The Bitcoin Downside Is Here - What's Next?

Downside Targets For This Bitcoin Pullback

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

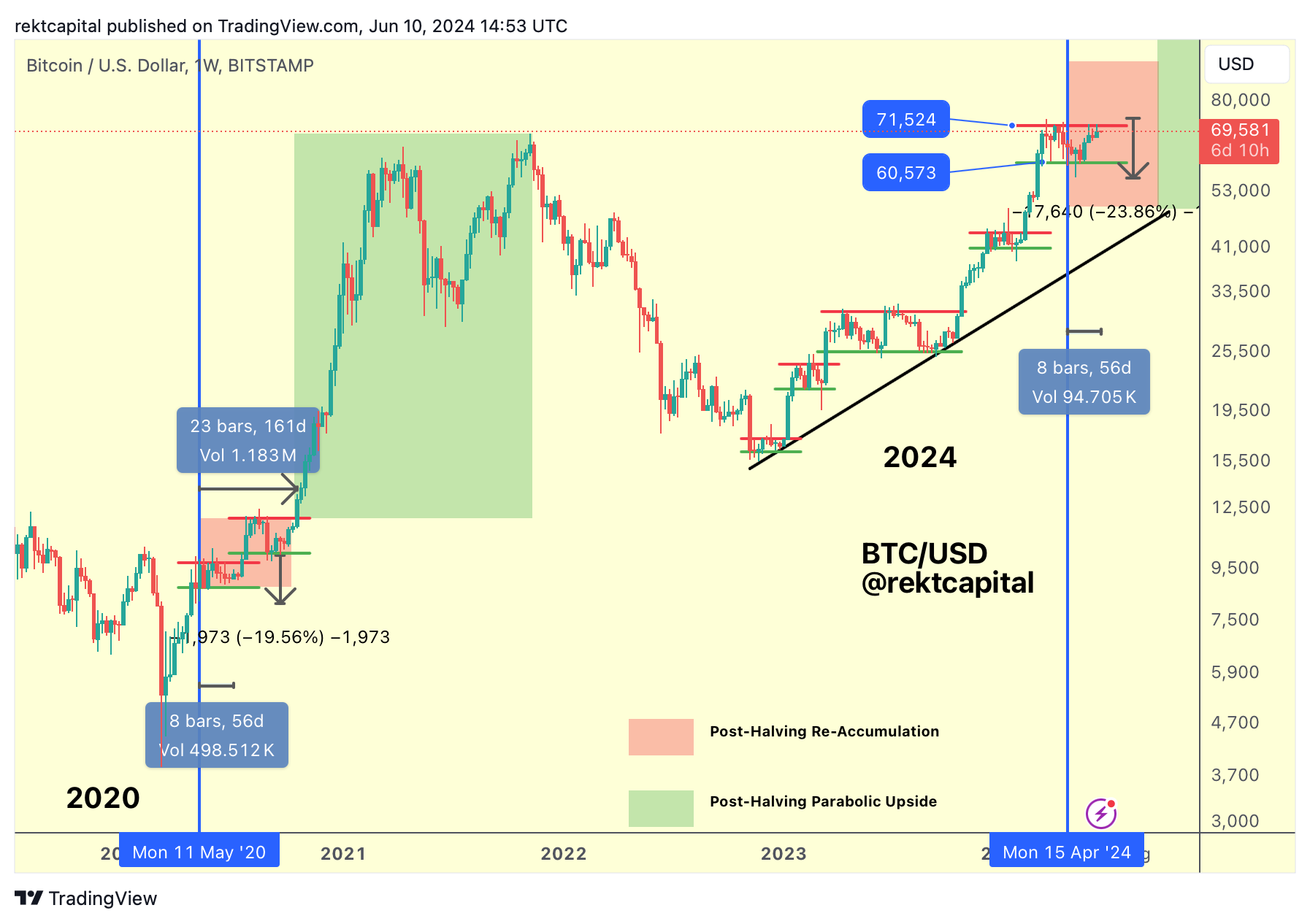

The Re-Accumulation Range

Over the past few weeks, we've been talking about how a rejection was possible at the Range High of the existing ReAccumulation Range:

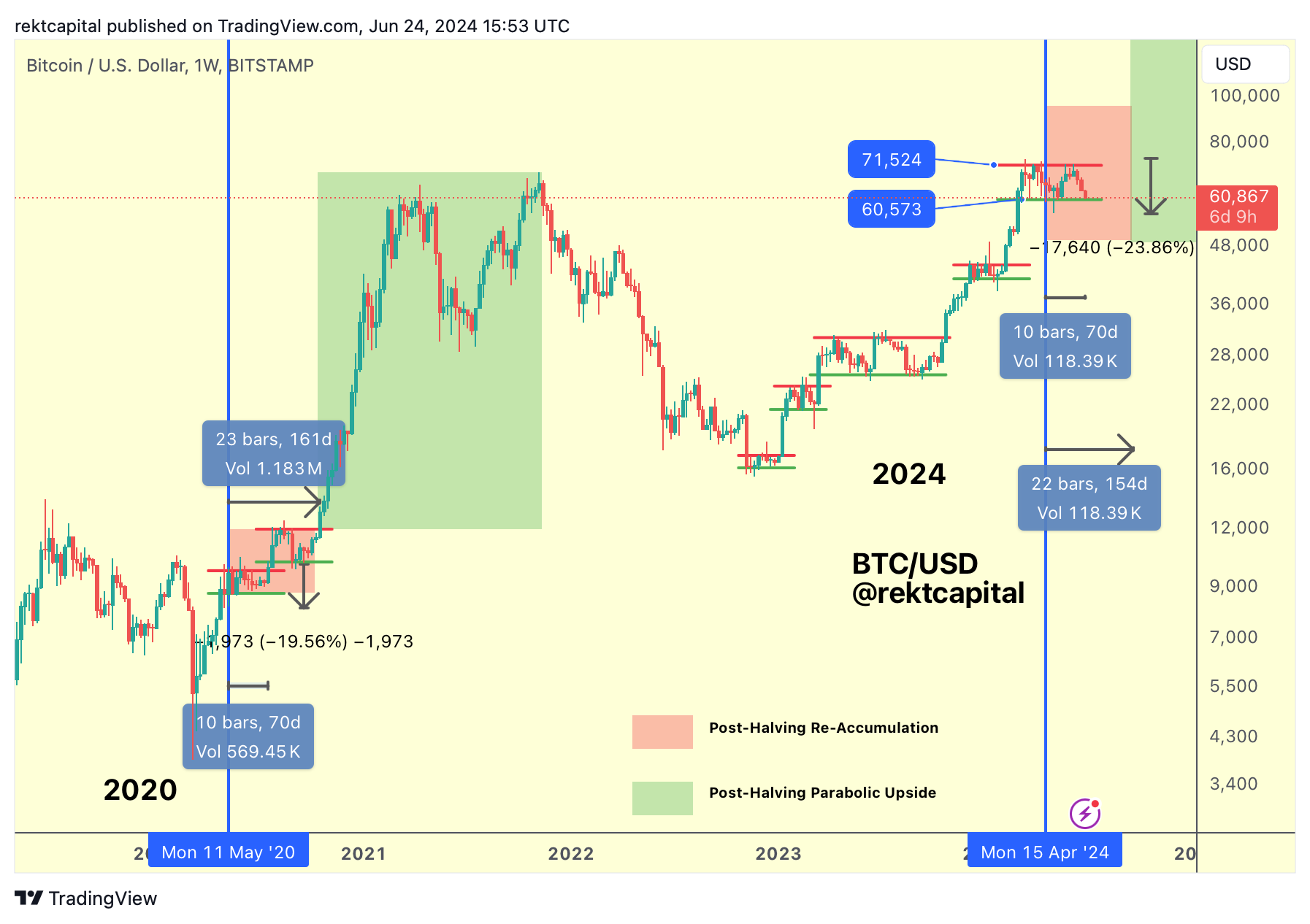

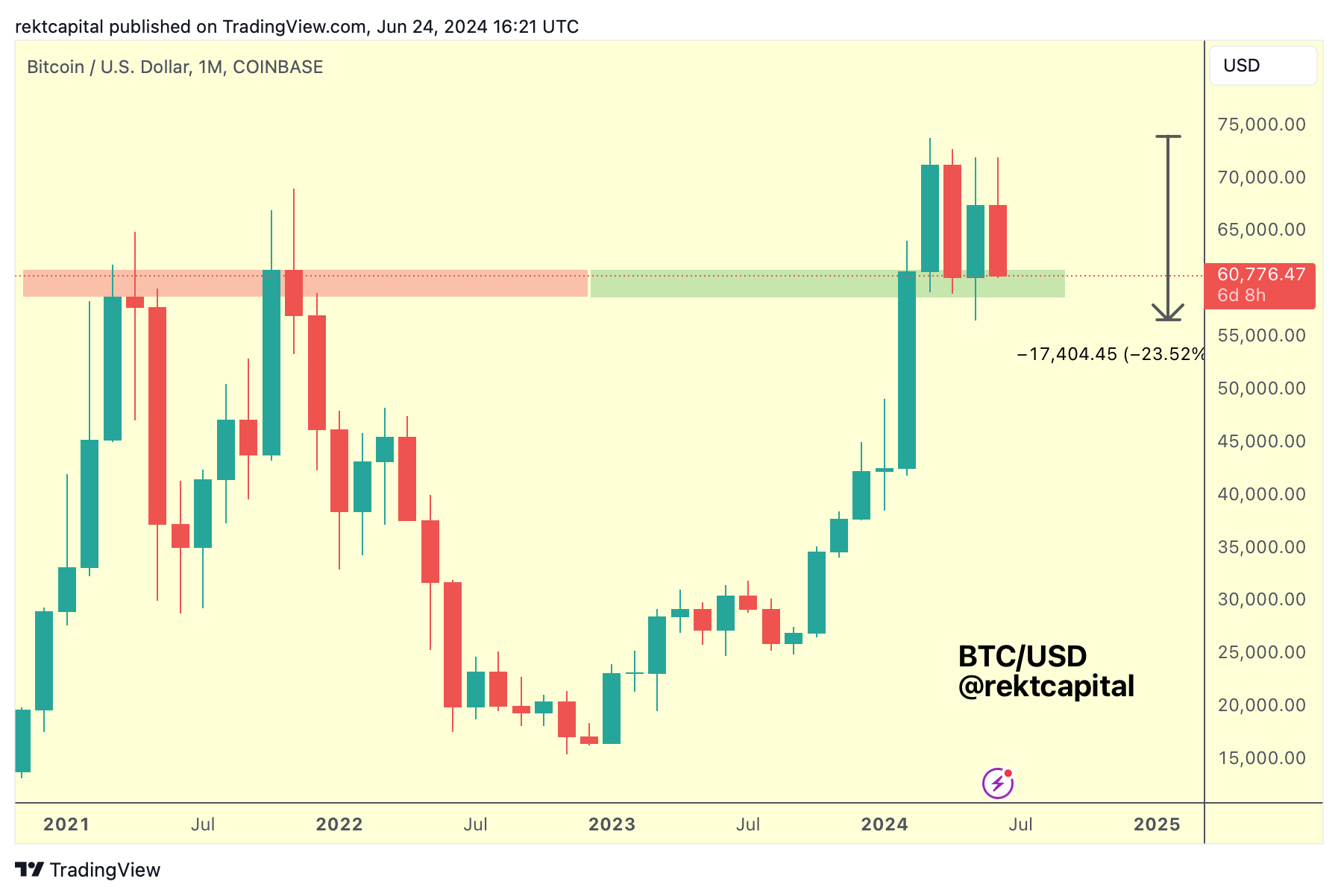

And here's this week's chart:

The rejection indeed took place and Bitcoin's sinusoidal range-bound behaviour continues, rejecting from Range High and returning to the Range Low.

Should this ReAccumulation Range continue to hold (and 2023-2024 ReAccumulation Ranges and historical Post-Halving Ranges suggest this one will), then price will likely cluster at the Range Low area only to reverse to the upside over time to revisit the higher levels in the range.

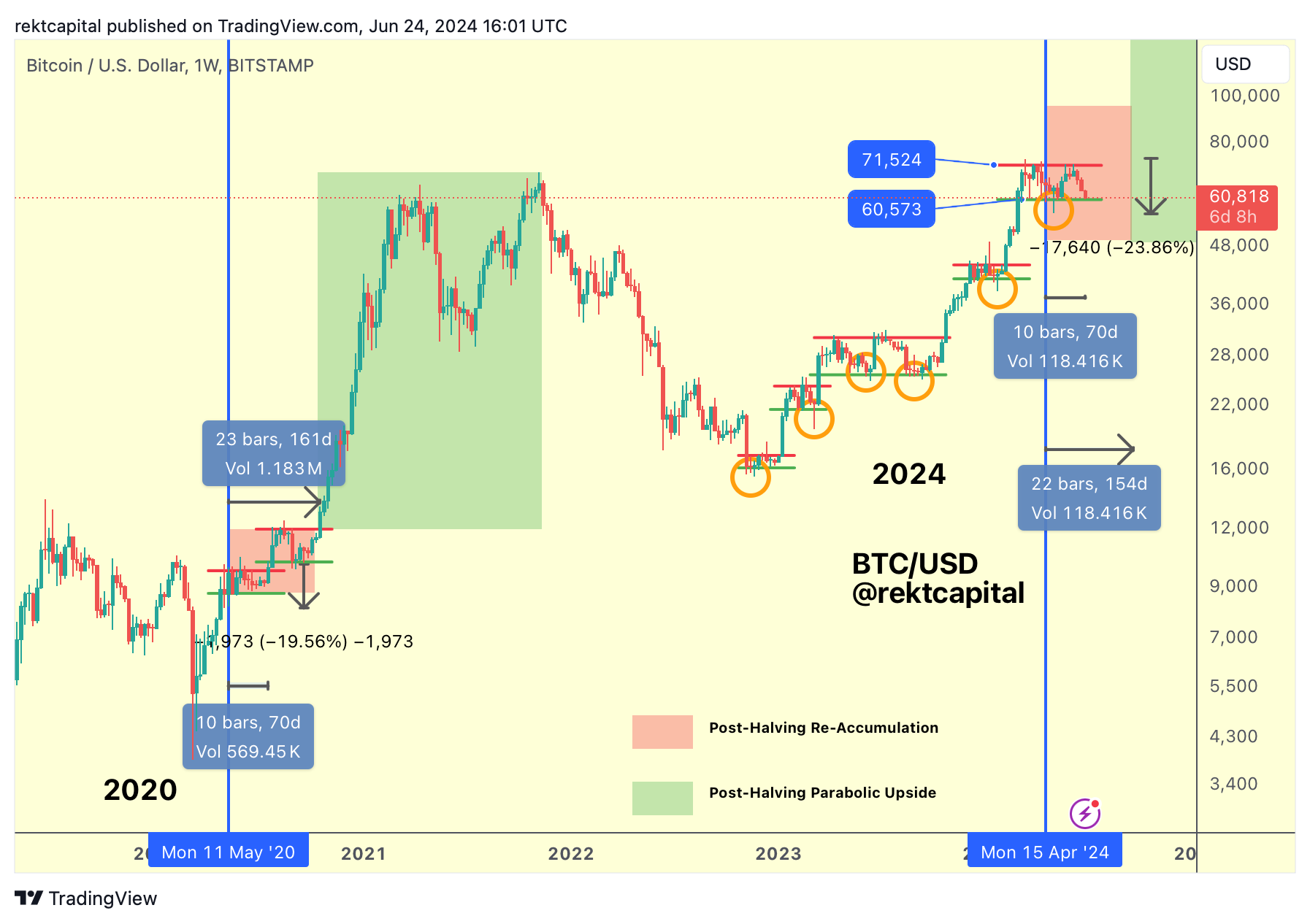

But Bitcoin does have a history of performing downside deviations, however brief, as part of a fake-breakdown process to grab liquidity at lower price levels and capitulate final panic sellers (orange circles):

For history to repeat once again, Bitcoin would need to deviate below the $60600 level once again but not Weekly Close below it.

In fact, Bitcoin would need to register a brief downside wick below the Range Low but ultimately Weekly Candle Close inside the ReAccumulation Range to preserve this market structure.

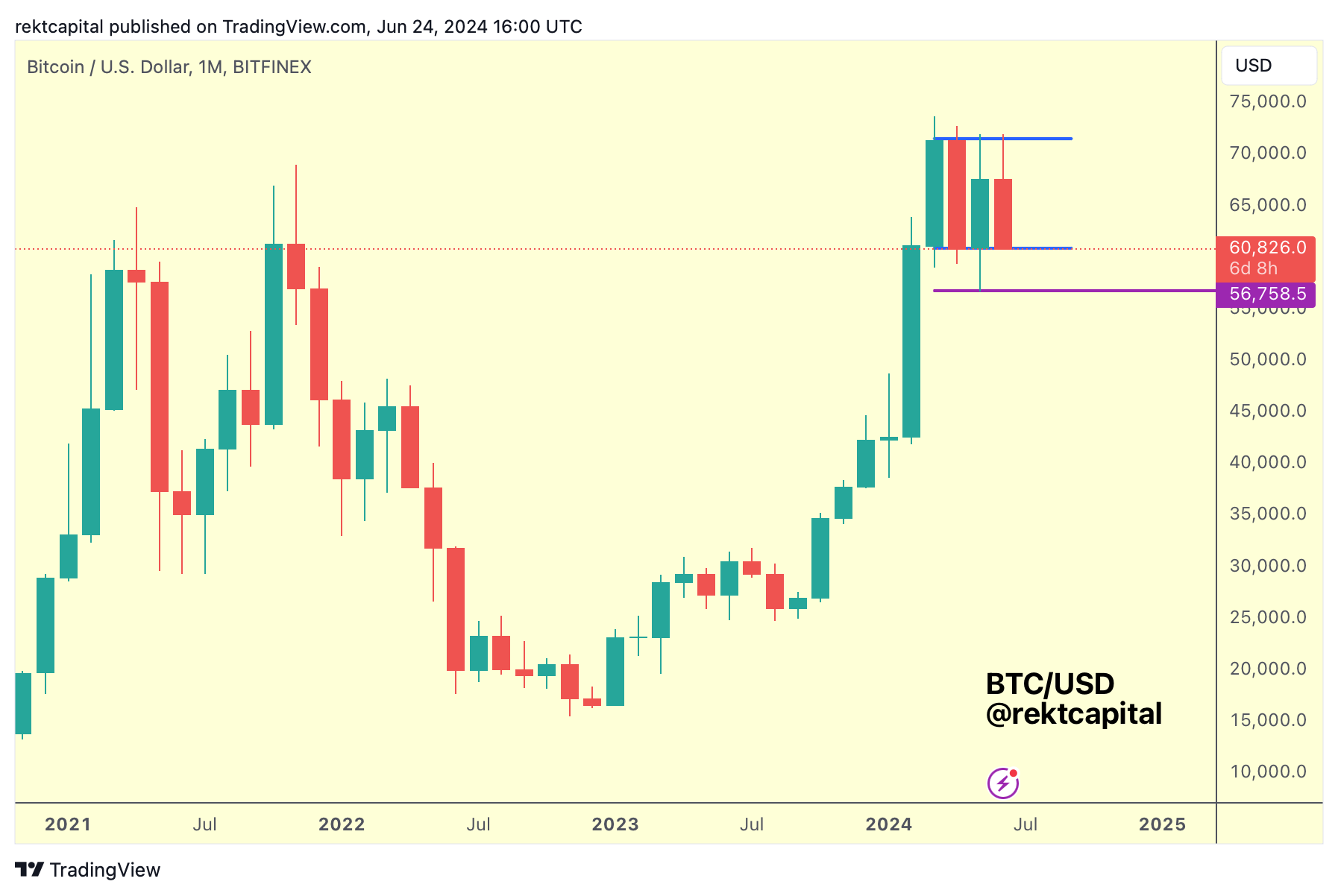

Monthly Range

Ultimately, the Monthly Candle Close will be most important.

Last month, Bitcoin downside deviated below the ReAccumulation Range to ~$56750 before finally Monthly Closing inside the Range.

In fact, over the past few months we'd seen a variety of downside wicks below the $60600 support; the longest wick took place last month, but even in March and April Bitcoin produced wicks as well, though much shorter.

With the Monthly Close just around the corner, there is scope for a highly emotional few days among investors, with price at crucial support right now.

This Monthly Range is developing above the previous old All Time Highs, once a point of rejection, now acting as a point of major support:

This sort of consolidation at highs has historically been a recurring theme for BTC when price would revisit the old All Time Highs:

This time is no different, though the range is much longer than in previous cycles.

Nonetheless, the re-accumulation area around old All Time Highs is still intact, but downside volatility awaits and it's essentially it isn't too prolonged a process.