Bitcoin - Stability Now Is The Key To Future Grow

Price-strength confirmation

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

Bitcoin - Historical Demand Zone Secured

Bitcoin has managed to preserve its historical demand zone (orange) as support with the latest Weekly Close.

In fact, price is developing support here at a slight Higher Low, indicating premium-buying behaviour at these prices, despite the brief downside wicks below the demand zone over the past two weeks.

As long as Bitcoin continues to hold here, price could prepare itself for a range-bound move across to ~$114k for key trend continuation and then try to revisit $120k+.

But to get there first, it's important that BTC holds here and also reclaims the 21-week EMA (green) because price has actually Weekly Closed below said EMA:

Of course, though positioned for a bearish retest, this cycle has been a cycle of downside deviations and so it's not a given that price will reject from the 21-week EMA.

After all, throughout the cycle price has Weekly Closed below key levels, positioning for a bearish retest, only to then successfully reclaim them as support and rally higher.

The week is young and BTC has the entire week to reclaim this 21-week EMA as support which would grant trend continuation across the Range.

Here's what the 21-week EMA looks like on the Weekly chart mentioned at the beginning of this edition:

Reclaiming the 21-week EMA as support would enable a move to ~$114k in an effort to flip that region into support to then enable another challenge of $120k+.

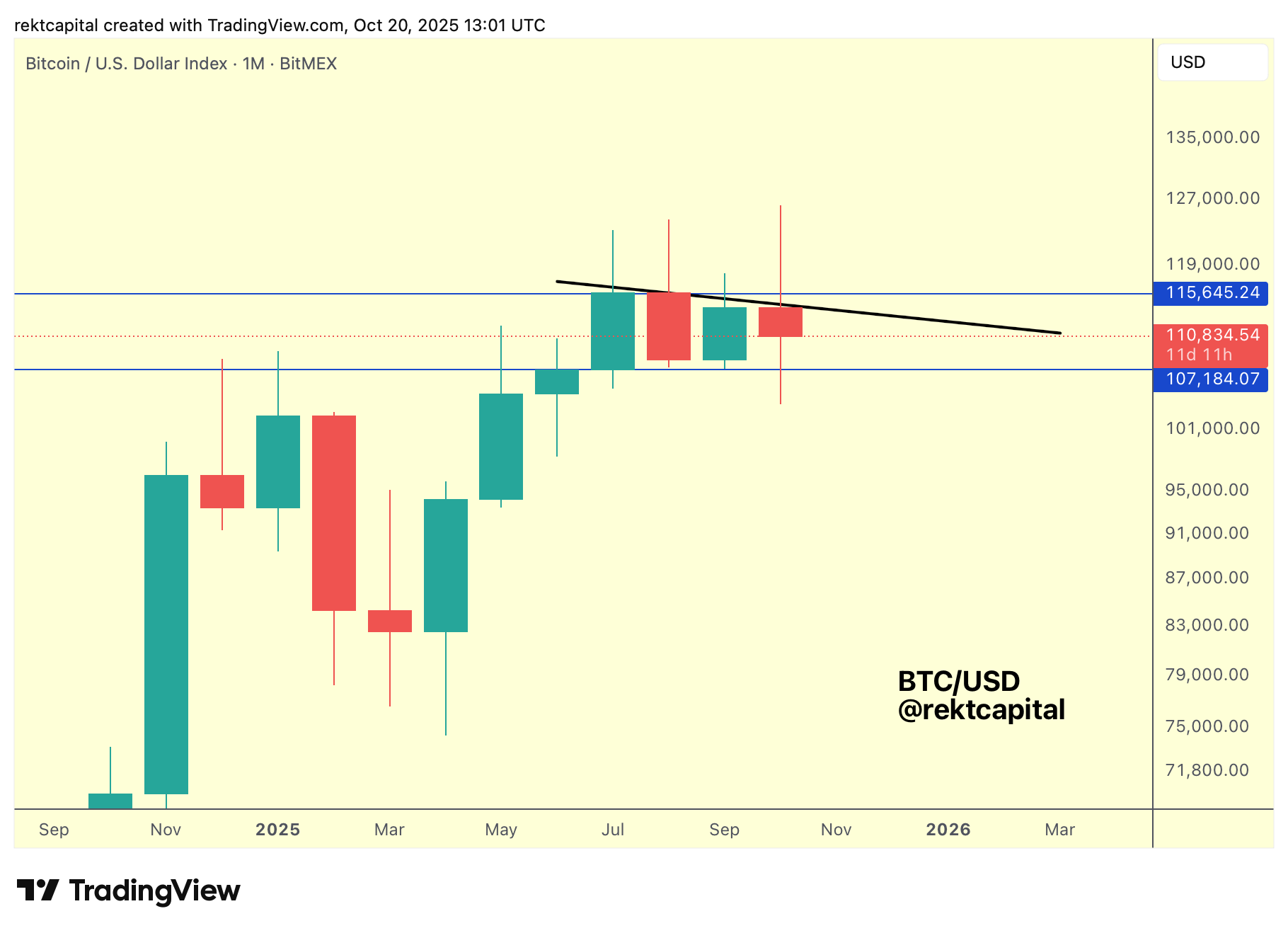

Monthly Timeframe

At the end of the day, Bitcoin is simply moving sideways inside its Macro Range of $107-$116k (blue-blue), with price downside wicking below the Range Low and upside wicking below the Range High.

As part of this consolidation, there is a potential Lower High developing (black) which isn't yet solidified; the upcoming Monthly Close will inform more about whether that indeed will become a resistance.

Generally, BTC needs to try to breach this Lower High and/or Range High resistance to breakout from the Range, and so the positioning of the Monthly Close will be quite pivotal.

A Monthly Close above the Lower High would invalidate it, and a Monthly Close above the Range High resistance of ~$116k would position price for a Range breakout, especially if a November post-breakout retest of $116k into new support takes place.