Bitcoin - The Reversal

Is Bitcoin ready for a full-blown reversal?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Bitcoin - The Rebound

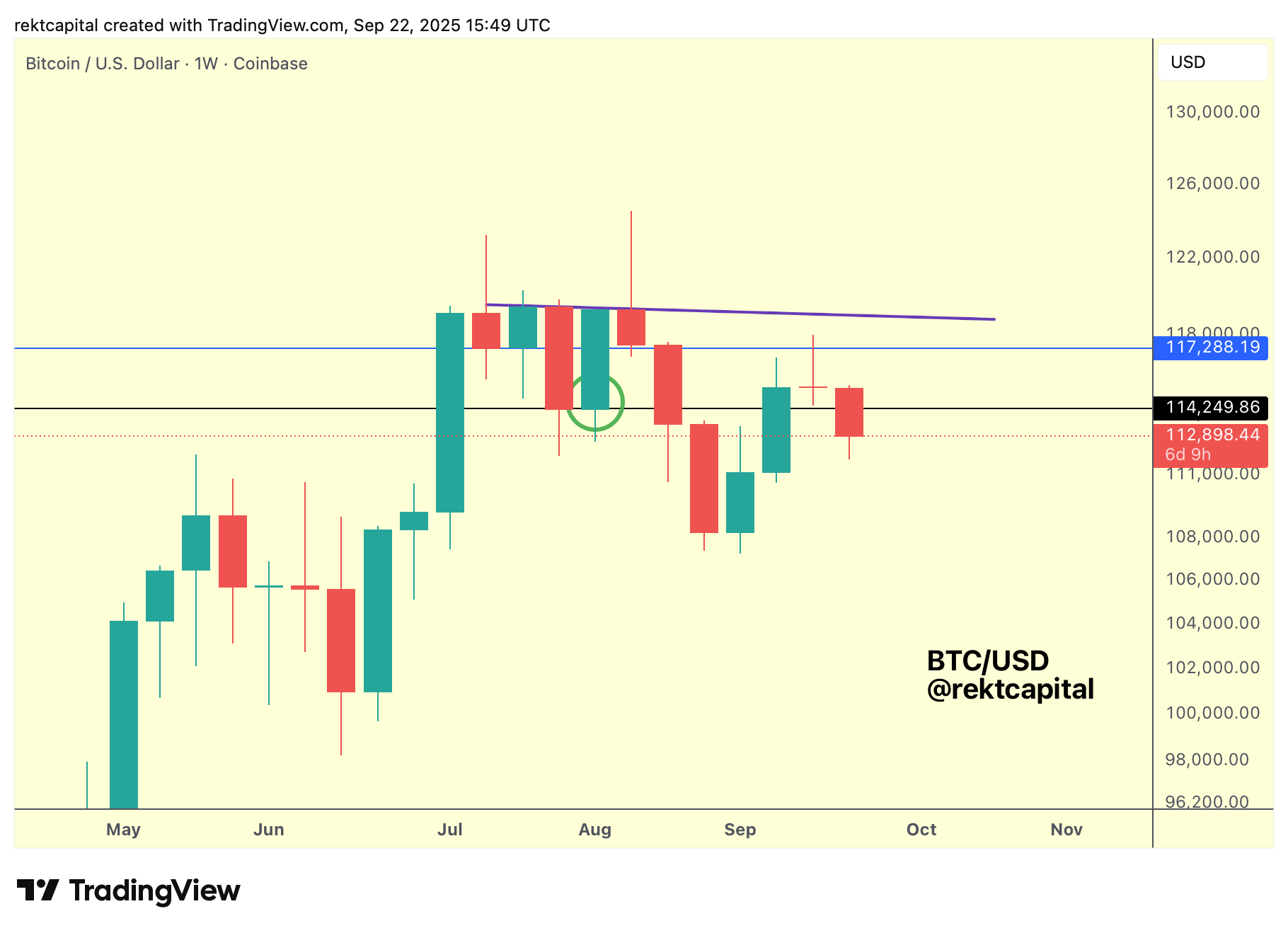

Last week, we spoke about how Bitcoin was in the process of a Weekly retest:

That retest has since failed:

Despite the rebound from the green 21-week EMA (which is confluent with the red region of old resistance which is acting as support nowadays), Bitcoin has Weekly Closed below the $114.2k level (black), which is technically setting price up for a post-breakdown relief rally.

Which is why Bitcoin needs to reclaim $114.2k on the Daily timeframe to stave off this post-breakdown relief rally scenario; luckily, BTC has over 6 days left in the week to perform that reclaim.

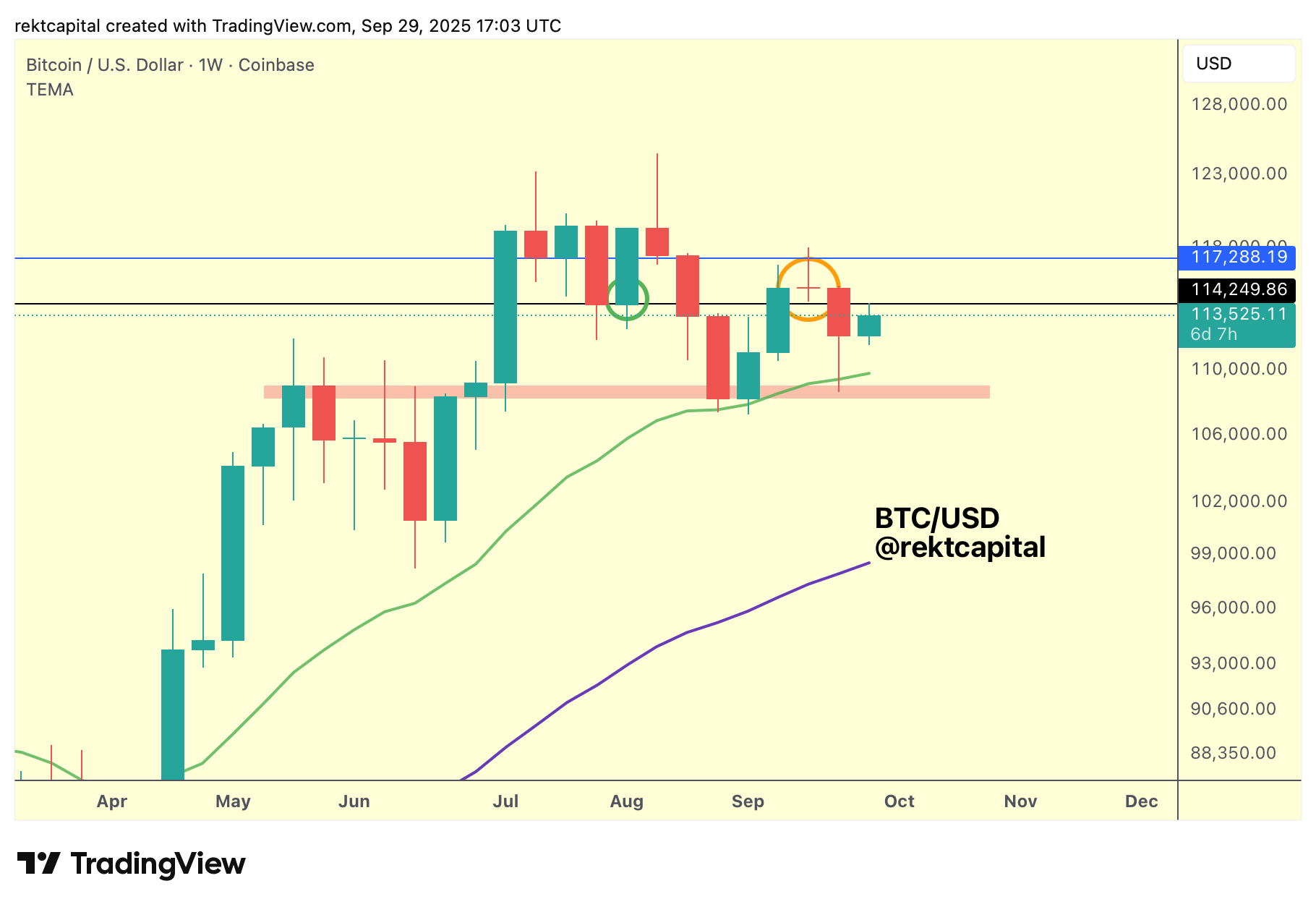

But the most important technical milestone is that price has held the 21-week EMA as support, something I tweeted about last week:

#BTC

— Rekt Capital (@rektcapital) September 25, 2025

While Bitcoin continues to try to figure itself out at ~$114.2k...

The green 21-week EMA keeps climbing, getting closer & closer to price

Generally, price needs to maintain itself above this EMA going forward to position for a reclaim of ~$114k$BTC #Crypto #Bitcoin https://t.co/Xh774NbvRL pic.twitter.com/2JQ1F1nDWV

Because, as mentioned in the tweet, that 21-week EMA needs to hold to get price back in contention for reclaim $114.2k.

And price is there right now, fighting for that reclaim as we speak.

Bitcoin - The Rebound

But it wasn't just the 21-week EMA that has enabled this rebound; the 21-week EMA happened to become confluent with an early-stage Hidden Bullish Divergence which was shared in the more regular video updates with the Hall of Fame Pro:

That Hidden Bull Div played out to the point where price is now in contention for a reclaim of $114.2k, and here is what that situation looks like:

If Bitcoin is able to Daily Close above $114.2k (black), recent history has shown that this can be a recipe for success in terms of rallying to as high as $117.2k (blue).

And Bitcoin has entire week to figure a way out to reclaim $114.2k and a Daily Close above $114.2k is one of the very convincing ways to achieve that confirmation early on.

The Weekly CME Gap

The fact that Bitcoin has a lot of time in the week to reclaim $114.2k also means there is also time to potentially fill the Weekly CME Gap that has developed at $109680-$111310.

The late August Weekly CME Gap was downside wicked into, for example, which closely potentially mirrors this current Weekly CME Gap.

And seeing as most Weekly CME Gaps, if not all of them, fill for Bitcoin then there's a good chance some sort of dipping in the short-term could take place as part of price trying to fuel itself towards reclaiming $114.2k in the future.