Bitcoin - The Road to $70,000 - Part 2

What happens next?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

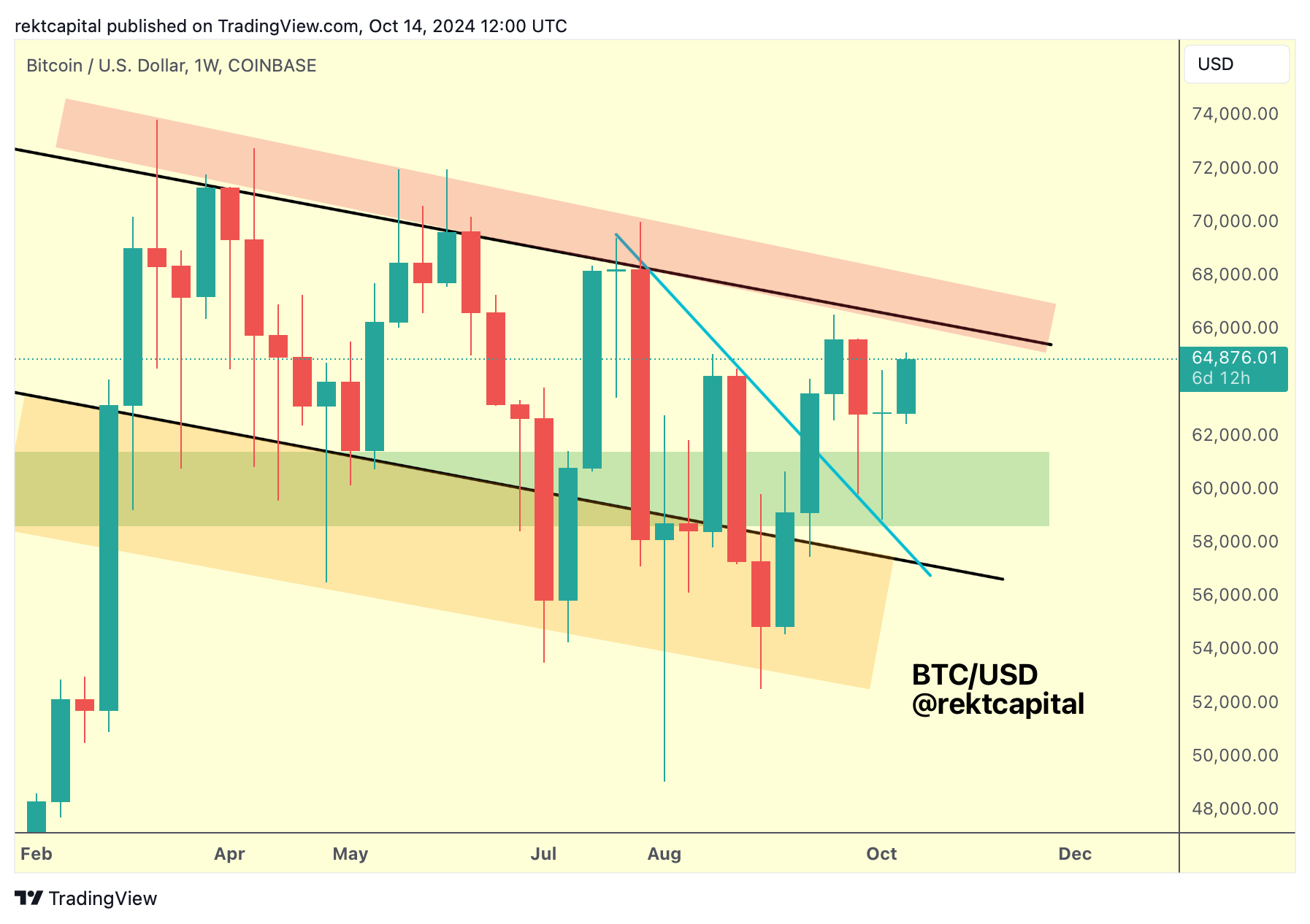

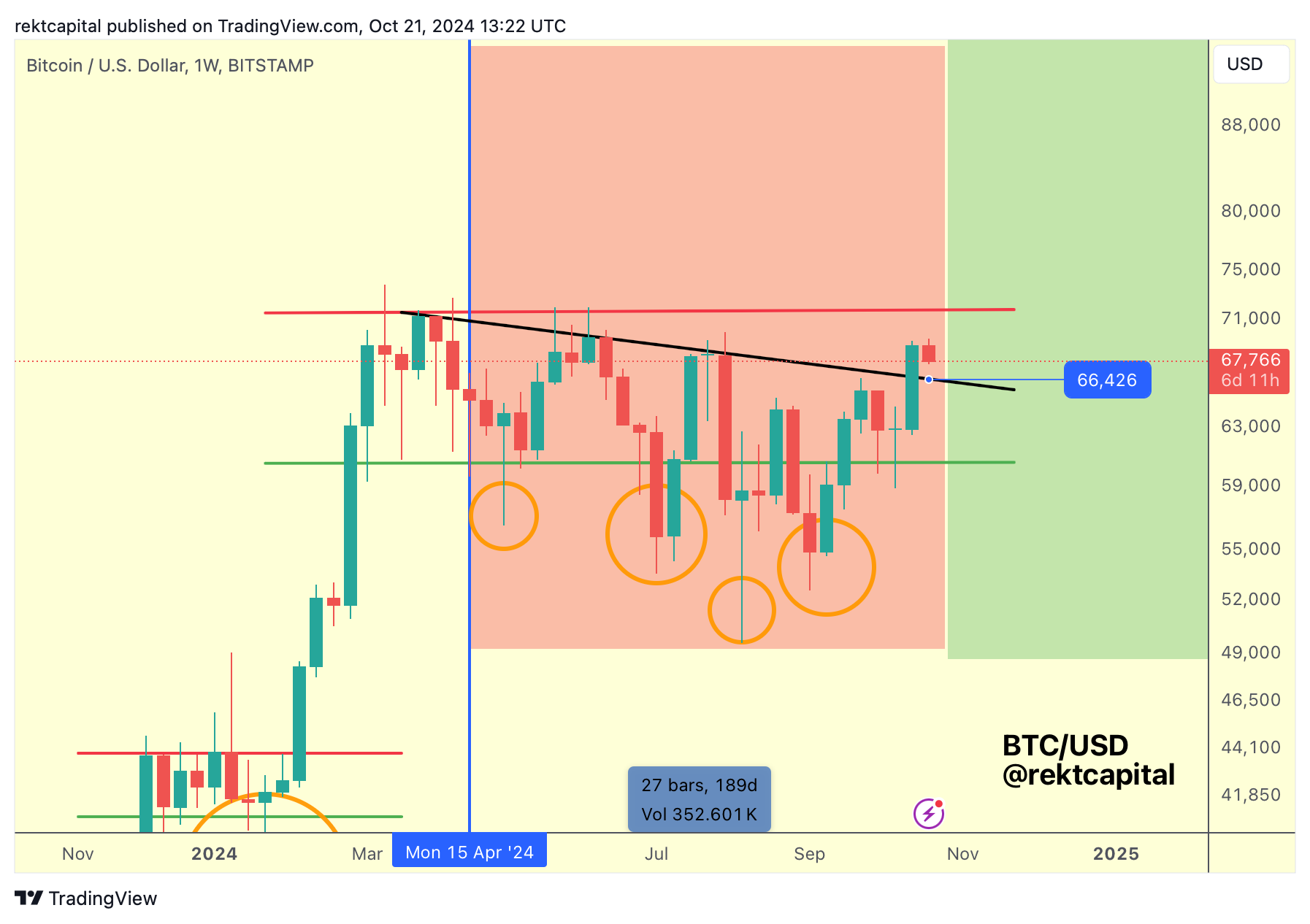

The Weekly Downtrending Channel

In recent weeks, we've focused in large part on the Downtrending Channel when it comes to Bitcoin's price predicament:

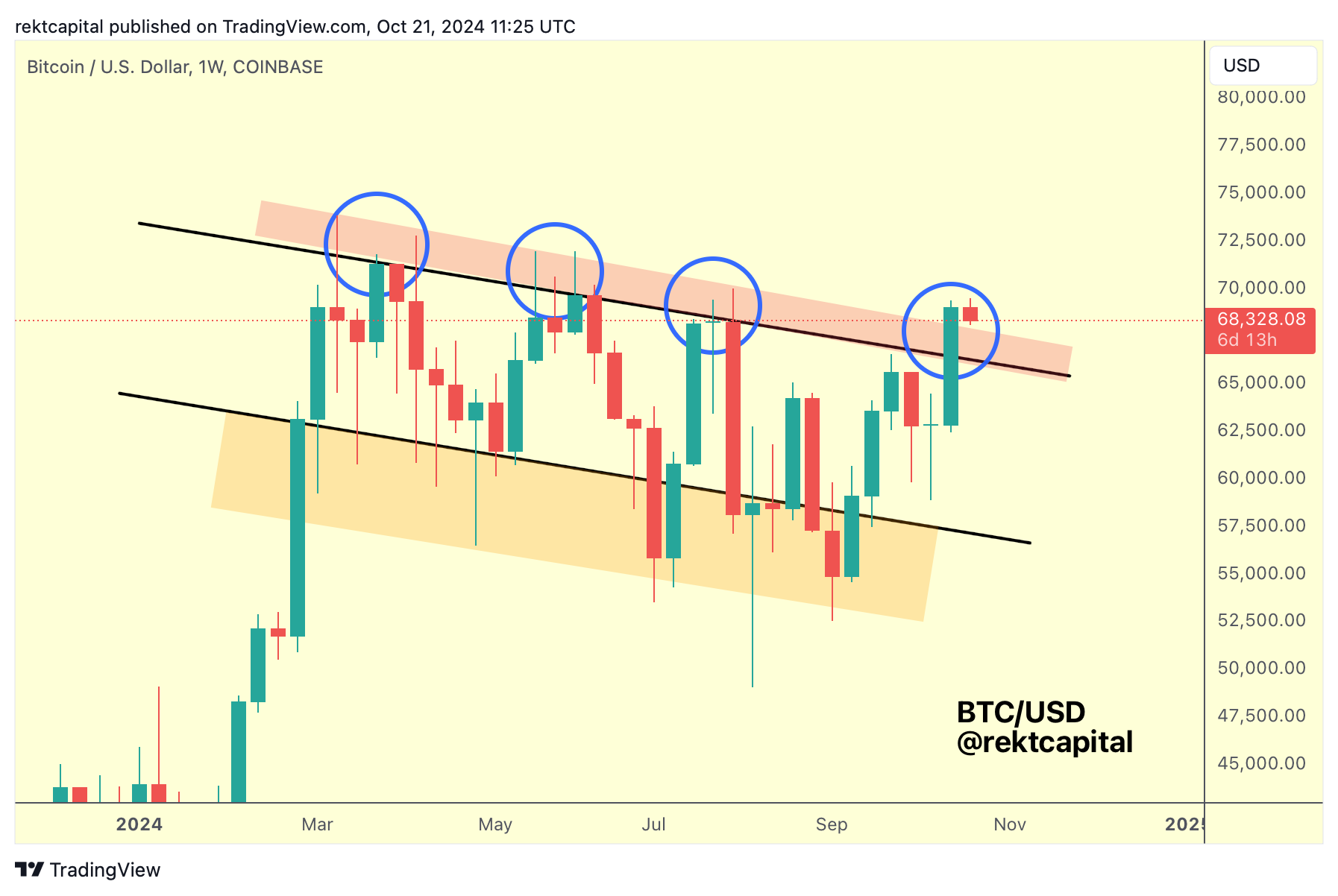

And now, Bitcoin has finally broken out from this Channel:

In breaking out from this Channel, Bitcoin has therefore invalided the series of Lower Highs (black) dating back to mid-March 2024.

The downtrend is therefore over.

More, in doing so Bitcoin has invalidated the series of upside wicking beyond the Channel Top resistance as well (blue circles).

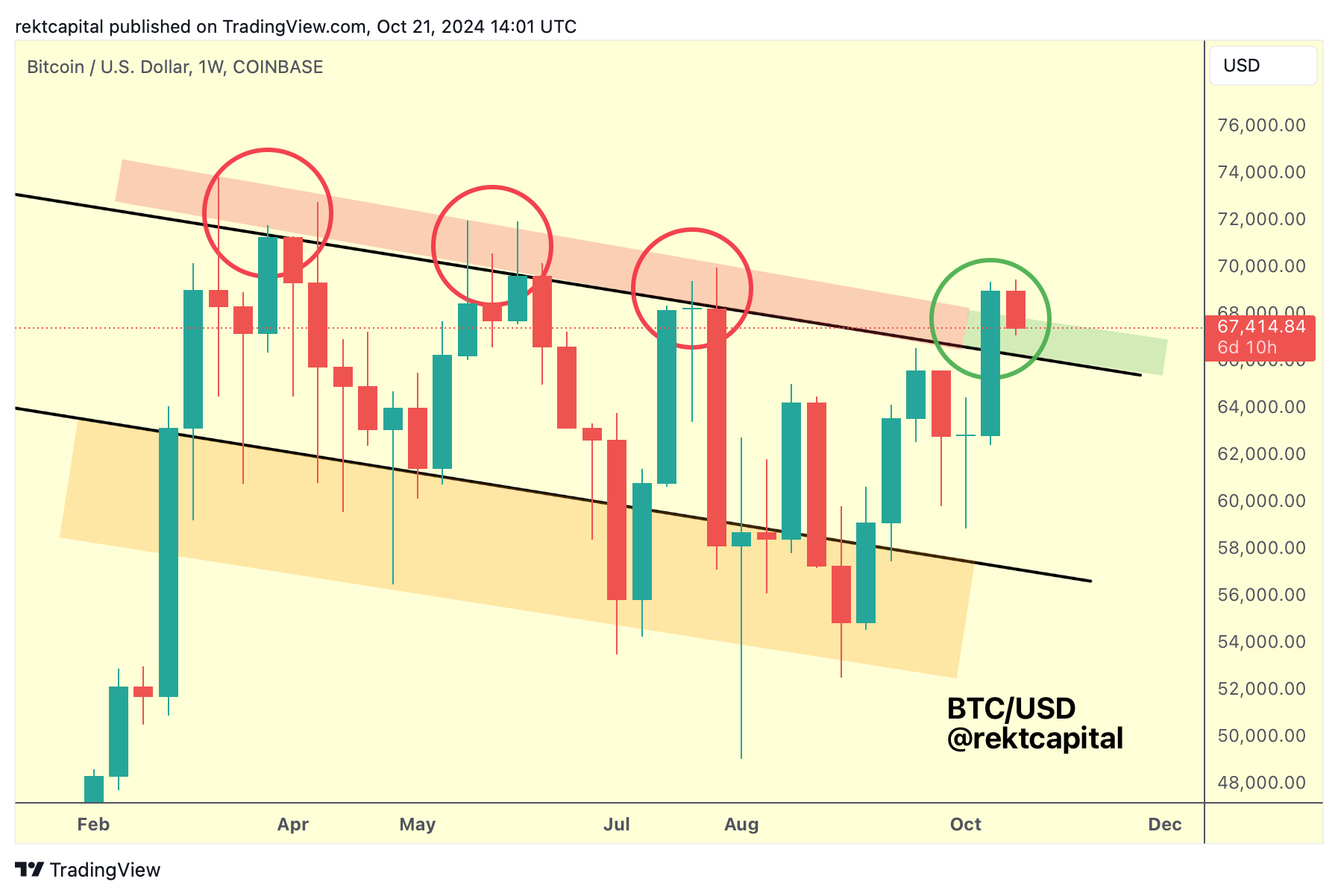

After all, Bitcoin would fail on many occasions to break beyond this Downtrending Channel resistance (red) and the recent Weekly Close has officially shifted the tide.

But as with any pivotal breakout, an old resistance tends to become a new support, which is why a retest of this old point of rejection is currently being retested by price:

A successful retest here would confirm the breakout from the Downtrending Channel to ensure trend continuation to the upside.

That retest could sink to as low as the Channel Top (black) which is currently representing the price point of ~$66300:

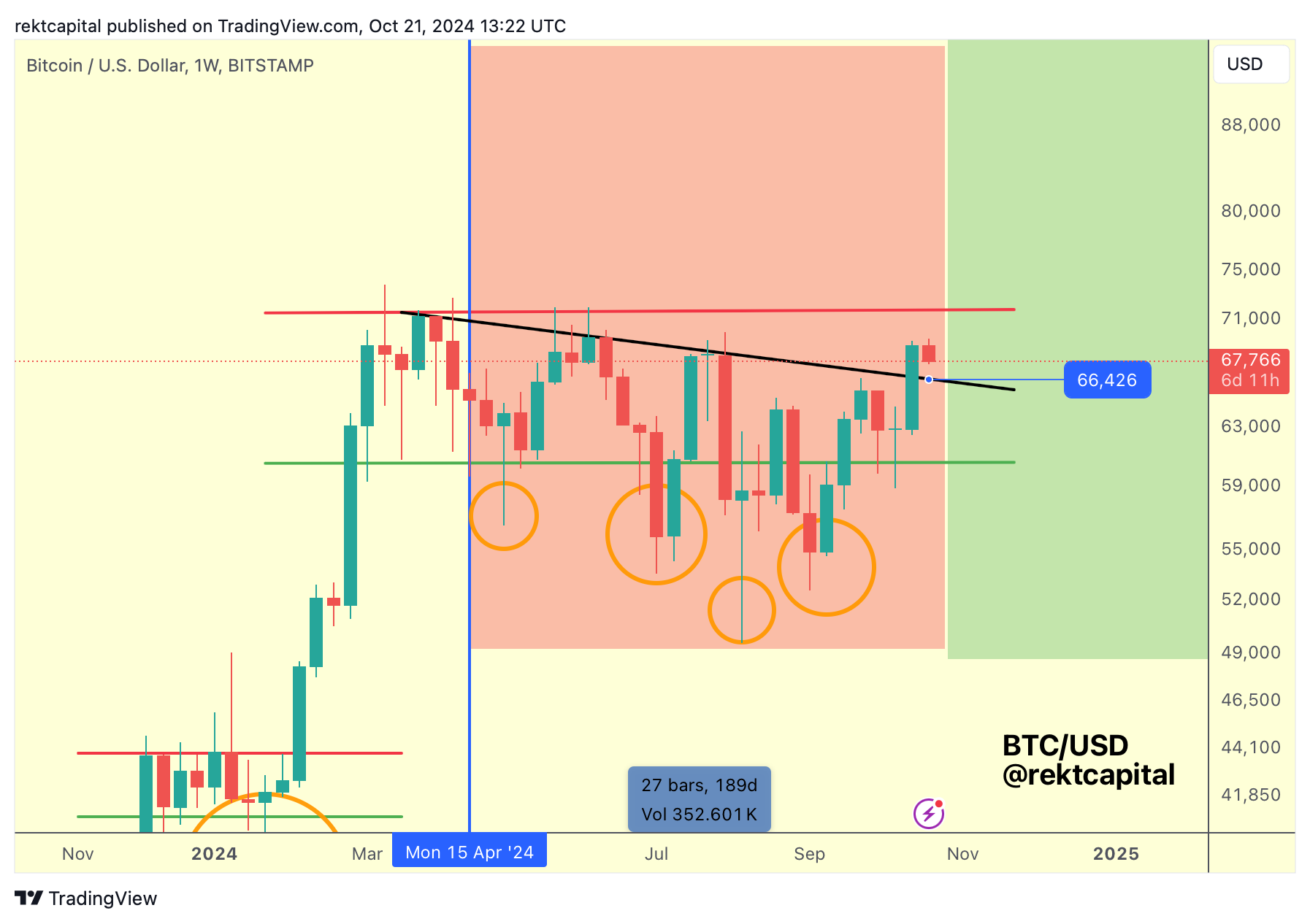

The Weekly ReAccumulation Range

How does this price action look like through the lens of the ReAccumulation Range?

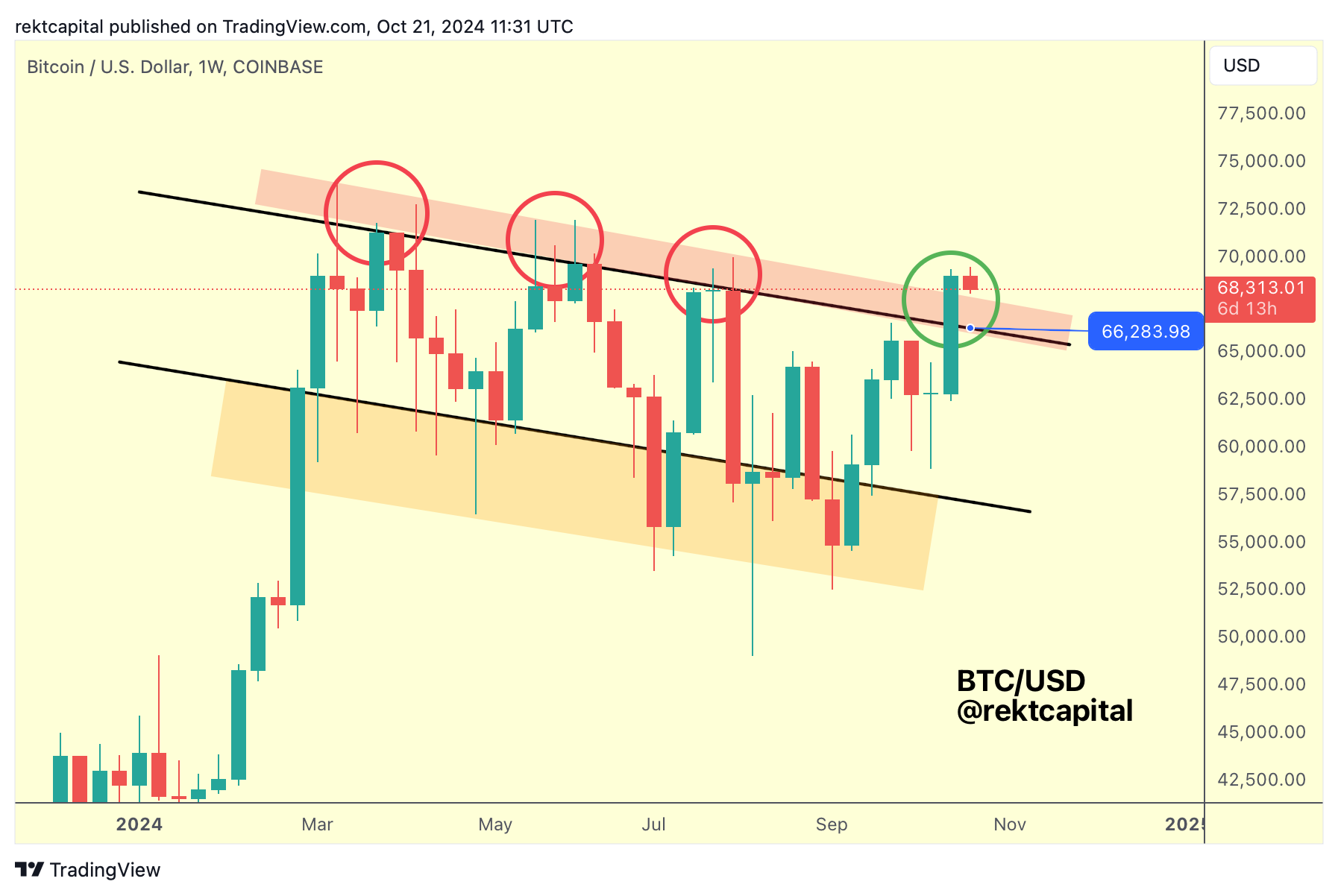

Last week, we spoke about how that black Channel Top was a major resistance in stopping price from revising the Range High:

Here's today's update:

Bitcoin has Weekly Closed above the Lower High (black) and is now going to dip into it to turn it into new support.

Successful retest would see price revisit the Range High at ~$71500 (red) in the future for what would be Bitcoin first challenge of the top of the ReAccumulation Range since June.

Bitcoin's goal in revisiting the Range High will be to showcase how said level is a weakening resistance.

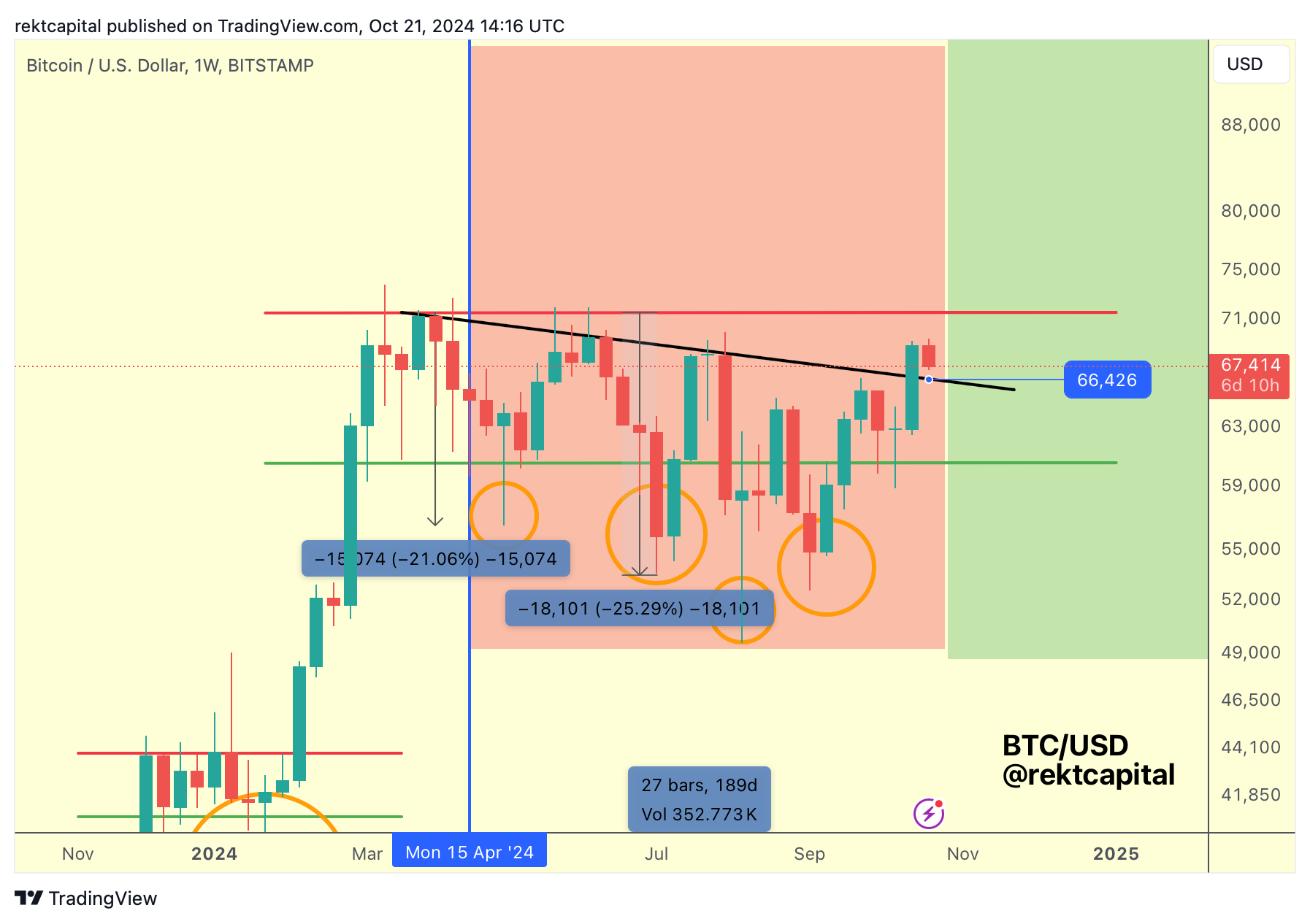

Very much in the same way that we managed to pinpoint how the Downtrending Channel Top (black) was weakening as a resistance in last week's newsletter as well:

So as we slowly make the move to the Range High of the ReAccumulation Range at ~$71500, the question will be...

How shallow of a retrace could we expect on rejection from the Range High?

Because since mid-March 2024, Bitcoin has registered deeper (-21%) and deeper (-25%) rejections from the Range High.

On this next upcoming advance, Bitcoin will want to demonstrate that the Range High is weakening and so some rejection could be expected but the ensuing pullback would be much shallower that what price showcased in the past.