Bitcoin - Trend Continuation

Re-Accumulation Range Upward Consolidation

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

The Re-Accumulation Range

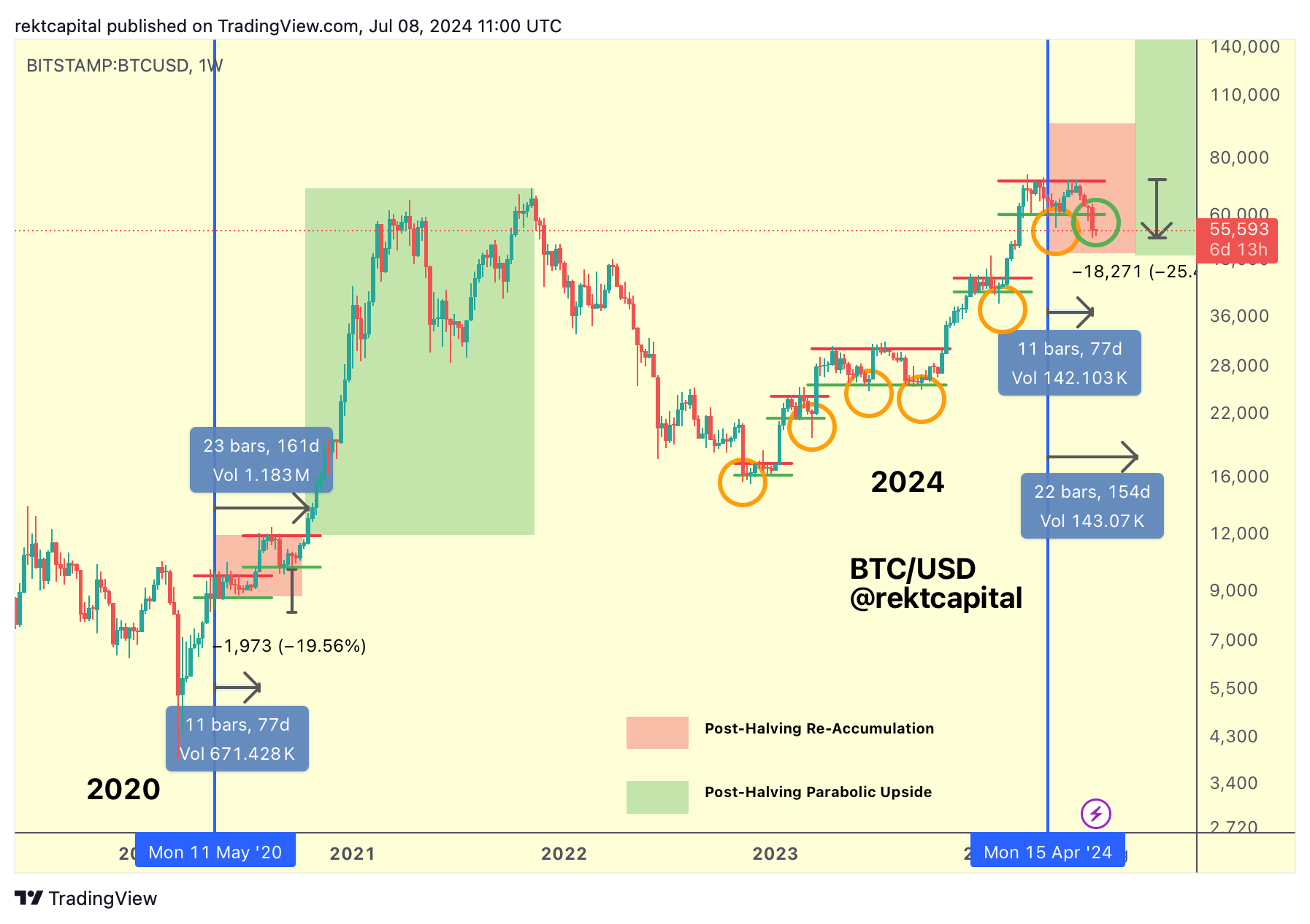

Over the past few weeks, we spoke about how downside deviations below the Range Low of the Post-Halving Re-Accumulation Range tend to signal bargain-buying opportunities:

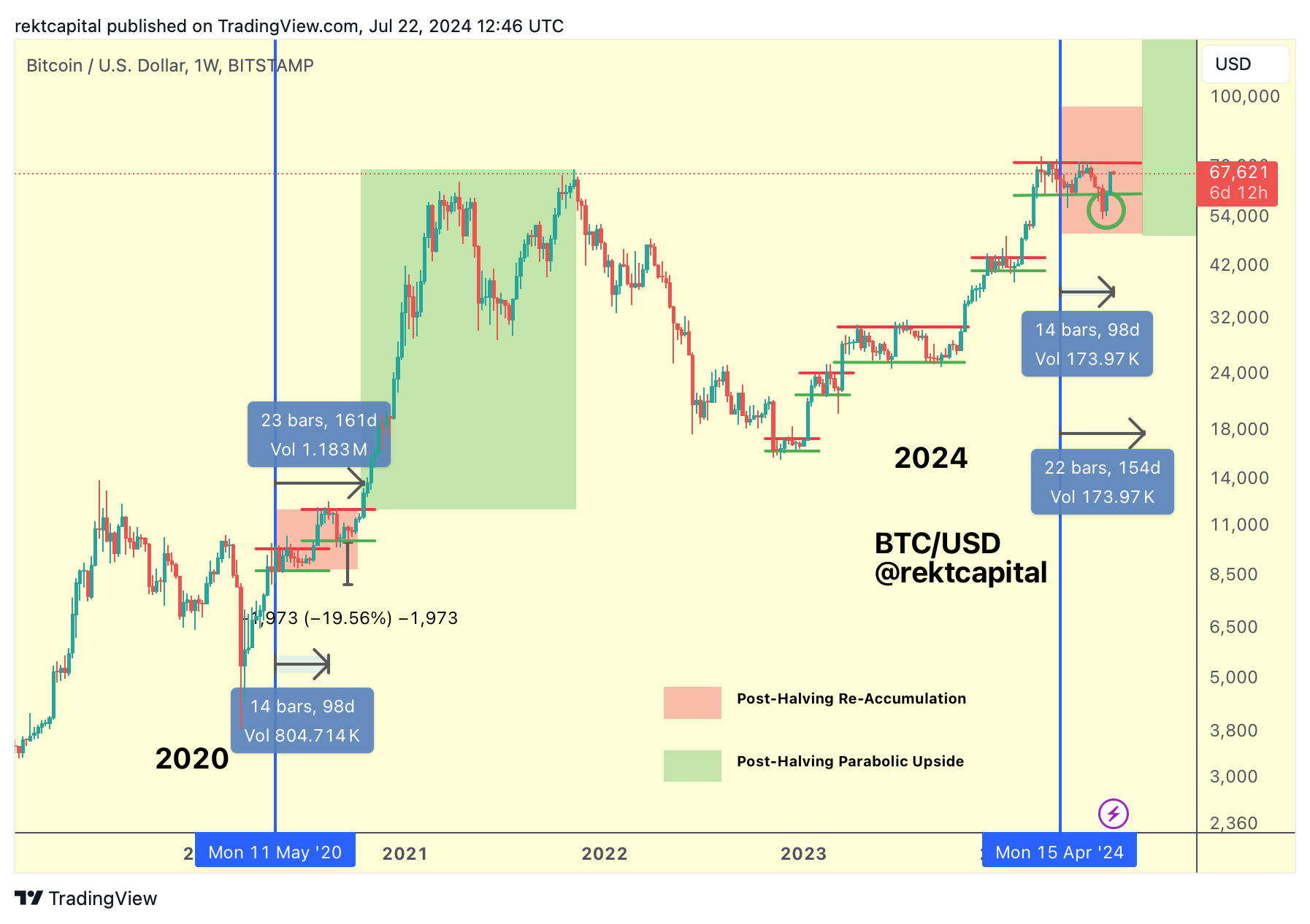

Here is today's chart:

Not only has Bitcoin been able to successfully reclaim the Re-Accumulation Range as a whole but price has also substantially travelled across it, getting very close to revisiting the Range High at ~$71500.

Bitcoin has been performing a sinusoidal consolidation, rallying from Range Low to Range High, back to Range Low and then back to Range High - for months now.

When Bitcoin gets close to the Range High, upside wicks beyond this level tend to occur before rejection and bearish continuation to the downside.

When Bitcoin gets close to the Range Low, downside wicks (and as 2-3 weeks ago have shown us, downside deviations in candle-bodied form) tend to develop before reversing to the upside, reclaiming the Range Low as support and then rallying to higher prices within the range.

This ReAccumulation Range also happens to sit on an Old All Time High resistance area which has been consistently retested successfully as support for the past five months:

Here is my early July analysis to demonstrate the downside deviation from which price has since recovered:

And here is today's chart:

Bitcoin continues to hold the old All Time High area as support.

What's more, Bitcoin has successfully managed to form a new Higher Low against this green area, evidencing premium-buying behaviour at the green support (even though brief downside wicks below the area occurred also).

Further, Bitcoin is challenging for a new Higher High this month, in an effort to invalidate the series of Lower Highs that BTC has been producing since the Local Top earlier this year.

A Higher Low, a potential Higher High, an invalidation of the Lower Highs - these are all ingredients for a shifting in the trend around these price levels.

And even though price has been clustered between $60600-$71500 for the most part for the past several months, these are the small changes in price action that precede major trend changes over time.

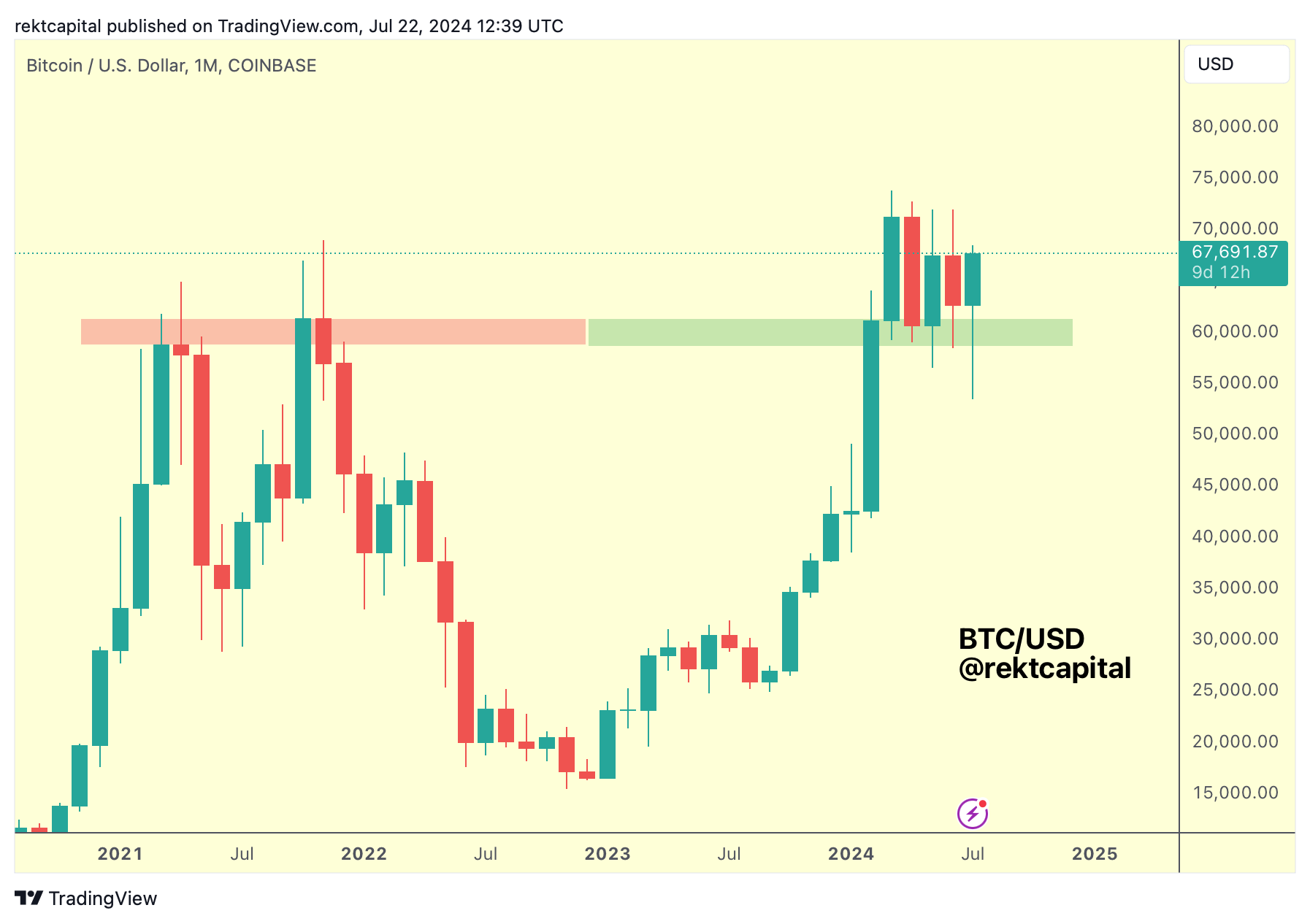

Bitcoin is currently in the ReAccumulation phase but this phase, with time, will precede the Parabolic phase in the cycle and it would be wise to hold on and not give up so as to enjoy that phase fully.