Bitcoin - The Bull Market Peak

Understanding how to locate the BTC Bull Market peak using one of my favourite indicators

Less Than Two Weeks Away...

The Bitcoin Halving is less than two weeks away.

When you think about it, it really is a momentous occasion.

Every year, people celebrate New Year's Eve and make well-intentioned promises to themselves.

But how does one celebrate the Bitcoin Halving event, an event that comes around once every four years?

Historically, the New Year's resolutions people make tend to fail within the first few months of the New Year; gyms become empty around March.

On the other hand, historically, Bitcoin tends to enjoy exponential upside in the months following the Halving.

It's worth celebrating an event that enables a high-probability of success for your portfolio and in turn, and most importantly - your life.

Especially if the event comes by only once every four years.

Pre-Halving Retrace Or Re-Accumulation?

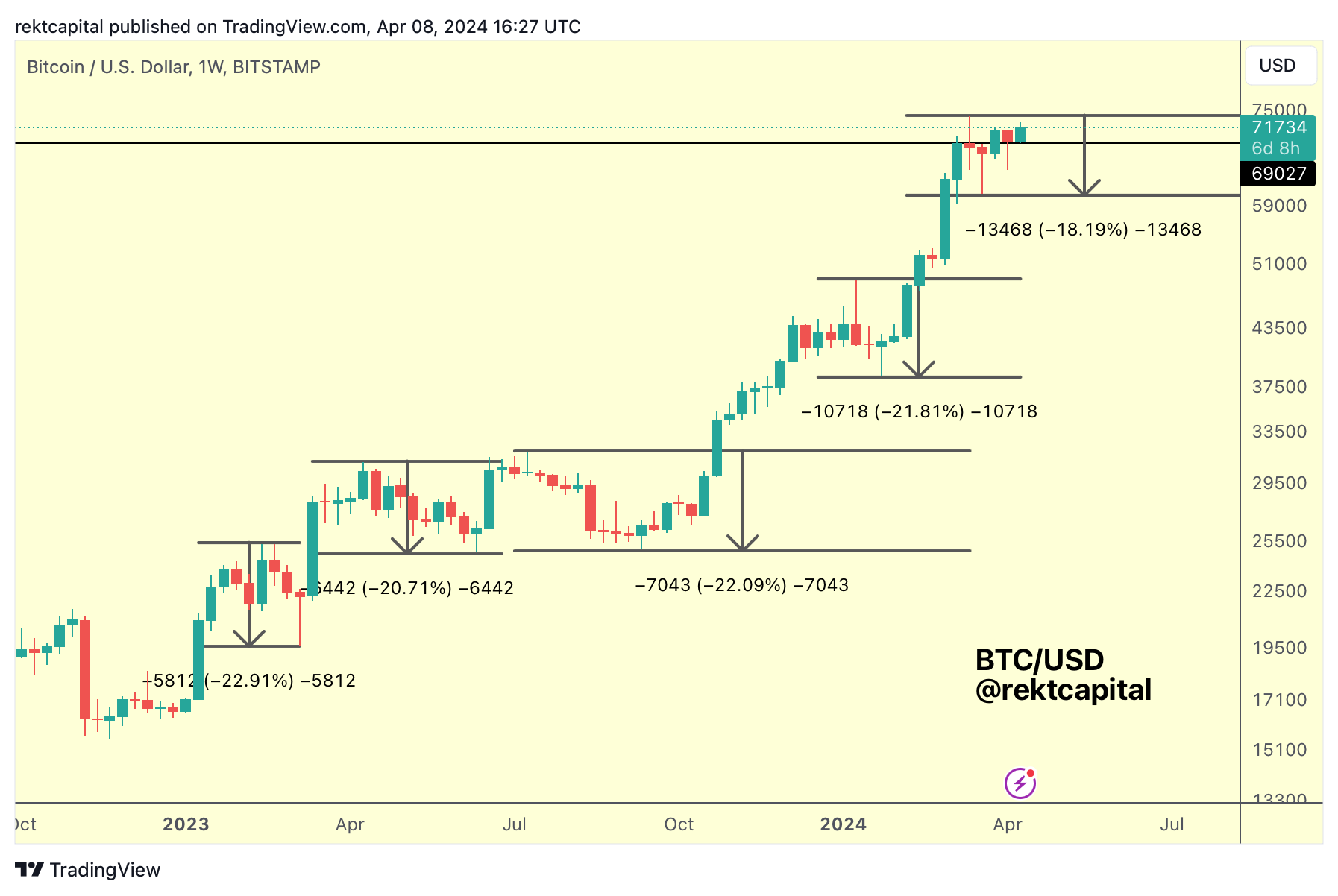

Bitcoin has been consolidating for a few weeks now, ever since that -18% pullback back in mid-March.

And if we think about the idea of an Accelerated Cycle, then this is exactly the sort of mean-reversion that price needs to decelerate and resynchronise with historical cycles.

Historically, Bitcoin always tends to experience a slow-down in its momentum going into the Halving event.

There tends to be a Pre-Halving Retrace period (dark blue circle) which then transitions price into a Re-Accumulation phase (red phase).

So based on Halving Cycles, this price action is not out of the ordinary.

But what's interesting about this price action is that we see then same tendency when price reaches old All Time High regions:

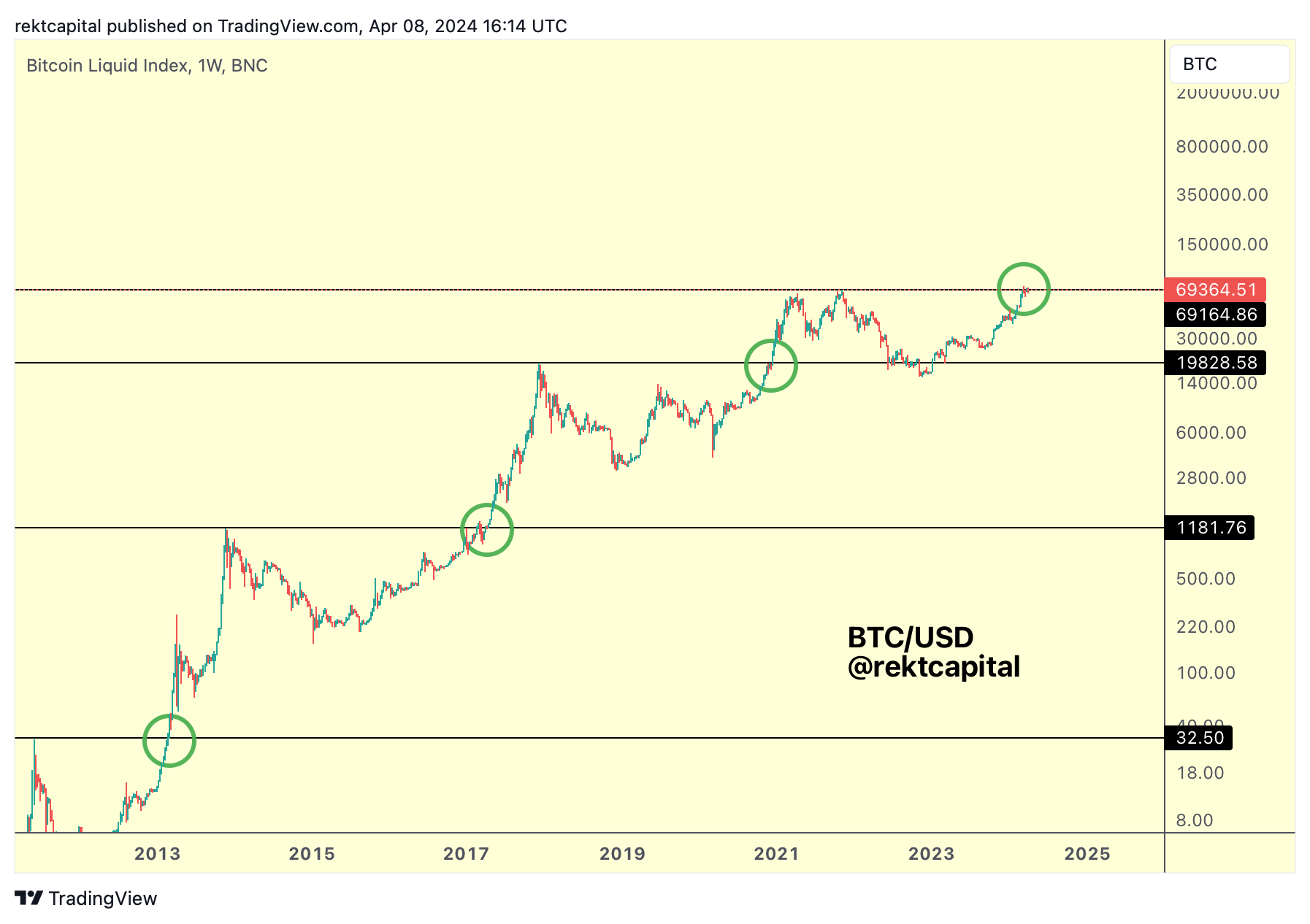

The green circles showcase that Bitcoin typically tends to experience lots of volatility in and around the old All Time High levels (black).

This upside and downside volatility invariably forms a Re-Accumulation period around these highs.

So we have this historical tendency and also the Halving Cycle tendencies that combine to offer double-confluence that this is simply the time to be patient.

It's a time to be patient, it's a time to accumulate on any pullbacks, it's a time to enjoy the last bargain-buying opportunity in the Pre-Halving period ever, before Bitcoin finally takes off into Price Discovery.

With the Halving less than two weeks away, the Pre-Halving Retrace phase is surely coming to a close and the Re-Accumulation phase is forming in full-force.

The Pre-Halving Retrace phase and the Re-Accumulation Phases are the only two bargain-buying opportunities left for Bitcoin.

And it's very likely that the Pre-Halving Retrace offers lower prices compared to the lows in the Re-Accumulation Phase.

But as the conditions change and the cycle evolves, buying Bitcoin at higher prices may feel strange but the reality is that those slightly higher prices are most likely going to be the best and lowest prices the market will offer us before price breaks out into Price Discovery.

And this is simply an effect of premium-buying behaviour as market participants are more trigger-ready to buy on pullbacks, whenever they materialise.

This is true on the more week-to-week basis but also on a month-to-month basis: Bitcoin hasn't pulled back more than -23% since November 2022:

The main takeaway is simple:

- Any pullbacks are absolute must-have opportunities when they happen, if they happen

Because after the Halving, there may very well be a period of consolidation but this will be the very last slow period before things really pick up.

And Altcoins, which have bottomed and reversed quite considerably, still haven't even caught up to Bitcoin yet.

So this phase in the market is all about strategising, preparing, positioning yourself for success, and being ready to take opportunities when they arise.

The window for outsized opportunity for Bitcoin is narrowing.

Price Discovery awaits, but with time.