Bitcoin - The Road to $70,000 - Part 3

What happens next?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

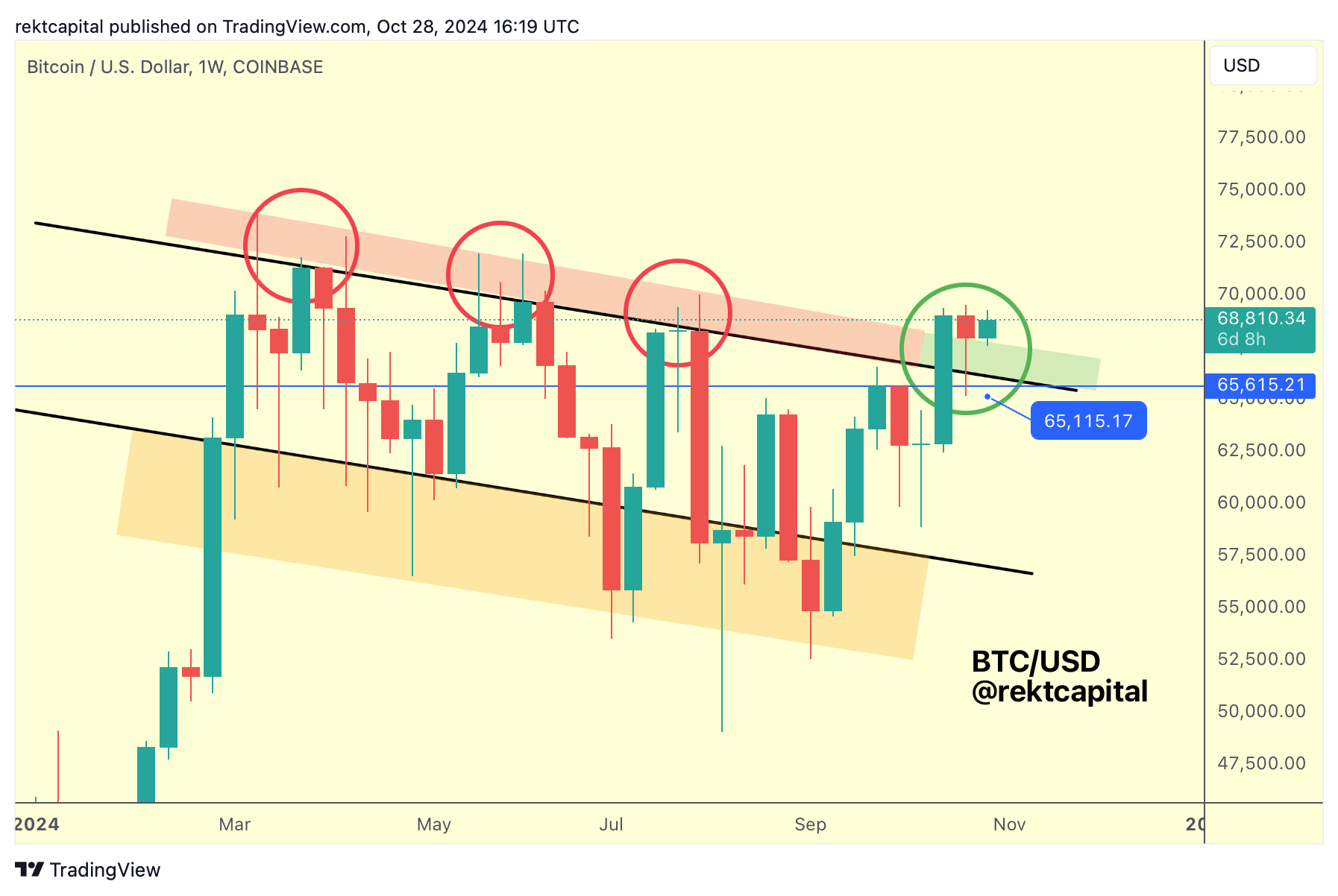

The Weekly Downtrending Channel

Last week, we spoke about how Bitcoin could drop into the low $66000s in order to successfully retest the top of its Downtrending Channel.

Here is last week's analysis:

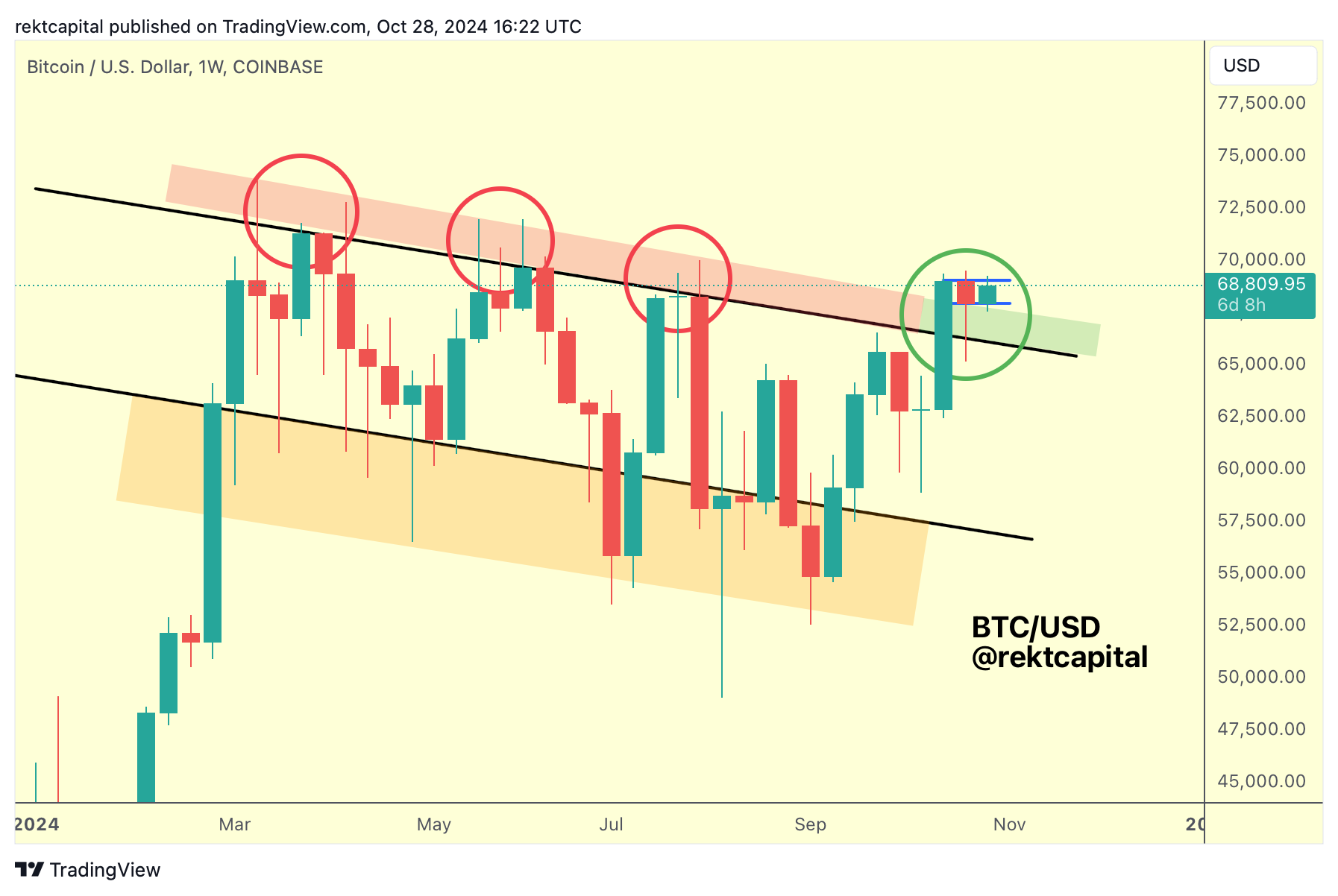

And here's today's update:

Bitcoin indeed pulled back into the top of the Downtrending Channel (black) to retest it as new support, even overextending to the downside via a wick, tagging the late September highs and turning them also into new support.

Bitcoin has been able to dip into lower price levels to grab liquidity while maintaining itself not just above the black Channel Top but also Weekly Close above the green box.

This green box represents the general old resistance area which has since been turned into new support.

Effectively, two week ago BTC broke the red resistance area.

Last week, BTC retested this old resistance into new support.

And this week, price is going to try to stabilise here, potentially dip a little bit as part of that stabilisation, but any downside volatility will be in an effort to further position price for trend continuation.

In the meantime, it looks like BTC may need to consolidate in the short-term first, in what could be a potential Bull Flagging structure:

There is scope for additional sideways movement to coil price up for a future breakout from here which would see price revisit the $71500 highs.

But it's important to keep in mind that while BTC moves sideways here within this potential Bull Flag, there will always be a chance for a downside wick into the green area that represents the new support at the Channel Top.

Why?

Because that is now the new source of buy-side liquidity for BTC after transitioning it from a point of sell-side supply.

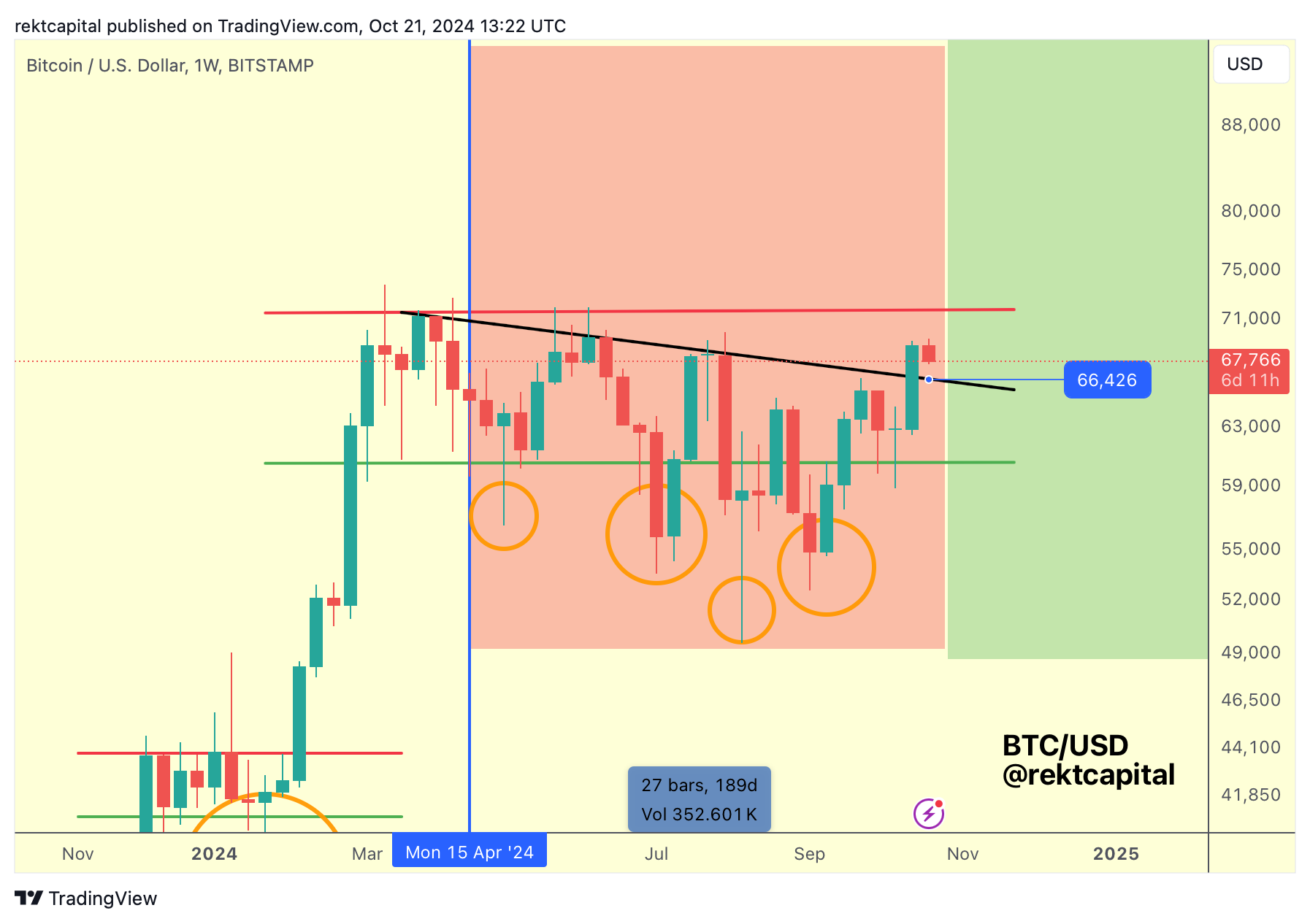

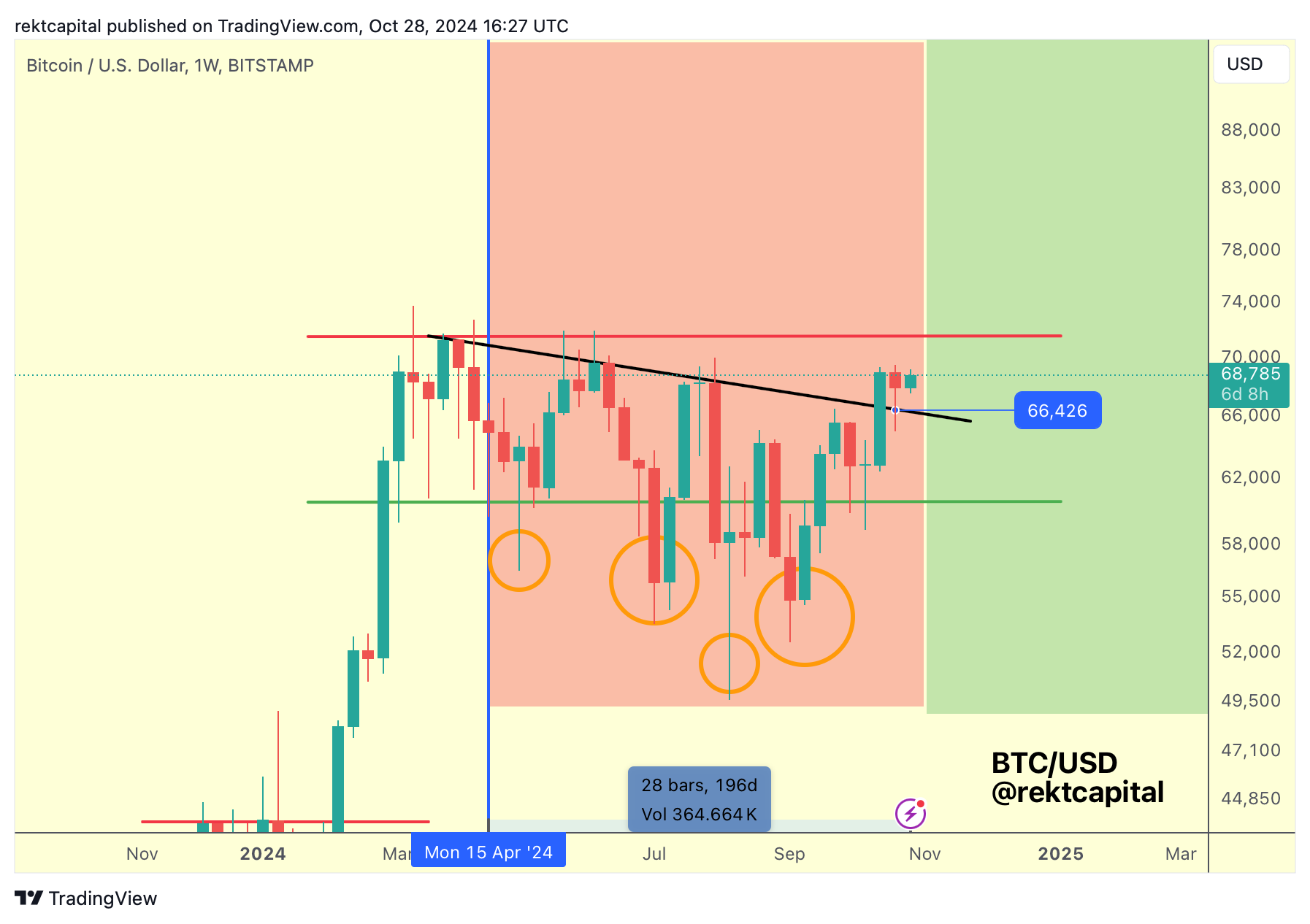

The Weekly ReAccumulation Range

Over the past few weeks, we've been covering Bitcoin's ascent from the ReAccumulation Range Low at $60600 on its way to revisiting the $71500:

Two weeks ago, we covered how the Channel Top (black) was weakening as a point of rejection:

Last week, we spoke about how price was going to drop into the Channel Top for a retest after Weekly Closing above it:

And this week we know that the Channel Top has transitioned into a new support:

Bitcoin is doing all the right things to position itself for trend continuation.

After all, a successful retest of the Channel Top is what BTC needs to revisit the Range High at ~$71500 (red) in the future.

And just like we mentioned last week, it's very likely that the Range High will reveal itself as a weakening resistance, which should allow for price to break beyond it in time.