Bitcoin - Macro Retest In Progress?

On the cusp of a new uptrend?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

Bitcoin - Historical Demand Zone Secured

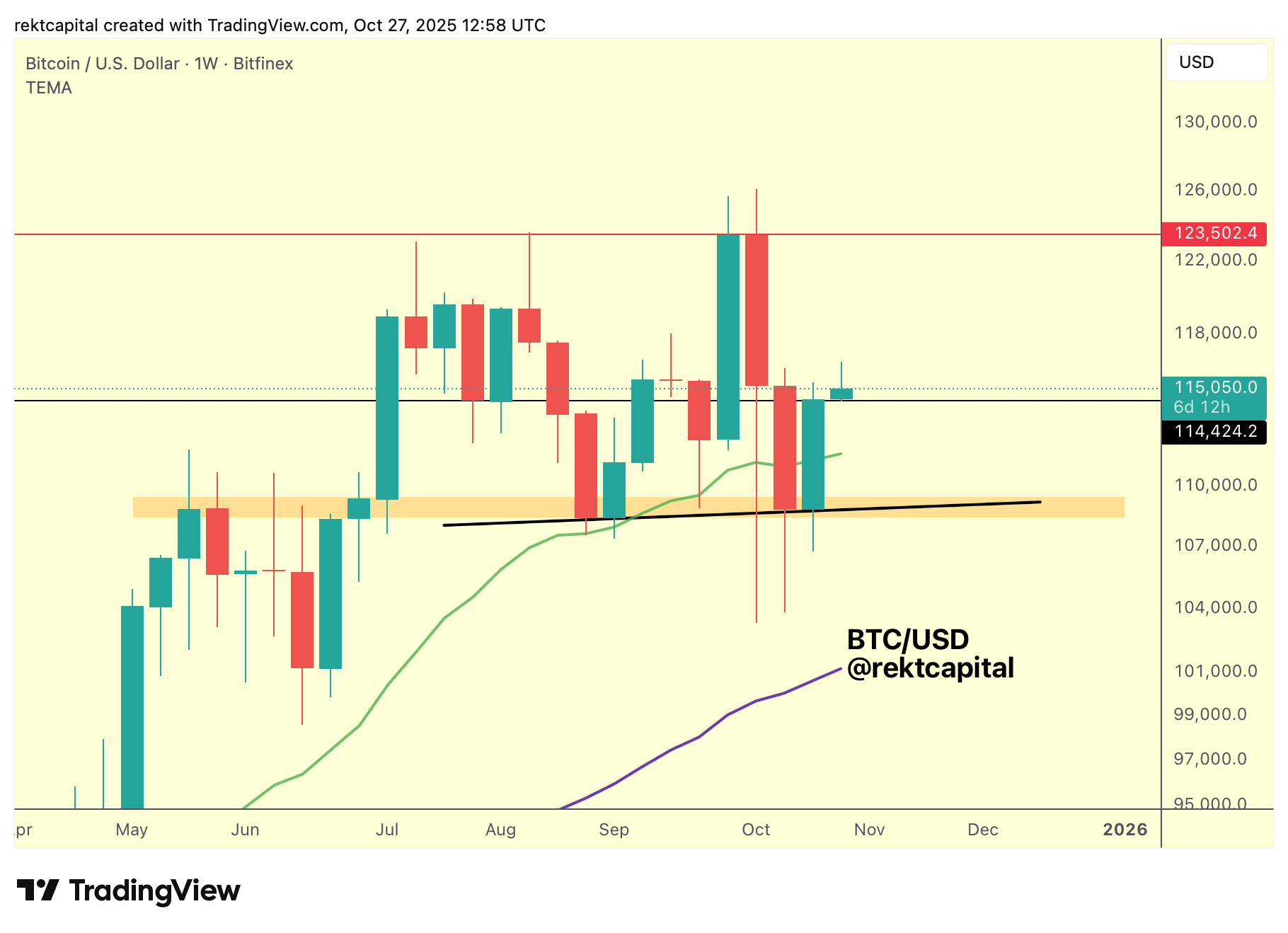

Over the past few weeks, we've been speaking about how Bitcoin was trying to preserve its historical demand area (orange) as a support going forward:

In fact, just last week here in the Newsletter we spoke about how Bitcoin needed to not just hold the orange area as support but also reclaim the 21-week EMA (green) as well to position price for a revisit of $114.5k (black):

Bitcoin has since not only successfully retested the orange area but also performed a Weekly Close above the 21-week EMA (green):

More, Bitcoin also Weekly Closed above the $114.5k level (black), as a result positioning itself for a retest of both the $114.5k level and 21-week EMA.

That is, Bitcoin could confirm both of these levels into support by retesting them, and seeing as price Weekly Closed above $114.5k (black), that means price could perform a volatile retest of $114.5k while producing a volatile downside wick into the 21-week EMA below (green).

This volatility would be perfectly fine as long as Bitcoin Weekly Closes above the $114.5k level at the end of this week (or at least continues to perform Daily Closes above said level on the Daily timeframe).

Therefore, a macro retest may be on the horizon for price to build out a base at around the $111k-$114.5k region.

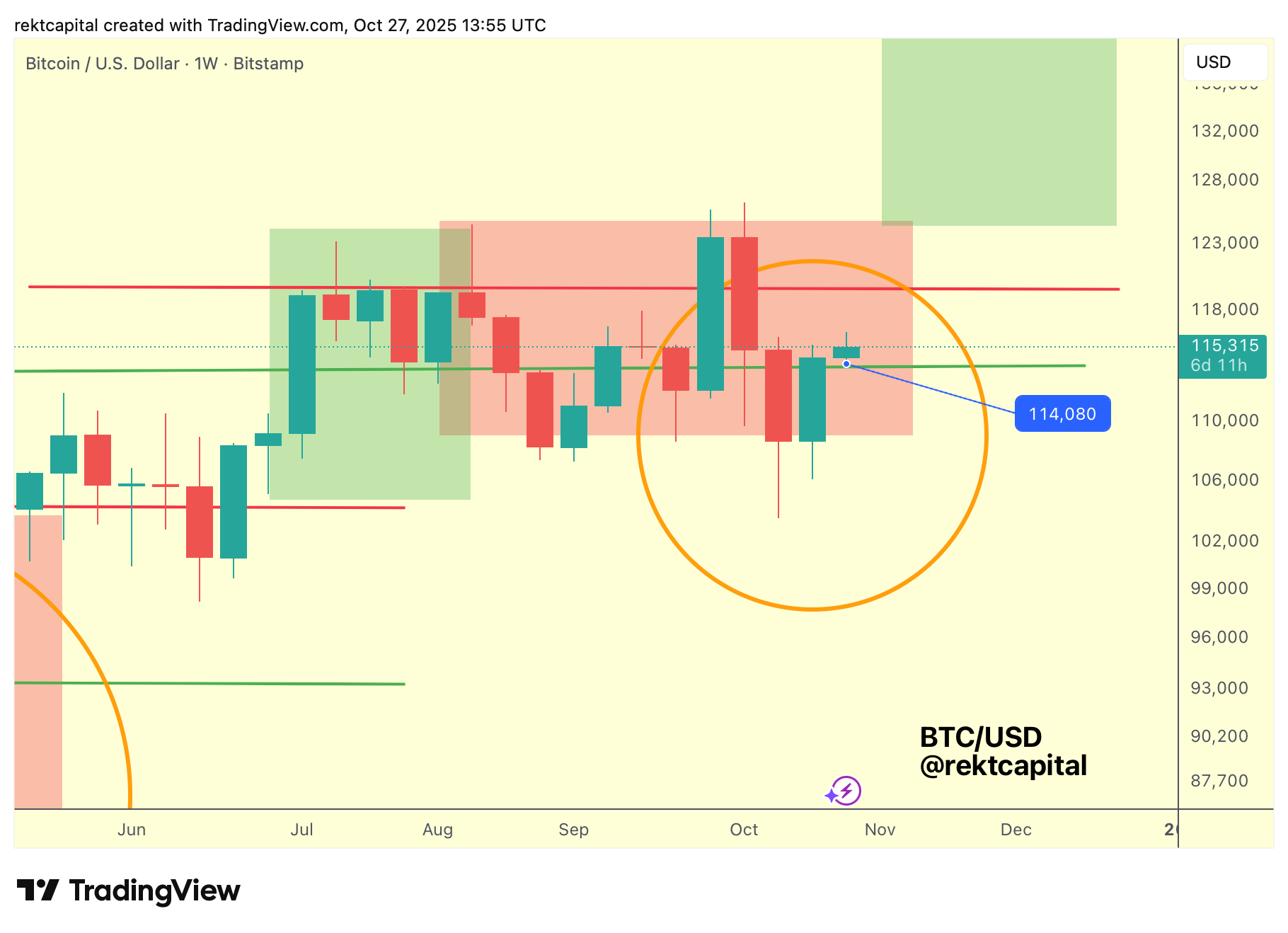

Why Is $114.5k So Important?

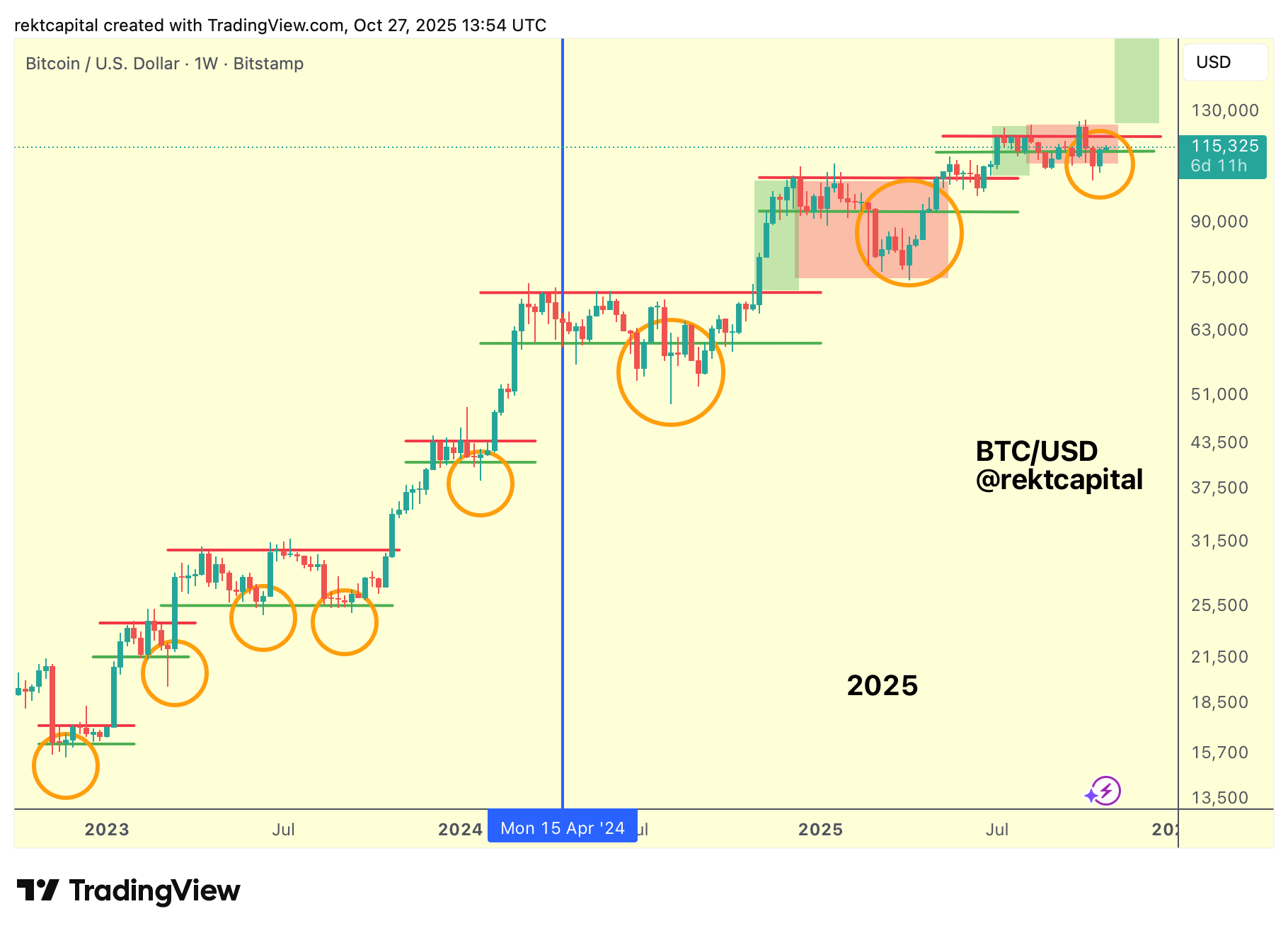

This has been a cycle of extended Re-Accumulation Ranges (green-red ranges) and downside deviations below them (orange circles).

As a result, we argued that the current downside would also figure as a downside deviation beneath the Re-Accumulation Range.

And seeing as Bitcoin already performed its downside deviation, price is actually trying to end it by Weekly Closing above the ReAccumulation Range Low of $114.5k and to successfully retest is as support so that price can rally across the Range once again and confirm resynchronisation inside it.

Confirming the Range Low of ~$114k as support would confirm re-entry into the Range, kickstart consolidation within the Range again, and enable a move across it towards the Range High of ~$119000 (red) in an effort to breakout from it and challenge $120k+ once again.

The retest of $114.5k is in progress and it's truly a pivotal retest, very fitting for a pivotal price point.