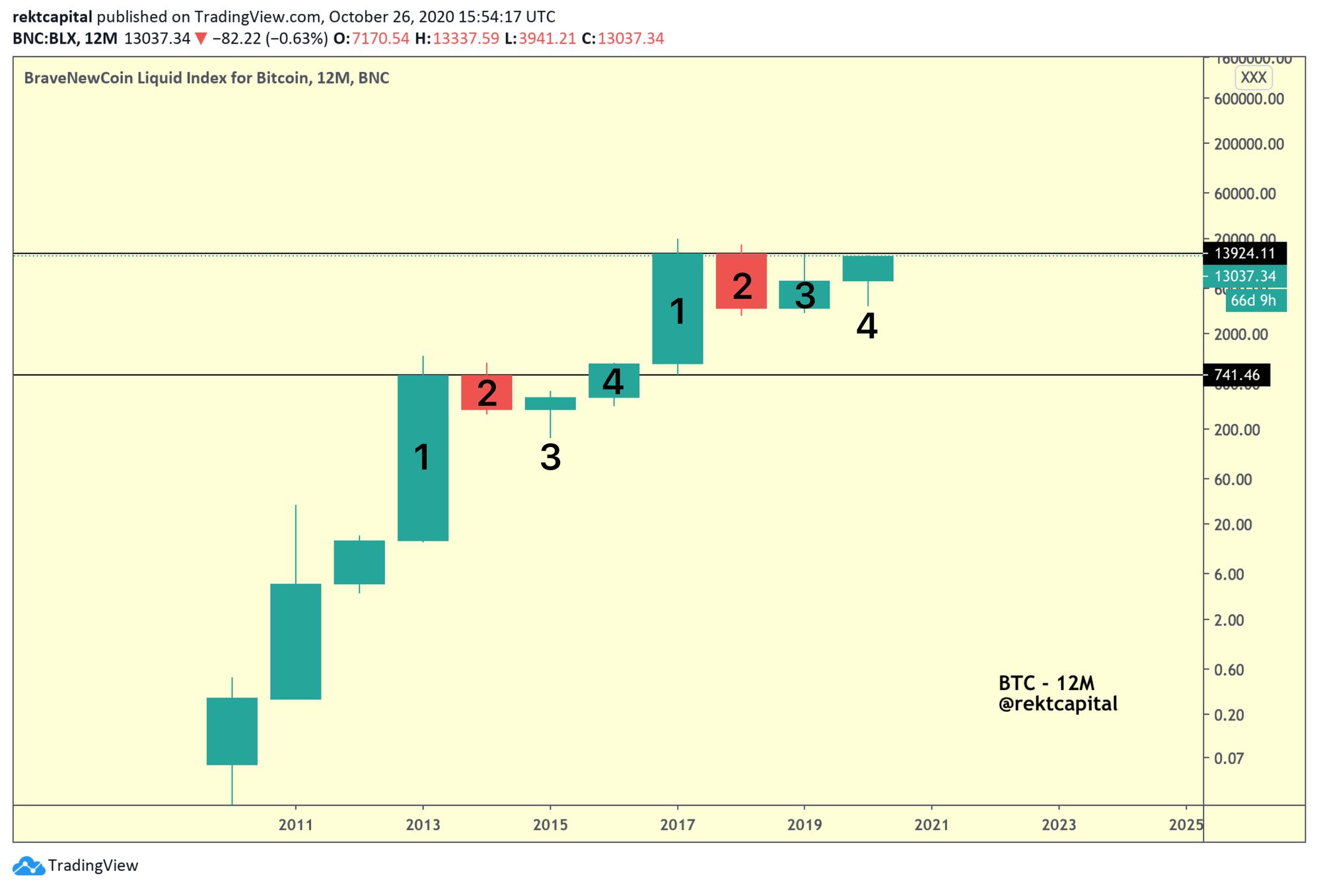

Diminishing Rate of Return on Bitcoin Investments

It is Phase 1 candles that springboard Bitcoin to new All Time Highs.

At a glance at the price chart above however, the exponential Phase 1 candles appear to produce less exponential rallies over time (i.e. black arrows).

That means Bitcoin’s next exponential Phase 1 in the new Four Year Cycle will likely be less exponential than previous Phase 1’s.

It is likely there are diminishing returns after each Bitcoin Halving.

Much like the actual Phase 1 twelve-month candlesticks, the rate of overextension in the form of upside wicks past these crucial Four Year Cycle resistances (i.e. black horizontal levels in the chart below) are also getting shorter and less volatile over time.

Where Could Bitcoin Rally To In 2021?

If we assume the rate of diminishing Post-Halving returns to remain constant across all exponential “Candle 1’s”, Bitcoin could rally exponentially to a relatively conservative new All Time High of ~$90,000.

That said, this conservative extrapolation of current Post-Halving bull trends by standards of Bitcoin’s price history doesn’t account for upside wicks past key Four Year Cycle resistances (i.e. black horizontals).

This means Bitcoin could very well overextend past $90,000 and even beyond the psychological level of $100,000 before finally rejecting.

And that’s about it for today — thanks so much for reading today’s free issue of the Rekt Capital newsletter. Let me know your feedback in the comments!

I write research articles like this every Monday for subscribers of the newsletter.

Hopefully this special edition gave you a powerful idea as to the level of quality, detail, and dedication that you can expect as a valued subscriber of the Rekt Capital newsletter.

So if you’d like to receive cutting-edge research like this straight to your inbox, feel free to subscribe for an early-bird discount of less than 0.50 cents per newsletter.

Speak soon,

~ Rekt Capital