Bitcoin - The Roadmap Going Forward

Future Downside Deviations & BTC Dominance's Uptrend to 71%

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

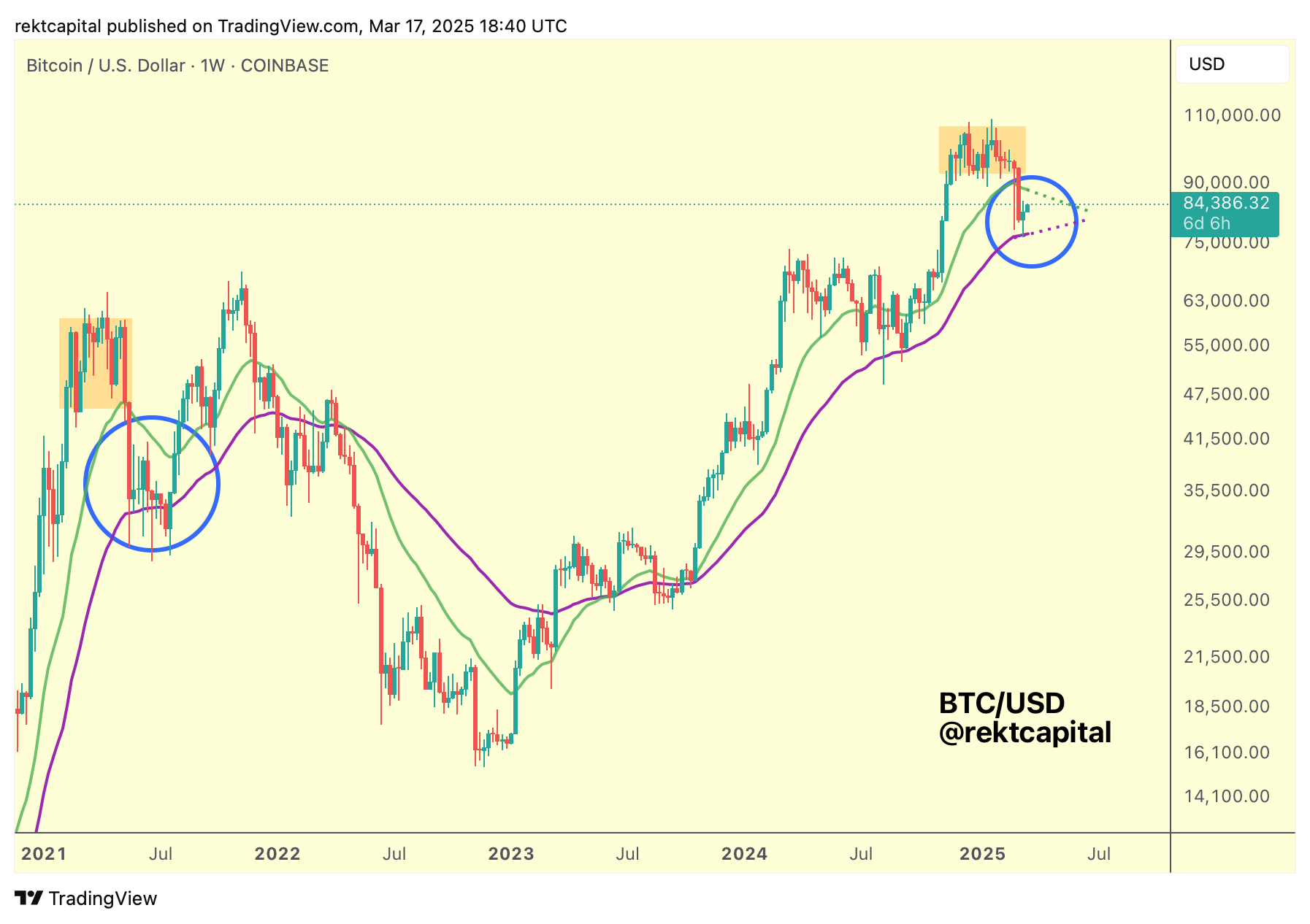

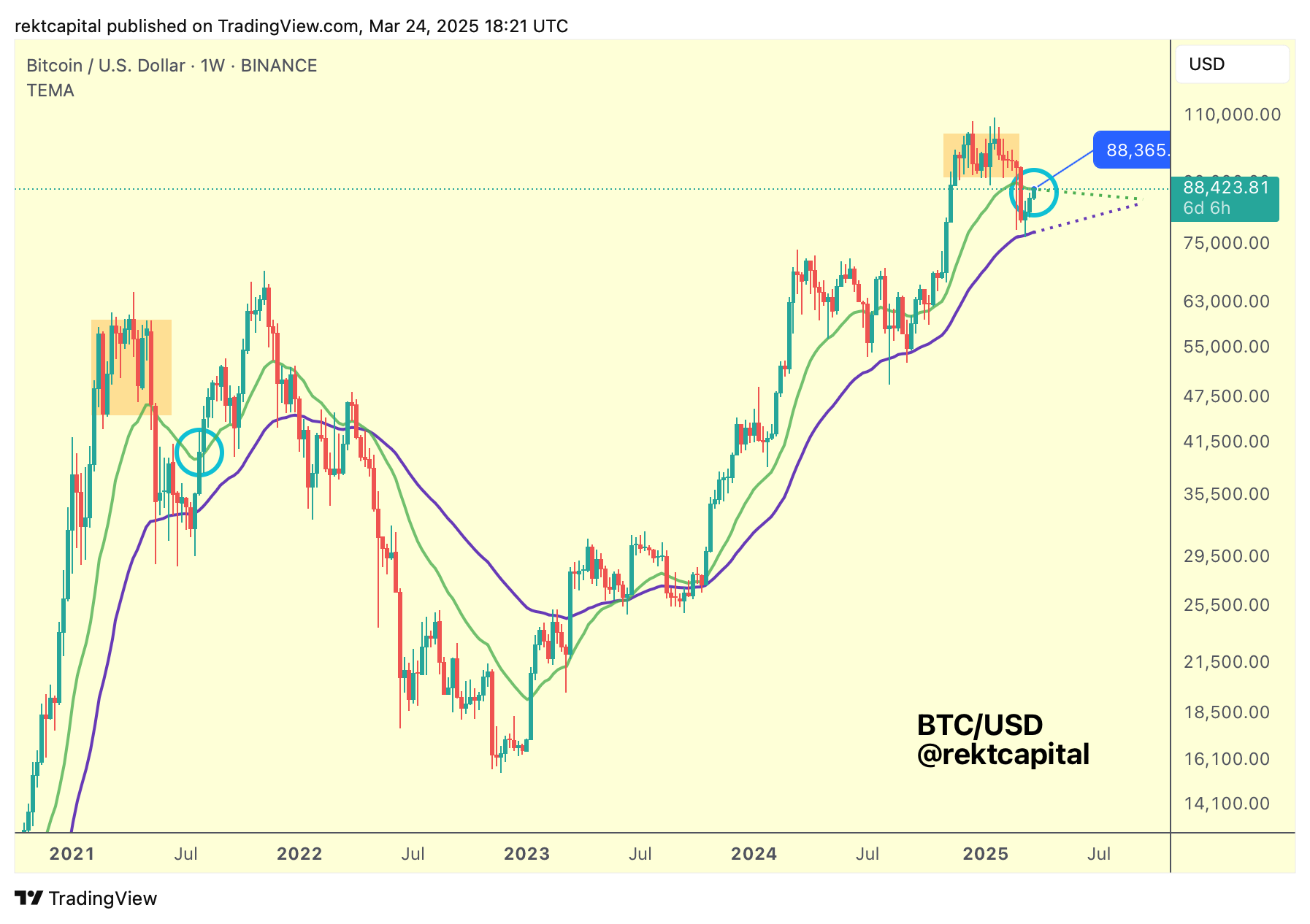

Consolidation Between The Bull Market EMAs

Last week, I spoke about how Bitcoin was consolidating between the two major Bull Market EMAs: the green 21-week and purple 50-week EMAs.

Bitcoin has continued its consolidation between these two EMAs, with price getting closer to the 21-week EMA for a major trend decision:

With Bitcoin now at the 21-week EMA, price will need to Weekly Close above this EMA and post-breakout retest it into new support.

This was the exact confirmation that Bitcoin needed back in mid-2021, when price crashed -55%.

This confirmation effectively enabled a breakout from the consolidation range developed by the two Bull Market EMAs.

Back in mid-2021, BTC produced upside wicking beyond the 21-week EMA in its first "Weekly Close" week and downside wicking below the 21-week EMA in its "Retesting" week (light blue circle).

Which just goes to show that if history were to repeat this time with a Weekly Close above the 21-week EMA, things could get volatile both on the upside (trapping FOMO buyers in the upside wick) and the downside (with panic sellers selling into a downside wick).

However, the 21-week EMA (green) represents the price point of ~$88400 and a Weekly Close above it could kickstart uptrend continuation towards the ReAccumulation Range Low of $93500 in an effort to challenge for a ReAccumulation Range reclaim.

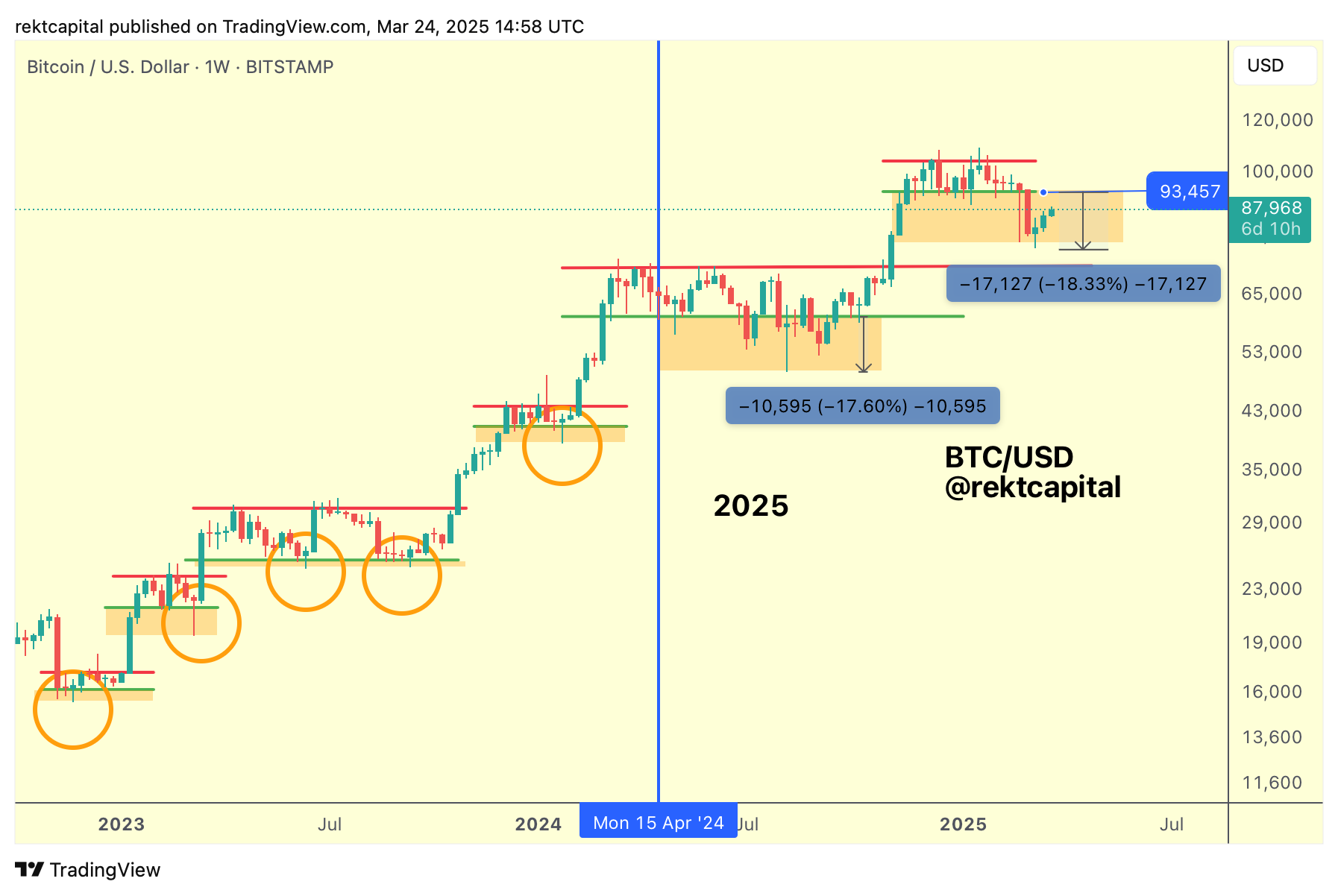

Return to the Macro Range

Ultimately, the reclaim of the 21-week EMA (green) is necessary to position price for further uptrend continuation towards the $93500 Range Low of the previously lost ReAccumulation Range.

This cycle has been a story of ReAccumulation Ranges and downside deviations below it.

This current range resembles the Post-Halving ReAccumulation Range whereby downside deviations below the Range Low occurred in candle-bodied form.

Bitcoin will need to Weekly Close above the $93500 ReAccumulation Range Low to resynchronise with the Range and officially end this period of downside deviation.

That being said, the Post-Halving ReAccumulation Range has shown that simple Weekly Closes above $93500 may not suffice; that a successful post-breakout retest of the ReAccumulation Range Low of $93500 would be essential to confirming resynchronisation with the range.

So even if BTC manages to Weekly Close above $93500 in the future but lacks the confirmation of a successful retest of it into new support, price could then lose the $93500 level and downside deviate again, in similar fashion to the Post-Halving ReAccumulation Range.

The confirmation signals for the resynchronisation with the ReAccumulation Range are therefore clear: Weekly Close above $93500 followed by a post-breakout retest of the $93500 into new support.

In the meantime, BTC needs to first reclaim the 21-week EMA of $88400 as support to enable that revisit of $93500.