Bitcoin: Will September Just Be a Fake-Breakdown Month?

Looking forward to a bullish Q4, as per historical tendencies

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

The Weekly Channel

Last week, Bitcoin confirmed a breakdown from its black Downtrending Channel.

The good news however is the price was able to Weekly Close above the bottom of the orange area, which has been a valuable price reversal zone for BTC over the past several months.

This orange area has figured as a bargain-buying liquidity area from which price would rebound, whether via downside wicks or entire candle-bodies.

Since July, Bitcoin has broken down from this black Downtrending Channel three times and on each of the previous breakdowns price has been able to reclaim the channel within a matter of weeks.

Could the same occur also this time?

For Bitcoin to entertain such a scenario, price would need to reclaim the $55850 lows (blue) which price Weekly Closed below most recently; these lows represent the bottom of the early July correction:

Reclaiming the blue level as support would enable a move back into the Channel Bottom which would be the crucial area to reclaim as support.

Here is that scenario visualised:

If September has become a breakdown month then October should become a moon where price manages to reclaim the Downtrending Channel as support:

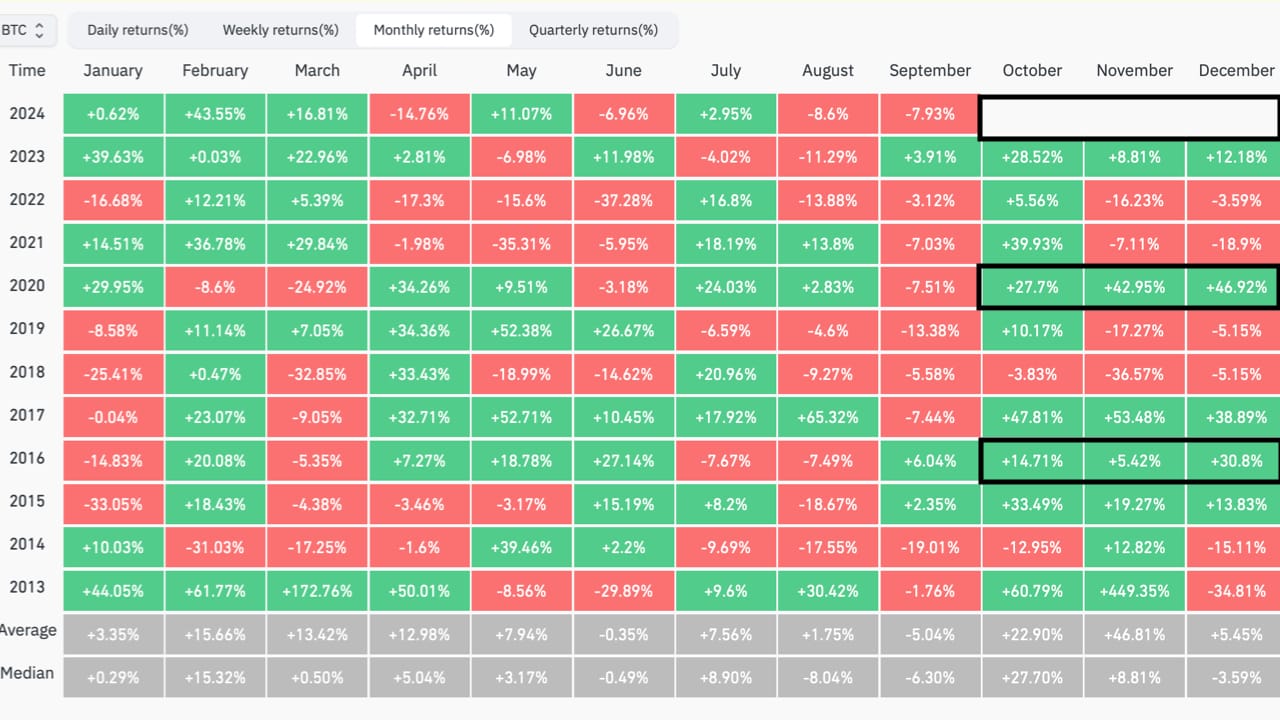

After all, in Halving years Bitcoin has enjoyed three consecutive months of upside price action in October, November and December.

September tends to generally be a month of consolidation, often achieving downside of less than -10%, with the exception of -19% in a Bear Market (2014) and -13% in a Pre-Halving year (2019).

When it comes to September, single-digit upside or downside is the more likely outcome, which only highlights this inherent consolidation quality that we tend to see from Septembers.

So single-digit downside is not out of the ordinary in Septembers but neither are three consecutive months of uptrending price action in the Octobers, Novembers, and Decembers that follow afterwards.