Bitcoin - Ready For a Breakout Relief Rally?

Macro Downside Deviation, Oversold RSI, and Compressing Volume

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Consolidation Between The Bull Market EMAs

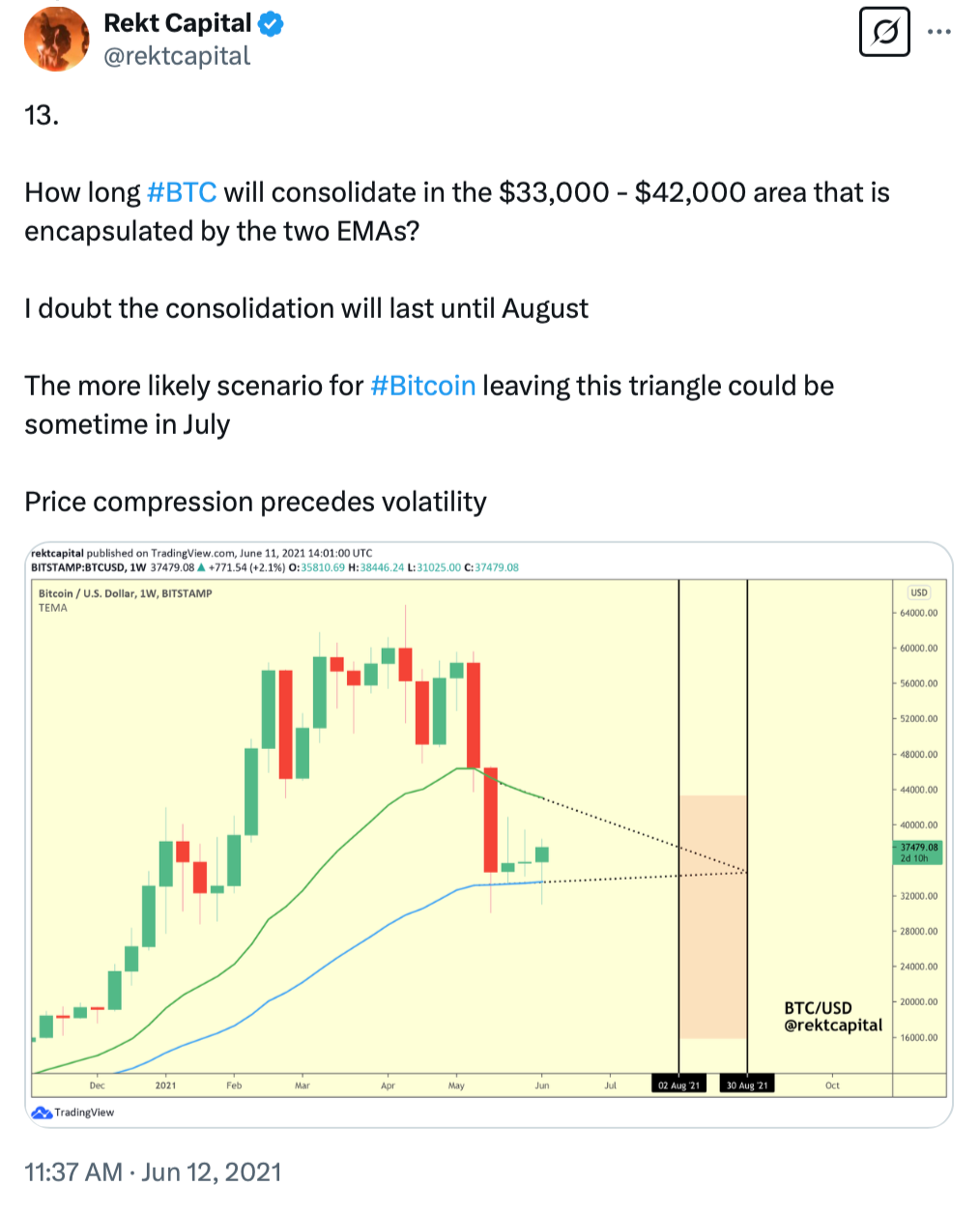

Back in June 2021, I posted about how Bitcoin's price action was consolidating between two key Bull Market EMAs: the green 21-week EMA and the blue 50-week EMA.

Price indeed did breakout in late July 2021 to rally to new All Time Highs in November 2021.

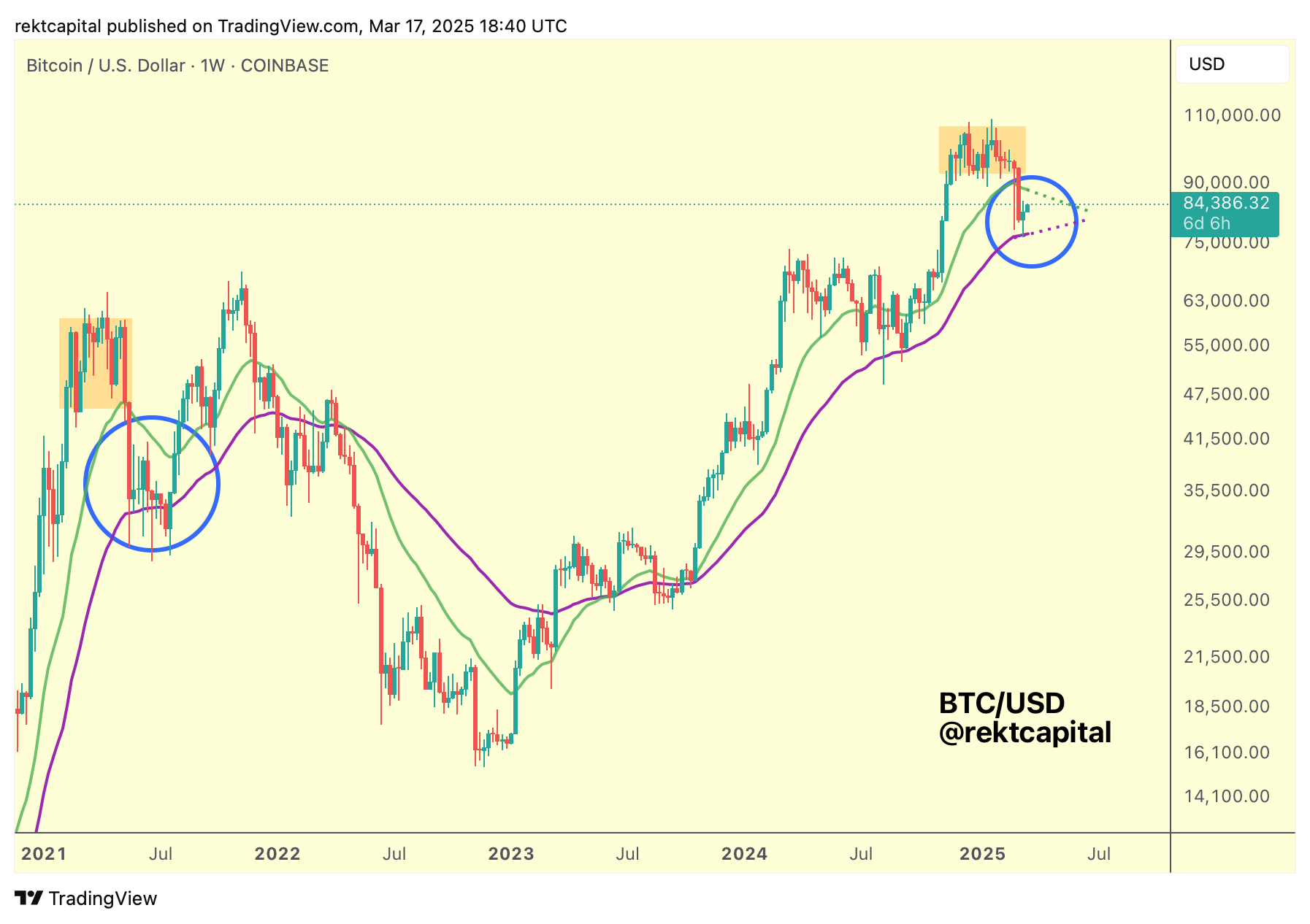

But what's interesting is that BTC is developing a very similar price predicament:

Once again, BTC finds itself sandwiched between the two Bull Market EMAs where price will be coiling into the apex of the triangular structure developed by them in preparation for a major trend shift.

Back in 2021, it took a bit of time for price to breakout to the upside but then again it's important to understand that there are a few differences between then and now.

First of all, this coiling between the two EMAs back in 2021 took place between May and late July 2021 (i.e. a little further along in the Bull Market compared to the consolidation now which has developed since late February 2025).

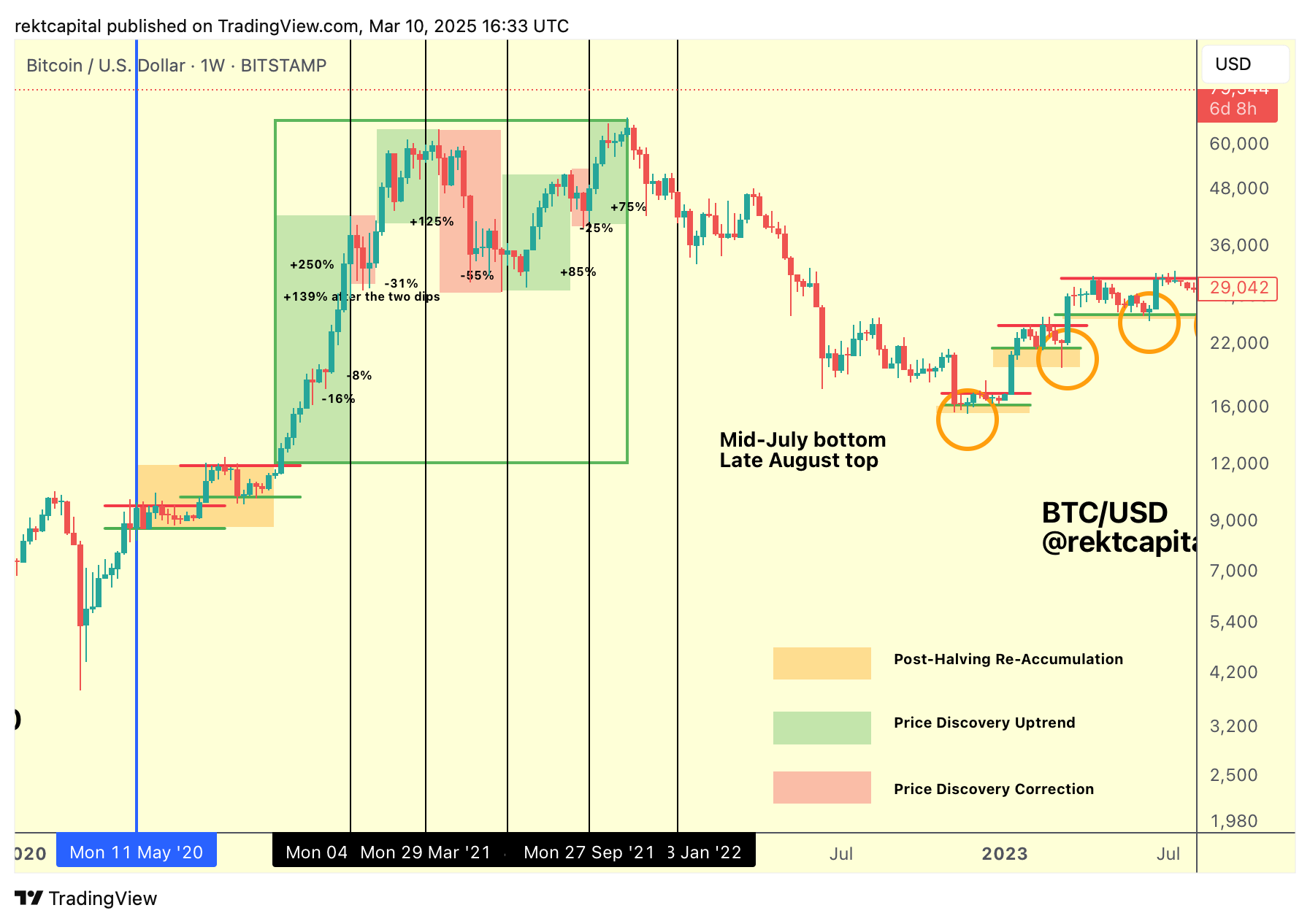

More, in 2021 this consolidation between the EMAs took place after a -55% drop which corresponded to the Second Price Discovery Correction of that cycle.

In this cycle, the consolidation between the EMAs is occurring after a -29% drop during what is technically the First Price Discovery Correction of the cycle (i.e. earlier in the Bull Cycle compared to 2021).

By extension then, the orange boxed top highlighted in the chart in 2021 was the local top of the Second Price Discovery Uptrend, whereas the orange boxed top in this cycle is the local top of the First Price Discovery Uptrend in this cycle.

Nonetheless, the comparison of these two data points across cycles, though not perfect, still offers a compelling idea for understanding market cycle positioning overall for Bitcoin.

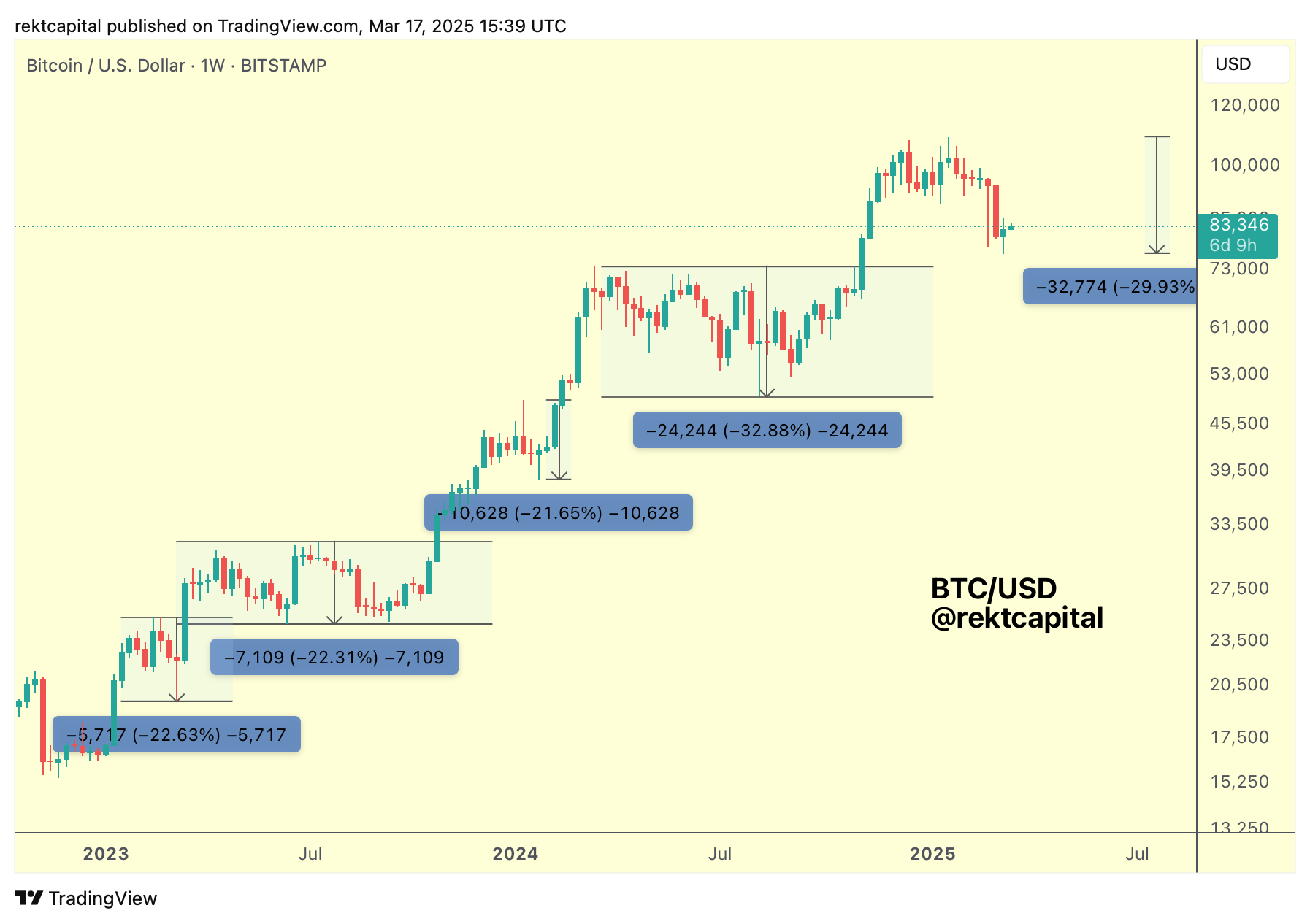

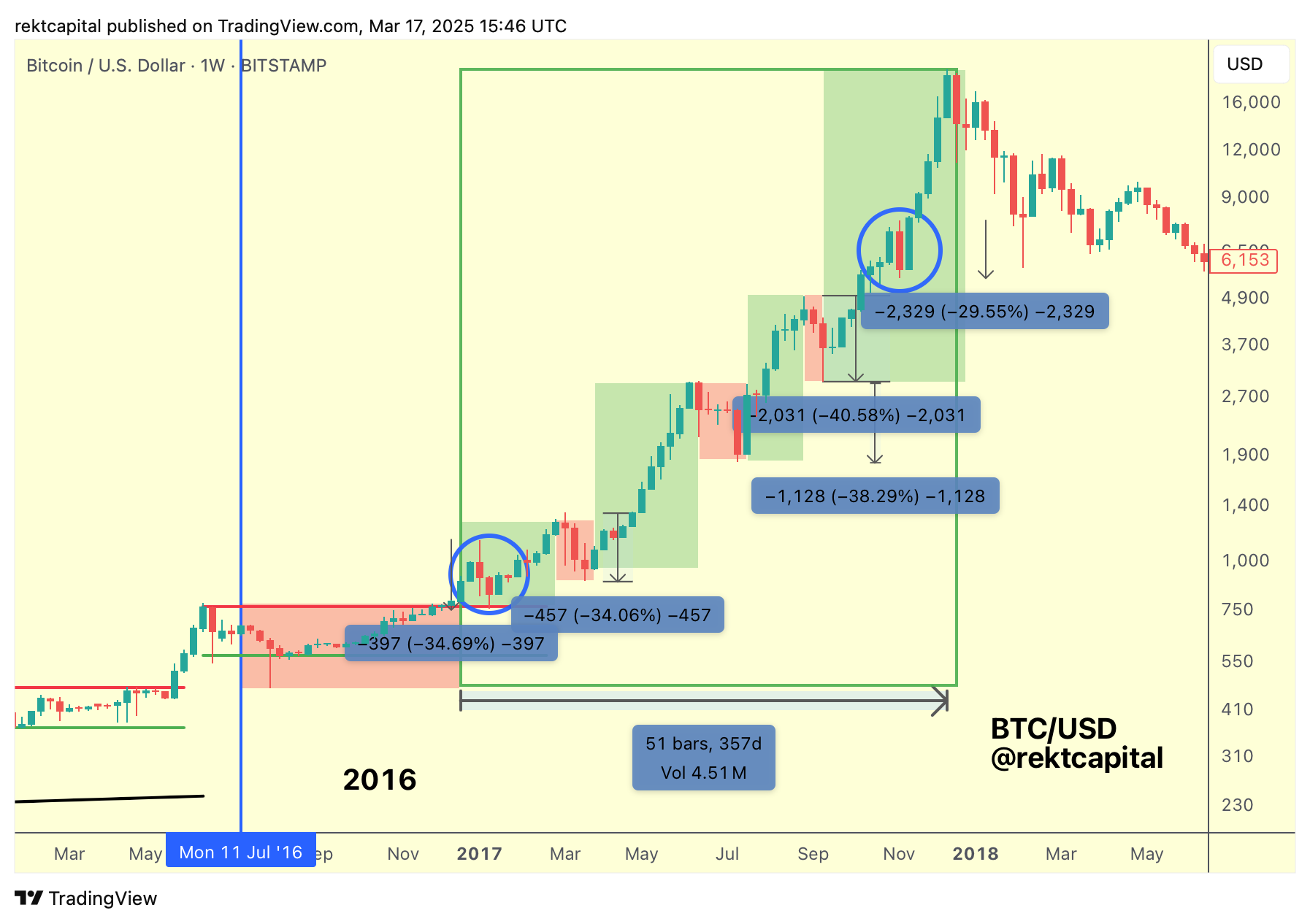

Bitcoin Corrections Across Cycles

This current pullback is an almost -30% retrace, which is still shallower than the Post-Halving pullback of -32%

More, last week we spoke about how across cycles anything in the -30% to -40% range for corrections is not out of the ordinary:

In 2021, BTC would retrace -31% to even -55% during Corrections:

And in 2017, BTC would drop -34% to -40%, with -29% being the shallower of all pullbacks in that cycle:

What's interesting about these corrections across cycles is that they appear to get deeper as the cycle matures and in the final correction, price registers one of the most shallow corrections in the cycle before embarking on a final run to the ultimate Bull Run Peak.

Judging by this tendency alone, Bitcoin is currently experiencing one of its deepest corrections in the current cycle; thus history suggests price should be able to reverse into an uptrend in the future before experiencing another, final, more shallow pullback before the final run up into a Bull Market peak.