Bitcoin – Relief Rally Next or Bear Market Confirmation?

Could the RSI pivot determine whether momentum holds?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

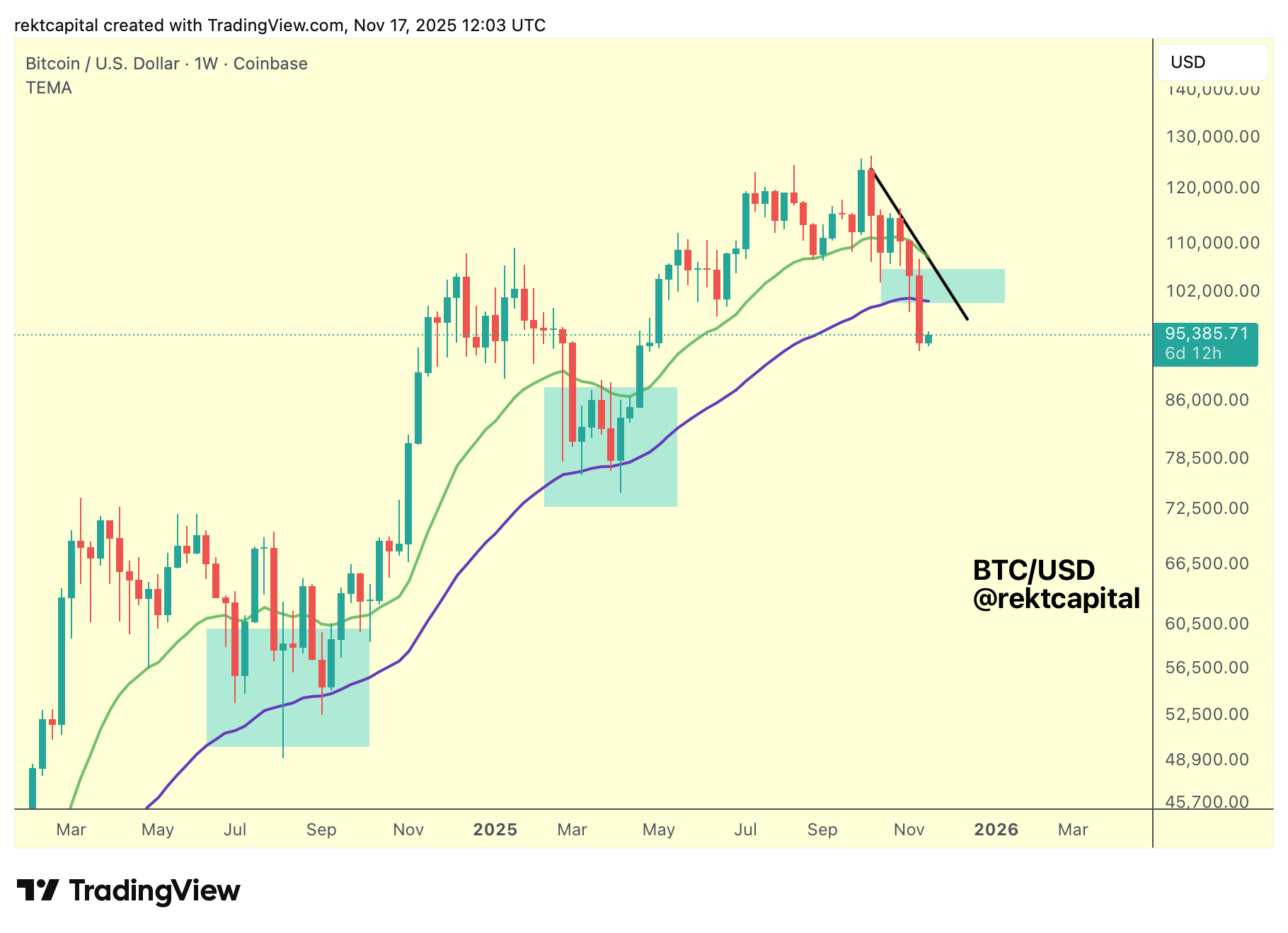

Weekly Close Beneath the 50-Week EMA

Bitcoin begins the week with a Weekly Close below the 50-Week EMA (purple), and that’s not something we typically want to see if bullish Market Structure is to remain intact.

Historically, bear markets tend to confirm when price loses the key bullish levels that have supported upside momentum across the cycle.

Across this cycle, clusters of Lower Lows forming at the 50-Week EMA have helped sustain a broader bullish technical uptrend.

This time, however, instead of forming another cluster at the EMA — and instead of approaching the possible Macro Lower High (black) developing above — price is clustering beneath the 50-Week EMA.

That Weekly Close below the 50-Week EMA represents only the first step in a potential breakdown.

A full breakdown unfolds in three parts: first, a Weekly Close below the key level; second, a post-breakdown relief rally that turns that level into new resistance; and third, downside continuation that completes the bearish confirmation.

Bitcoin has been very familiar with downside deviations throughout this cycle, but if the cycle itself is over, then both the bullish tendencies and the tendency for benign downside deviations may no longer apply.

For those who believe in a lengthened cycle or that global liquidity governs everything, the 50-Week EMA will be crucial in determining whether that perspective holds any merit.

Because if Bitcoin is unable to reclaim the 50-Week EMA as support, and instead the EMA begins acting as resistance, then the market could be transitioning from a downside deviation into the early stages of a confirmed bearish trend.

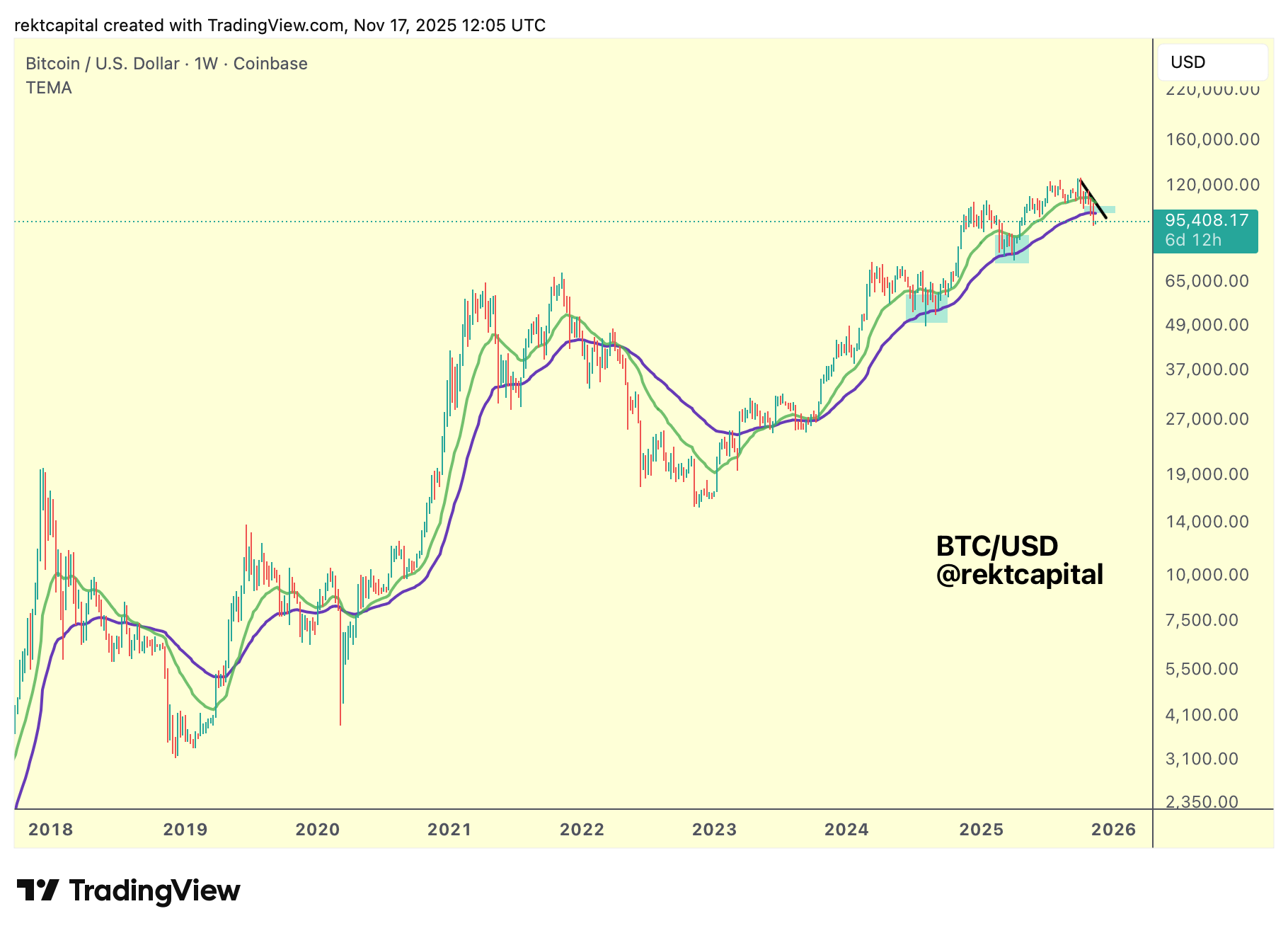

Early Bear Market Parallels at the 50-Week EMA

If Bitcoin cannot reclaim the 50-Week EMA (purple) as support and instead begins to treat it as resistance, price will start to mirror what tends to occur in early bear markets.

In those periods, a Weekly Close below the 50-Week EMA is followed by several weeks of post-breakdown relief rallies into that moving average, but those attempts ultimately fail, and the EMA simply acts as resistance until downside acceleration unfolds.

That same behaviour defined the 2018 bear market as well.

Weekly closes below the 50-Week EMA were met with meandering price action beneath it, brief relief rallies toward the EMA, and then firm rejections that paved the way for deeper decline.

Best case scenario - Bitcoin is still in a Bull Market and BTC will find a way to reclaim the 50-week EMA to end its downside deviation below it.

But the second best case scenario is that Bitcoin is already in a bear market, but there will be a period of multi-week hesitation underneath the EMA, perhaps even a brief period of overextension beyond the EMA before a clearer trend resolution to the downside.

Obviously, the worst-case scenario would be to not even tag the 50-week EMA as resistance and just lose levels and enter downside acceleration right away; if we are already in a Bear Market, then historically, this "immediate downside acceleration" scenario doesn't appear to be as likely as the historically recurring relief-rally scenario into the 50-week EMA before downside continuation.

Of course, the absolute best case would still be that Bitcoin remains in a bull market, but if we are instead transitioning, these early signs: Weekly Close below the EMA, relief rallies failing at the underside, and the beginning of trend weakening would be consistent with how prior early bear phases have formed.