Bitcoin - The Channel

Only 35 days left until breakout?

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

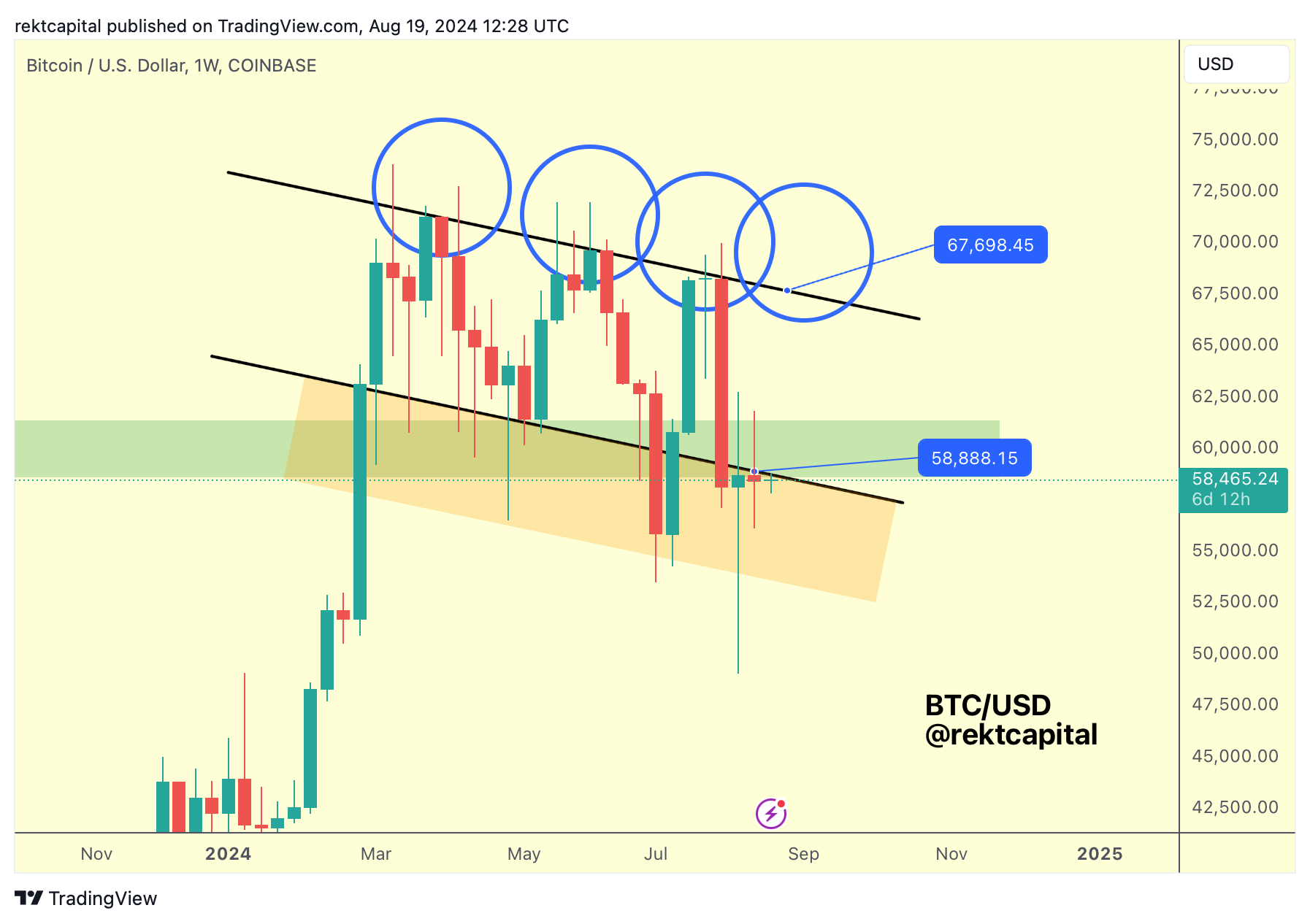

The Weekly Channel

The predominant market structure for Bitcoin can be conceptualised in two ways:

- The Weekly Channel (above)

- The Re-Accumulation Range (as we'll discuss a little later on)

When it comes to the Weekly Channel, Bitcoin has been trying to reclaim the bottom of it as support for the past 3-weeks or so but to no avail.

Last week, Bitcoin needed to perform a Weekly Close above $58888 to secure this reclaim but price failed to do so.

But because of the declining nature of this Channel Bottom, it will represent lower and lower prices, which will technically mean that it will be easier for price to Weekly Close above it in the future.

Last week, the price point of the Channel Bottom was $58888 but this week that figure has slightly dropped to ~$58674:

A reclaim of the Channel Bottom would mean that price has reclaimed this overall Channel and would suddenly mean that a revisit of the ~$67000 Channel highs would be on the cards again.

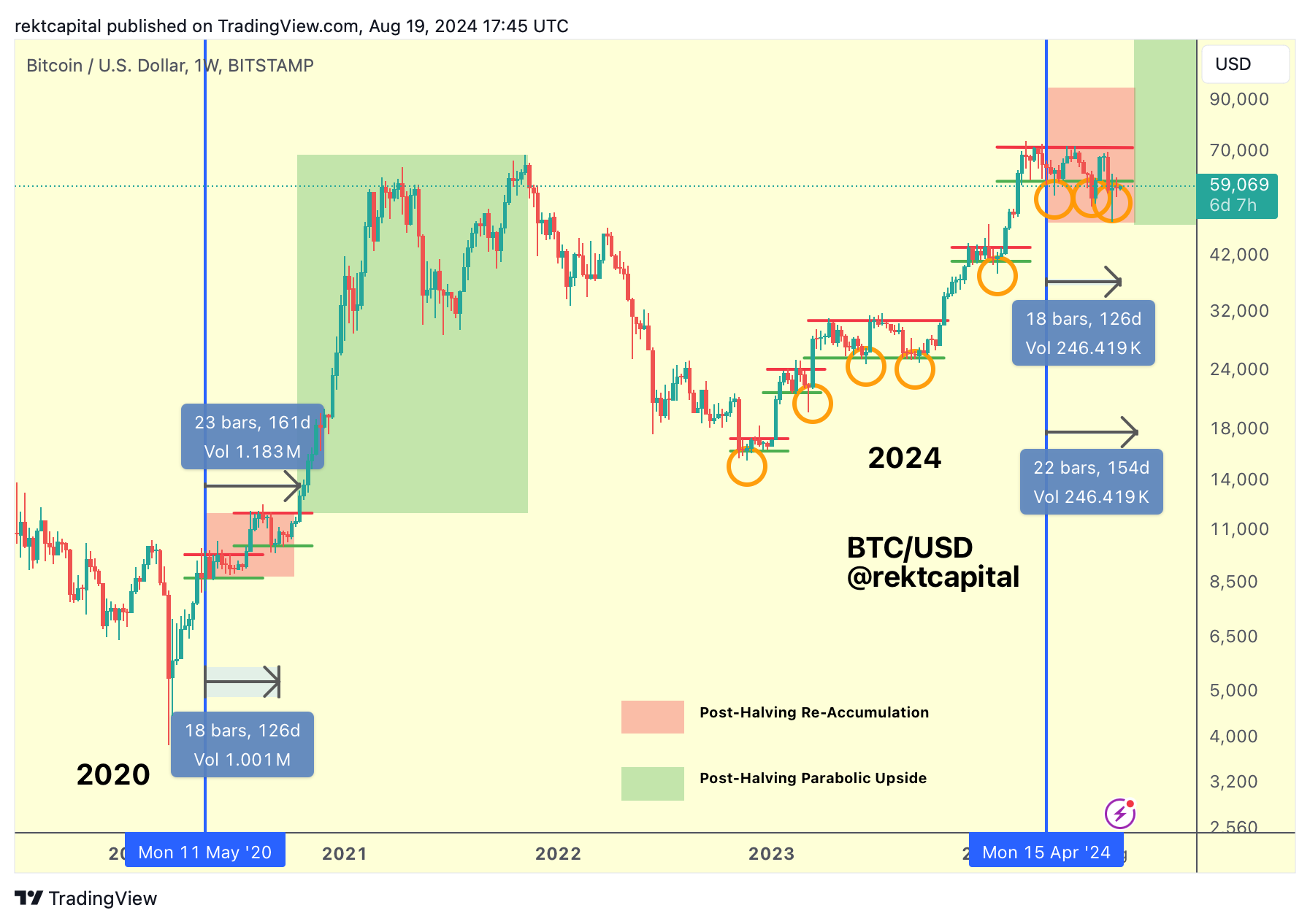

This is where the ReAccumulation Range perspective comes in:

Historically, Bitcoin has broken out from ReAccumulation Range some 150-160 days after the Halving.

Given that we are 126 days after the Halving, that means that Bitcoin could be just over a month away from a breakout from the Range.

Of course, first price needs to reclaim this ReAccumulation Range as support and that starts with a positive reclaim of the Weekly Channel Bottom followed by a positive reclaim of the ReAccumulation Range Low at $60600.

A reclaim of the ReAccumulation Range would mean that BTC would revert to its historical Post-Halving price tendencies where the predominant mode of price action is simple consolidation.

By the same token, more importantly, a reclaim would mean that it would probably also resynchronise with a 150-160 Post-Halving breakout date which would translate into late September.

What's interesting about this is that Bitcoin is still technically experiencing lingering acceleration in this current cycle.

In mid-March 2024, this rate of acceleration was 260 days whereas now it has dropped to 100 days or so.

And by late September, this rate of acceleration would further drop to some 70 days or so.

The key takeaways here are that a September breakout would be in line with historical tendencies but that such a breakout would mean that Bitcoin would still be in a slightly accelerated cycle.

Resynchronising with traditional Halving cycles is one thing and reducing the rate of acceleration in the cycle is another.