Bitcoin - Shorter Parabolic Phase In This Cycle?

What happens next?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Price Discovery Is Here

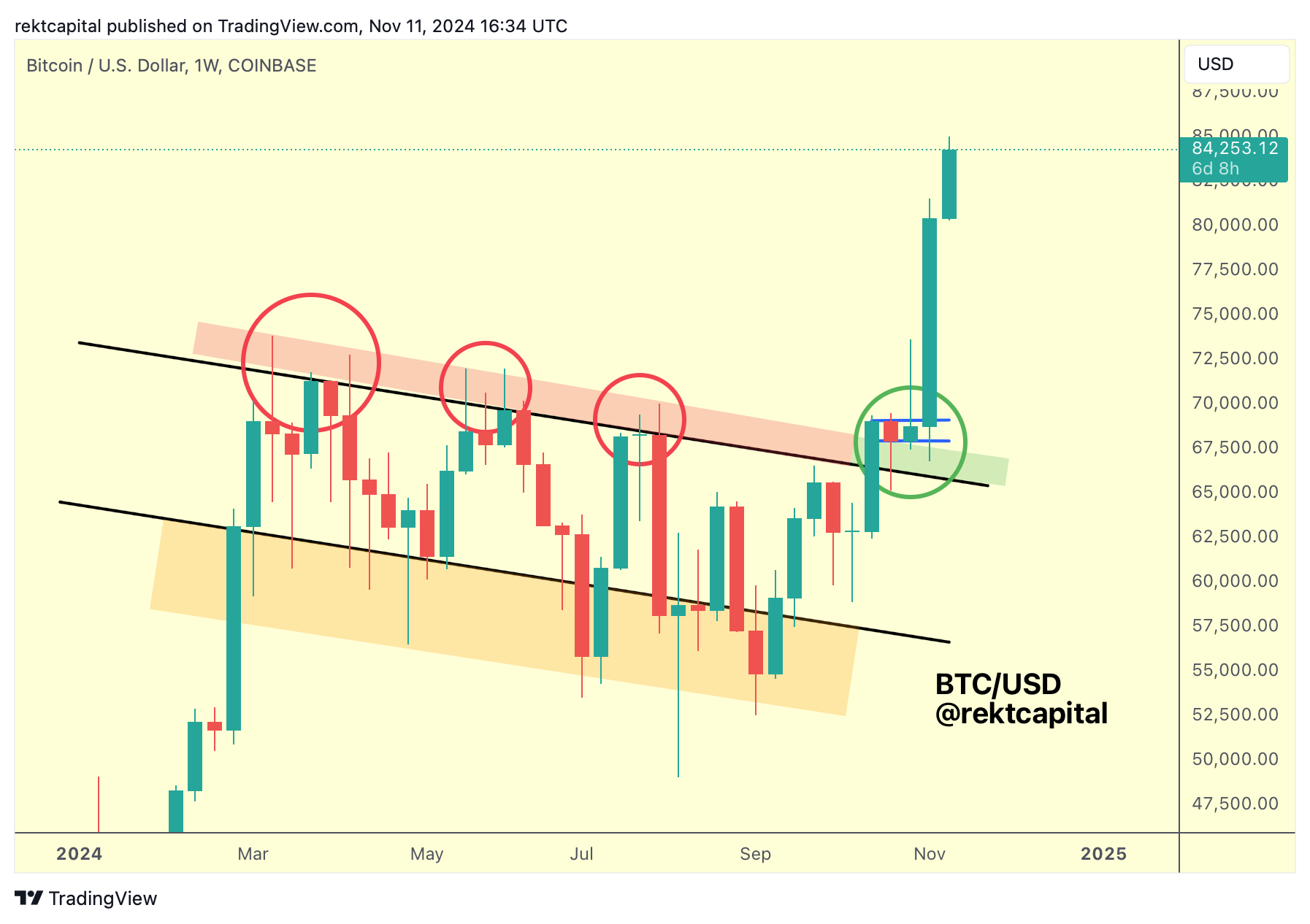

Here's what the Downtrending Channel that we've come to know and love over the past several months looks like now:

Bitcoin has confirmed a breakout from it and is now enjoying a rally into Price Discovery.

More, the ReAccumulation Phase is over:

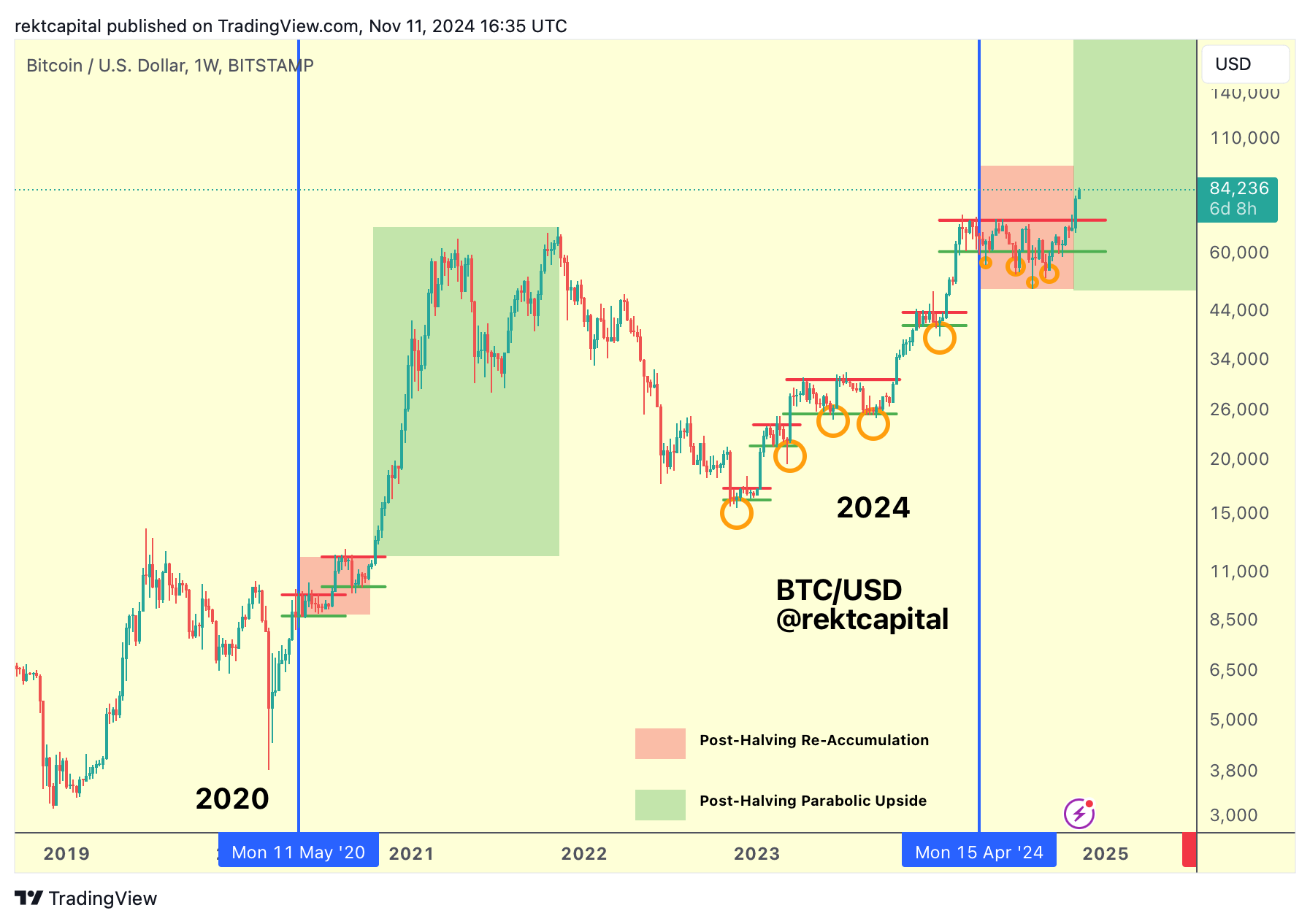

Bitcoin broke out from its over 200+ day ReAccumulation Range, transitioning away from the ReAccumulation Phase (red) into the Parabolic Phase of the cycle (green).

How long will this Parabolic Upside phase in the cycle last?

The Parabolic Upside Phase

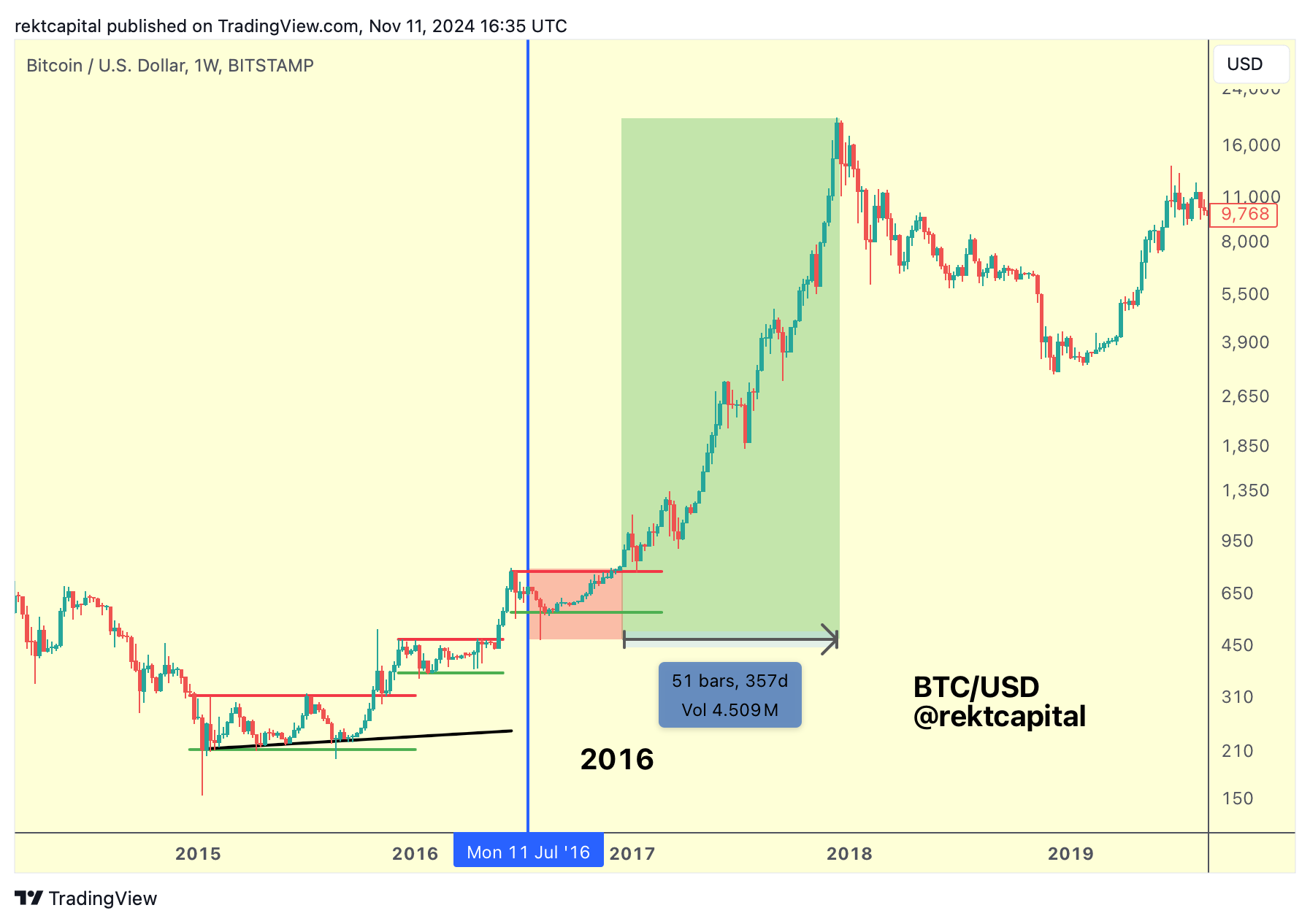

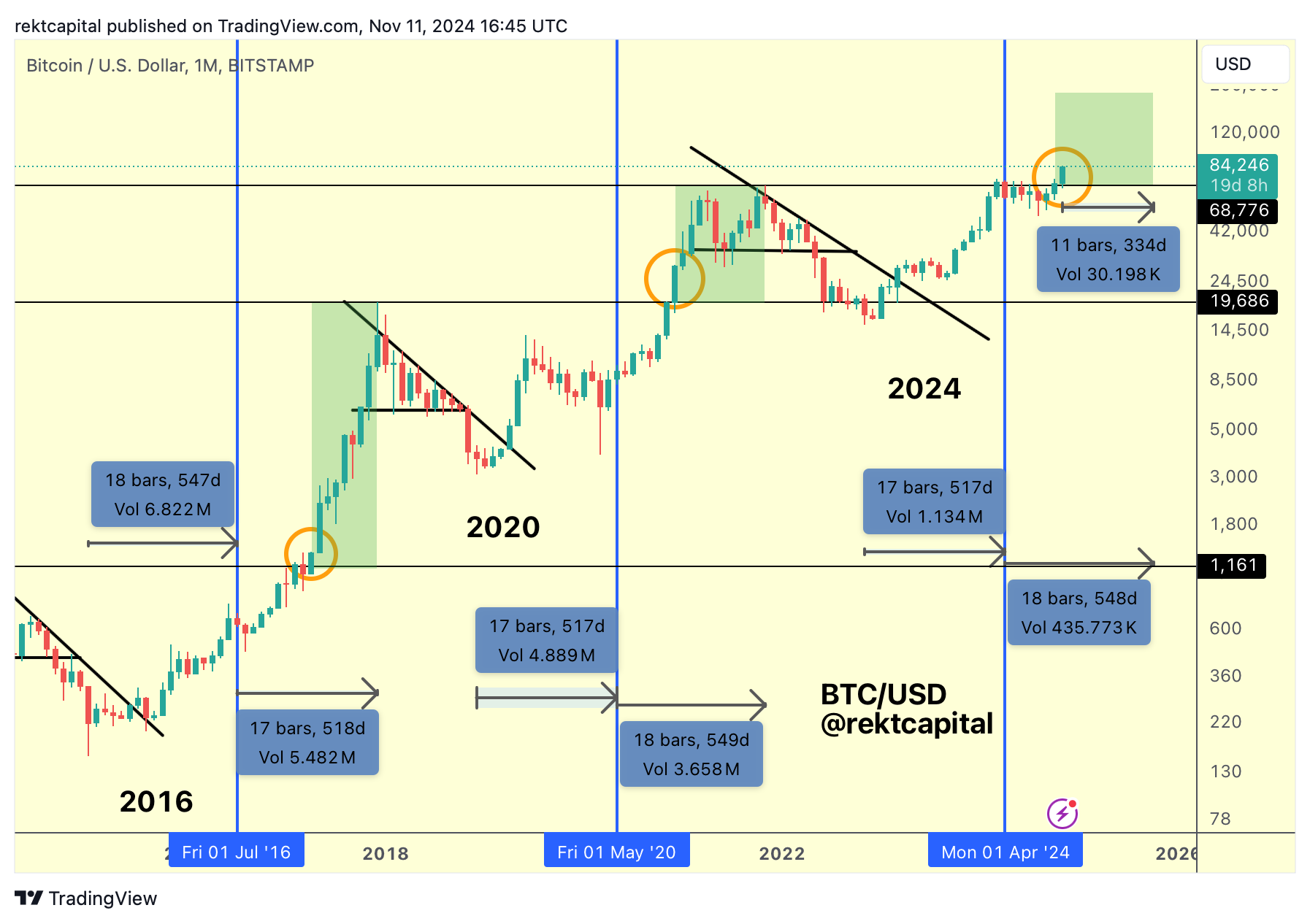

In 2016, this Parabolic Upside phase (green) lasted 357 days.

However, the ReAccumulation phase (red) lasted 154 days.

In 2020, the Parabolic Upside phase (green) lasted 385 days.

However, the ReAccumulation phase (red) lasted 163 days.

If 2016 history were to repeat in terms of a 357 day Parabolic Upside phase in this cycle, that would see the Parabola end in late October 2025.

If 2020 history were to repeat in terms of a 385 day Parabolic Upside phase in this cycle, that would see the Parabola end in late November 2025.

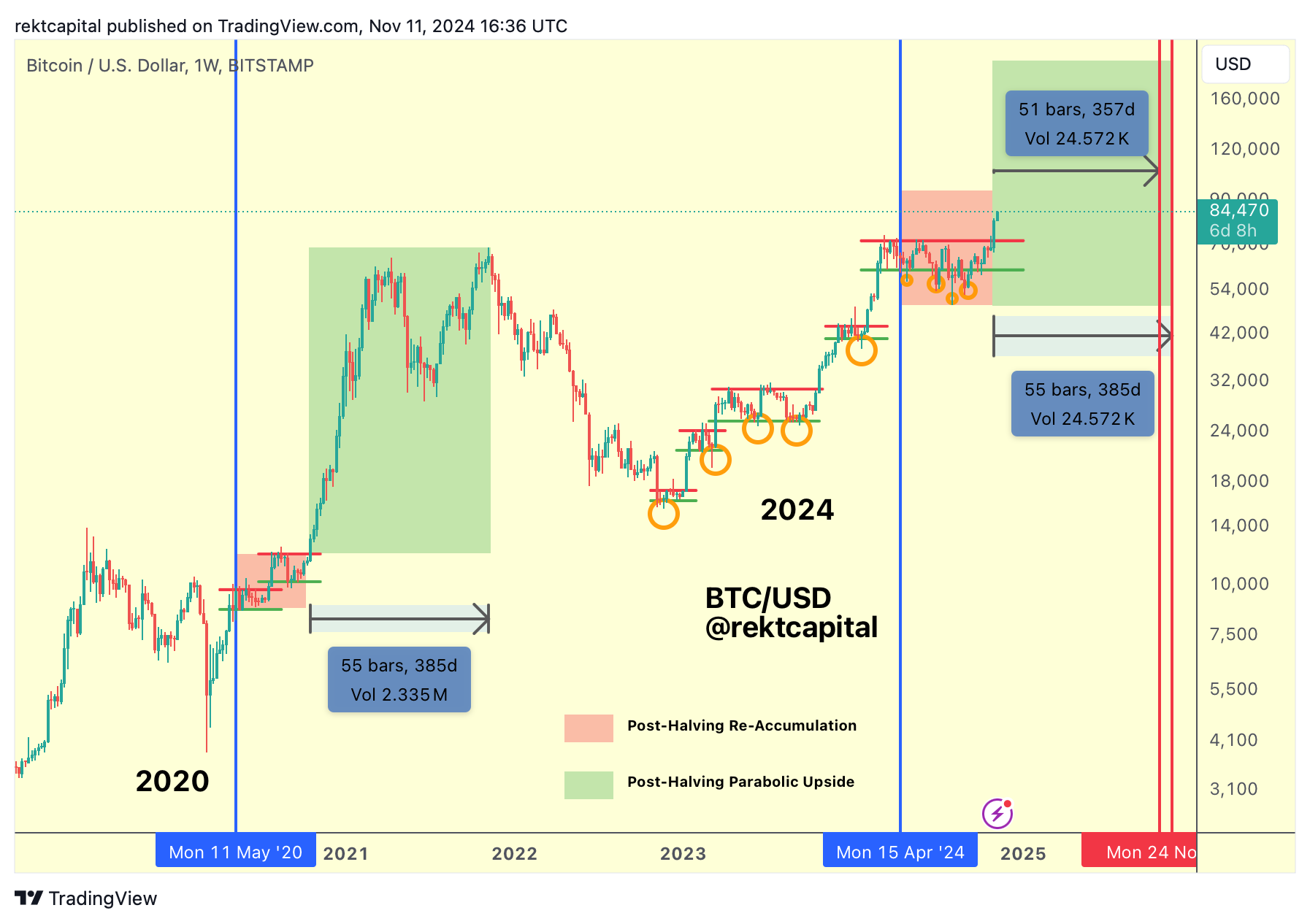

The problem here is that 2016 and 2020 produced shorter Post-Halving Re-Accumulation phases (154 and 163 days, respectively).

In this cycle, this ReAccumulation phase lasted some 205 days.

Could that therefore extend the Parabola or actually shorten it?

History suggests it may actually shorten it.

A Potentially Shorter Parabola?

History suggests that BTC tends to peak in its Bull Market some 518-548 days after the Halving.

And because BTC bottomed in its Bear Market 517 days before the Halving, then it looks like BTC will peak in this cycle 548 days after the Halving which translated into mid-October 2025.

If this indeed turns out to be the case, then that would involve a shorter Parabolic Upside phase than usual, resulting in a Parabola of 334 days or so.

That's of course shorter than the 2016 Parabolic Upside phase (357 days) or the 2020 Parabolic Upside phase (385 days).

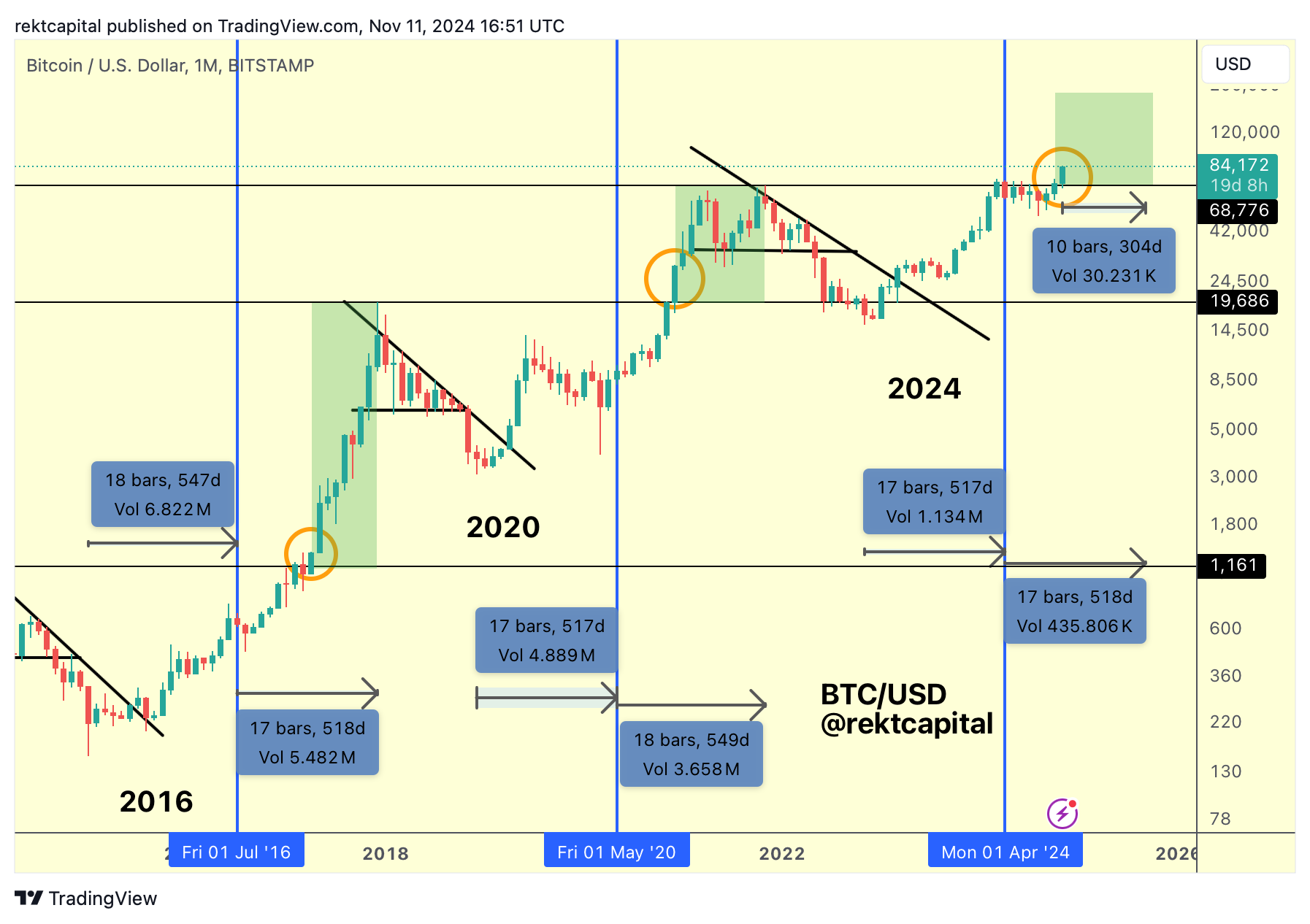

Another important factor to consider is that Bitcoin is still technically accelerating in its cycle, though just by 12 days or so.

If we then assume this cuts into the Parabolic Upside phase of the cycle, that would reduce the days from 334 days to 322 days which would bring a Bull Market peak closer in time, more to late September or early October 2025.

If we accommodate for this adjustment then that would mean...

That Bitcoin would experience a more of a mirrored cycle relative to the Halving, with a Bear Market bottom 517 days before the Halving and a Bull Market peak 536 days after the Halving (this chart doesn't show this perfectly due to its monthly timeframe).

Nonetheless, all these different variables would point to a mid-September 2025 Bull Market peak as a result.