Bitcoin - How Deep Could Bitcoin Retrace?

Preparing for the ETF aftermath

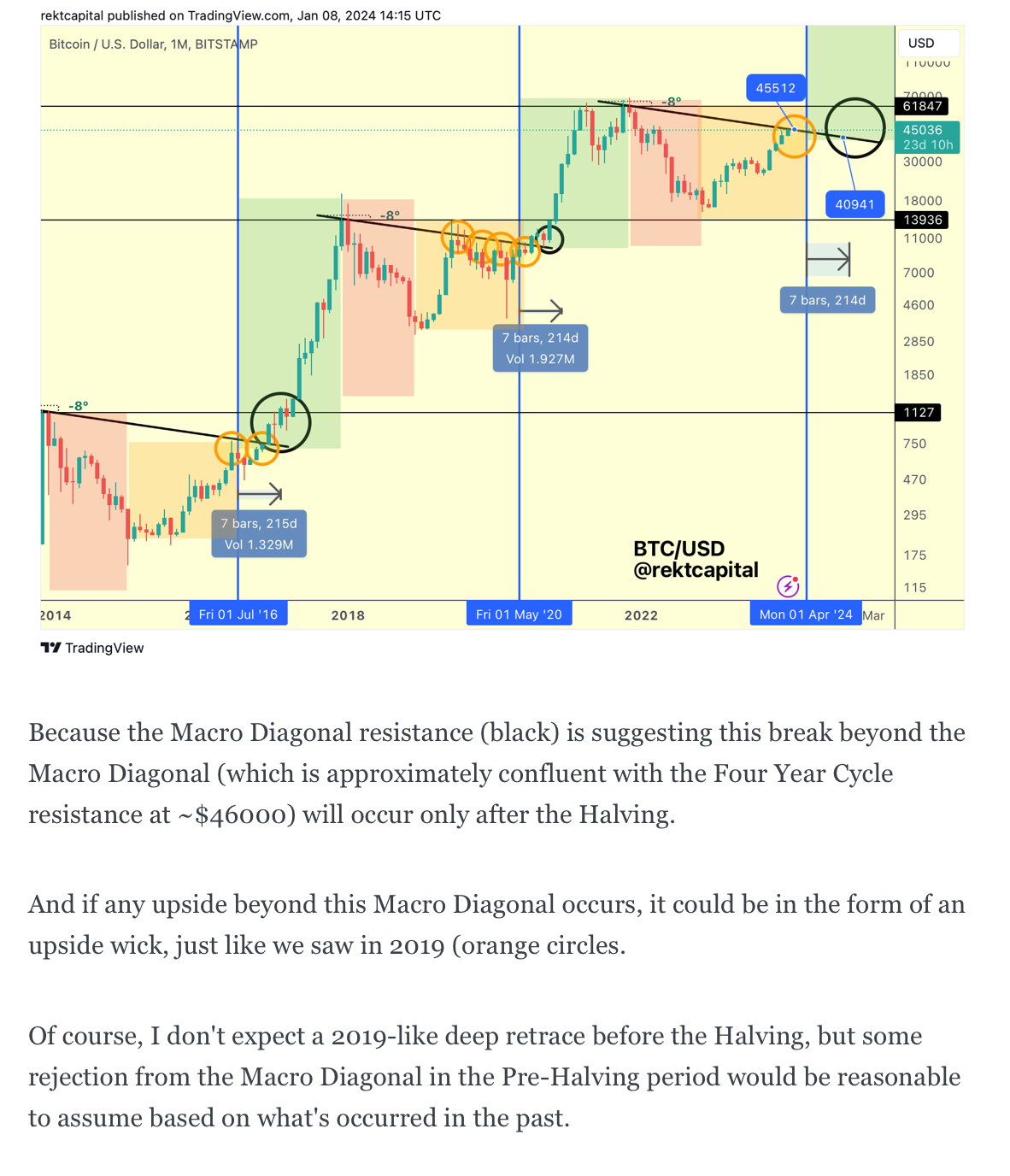

Bitcoin - The Macro Diagonal

Here is last week's analysis, as a preface:

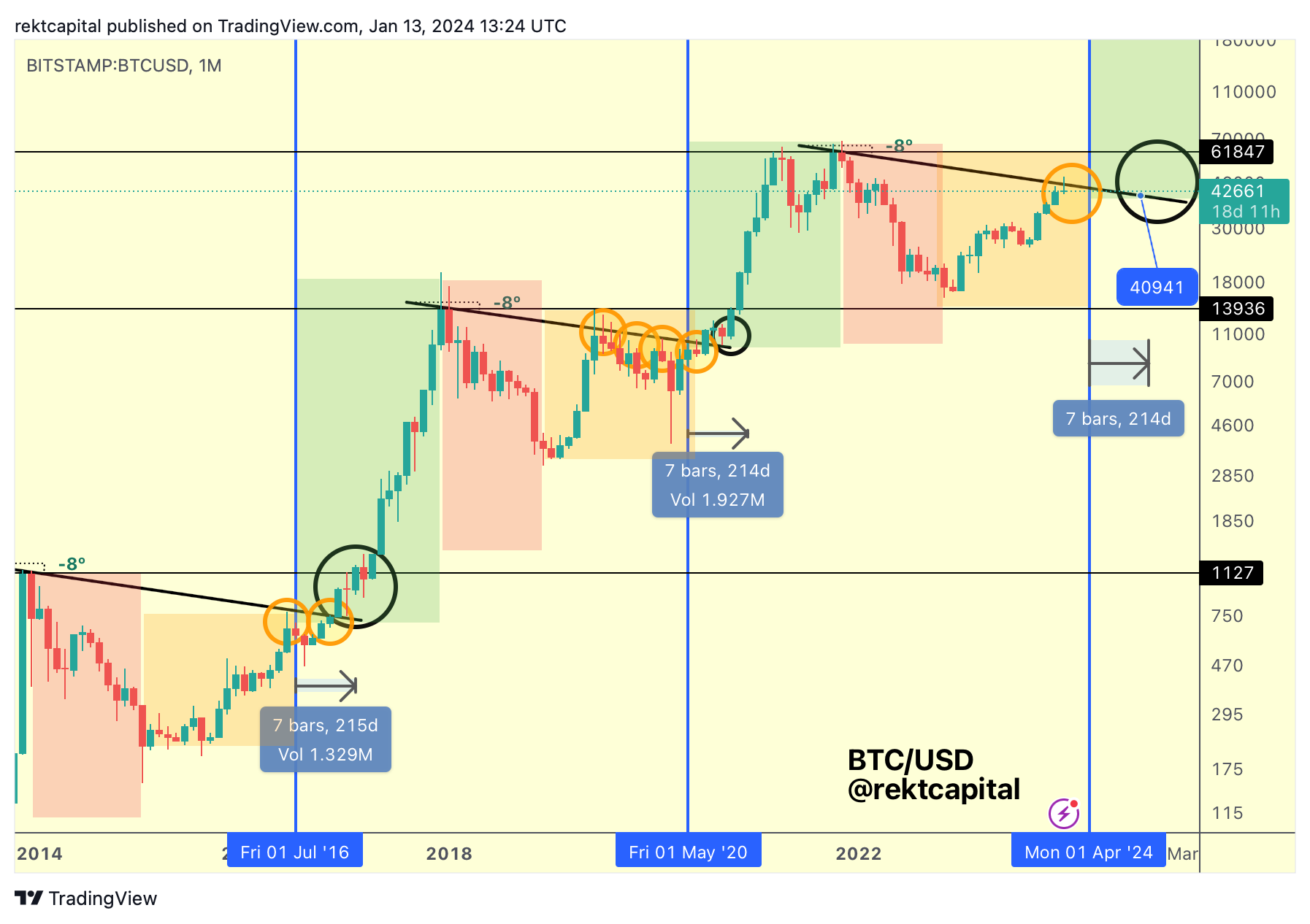

And here is today's analysis:

The Macro Diagonal is indeed rejecting price.

In fact, we even anticipated a possible upside wicking scenario beyond the Macro Diagonal which has since occurred.

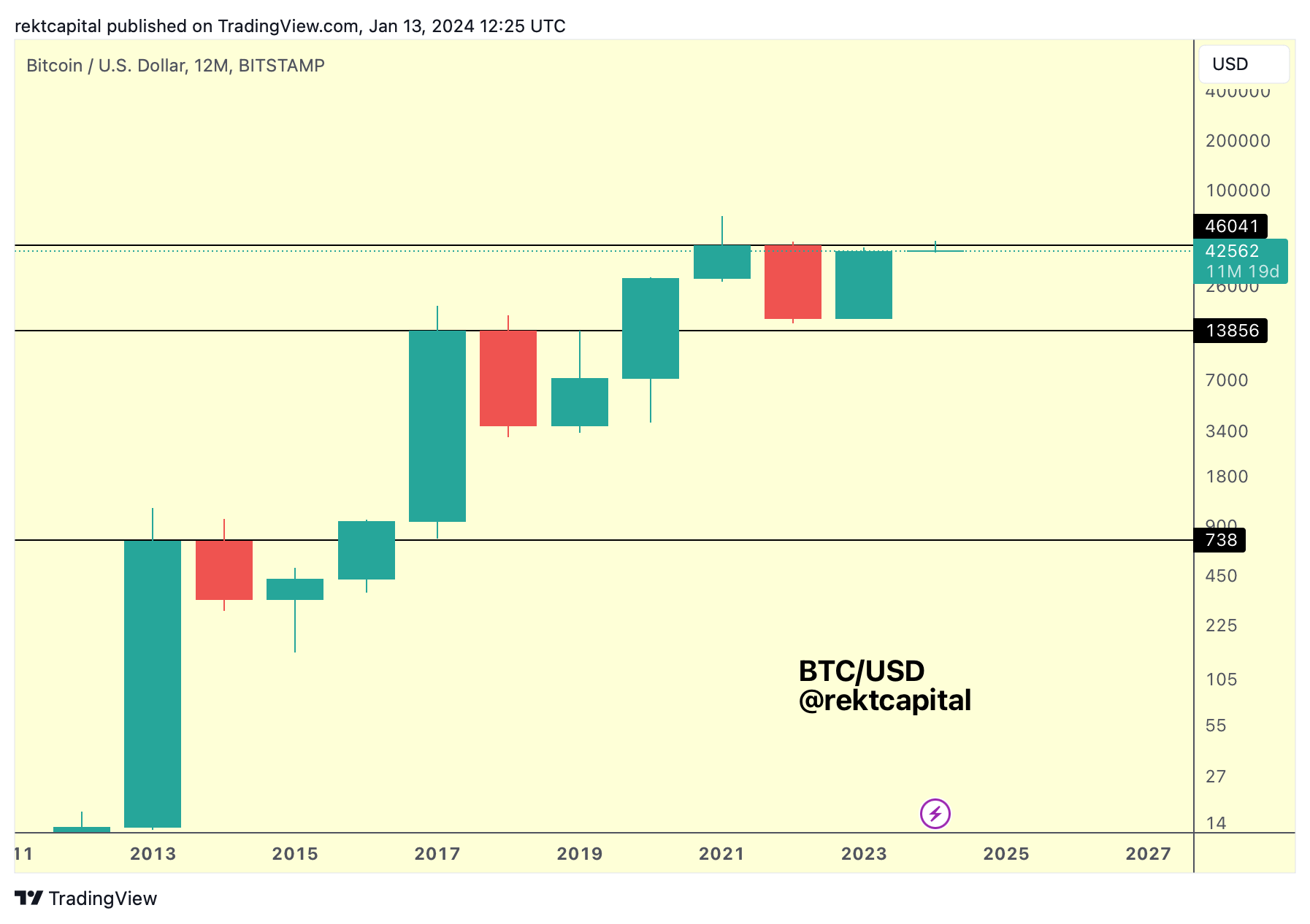

Most importantly, history appears to be repeating itself whereby the Macro Diagonal resistance (black) is reacting price in the Pre-Halving period.

However after the Halving, this Macro Diagonal will most likely turn into a new support and that pivotal technical moment tends to occur 200+ days after the Halving event itself.

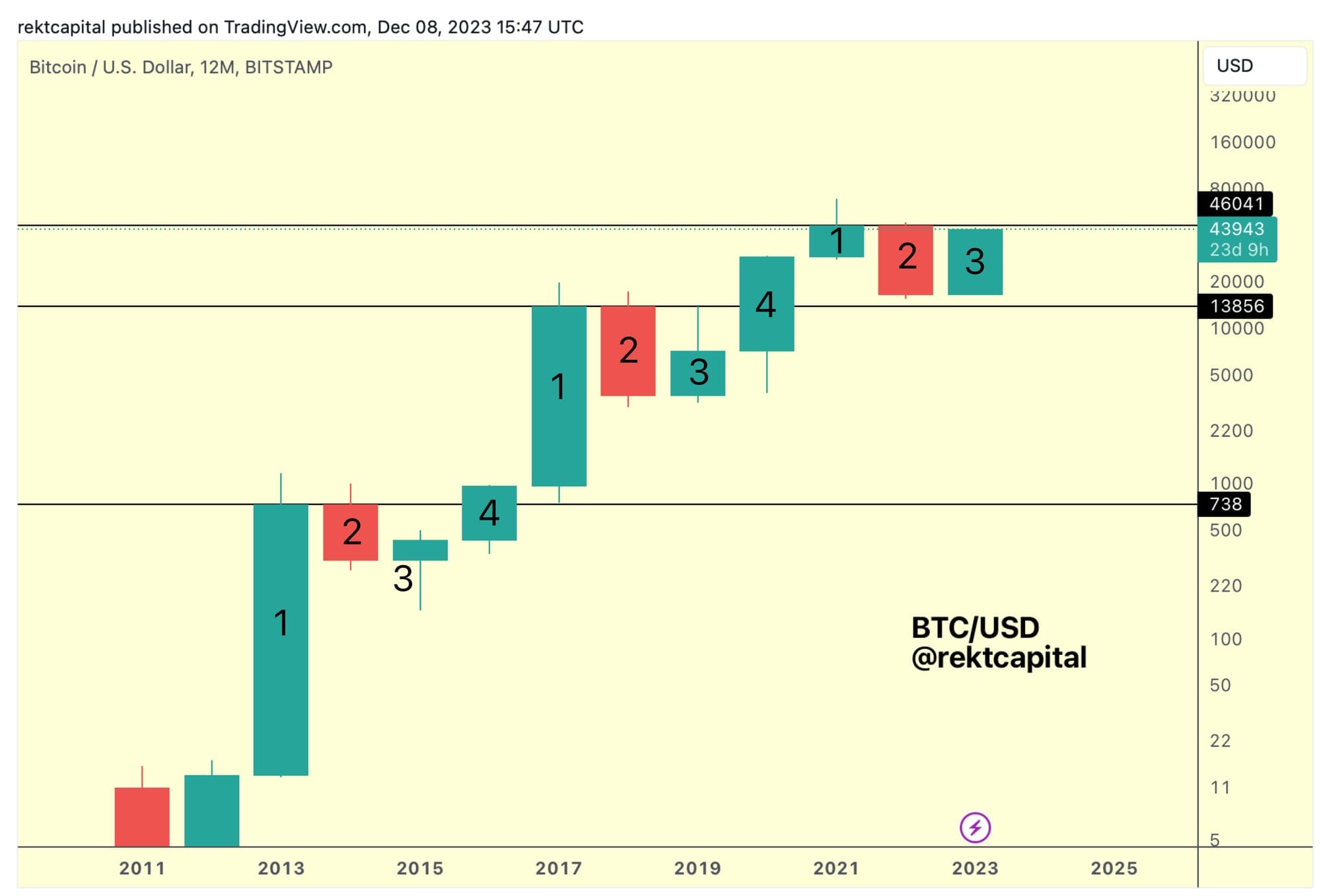

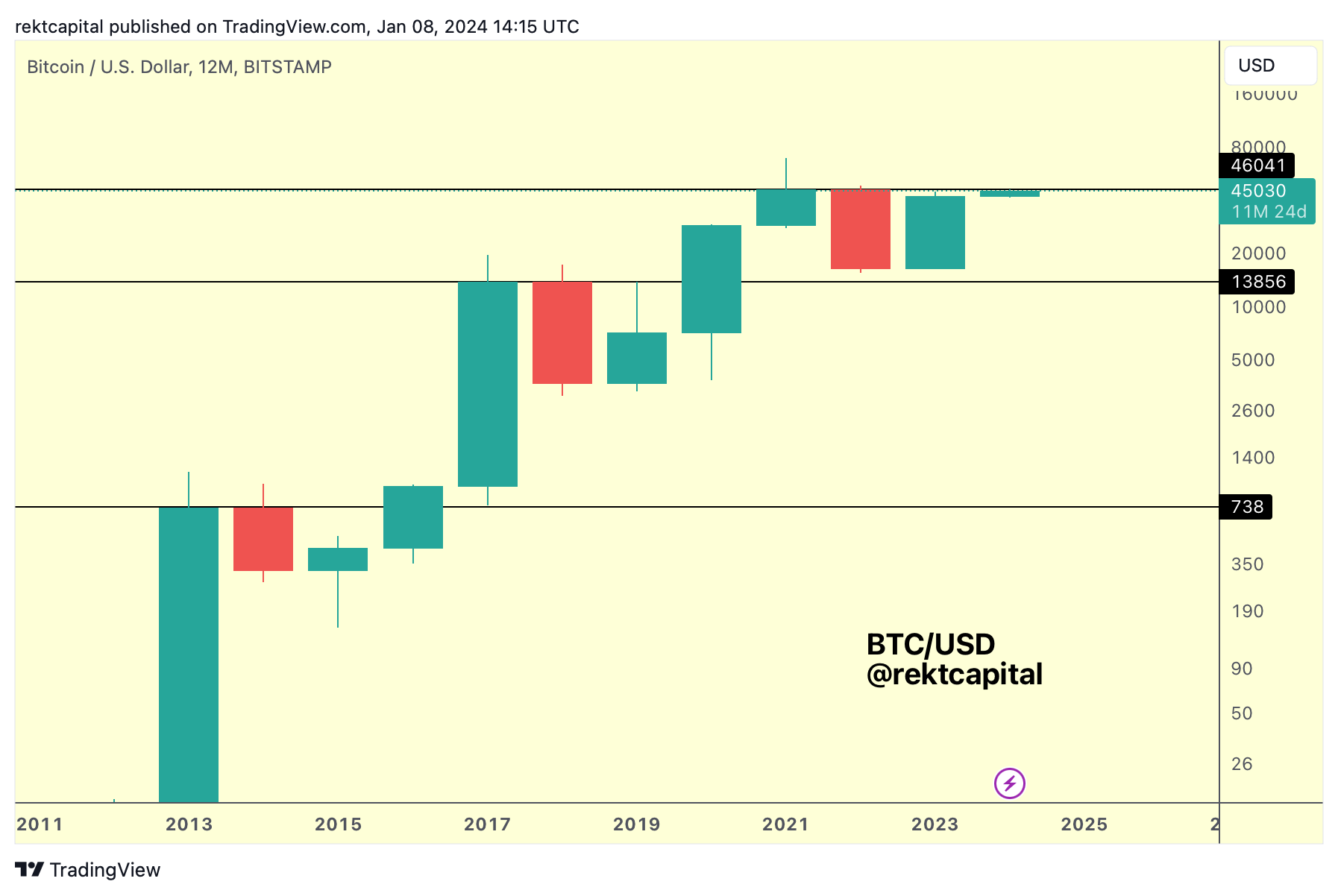

Is this the Pre-Halving top?

The Macro Diagonal as well as the Four Year Cycle resistance suggest this to be the case:

Because just like we mentioned in that aforementioned newsletter excerpt, the Macro Diagonal is approximately confluent resistance with the Four Year Cycle resistance which represent the price point of ~$46000 (black).

And typically, the new Candle 4 (i.e. Halving year) tends to reject from this Four Year Cycle resistance (black) earlier in the new year and this time has been no different:

So while Bitcoin tends to reject from the Four Year Cycle resistance early on in its Halving year, it is only after the Halving event that price tends to break beyond the Four Year Cycle resistance (black) rather comfortably.

So where does that leave us?

What's next?