Bitcoin - The Retests

Includes ETH/USD, ETH/BTC, Altcoin Market Cap, and Bitcoin Dominance (Monthly and Weekly) analysis.

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Bitcoin - Key Retests In Progress

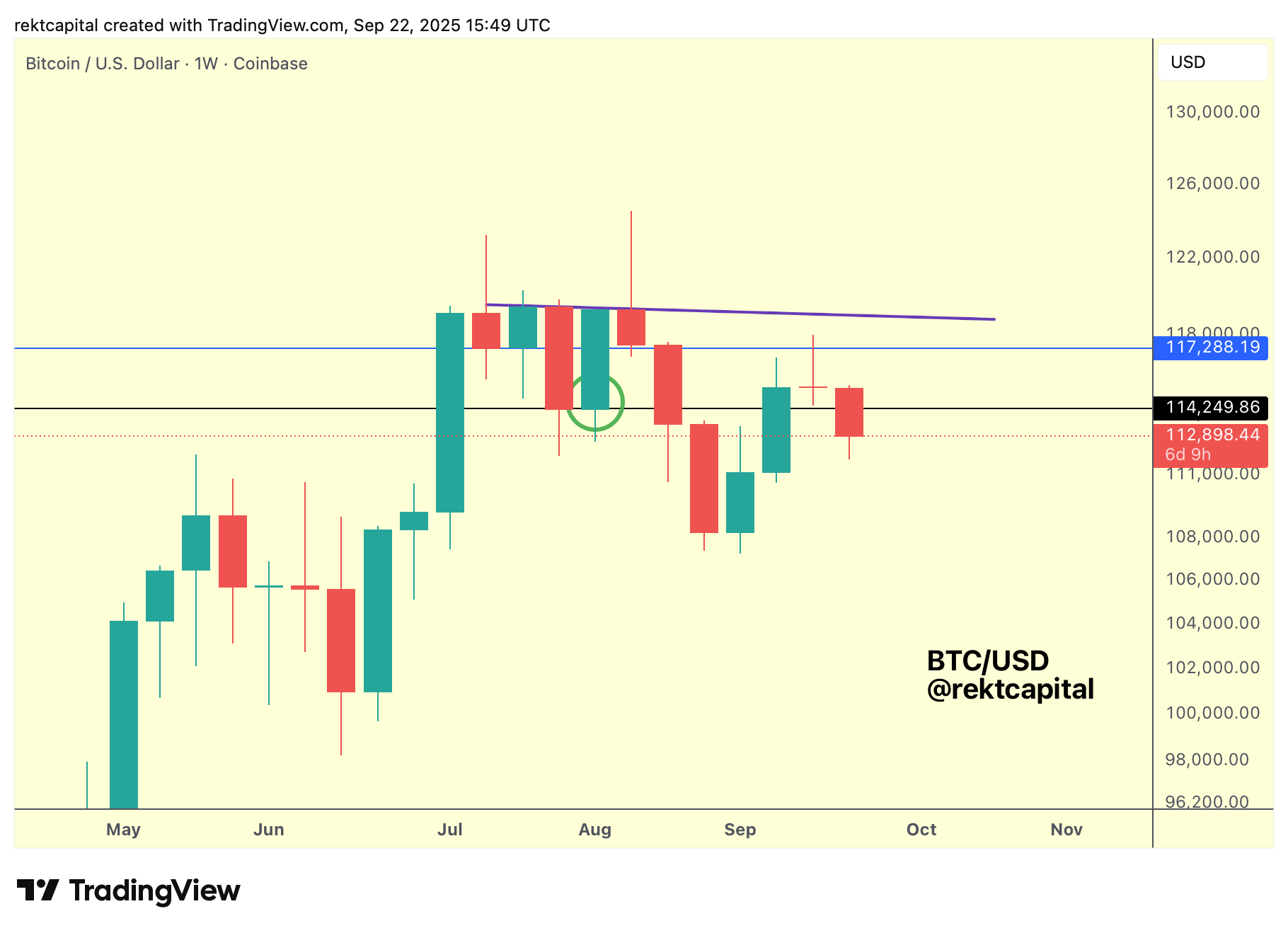

Bitcoin has managed to Weekly Close above $114k, signalling that it is figuring as a support, even though price is slinking below it for the time being.

But it's key to remember that this could be a volatile retest of the $114k level, which could end as a downside wick, much like in the green circled area.

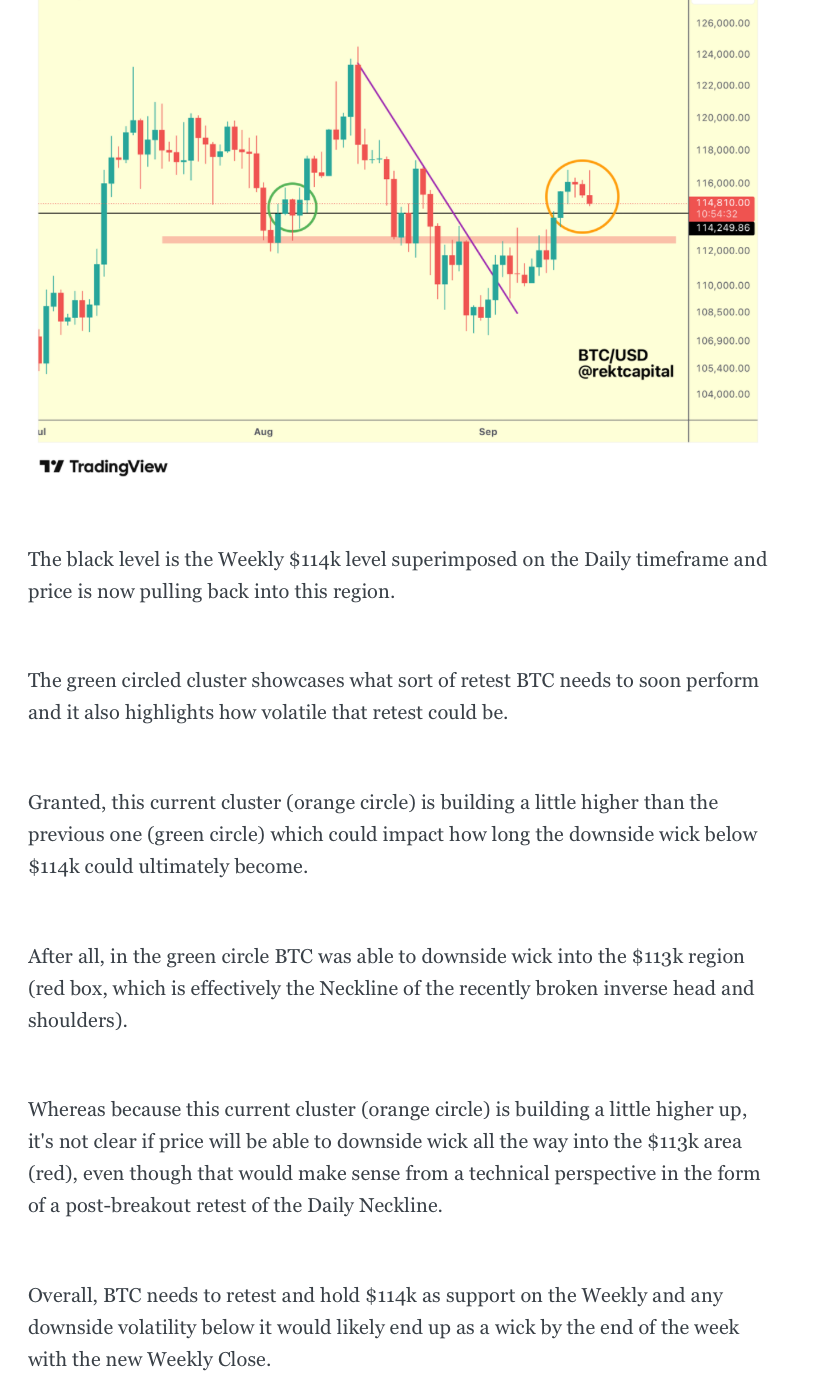

But what this current downside deviation below $114k is achieving is key retesting and pattern validation on the Daily timeframe.

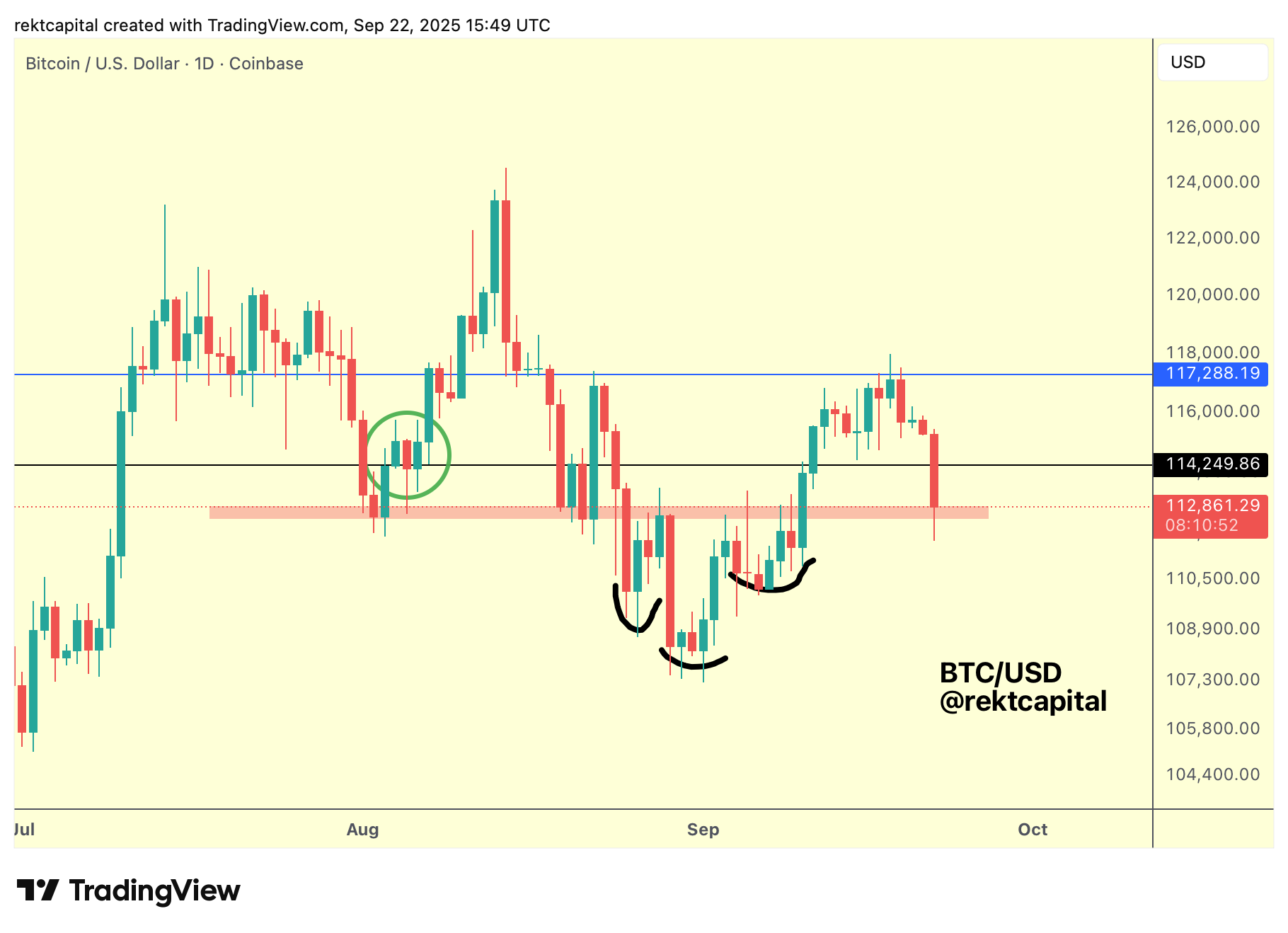

As a preface to today's Daily analysis, here's last week's take on the inverse Head and Shoulders and $113k as a key pivot point:

Here's today's analysis:

The fact that price is now pressing into the $113k Daily Neckline of the Head and Shoulders makes technical sense.

So going forward, Bitcoin needs to Daily Close above the red region to demonstrate that it is acting as support.

And continued stability here would enable a reclaim of $114k before the Week is done.

This is how this deviation below $114k on the Weekly is satisfying key confirmation for the Daily inverse Head and Shoulders, to fully confirm a breakout from that Daily structure.

The Daily retest is in progress (inverse Head and Shoulders) but so is a key Weekly retest (of $114k) as well.

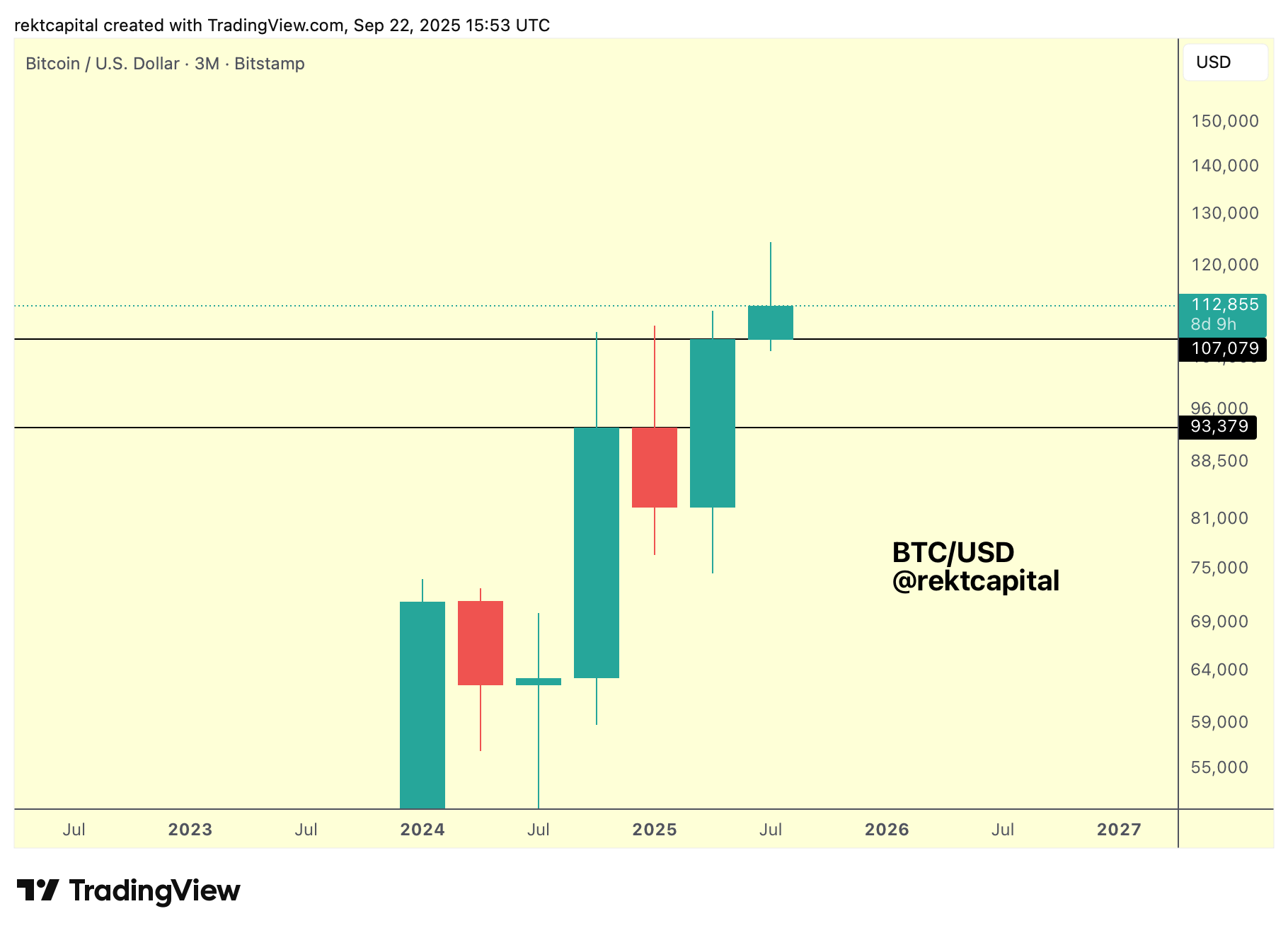

Monthly And Quarterly Ranges

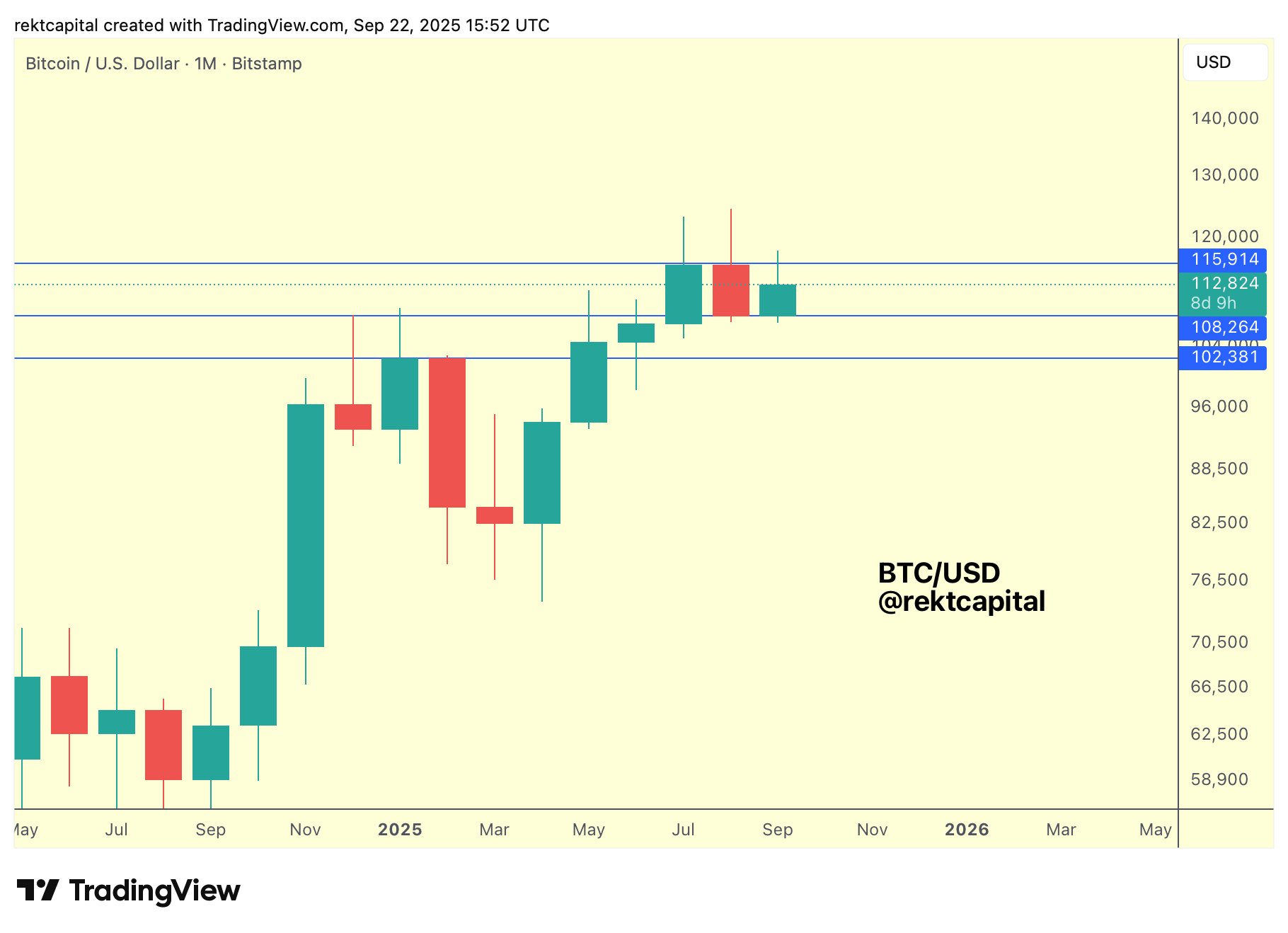

At the end of the day, Bitcoin is consolidating inside its Macro Range of $102k-$116k, with the key mid-point of this Range being $108k.

And by holding the $108k level, Bitcoin is effectively demonstrating that it wants to occupy the upper portion of its Monthly Range.

And $108k happens to be a confluent support with the Quarterly timeframe:

Therefore, $108k will likely figure as a strong demand area; it has already been retested as support on the Quarterly this Quarter (whereas in the previous Quarter that same level was a resistance) and so it's not technically necessary for price to tag $108k once again.

In saying that however, $108k is the Monthly Range Low, as seeing as price is consolidating inside the upper portion of the Macro Range ($108k-$116k), then technically anything goes inside this area as normal sinusoidal price behaviour as part of consolidation.

So double-retesting of $108k on the Quarterly isn't off the table completely simply because of how the Monthly Range is structured; but for $108k to even become a scenario, BTC would need to fail its inverse Head and Shoulders retest and its $114k Weekly retest - both of which are still very much in play at this moment in time.

Let's now dive into ETH/USD, ETH/BTC, Altcoin Market Cap, and Bitcoin Dominance (Monthly and Weekly) analysis.