Where Could Bitcoin Peak In The 2021 Bull Market?

The Bitcoin Halving Series Part 3 of 4

Welcome the Rekt Capital newsletter, a place for people who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Today’s newsletter edition is Part 3 of the series and is free for everybody to read.

I write research articles just like this one every Monday for subscribers of the Rekt Capital newsletter.

So if you’d like to receive cutting-edge research like this straight to your inbox, feel free to sign up for $12 a month:

Preface

This newsletter is Part 3 of the Rekt Capital Bitcoin Halving Series.

It focuses on addressing what investors could expect from Bitcoin’s price in the several months that lie ahead.

It addresses two simple questions:

- How much did Bitcoin rally in the months after its previous Halvings?

- Based on these historical insights, how much could Bitcoin rally in the months ahead?

Let’s dive in.

(In case you missed them, feel free to read Part 1, Part 2 and Part 4.)

Part 3

Bitcoin After The Halving and Beyond

Let’s take a look at how previous Halvings have affected the price of Bitcoin.

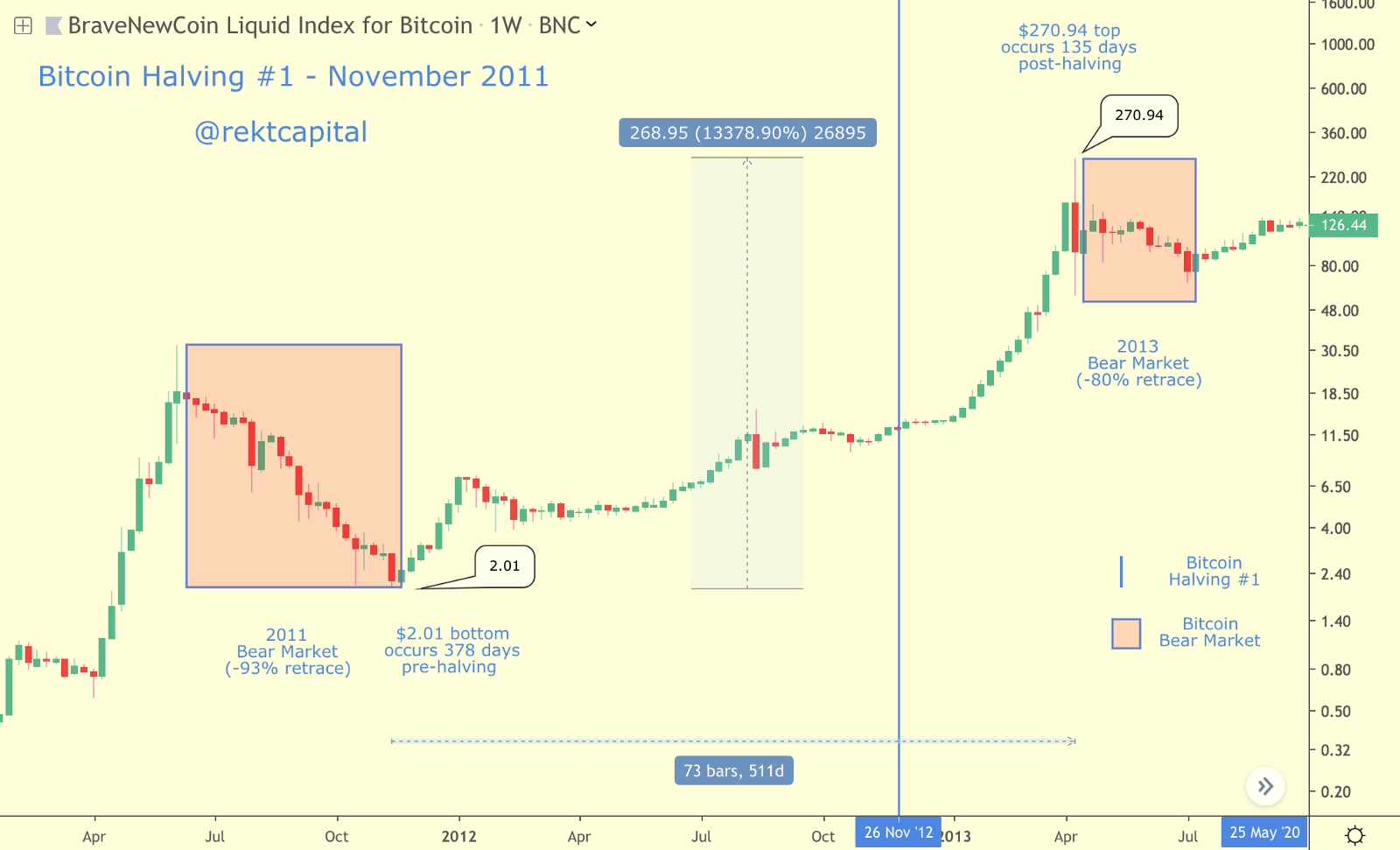

The first Bitcoin Halving spurred 13,378% growth in Bitcoin’s price whereas the second Bitcoin Halving spurred a 12,160% rally.

A 12,160% rally from Bitcoin’s mid-December 2018 bear market bottom of $3,150 would result in a ~$383,000 Bitcoin:

By the same token a 13,380% rally would lead to a ~$420,000 Bitcoin:

These exponential estimates are based on Bitcoin’s historical performance prior to and after its previous Halvings. That is, these estimates span the entirety of the Bitcoin Market Cycle.

But now that Halving #3 is in the books, let’s dissect the Bitcoin Market Cycle into its pre-Halving and post-Halving stages and strictly focus on post-Halving price performance across history:

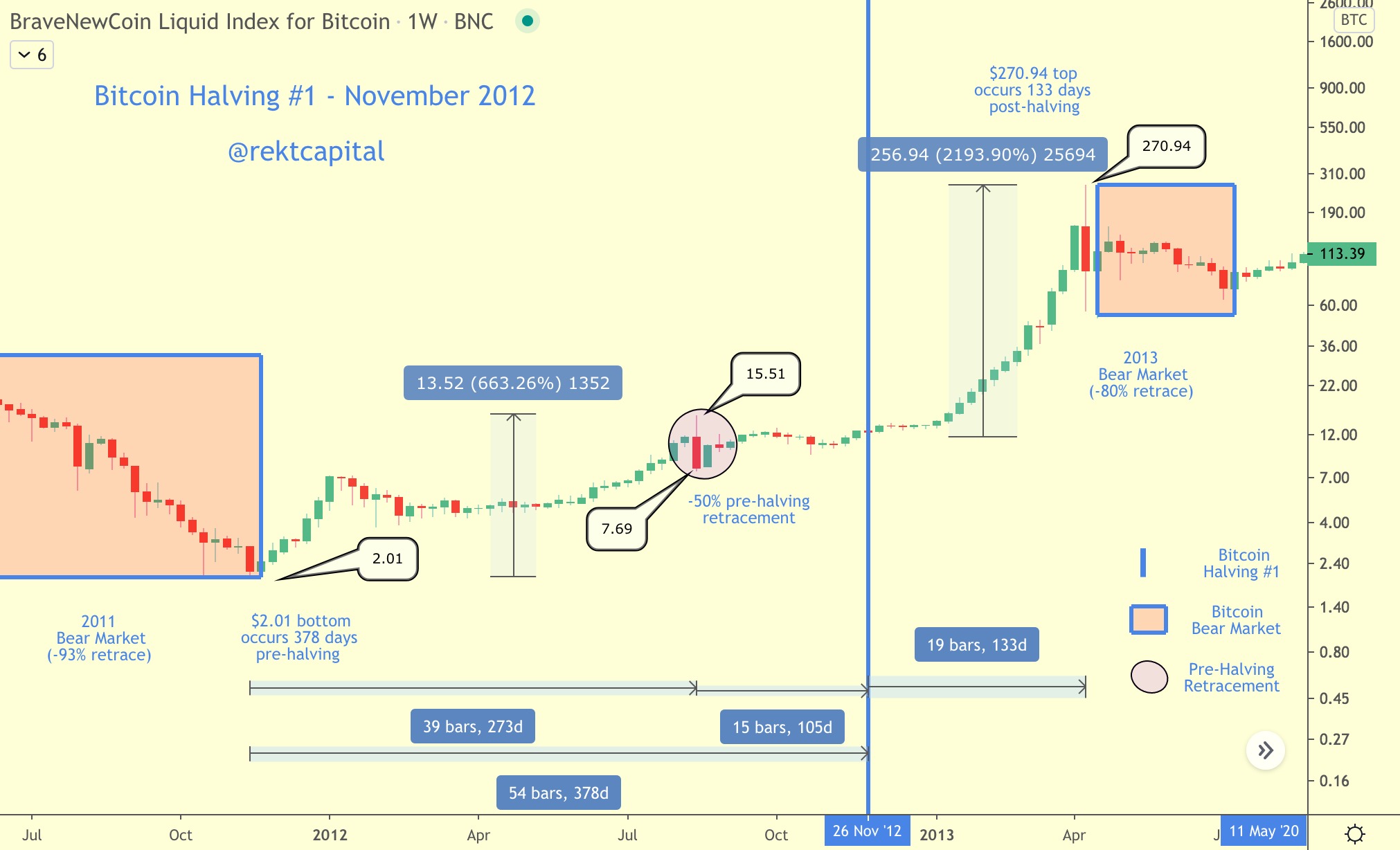

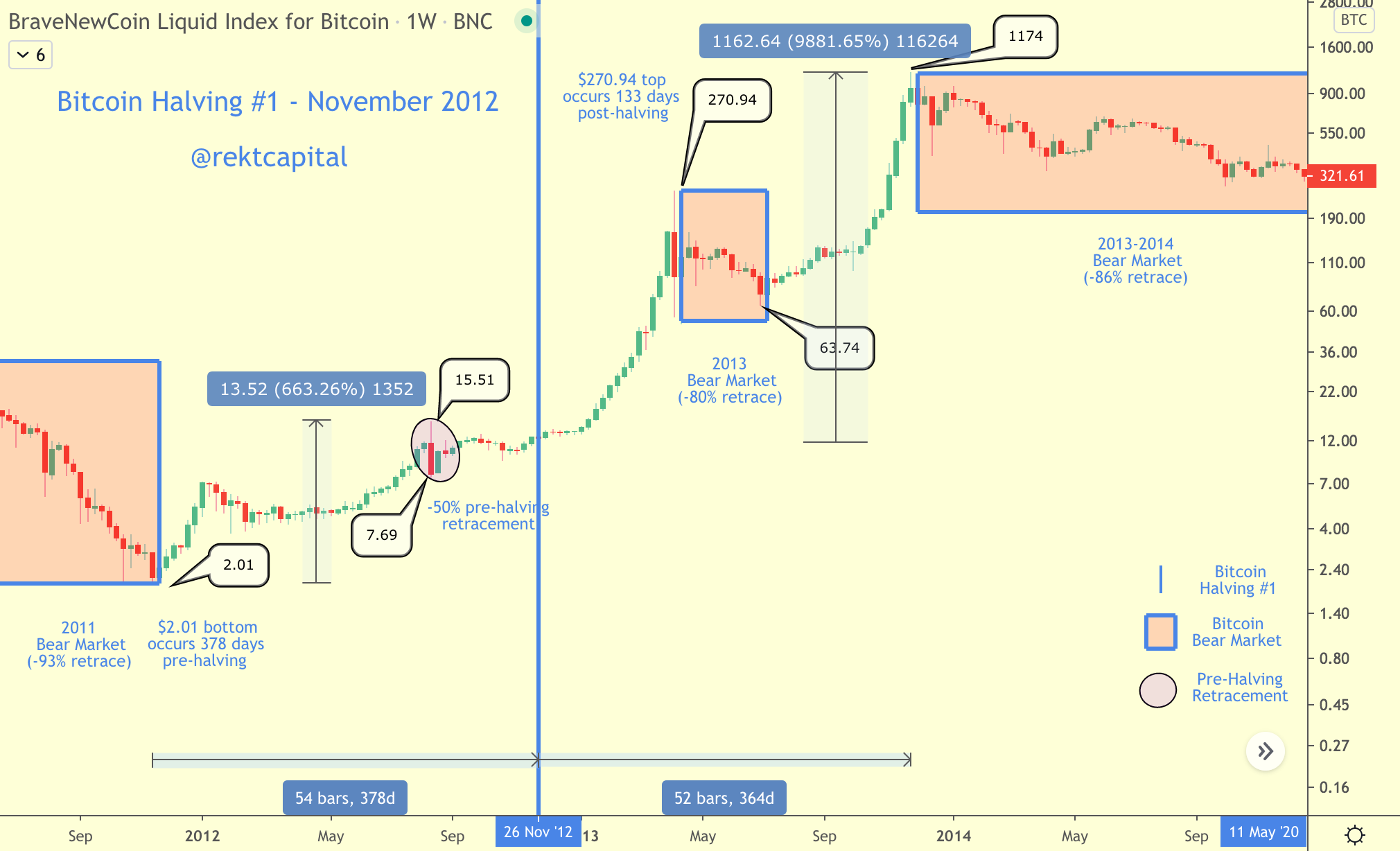

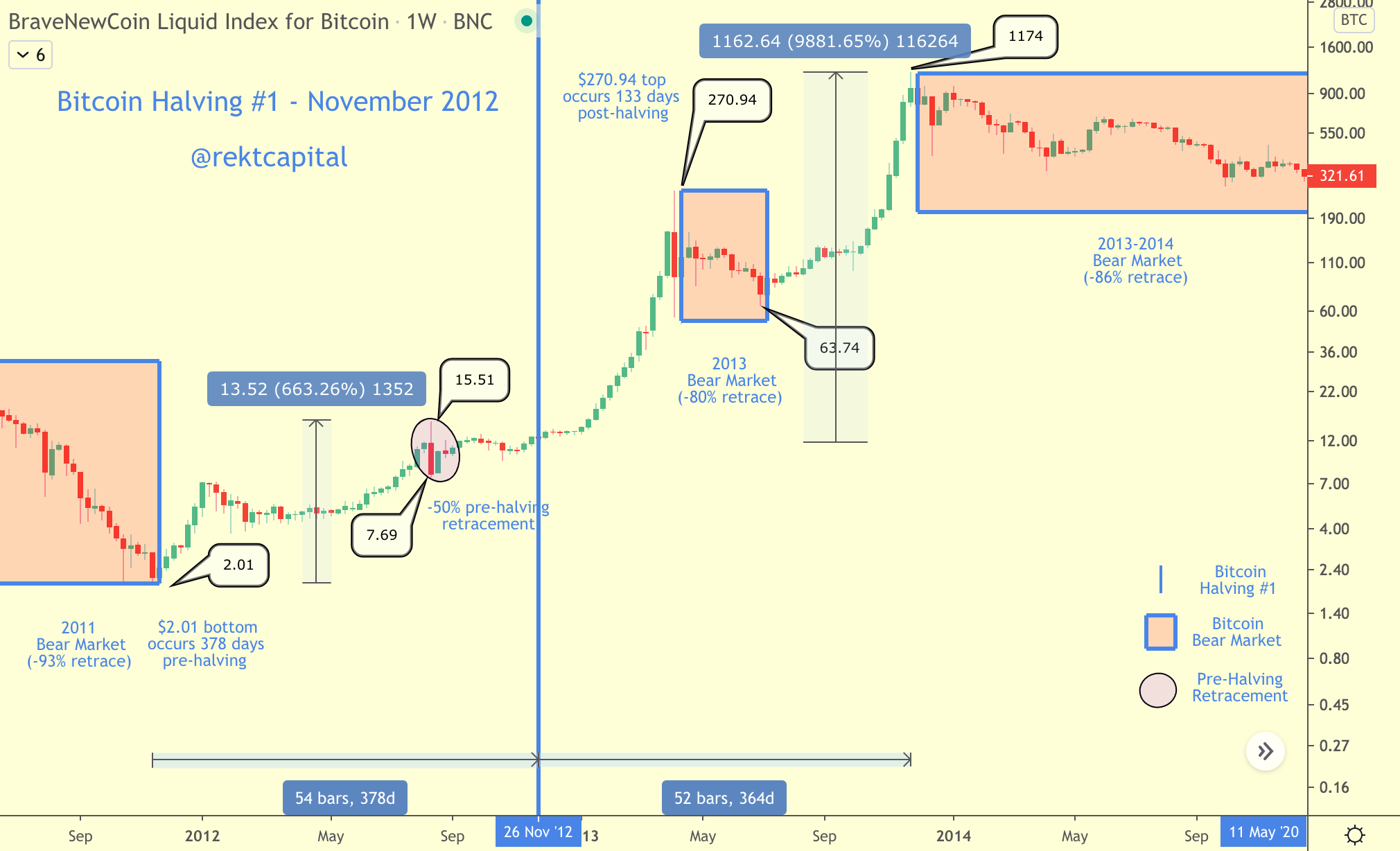

Bitcoin Post-Halving #1:

After the 2011 Bear Market where price retraced -93%, Bitcoin finally bottomed at $2.01, approximately 378 days before Halving #1.

Leading up to Bitcoin’s first Halving, Bitcoin rallied 663% to reach the pre-Halving top of $15.51.

Once Bitcoin bottomed after its -50% pre-Halving retrace, Bitcoin rallied almost 2200% in just over 130 days post-Halving to reach its Market Cycle top of $270.94.

However, there is a noteworthy, unique quality that Bitcoin’s price showcased after Halving #1.

It fragmented into two distinct Market Cycles:

After its initial +2200% post-Halving #1 rally, Bitcoin endured an -80% Bear Market correction that lasted ~84 days.

In previous Halving-focused articles, I would emphasise this specific, immediate Market Cycle after Halving #1 so as to best isolate the effects of a purely Halving-based uptrend, in the immediate months after the Halving.

After all, the 2013 Bear Market was catalyst-based and, to some extent, derailed the Halving effect, however briefly.

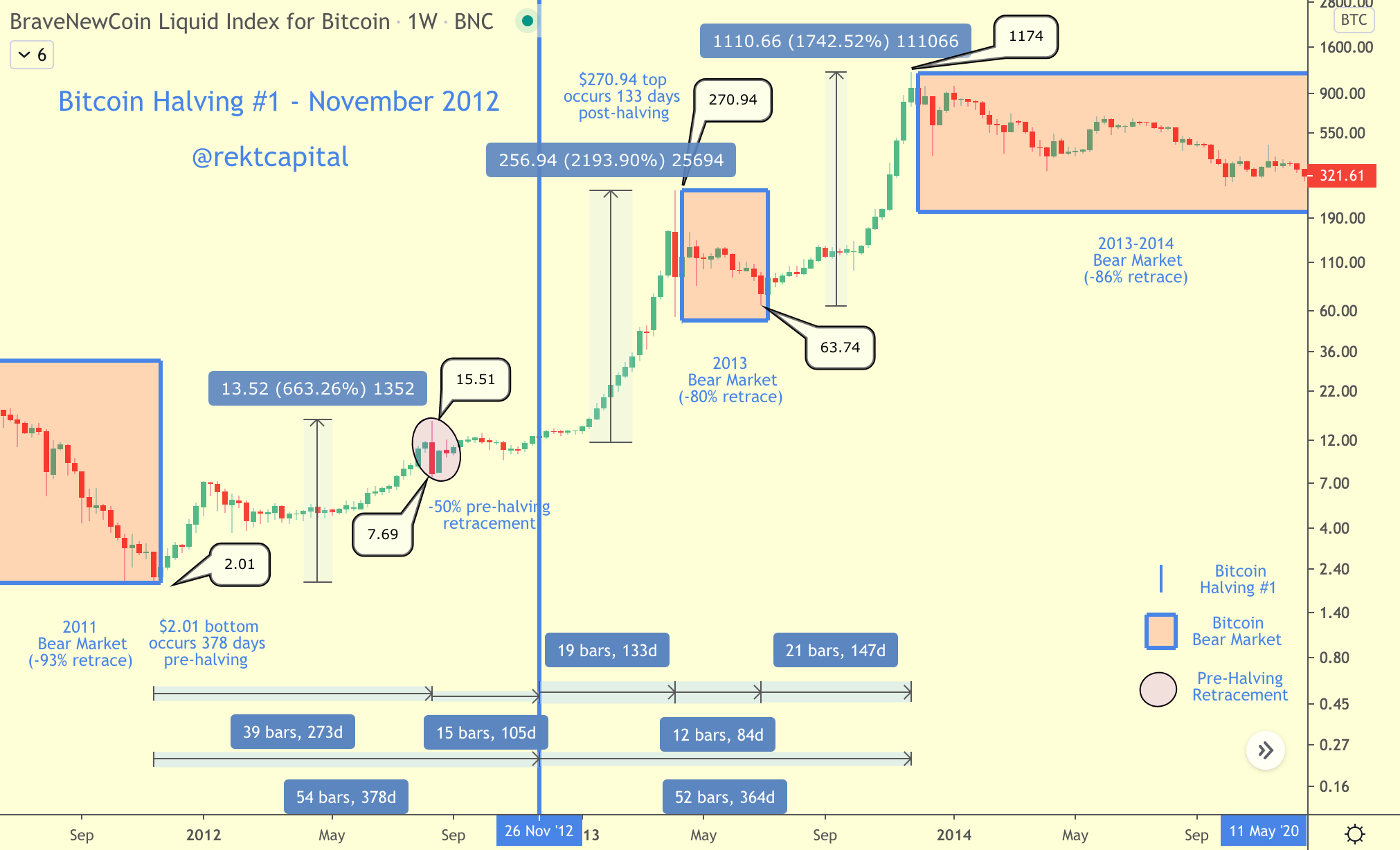

For transparency’s sake though, it is worth looking into the recovery that followed the -80% Bear Market in 2013.

During this recovery, Bitcoin enjoyed a new +1742% uptrend to reach a Market Cycle top of $1174, before enduring yet another Bear Market which was -86% deep.

In short, Bitcoin’s post-Halving #1 performance was fragmented into two different Market Cycles whereby a) Bitcoin first rallied almost +2200% then experienced a -80% shortly afterwards before b) recovering into yet another uptrend that saw price appreciate +1742%.

If we sum up the total price appreciation of Bitcoin’s post-Halving #1 price performance however…

Bitcoin’s price appreciated +9881% overall after Halving #1.

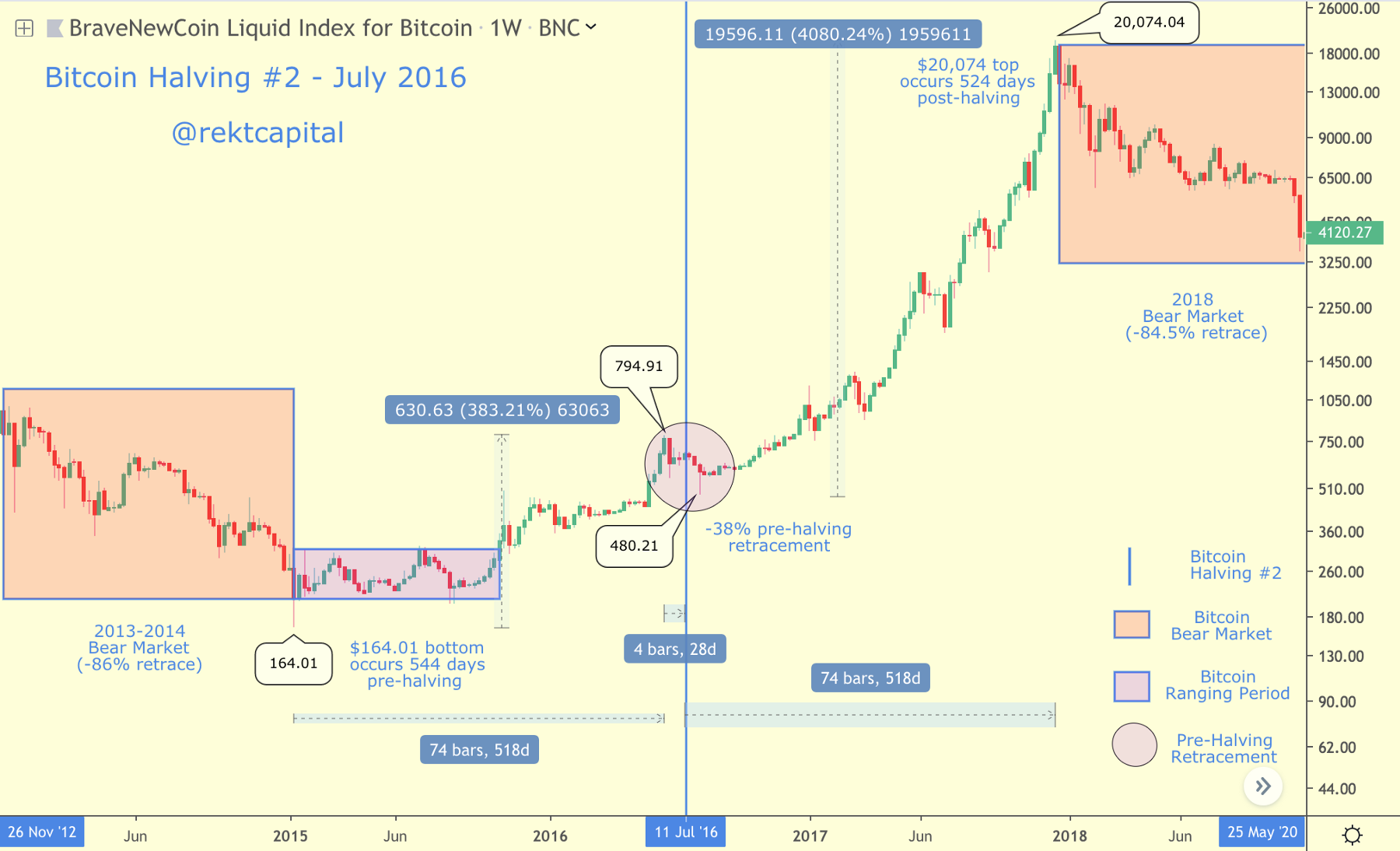

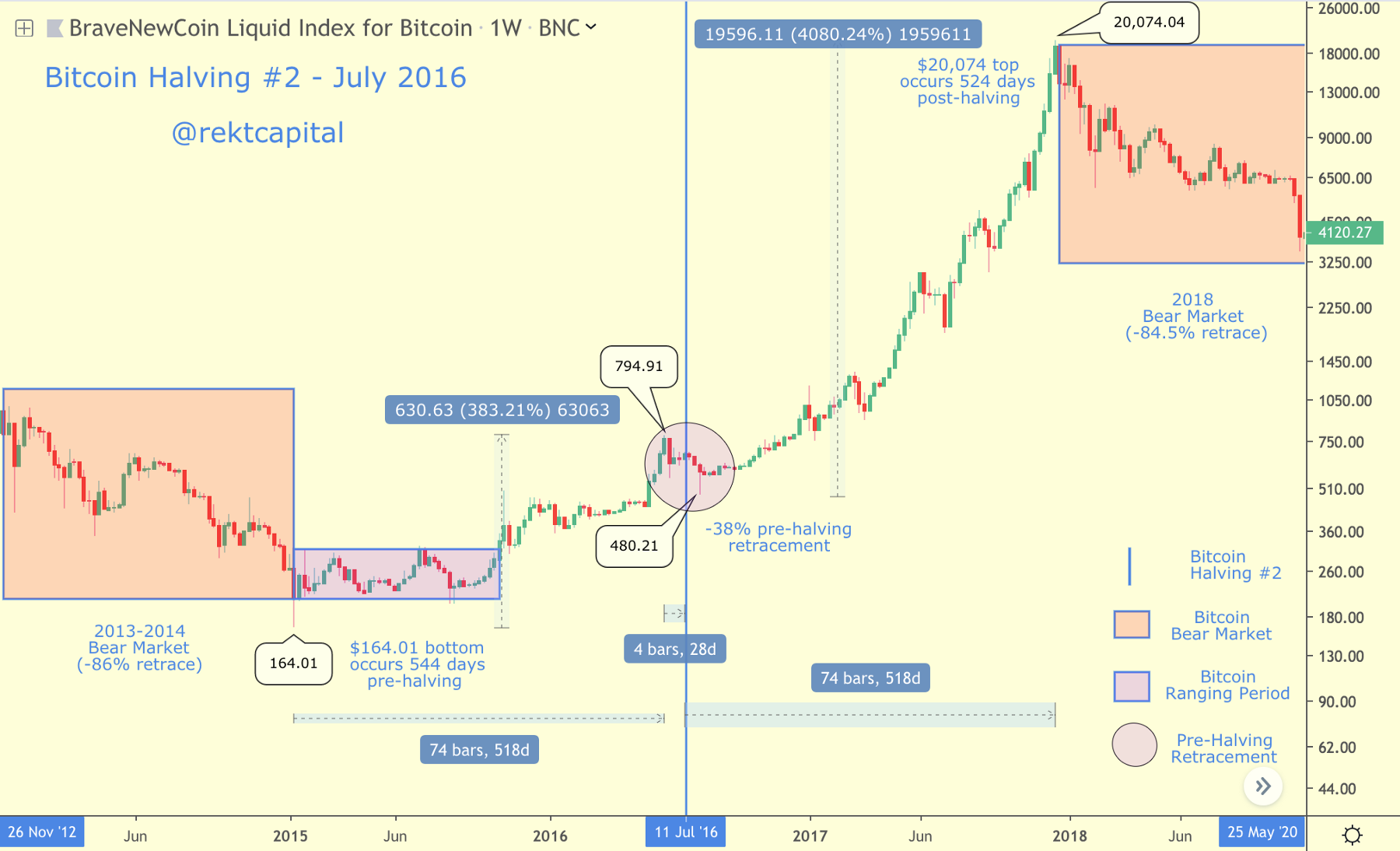

Bitcoin Post-Halving #2:

Leading up to Halving #2, Bitcoin rallied 383% to reach the pre-Halving top of $794.91.

Bitcoin rallied 4080% in 524 days to reach the Market Cycle top of $20,074.

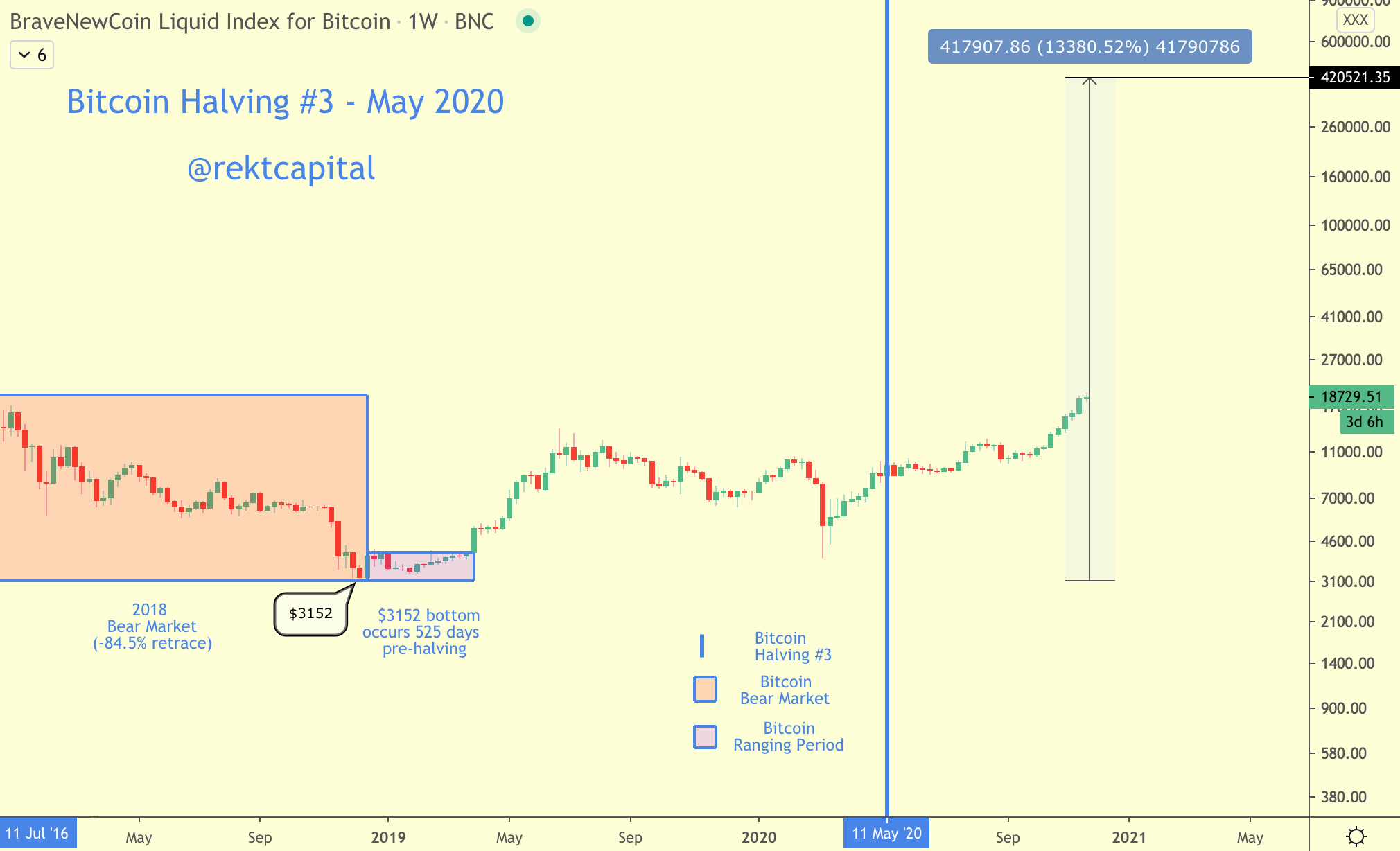

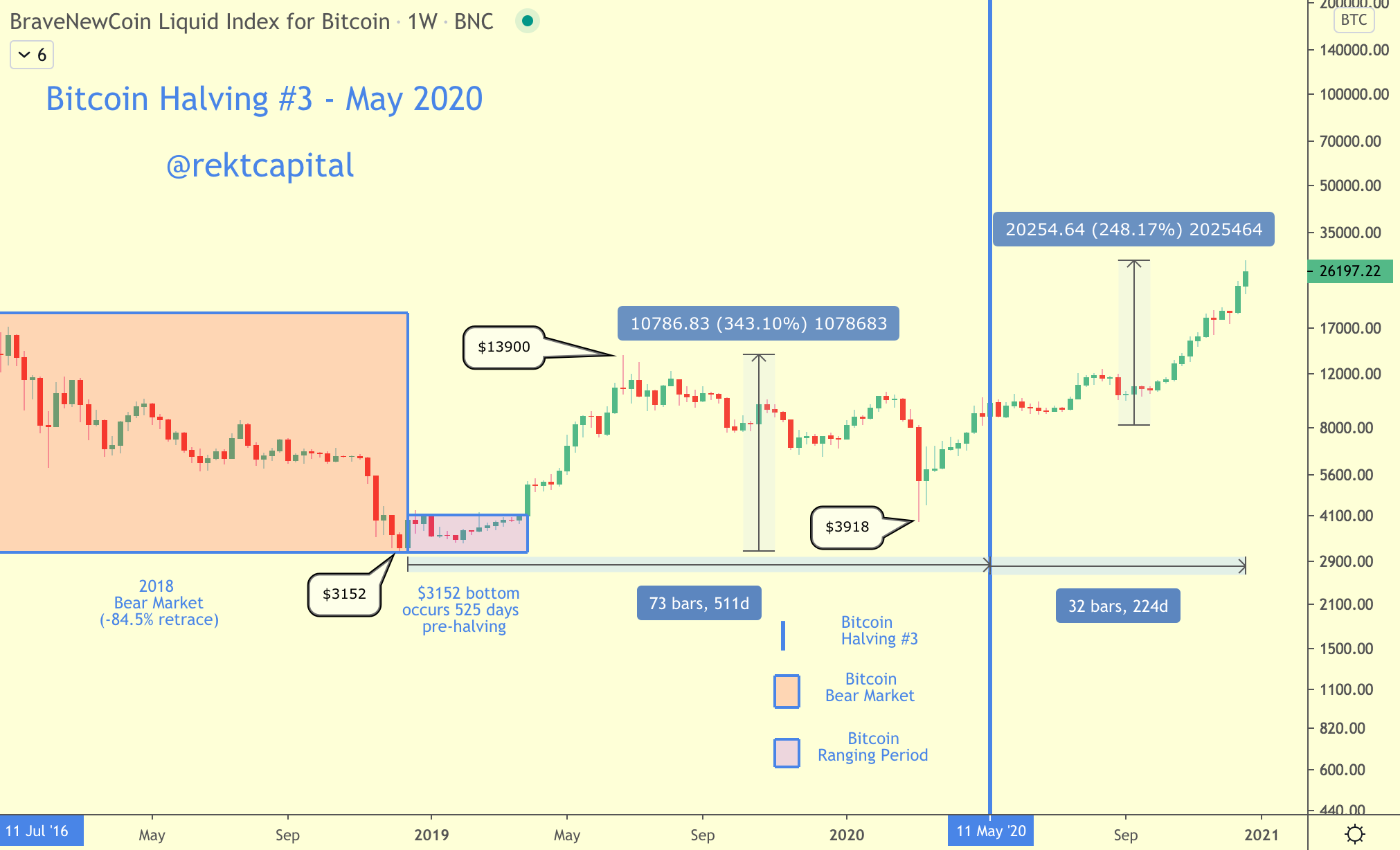

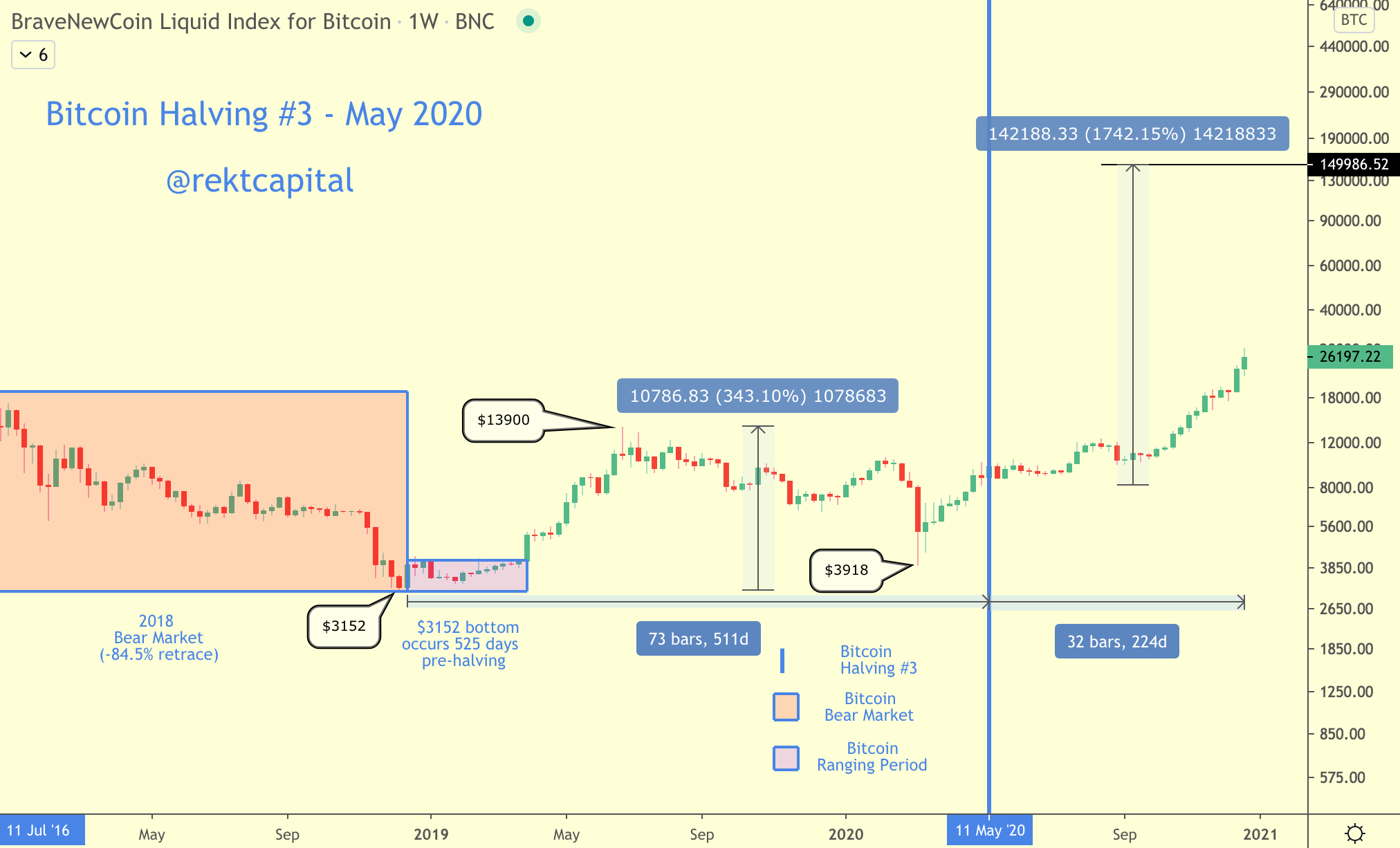

Bitcoin Post-Halving #3:

After the 2018 Bear Market where price retraced -84.5%, Bitcoin bottomed at $3152, approximately 511 days before Halving #3.

Leading up to Bitcoin’s third Halving, Bitcoin rallied +343% to reach the pre-Halving top of ~$13,900.

Overall, Bitcoin has rallied +805% since its $3152 bottom so far, eclipsing the previous All Time High of $20,000 in the process.

Bitcoin’s post-Halving #3 performance confirms an important, historically-recurring tendency across all Halvings:

- The Bitcoin Halving serves as a major catalyst for new Bitcoin Bull Markets.

- Several months after each Halving, Bitcoin tends to eclipse its old All Time High, rallying to new, uncharted price levels.

- Most of the exponential growth in Bitcoin’s price as a result of the Halving tends to occur after the Halving

Let’s now focus specifically on Bitcoin’s performance after Halving #3:

As of this writing, Bitcoin is up +248% since its $8161 price point at the time of Halving #3.

How could Bitcoin’s Third Halving affect Bitcoin’s price?

Earlier in the article, we spoke about the general price appreciation that Bitcoin tends to enjoy across the entirety of its Halving-driven Market Cycle.

Bitcoin has rallied 12,000%-13,300% in each of its Halvings to date.

But now that we’ve looked at all Post-Halving periods and their price performance, let’s discuss how could Bitcoin continue to perform after Halving #3, based on historical Post-Halving performance.

Let’s specifically focus on extrapolating post-Halving #3 performance based on historical performance.

If we extrapolate Bitcoin’s post-Halving #1 performance to Bitcoin’s post-Halving #3 performance, Bitcoin could rally anything between +1742% and 2200%.

A +1742% rally after Halving #3 would result in a ~$150,000 Bitcoin.

A +2193% rally after Halving #3 would result in a ~$188,500 Bitcoin.

What if we extrapolated Bitcoin’s post-Halving #2 performance (+4080%) to Bitcoin’s potential post-Halving #3 price appreciation?

A +4080% rally after Halving #3 would result in a ~$342,000 Bitcoin.

The Curious Role of Time…

Here’s a curious observation…

It took roughly the same amount of time for Bitcoin to bottom prior to Halving #1 (i.e. 378 days) as it took for Bitcoin to rally before topping out after its second post-Halving #1 Market Cycle (i.e. 364 days).

This curious role of time prior to and after Halving #1 is also evident in the context of Halving #2:

It took roughly the same amount of time for Bitcoin to bottom prior to Halving #2 (i.e. 546 days) as it took for Bitcoin to rally before topping out after its second post-Halving #1 Market Cycle (i.e. 518 days).

What if this curious role of time continues in the context of Halving #3?

Bitcoin bottomed 511 days prior to Halving #3.

Should Bitcoin rally for 511 days after Halving #3, that would mean that Bitcoin would peak in early October 2021.

While historically recurring price tendencies carry more weight over such temporal observations, this curious role of time in the context of Bitcoin’s Halvings should not be understated.

Feel free to Subscribe for the final part of this Bitcoin Halving series - coming out on the 4th of January, 2021:

Thanks for reading this free edition of the Rekt Capital newsletter.

Hopefully this special edition gave you a powerful idea as to the level of quality, detail, and dedication that you can expect as a valued subscriber of the Rekt Capital newsletter.

I write research articles like this every Monday for subscribers of the newsletter.

So if you’d like to receive cutting-edge research like this straight to your inbox, feel free to subscribe for an early-bird discount of $5 a month: