Bitcoin - The ETF Is Near

How to prepare for the ETF volatility ahead

Bitcoin - Weekly Timeframe

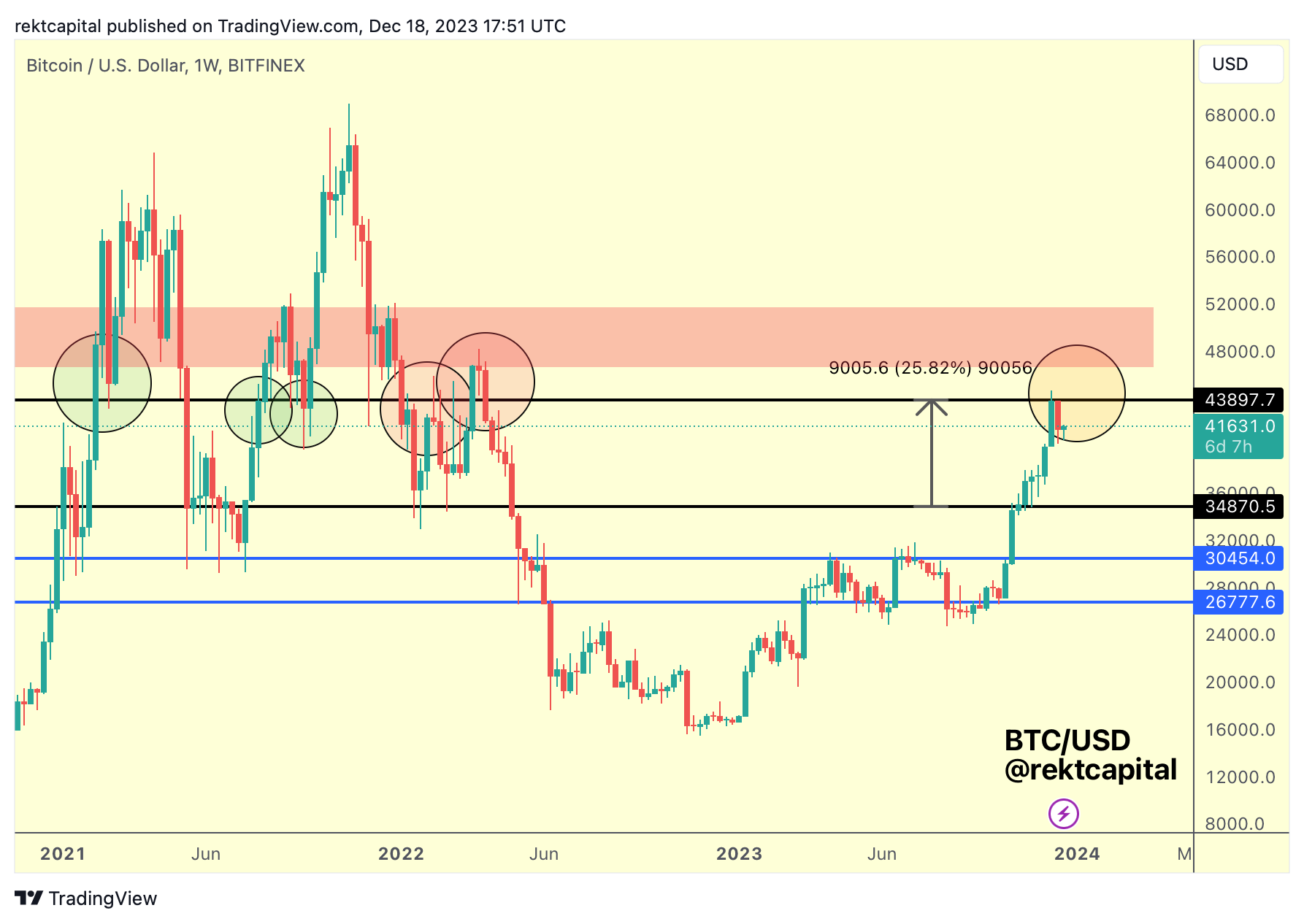

Since late November, we've been discussing a very specific range for Bitcoin.

In late November, we discussed how Bitcoin was in the process of retesting the Range Low of ~$36130 as new support in an effort to revisit the Range High of ~$44000:

Bitcoin then finally revisited the Range High successfully for a +25% move in total:

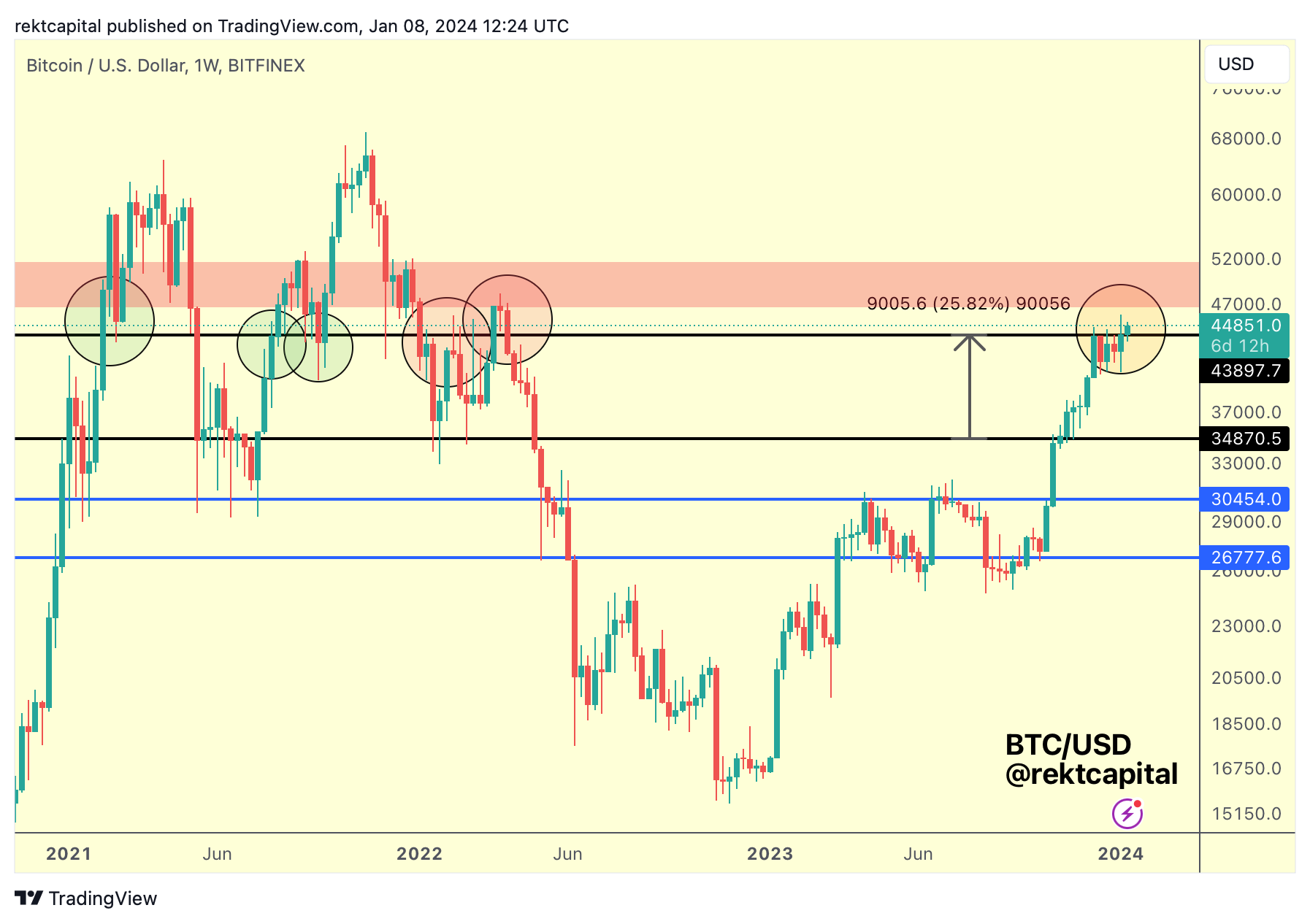

And since revisiting the Range High resistance, we saw some rejection from there, but ultimately Bitcoin hovered just below said resistance for multiple weeks:

In fact, BTC is trying to break this Range High resistance once again, trying to stabilise above it and reclaim it as support.

The very first green circle on the very left isn't very useful in timing a retest of the black ~$44000 Range High resistance as price simply blew past it.

However, the second green circle on the left is very useful as it shows a picture-perfect retest and a successful one at that, enabling a move deep into the upper regions of the red resistance box above (i.e. low $50,000s).

And it's looking very likely that we're seeing a successful, picture-perfect retest at these price levels yet again:

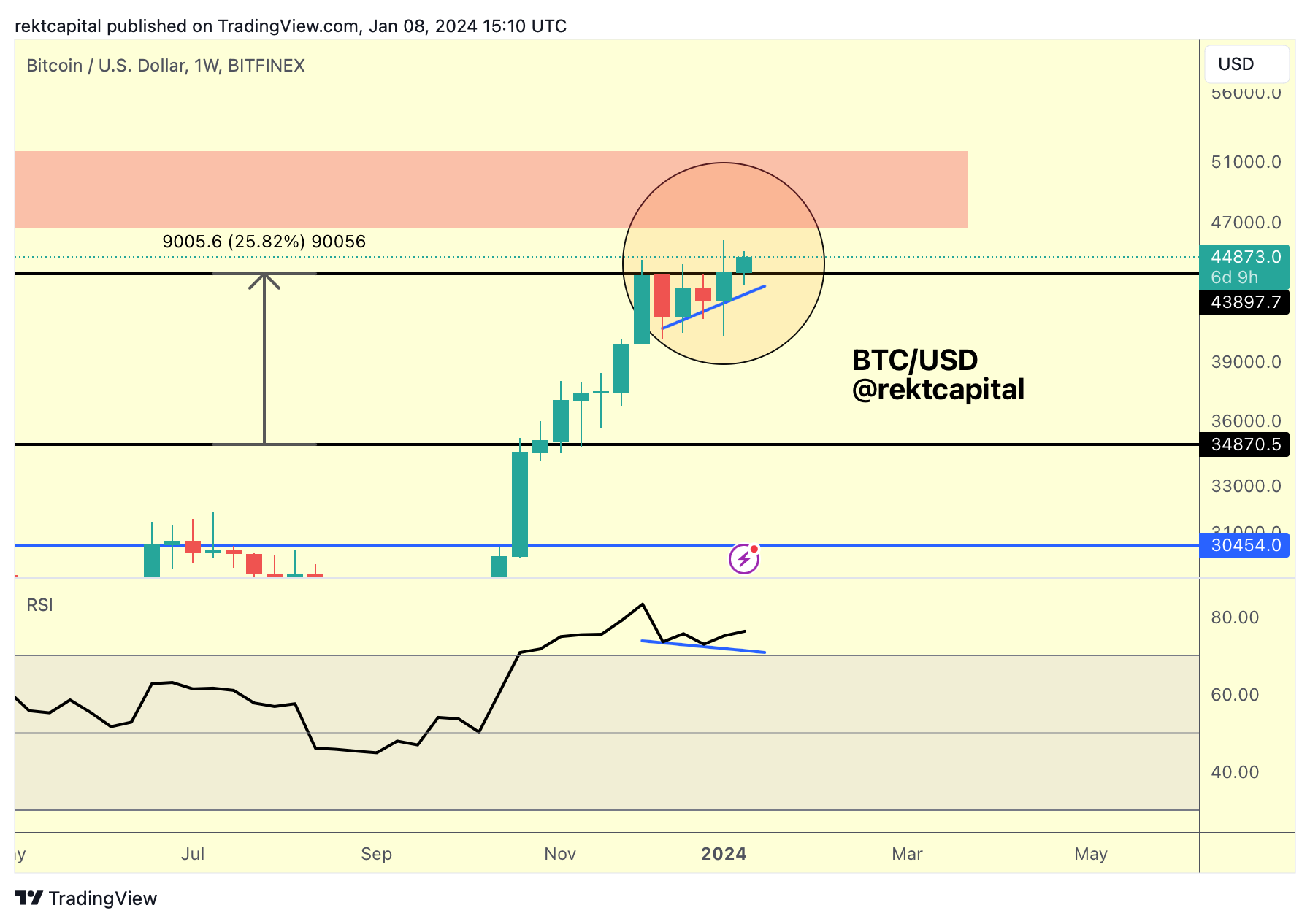

Bitcoin Weekly Closed just above the black Range High resistance and already this early on in the new week has successfully downside wicked into this level for a retest.

Technically, Bitcoin is therefore positioned for further upside.

To add to that is the favourable predicament on the RSI as well.

The RSI has been forming Lower Lows (blue) whereas the price action has continued to form Higher Lows (blue).

This in conjunction mean that BTC has developed a Hidden Bullish Divergence.

This Bull Div is playing out right now, as price continues to trend higher and the RSI has lifted off from its Lower Low trendline.

But BTC needs to successfully retest this Range High resistance (black) of ~$44000 to see the Bull Div take full effect.

And that retest is successful thus far.

So far, so good.

But let's break this down into much more detail...